Published on June 3, 2020 by Aman Singh

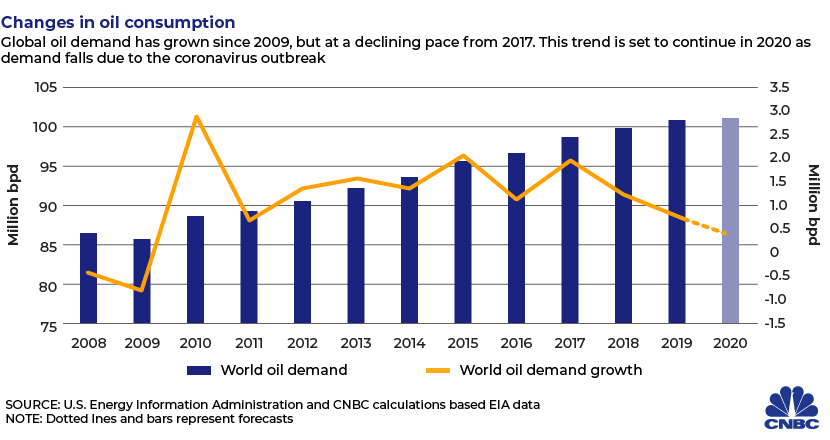

The COVID-19 outbreak has affected nearly all industries globally, with no indication of when “normal” business will resume. The oil and gas sector has not been spared. Global oil demand is expected to drop by 6.8m barrels per day in 2020, according to the latest projections by OPEC and the IEA, with the sharpest contraction in April – a drop of 20m barrels per day. This can be directly attributed to reduced consumption amid the global lockdown.

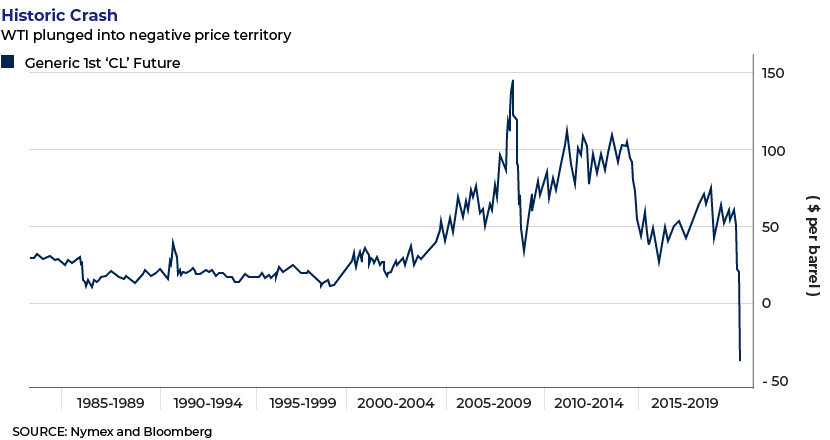

With demand hitting rock bottom and storage facilities almost full, WTI prices dropped to -USD37.63 a barrel on 20 April 2020 as the May futures were to expire the following day. June prices are also down, with WTI trading at above USD20 per barrel and Brent crude at less than USD26 a barrel. This slump in WTI prices will likely send deflationary signals across the global economy

The industry faced a bigger challenge recently (although this is resolved for now); nevertheless, the underlying issues are likely to see growth plummet for a very long time.

It all started when OPEC+ nations, including Russia and Saudi Arabia, sat to discuss measures to resolve the drop in oil demand. They proposed cutting production to maintain crude oil prices. Russia and Saudi Arabia did not agree to the proposal, as per a report by CNBC, and instead decided to increase oil production; this surplus production, coupled with all-time low consumption, forced oil prices to fall.

According to Financial Times reports, this may appear to be a price war between Saudi Arabia and Russia, but it is believed there may be the ulterior motive of unsettling the US shale market, currently in debt for trillions of dollars. It is said that Russia started this price war in response to the sanctions imposed by the US on a subsidiary of Russian integrated energy company Rosneft for conducting business with Venezuela.

Due to the rapid, global spread of COVID-19, however, Russia and Saudi Arabia – two of the world’s biggest oil producers – finally agreed to cut production: Russia by 2m barrels per day (versus production levels of 10.4m barrels per day) and Saudi Arabia by 3.3m barrels per day. Even with these production cuts, oil prices are not expected to recover soon given the uncertainty of oil demand. Some reports also indicate that Russia may not actually be cutting production by the promised rate, as it faces a major risk of damaging its producing wells because of the geology of the producing regions, eventually damaging its fields/reserves.

Extracting oil and gas (O&G) is a costly business, as it involves high capital and operating expenditure. Given the uncertain crude oil prices, expected ROI is uncertain and continues to dip lower. This may lead to financing issues for upstream O&G companies, as most creditors and investors may not consider investing in them. Oil companies, especially those in the US, are expected to go down first, owing to the inability of the US shale market to sustain such price fluctuations. In fact, many of them have started to explore their options, including Chapter 11 bankruptcy protection. US shale company Whiting Petroleum has already filed for bankruptcy protection.

How Acuity Knowledge Partners can help

Since the oil price crisis began in 2013, upstream companies have started to look for other options, including vertical integration and diversification. The current COVID-19 scenario has provided further impetus to thought leaders, consultants and experts to consider alternatives. Although this is not the end of the game, many questions remain unanswered: How can upstream companies be sustained during such times? Will integrating operations across the value chain help? Should a company think about diversifying its portfolio? How can small firms relying on one or two assets remain profitable? What possible contingency measures could be followed in the event of another similar price war? What if the world takes another year or so to recover?

Through our wide range research based offerings, we can help upstream companies in reshaping their strategy and help them in overcoming the current crisis by efficient management of current assets and a focused future growth strategy.

Sources:

https://www.ft.com/content/c9c3f8ac-64a4-11ea-a6cd-df28cc3c6a68

https://www.ft.com/content/da8399de-621c-11ea-b3f3-fe4680ea68b5

What's your view?

About the Author

Aman Singh, in his current role at Acuity Knowledge Partners supports a global consulting firm by providing qualitative research support. Prior to this, he worked for a consulting firm and was responsible for conducting strategic research for Upstream clients. He holds an Engineering degree in Oil and Gas Upstream operations from University of Petroleum & Energy Studies (class of 2017)

Like the way we think?

Next time we post something new, we'll send it to your inbox