Published on April 11, 2019 by Divya Jain

Investors are continuously looking for better investments, to get the best returns on their capital. They also look for reliable sources that can provide extensive and precise data, to make fruitful investment decisions. Most important is the speed of investment data transmission. Insights gained in time (i.e., before it becomes common knowledge) are advantageous for an asset manager. Value-added information like performance details, comparison/peer reviews and what more these sources have to offer are important considerations.

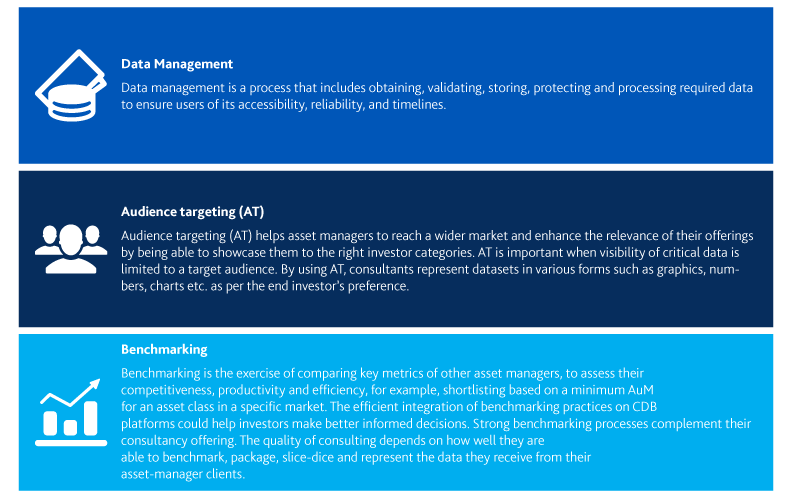

In today’s world of “big data”, databases that can tap vast amounts of data from the industry are invaluable. Effective utilization of this data to an asset manager’s advantage is one of the most important features of Consultant Databases (CDBs). Interpreting available data as meaningful insights for asset managers to make informed manager selection decisions is part of the consultancy offering. The following are some of a CDB’s fundamental attributes:

In recent years, databases have incorporated new features to enhance their value in the industry. They are being improved constantly and invested in heavily to get these features fully functional. Factors such as data management, benchmarking and audience targeting are evolving rapidly in the financial sector. An asset manager’s database recommendations are driven largely by soft factors, rather than by a database’s fundamental attributes. The following chart summarizes some of the new key features:

A research study by Bielefeld et al.1 states that databases have their own unique propositions. Some have a global footprint, some have state-of-the-art technology, some have the best asset-manager clientele, and some have expertise in a specific asset class, while others are efficient in targeting a particular investor class.

Small and retail investors seek only key data in an infographic form or formats that are easy to digest, while institutional investors, private equity firms, and intermediary clients prefer detailed reports with in-depth analysis. Another important feature for clients, and largely overlooked until recently, is good user interface (UI) and experience. Incorporating this makes for intuitive and easy navigation and simple data visibility. Firms with databases that do not have good UI have started to dedicate resources toward making them slick and easy to use. Some are also hiring third-party vendors to upgrade their websites and portals with such features.

Most firms are trying to incorporate this feature in their databases, to provide high-quality manager selection consultancy. The quality of consultancy is directly proportional to the quantity of data hosted on their platforms and the quality of its analysis. This is sold as packaged reports back to the asset managers. In fact, for most well-oiled CDB platforms, consultancy and reporting are the biggest sources of revenue.

A real-life example

Consultants are consistently innovating with the help of technology to either capture more market share or increase their outreach. One recent example is of a prominent CDB platform and the data-mirroring feature that the company launched. Through this feature, this platform pushes all the data to its partner databases. Qualitative and quantitative data updates on partner databases are performed continuously, depending on when the data is released and updated on this platform. This reduces the time for updating and maintenance and the need to have in-house operational capabilities for partner databases. Of course, this comes with its merits, and demerits. However, there is no denying that this is a powerful feature.

These are just some of the important attributes. That said, the industry is constantly reinventing and improving itself. The constant evolution of CDBs in the past five years is testament to the fact that the list of attributes is set to grow. We have highlighted some of the current important attributes. However, we believe that implementation of sophisticated technology, heavy investments in third-party solution providers for UI upgradation, data-protection initiatives, overall solution delivery, and expansion in the scope of offerings to assist in formulating an “informed” manager selection process will guarantee rapid changes in this industry in the coming years.

Acuity Knowledge Partners’ Fund Marketing Services arm offers EDGE – a comprehensive proprietary CDB tool for overall database management, data uploads, quality checking and maintenance. We have extensive knowledge and years of expertise in managing CDB platforms. We have witnessed firsthand the change in the industry, the development of features and the evolution of capabilities, while effectively managing CDB platforms for our clients. With seasoned industry professionals and state-of-the-art technology, we deliver the best of both worlds.

References

1. A Research Database for Improved Data Management and Analysis in Longitudinal Studies – Roger A. Bielefeld, Ph.D., Toyoko S. Yamashita, Ph.D., Edward F. Kerekes, Ehat Ercanli, M.S., and Lynn T. Singer, Ph.D.

2. Picking Winners? Investment Consultants’ Recommendations of Fund Managers – Tim Jenkinson, Howard Jones and Jose Vicente Martinez

5. “Investment Consultant Rankings”, Pensions and Investments Research Center, June 30, 2012

What's your view?

About the Author

Divya Jain has extensive experience in the Consultant Database space and in RFP creation. At Acuity Knowledge Partners, she supports fund marketing services for the asset management industry. She holds a Master of Science in Finance from the University of Glasgow and a Bachelor of Commerce from Jain University.

Like the way we think?

Next time we post something new, we'll send it to your inbox