Published on January 15, 2025 by Sharmi Basu

-

Issuers are pitting corporate lenders against each other for the purpose of recapitalising debt to avoid bankruptcy.

-

The growing popularity of covenant-lite debt packages has paved the way for Creditor on Creditor Violence

-

Unity among lenders through cooperation agreements would restrict issuers from taking advantage of loopholes in the credit agreement.

-

A thorough study of indentures for credit amendments, highlighting areas with loose language for covenants, talking to legal advisors and rating agencies, and flagging governance risk are likely to help manage exposure and mitigate risk

Creditor-on-creditor violence: Companies that generally struggle to repay existing/maturing debt try to obtain favourable terms with existing or new creditors by pitting them against each other. The Wall Street Journal noted that while private equity firms and wealthy individuals referred to this as a liability management exercises (LMEs), debt investors refer to it as “creditor-on-creditor violence”. In most cases, majority lenders partner with the debtor and amend credit agreements without the knowledge or approval of minority lenders. The minority lenders then retaliate, resulting in lawsuits. The issuers weigh the pros and cons of the LME, since such transactions come with the risk of litigation and in most cases affect the reputation of the company in question and decide on the type of transaction best suited for them.

-

Liquidity enhancements

-

Increased optinality

-

Runway Extension

-

Litigation risk

-

Reputational considerations

Weak covenant protections and loose language in credit agreements allow for “covenant stripping”, which refers to stripping away original protections and amending credit agreements. Certain credit agreements allow for majority lenders, rather than all lenders, to change the credit agreement. The amendments mainly used include the following:

-

Priority of claim

-

Repayment terms and security for the debt

-

Automatic stays against bankruptcy

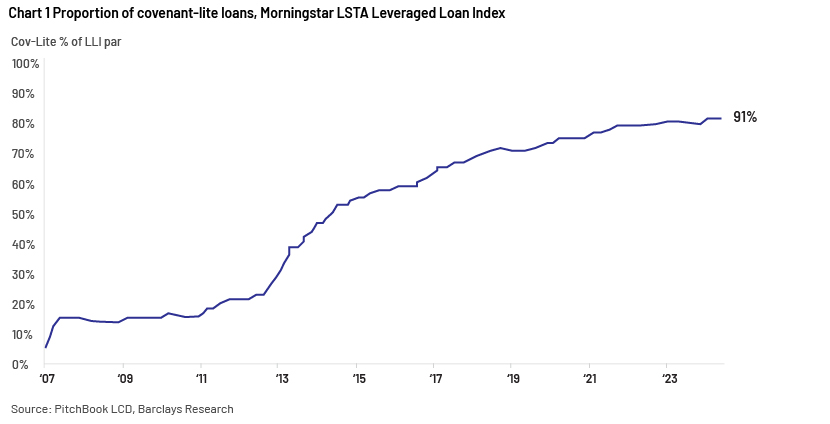

The proportion of covenant-lite debt – lacking maintenance covenants – has been increasing over time, with investors preferring covenant-lite deals for the purpose of obtaining spreads. About 91% of the Morningstar LSTA Leveraged Loan Index was covenant-lite as of July 2024 vs less than 10% before the 2008 financial crisis and about 20% in 2008, according to Barclays (see chart below). Private equity firms and hedge funds take advantage of this to lend money with higher coupons and favourable terms to distressed investors.

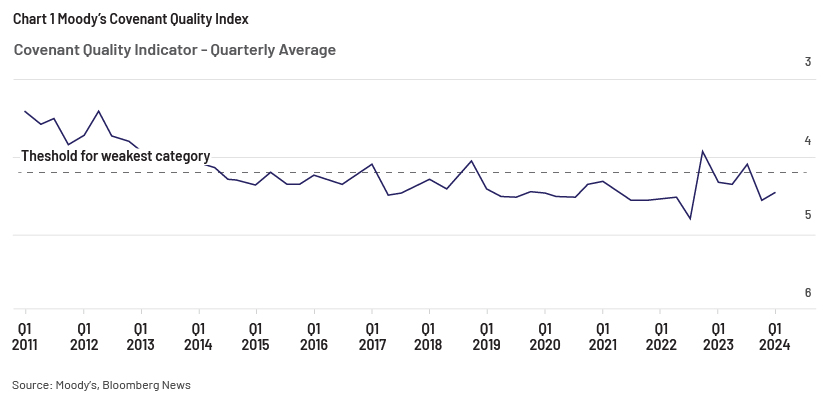

Moody’s Covenant Quality Index shows that legal protection for investors has been porous. Covenant quality has largely been below the threshold for the weakest category for leveraged loans since 2014-15 (see chart below), paving the way for LMEs, which have seen a surge since 2015.

Types of LMEs

There are two primary types of LMEs – up-tiering and dropdown – but some companies resort to a mix of the two, while others may resort to a double dip.

1. Up-tiering: Priming transaction

Minority lenders are “primed”, which means their debt suddenly ranks below that of majority lenders in the repayment order, and some original protections are stripped away. It typically provides a company with an injection of new-money liquidity from majority lenders on favourable terms.

-

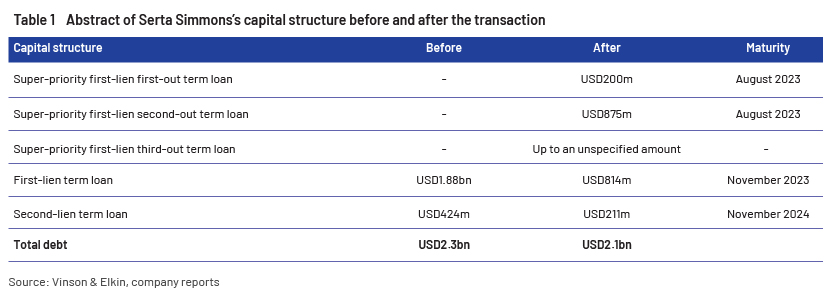

Serta Simmons’s debt exchange: In June 2020, Serta Simmons, one of the largest mattress producers in the world, entered into an agreement with a group of its lenders for a debt recapitalisation that included newly funded “first-out” debt along with super-priority “second-out” debt in exchange for parts of the existing first- and second-lien debt, and an additional basket of super-priority “third-out” debt to be used for future exchanges, all of which ranked ahead of the existing first-lien debt. The group of lenders involved in the transaction collectively held most of the outstanding loans under both the existing first-lien and second-lien agreements.

-

AMC Entertainment’s debt exchange: In June 2020, stating that its first-lien credit documents provided sufficient capacity for debt exchange, AMC Entertainment, a US-based movie-theatre chain, announced that outstanding unsecured subordinated notes would be exchanged at a discount (of about 50%) for new second-lien secured debt. Additionally, convertible notes held by Silver Lake Group LLC were exchanged for new first-lien debt. AMC managed to reduce its overall debt by more than USD1.0bn, and the unsecured and subordinated debt holders became first-/second-lien debt holders with the discounted debt exchange.

-

Rackspace Technology’s debt exchange: In 2024, Rackspace, a listed cloud company (majority owned by Apollo), executed a debt exchange providing different terms for different creditors through public and private exchanges and raising a new USD275m super-priority first-lien, first-out loan.

2. Dropdown: Asset transfer to an unrestricted subsidiary

This approach enables a company to enhance its liquidity by moving assets into an “unrestricted subsidiary”, i.e. a subsidiary not subject to the liens and claims of existing secured lenders, and to raise new financing secured by those assets. Dropdown transactions usually take advantage of “permitted investments” and “restricted payments” negative covenants. The scope of these covenants in the credit agreement defines the extent to which creditors are protected from the consequences of a dropdown transaction.

-

Crew’s trap door: In 2016, J. Crew, the US-based apparel and accessories retailer, used provisions in its senior secured credit agreement to move valuable intellectual property (IP) including the J. Crew trademark, outside its secured lenders’ collateral pool, to an unrestricted subsidiary, and used it as collateral for a debt exchange to avoid bankruptcy.

-

Revlon’s IP transfer: Driven by deteriorating operating performance and the need to procure additional funding, in 2019, Revlon, a US-based cosmetics and personal care company, revealed that it had transferred a significant amount of IP to unrestricted subsidiaries and entered into a new credit agreement for a secured USD200m term loan that was senior to its existing debt on the transferred assets and ranked pari passu on all others. The IP that was transferred to the unrestricted subsidiary was then licensed back to the company’s operating business.

3. Double-dip: Double claim to company assets

A double-dip transaction allows lenders to provide a secured loan to a borrower, the proceeds of which are then loaned to an affiliate of the borrower via an intercompany loan. The lender has a double claim on the borrower’s assets given the structure of the transaction.

-

Trinseo’s double-dip: Trinseo, a speciality material solutions provider, engaged in a double dip transaction in 2023 involving the dropdown of its Americas Styrenics business. The company obtained USD1.0bn of new-money loan from its investors (Apollo, Angelo Gordon and Oaktree) through Trinseo Luxco SPV, and this was used as an intercompany loan of USD948m, ranking pari passu with existing debt and USD125m of equity dropdown.

Outcome of LMEs

Litigation results for such cases have been mixed – going in favour of/against the creditors and the parties settling out of court in most instances; results have sometimes even been contradictory. Thus, drawing parallels with past cases is not recommended. Some cases resulted in the court ruling against the issuer, leading to settlements outside of court (e.g., Trimark); in other case, rulings were in favour of issuers, stating the investors should understand the risks of investing in covenant-lite debt (e.g., Serta Simmons).

Nevertheless, these post-transaction litigations provide borrowers with guidance for implementing an LME-based restructuring and provide creditors with assistance on dealing with LME exposures. Moody’s estimates that first-lien loan holders recovered about 95 cents on the dollar in restructurings from 1987 to 2019; this plunged to 73 cents in 2021 and 2022.

LMEs – a stopgap arrangement?

LMEs are more of a pit stop than a solution for a distressed issuer. The effectiveness of LMEs is unclear, with the different successful outcomes. Often, these transactions only give the issuers some time to stay afloat while management figures out ways to save the business. Forty-three percent of issuers end up defaulting again or filing for bankruptcy within 3 years of the first default, with an average time to re-default of 1.5 years, according to a study conducted by Bank of America (pool size of 21 LMEs). Most issuers have complicated litigations that last a number of multiple years.

What are lenders doing to mitigate LME risk and trade through the prisoner’s dilemma?

Creditors are keeping their guard up for the purpose of avoiding or limiting LME exposure. Cooperation agreements between creditors have become a popular tool amid rising cases of creditor-on-creditor violence. Such agreements between lenders result in favourable credit agreement terms. In some cases, credit agreements are facilitated by law firms themselves and in some cases, by the lenders. In June 2024, while Altice France was looking for alternatives for liability management, more than 90% of its term lenders and over 75% of secured noteholders joined forces to negotiate with the company and avoid creditor-on-creditor violence.

Creditors are also more cautious about the sacred rights of a credit agreement and insist that the sacred rights in the amendment/voting section include amendments to the pro-rata payment, pro-rata sharing and the waterfall of payments such that the amendment of such sections explicitly requires the vote of all lenders or at least all lenders that may be affected adversely by the amendment.

Credit agreements occasionally include a clause known as J. Crew protection to avoid J. Crew-like situations. The clause explicitly prohibits the transfer and licensing of IP from restricted subsidiaries to unrestricted subsidiaries. There are other provisions added to credit agreements to reduce LME exposure, such as the following:

-

Limiting investment in non-guarantor restricted subsidiaries

-

Restrictions on non-pro-rata open-market purchases

-

Restrictions on use of the incremental facility for affiliate debt that ranks pari passu with credit-agreement obligations

-

Restrictions on prepayment of all junior debt

-

Tighter covenants

How Acuity Knowledge Partners can help

As the market moves towards a normalising rate regime from a low-rate and covenant-lite loan regime, understanding these issues would become all the more important as it braces for potential defaults on these covenant-lite instruments. At Acuity Knowledge Partners, We have extensive experience in analysing issuers and in supporting investors globally. Our team of credit analysts support buy-side clients not only in fundamental credit review, but also in understanding and highlighting bond clauses and covenants, with headroom calculations and monitoring that is sometimes missed in the fine print.

Sources:

-

https://paripassu.substack.com/p/pp-trinseo-a-double-dip-pari-plus

-

Hedge Funds Smell Blood as Lenders Turn on Each Other – Bloomberg

Tags:

What's your view?

About the Author

Sharmi Basu has 11+ years of experience in fixed income research with a focus on Utilities, Telecom, Automobile and Retail sectors. Over the course of this time, she has worked for asset managers and hedge fund managers across the US and Europe and UK, helping them make investment decision by preparing detailed credit reviews – including detailed forecast based models with opinionated investment notes on corporates. Currently, she is supporting a large global asset management firm and covers US and European issuers across sectors for investment purposes and monitoring the portfolio on a day-to-day basis. Sharmi holds a Master of Business Administration (Finance) and a Master of Science..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox