Published on July 3, 2020 by Dhruv Gupta

The coronavirus pandemic will be remembered as a world-changing event. Like with the Great Depression, the fall of the Berlin Wall and the 2008 recession, it is expected to accelerate social and financial changes that would otherwise have taken much longer to materialise.

The onset of the pandemic and lockdowns globally have led to severe supply chain disruptions and demand and supply mismatches, and created huge gaps in industries. Businesses have adopted technology and evolved digitally to operate during this period. Organisations of all scale are partnering with firms to help them digitise, as seen with the Samsung-Facebook partnership aimed at digitising retailers to boost sales amid a massive slump, as buyers are afraid to step out of their homes.

Digitisation is reshaping the working world

What seems inevitable now is the speeding up of technology adoption and digitisation, with the primary rush to abandon cash in favour of digital payments to avoid the contagious spread of the virus. Social distancing has already prompted organisations and individuals to embrace fintech, artificial intelligence (AI), remote working and regulatory technology (regtech). The following themes are the new normal in the digitisation era:

1) Growing use of Fintech: Financial inclusion has become even more important during the pandemic. The outbreak has served as an opportunity for fintech unicorns and financial institutions to capitalise on increasing digitisation. There has been a huge uptick in the usage of banking apps in Asia and the Middle East and a 72% rise in the use of fintech apps in Europe. This also became evident from some of the investments during this pandemic:

-

-

Unicorn investors saw big opportunities for acquisitions and investments during the pandemic, with Visa’s USD5.3bn acquisition of Plaid and Intuit’s USD7.1bn acquisition of Credit Karma. In addition, SoFi, an online student lender, has acquired Galileo Financial Technologies for USD1.2bn

-

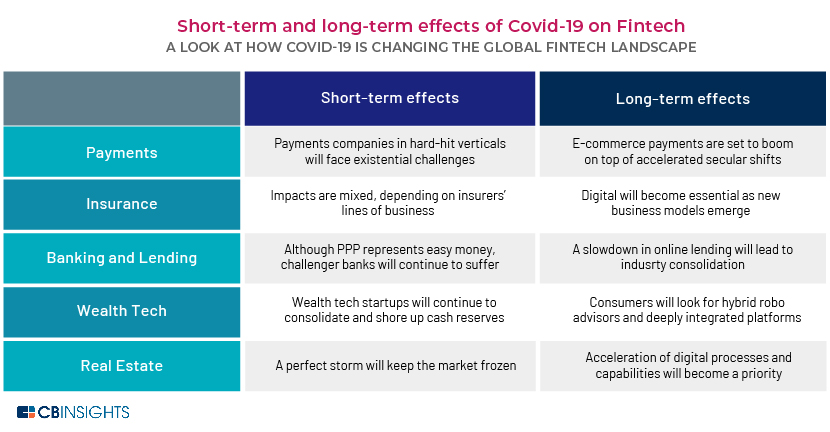

Although deals and funding for the fintech ecosystem are down, with certain sectors being hurt through the first five months of 2020, some parts of the fintech ecosystem actually stand to benefit in the long term from the COVID-19 pandemic:

-

-

-

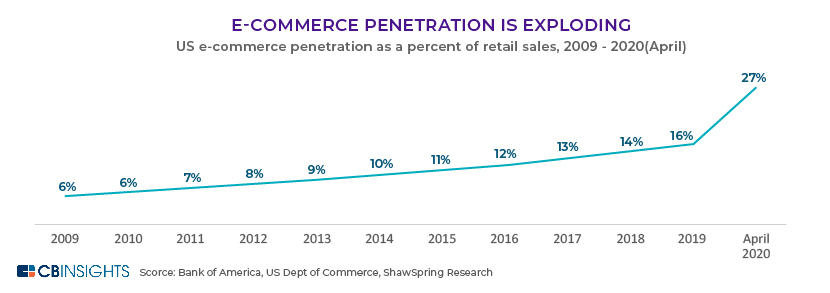

Fintech payment companies that serve the e-commerce space are seeing a surge in their transaction volumes even as other industries face existential crises

-

2) Adoption of AI in financial services/banking: AI is transforming the way businesses operate in the financial services industry, and we expect to see legacy IT systems – monolithic, in-house and bespoke – becoming a thing of the past as banks prepare for the reality of data-driven and AI-led operations. The majority of investment banks are increasingly adopting technology-driven business innovations, including AI, cloud computing, blockchain and quantum computing:

-

Adoption of chatbots in capital markets and conversational AI in investment banking enhances the experience for clients and internal staff, reducing the total cost of ownership through automation. The market for chatbots is expected to reach USD1.3bn by 2024, with real-time use of chatbots within organisations like BlackRock and BNP Paribas to settle mismatched foreign-exchange swaps, while Credit Suisse uses them to handle routine helpdesk requests.

-

Conversational agents enable clients to access research services and answer user queries on analyst reports, research coverage, research analysts’ profiles and target prices. The adoption of conversational agents in the post-COVID-19 era will enable banks to offer self-service capabilities to clients and reduce their dependence on client-servicing teams that manually handle client queries.

-

There are several conversational AI platforms in the market, such as OneReach.ai, Kore.ai, IPsoft, IBM Watson and Google Dialogflow. Understanding the importance of technology, Morgan Stanley has also built an AI-powered chatbot for internal users; it can answer research-related queries, and the company plans to roll out the platform to clients in the second half of 2020.

Artificial Intelligence and machine learning (ML) have found a place in critical areas of bank operations in the wake of the COVID-19 outbreak:

-

Wells Fargo: Adoption of AI and ML models in model governance has seen a steady increase

-

Ameris Bank: AI and ML have found applications in the areas of anti-money laundering and financial-crime and fraud detection, with higher use of AI-type technology in robotic process automation, which uses natural language processing to identify documents and classify elements such as text and words

-

BNY Mellon: The bank believes in the tangible benefits of using robotic process automation (RPA), intelligent automation and AI. Following the COVID-19 outbreak, the focus is greater on applications from a business and technology perspective, where AI and ML can help, largely due to use cases in marketing or even finance

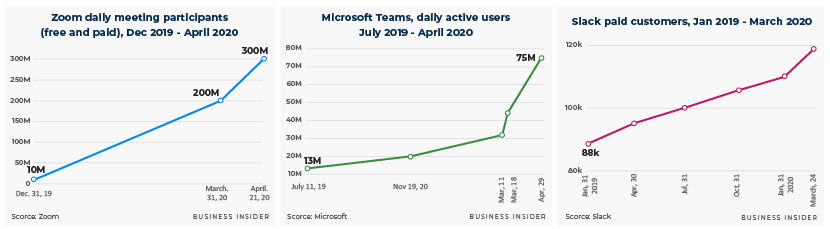

3) Remote working solutions: With employees being forced to work from home due to the COVID-19 pandemic, we may have unlocked several long-term work-from-home solutions, with organisations getting used to virtual desktops, cloud computing services such as Amazon Web Services and Microsoft Azure, and communication platforms such as Slack, Microsoft Teams and Zoom.

Some companies have already started planning for future remote working. For example, Tata Consultancy Services (TCS), Google, Facebook and Twitter have announced that the majority of their employees will work from home until 2021. This could encourage many firms to operate remotely and automate their operations to aid their smooth working.

4) Improved compliance automation

The need for regtech and greater compliance has been rising in recent years, with regulations tightening not just in Europe but across the world. With remote working here to stay, at least for a while, and given the wave of cybercrime, the COVID-19 pandemic has led to an increase in demand for regtech and compliance as market participants become increasingly aware of the benefits, namely in terms of automated onboarding, mitigating the risk of fines for regulatory breaches and providing a safety net for the compliance function.

Organisations are increasing their investments in advanced digital authentication, which goes beyond physical biometrics to include transaction monitoring in real time, ML and even behaviour recognition.

Digital transformation is here to stay

The last economic crisis, in 2007-09, led to the emergence of segments such as the sharing economy and alternative currency. The current crisis will likely spur similar innovation in digital transformation. With a growing number of organisations adopting different technologies to reach a larger customer base and make it easier to do business with them, we believe that once this pandemic is controlled, businesses and economies that embrace technology to reshape their businesses will be the ones that stay ahead of the competition.

The crisis has put the entire banking system under stress, increasing the need for personalised digital solutions and investment in new financial technology tools. Digital transformation has been at the top of organisations’ wish lists in recent years, but the COVID-19 pandemic is pushing digital transformation to the front of the line as they seek partnerships or key expertise associated with the adoption of chatbots/automation in investment banking, fintech, regtech and remote-working solutions in the long term.

How Acuity Knowledge Partners can help

We at Acuity Knowledge partners provide customized Capital Markets Technology Solutions for investment banks and advisory firms, enabling them to create intuitive workflows, technology led process improvements & optimizations, and fast track innovation road-maps irrespective of their enterprise technology architecture. Our investment banking solutions like TombstoneHub and Financial Data Extractor enables banks to derive faster turnaround times without compromising on accuracy. For more details on our suite of contextual technology automation solutions click here.

Sources

https://www.nejm.org/doi/10.1056/NEJMp2003539

https://tsa-me.com/coronavirus-looking-beyond-the-pandemic/

https://thefinancialbrand.com/94700/covid-19-digital-banking-transformation-opportunities/

https://www.cbinsights.com/research/fintech-unicorns-q1-20/

https://www.cbinsights.com/research/report/fintech-trends-q1-2020/

https://www.globalbankingandfinance.com/artificial-intelligence-in-financial-services/

https://www.finextra.com/blogposting/18865/emergence-of-conversational-agents-in-investment-banking

What's your view?

About the Author

Dhruv Gupta has over +3 years of experience in Investment Banking and Consulting industry. At Acuity, he is a part of the Investment Banking team with special focus on Technology, Media and Telecom sector. He has prior experience working with KPMG and holds a PGDM in finance from Birla Institute of Technology Management. Dhruv is a CFA level 1 certified professional.”

Comments

07-Jul-2020 10:58:16 am

I disagreed with the point on wealth tech long term effects, people look for Robo advisors in the short term however it\'s temporary as it already realised during the default of Franklin AMC schemes or crisis, the investor needs someone to manage their behaviour towards investments. As an investor, it historically realised that during the crisis, most investors sell off their portfolio at a low price, they repeat the same mistakes again and again in every crisis. Buy high, sell low and repeat until they broke. This point only valid for retail clients, does not work for HNI\'s, UHNI\'s.

Like the way we think?

Next time we post something new, we'll send it to your inbox