Published on April 5, 2023 by Ugesh Vayugundla

Computer vision in finance

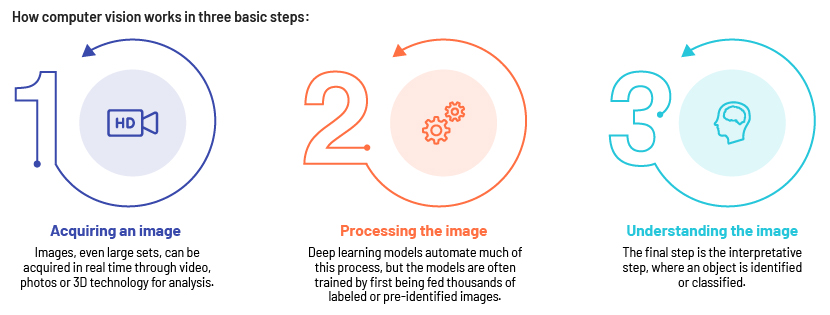

Computer vision, an artificial intelligence (AI)-powered technology, has wide applications across industries. From detecting traffic violations to recognising credit/debit card details, it uses pattern recognition techniques to understand visual data and deliver accurate descriptions.

For financial institutions looking to enhance their data-driven processes, data engineering in financeplays a vital role in integrating computer vision for smarter data management and automation across financial workflows.

Computer vision model is a software program trained using large number of images and advanced deep learning techniques. The applications extend to the financial services sector, helping institutions automate a multitude of processes. Tasks such as image-based fraud detection, automated check processing and financial document assessments are key applications.

Case studies

Extracting financial data from physical documents:

Data entry and data extraction are crucial processes in financial institutions. Document extraction techniques use computer vision, including optical character recognition (OCR), to optimise these repetitive tasks.

OCR can extract relevant information from financial documents such as invoices, bank statements and tax forms. It uses pattern-matching algorithms to analyse an image of a document or text, identify the characters in the image and convert them into machine-readable text. The technology is commonly used to digitise printed or handwritten text. The accuracy of OCR depends on the quality of the input image, the type of font used and the complexity of the layout. Advanced OCR systems can also recognise different types of handwritten text and derive information from tables, graphics, and barcodes. The information is used for financial tasks such as invoicing, bookkeeping and tax compliance. Document extraction aims to automate manual data entry processes and reduce errors and processing time.

Satellite imagery analysis for investment strategies:

Computer vision algorithms enable computers to gather information about physical assets and use the information to assist decision makers. For example, information from satellite images of buildings, roads and infrastructure provide insight on real estate and construction markets. Satellite imagery can be used to monitor the state of forests, agriculture and other land-based sectors, providing information about crop yields, resource utilisation and environmental conditions. By analysing these images, investors get a broader and detailed understanding of sectors and regions, enabling them to make effective business decisions. However, satellite image analysis is just one factor in investment strategy and should be used in conjunction with other forms of data and analyses.

Figure 2: An increase in the number of cars in a parking lot can help estimate the retailer’s revenue [iv]

Improving insurance claims processing:

Computer vision modes can automate and streamline claims processing. Tasks such as document scanning and image analysis, fraud detection and claims processing can be automated efficiently, improving business relevance. For example, by analysing images of damage to vehicles or buildings, insurers can quickly assess the extent of damage and estimate repair costs. Computer vision solutions can also analyse satellite images and capture aerial shots to assess the damage caused by natural disasters and calculate insurance payouts. By integrating computer vision in finance, institutions can improve the accuracy and speed of claims processing, reducing the time it takes for policyholders to receive payment.

Facial recognition in KYC processes:

Facial recognition and retina scans are biometric identification technologies that offer secure authentication and fraud prevention in financial products. They rely on unique physical characteristics and compare the captured data with stored data to verify identity. They are used across a range of financial products, such as online banking, mobile banking apps and ATMs, allowing customers to access their accounts securely and efficiently. Biometric identification helps financial institutions reduce the risk of fraud and identity theft and deliver a convenient and user-friendly experience for customers.

However, the use of these technologies comes with ethical concerns, particularly around privacy and the potential misuse of personal data. It is, therefore, crucial to implement proper security and privacy protocols when employing the systems.

Challenges Faced in Computer Vision Model

(i)Data quality:

A major challenge is data quality and consistency. For example, a change in document layout after converting the data into a readable format may lead to increased complexity.

(ii)Regulation:

Financial institutions must comply with privacy and data protection regulations, such as GDPR, which could limit the use of computer vision in finance.

(iii)Integration:

Integrating computer vision algorithms into existing financial systems is complex and requires significant investments in technology and infrastructure.

(iv)Cost:

Implementing computer vision algorithms is expensive, particularly for smaller financial institutions.

(v)Lack of expertise:

The sector has a shortage of computer vision experts, making it difficult for financial institutions to implement and maintain computer vision systems.

(vi) Ethics and bias Computer vision algorithms are likely to be influenced by biases and ethical considerations (for instance, in facial recognition technology), which can result in discriminatory or unfair outcomes.

Conclusion

Computer vision and related technologies such as OCR, satellite image analysis and facial recognition are gaining rapid traction in the financial services sector for their ability to improve accuracy, efficiency, and security across processes. However, their use comes with challenges related to data quality, compliance, integration, cost, and lack of specialised expertise. Despite these concerns, the benefits of computer vision in finance are significant, and its continued adoption will likely play a key role in driving digital transformation and innovation in the sector.

How Acuity Knowledge Partners can help

We deploy a team of data scientists, engineers, and domain specialists to implement ideas or address challenges related to computer vision in finance. We help financial institutions build data pipelines and provide analytical solutions to their use cases. We also do bespoke research across their interests to define the scope of computer vision. Despite the challenges, we enable clients to drive digital transformation and innovation in the financial services sector by leveraging the benefits of computer vision and related technologies.

References:

-

https://emerj.com/ai-sector-overviews/machine-vision-in-finance-current-applications-and-trends/

-

https://skywatch.com/4-ways-satellite-imagery-is-changing-how-we-invest/

-

https://pyimagesearch.com/2022/07/20/computer-vision-and-deep-learning-for-banking-and-finance/

Tags:

What's your view?

About the Author

Ugesh is a data scientist at Acuity, with an experience in building end-to-end data pipelines to perform data analysis and build visualizations. He has also worked on training object detection models during his professional career. Prior to joining Acuity, he worked with Aditya Birla Group and Infosys Ltd. He holds a master’s degree in chemical engineering from Indian institute of science, Bengaluru.

Like the way we think?

Next time we post something new, we'll send it to your inbox