Published on October 9, 2024 by Maruti Patnaik

Cross-border payments and real-time payments are becoming two critical factors in streamlining business operations. As new technologies emerge across the payments domain, such as API connections and blockchain, businesses and consumers expect better and faster payment facilities. This demand for better payments creates an opportunity for fintech and paytech providers to introduce new payment solutions in their portfolios. Faster cross-border payments are the backbone of global trade and fuel the import and export of goods and services to facilitate a seamless movement of commodities.

Central-bank projects key to facilitating cross-border payments

Cross-border payments have been limited by a lack of operability as paytechs and national payment systems collaborate to facilitate FX conversions and settlements. Furthermore, banks and payment providers still operate with legacy platforms that follow scheduled batch processing and are not efficient enough to handle large daily transaction volumes.

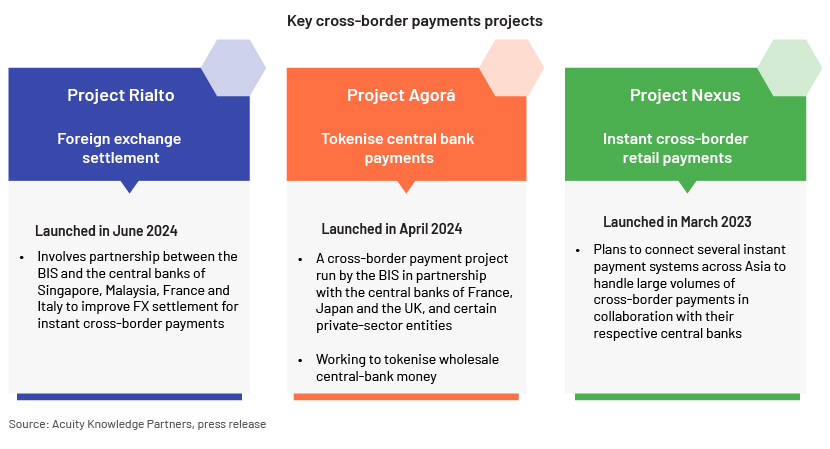

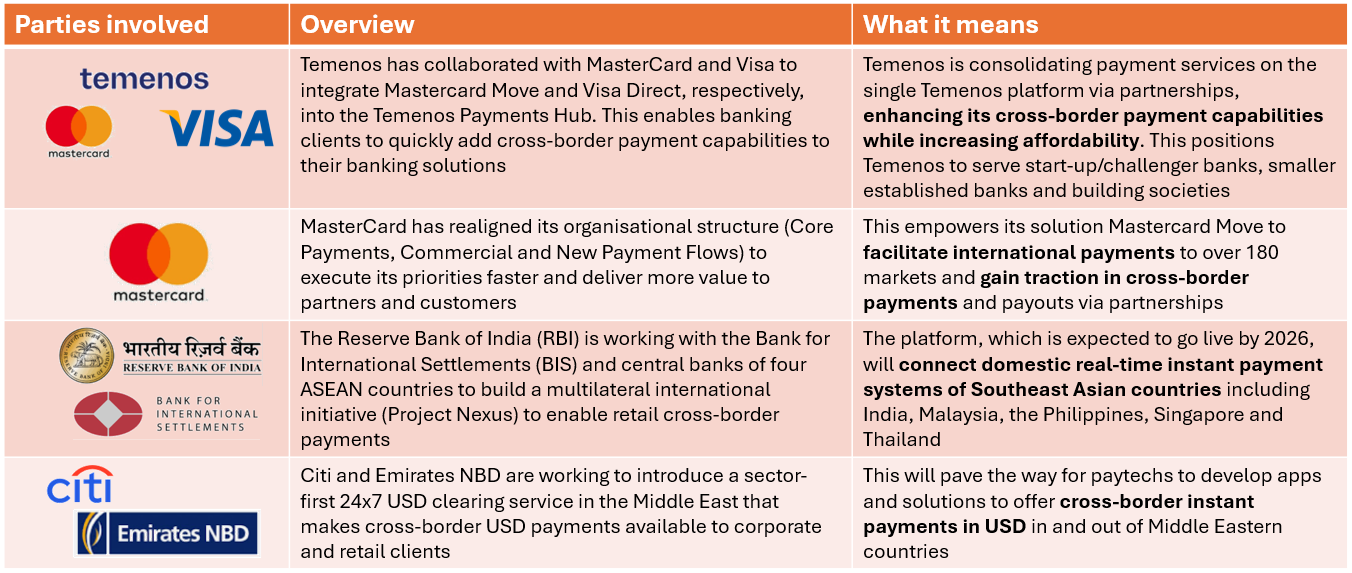

The Bank for International Settlements (BIS) and central banks are working to streamline cross-border payments via key projects

Paytechs and central banks are getting involved to drive cross-border payments and facilitate large volume.

Instant payments to drive global economies

Central banks globally are implementing initiatives to add new real-time instant rails or improve their instant payment mechanisms and infrastructure to add new overlay services on top of their real-time payments (RTP) schemes. This would help drive economies and improve money circulation in their respective countries. It would also empower governments to prevent misappropriation of funds and manage anti-money laundering/counter the financing of terrorism (AML/CFT).

New features in RTP schemes:

UPI delegated payments feature: India’s instant payments scheme, Unified Payments Interface (UPI), added an overlay service that enables multiple users to make transactions from a single primary bank account, with transaction limits set for the secondary user. This enables the primary user to give access to secondary users who do not have banking accounts.

Request to Pay: Bangko Sentral ng Pilipinas (BSP) is working to introduce its Request to Pay overlay services in its instant payments scheme this year.

EU regulation mandates banks to offer instant payments to customers and add overlay solutions such as Request to Pay in their instant payment schemes. These regulatory developments are expected to enhance the adoption of instant payments in Europe.

Key real-time payments schemes launched since 2020

| Payment system/system operator | Year of launch/country | Payment applications |

| BI-FAST – managed by Bank Indonesia (BI) | 2021/Indonesia | P2P, B2B, B2P |

| NAPAS FastFund 247 – managed by National Payment Corporation of Vietnam (NAPAS) | 2021/Vietnam | P2P |

| FedNow – operated by Federal Reserve Banks | 2023/US | P2P, P2B, B2P, B2B, payouts |

| SBI365 – Reserve Bank of New Zealand | 2023/New Zealand | P2P |

| PIX – run by Banco Central do Brasil (BCB) | 2020/Brazil | B2B, B2P, P2B, P2P, P2G, B2G, G2P, G2B |

| Transferencias 3.0 system – monitored by the Banco Central de la República Argentina (BCRA) | 2020/Argentina | P2P, P2B, B2B |

| Instant Payments System via BLINK – BORICA AD, operates the technology infrastructure of the Bulgarian payment sector | 2021/Bulgaria | P2P |

| Azonnali fizetési rendszer (AFR) – operated by GIRO Zrt (owned by the Central Bank of Hungary) | 2020/Hungary | P2P, P2B |

Note: P2P: Peer to peer; P2B: person to business; B2P: business to person; B2B: business to business

As central banks build new instant payment schemes and infrastructure, the sector is expected to witness collaborations among central banks, payment rail operators and paytechs to enable seamless transactions between international schemes. Both businesses and customers need access to the appropriate infrastructure to adopt and accept instant payments and drive high volumes. This would enable these paytechs to add overlay services across cross-border real-time payments with minimum fees and higher transaction success rates to attract customers and businesses to use their platforms and services.

Two primary challenges in implementing digital payments

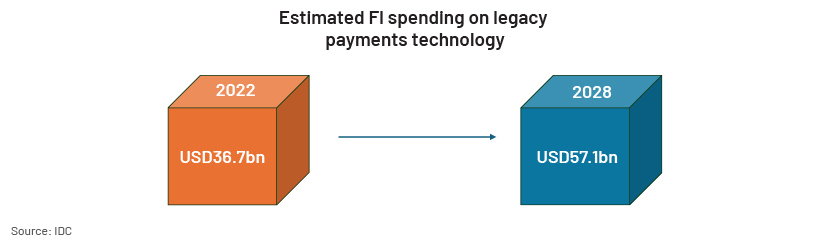

Legacy systems are expected to remain a challenge for traditional banks, which will likely drive spending on legacy payments technology. Global financial institution (FI) spending on legacy payments technology is expected to increase to USD57.1bn in 2028 – a significant barrier to deploying cross-border and real-time payments.

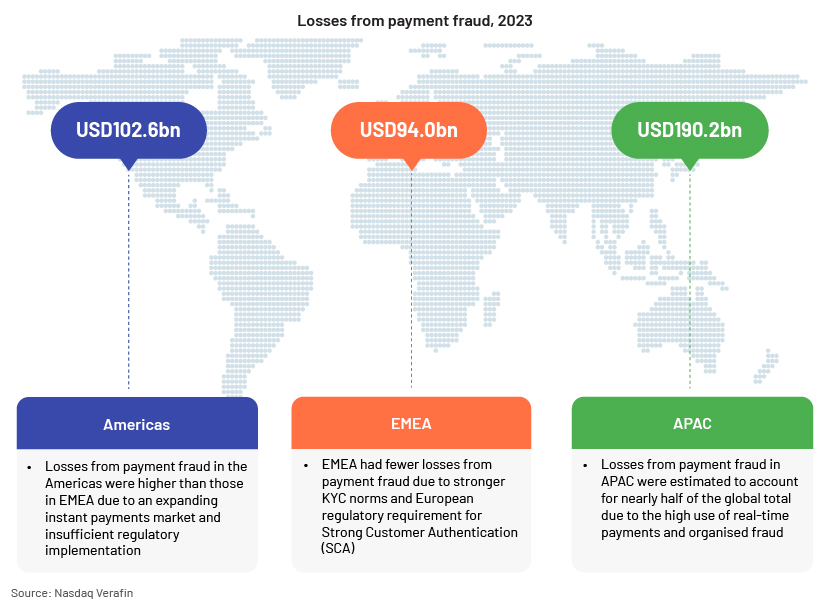

Global losses from payment fraud were expected at around USD386.8bn in 2023, according to Nasdaq Verafin. This suggests that paytechs would need to leverage AI/ML and fraud analytics and other emerging technologies to mitigate challenges in securing cross-border payments before this service could become a global standard.

What to expect in 2024-25

The global payments landscape is evolving rapidly, driven by technological advancements and changing customer expectations. Traditional cross-border payments are becoming slow, expensive and complex, and currently involve multiple agents and currency-conversion costs, adding to payment transaction costs. As such, real-time payments present opportunities to transform cross-border payments and eliminate friction. The paytech and payments sector can expect central banks, paytechs and fintechs to collaborate to develop multiple cross-border and instant payments systems to create a more interconnected and efficient global payments landscape.

How Acuity Knowledge Partners can help

We are the leading provider of offshore research and analytics services to global financial and corporate sectors. We have dedicated corporate and consulting teams with subject-matter expertise on payments and paytechs. These teams have been tracking the payment and paytech sector over the past decade to provide insight on the evolution of digital payments and related trends, regulatory changes and restrictions, best practices, paytechs’ competitor strategy and product portfolio, and deep-dive product analyses of payments platforms. Reputed fintech and paytech clients leverage our payments and paytech research services. We have helped them grow their business and support their go-to-market strategy with our research services.

Sources:

-

Positioning Mastercard for the Next Era of Growth | Mastercard Newsroom

-

Visa & Revolut Partner to Launch Real-Time Cross-Border Payments | FinTech Magazine

-

2024-Global-Financial-Crime-Report-Nasdaq-Verafin-20240115.pdf

-

How Lowell’s customers benefit from Request to Pay – Deutsche Bank (db.com)

-

Free transfer fee through BI-FAST. Let's find out more (maybank.co.id)

-

Indonesia Joins Payment Digitalisation Trend With New BI-FAST Service (vixio.com)

-

The future of cross-border payments depends on collaboration | The Payments Association

-

Project Rialto: improving instant cross-border payments using wholesale CBDC settlement (bis.org)

Tags:

What's your view?

About the Author

Maruti has more than 10 years of experience in technology research and consulting. He currently works with the marketing and research teams of a leading fintech supporting them execute their go-to-market strategies. Prior to joining Acuity Knowledge Partners, Maruti worked for GlobalData where he worked on areas around emerging themes such as AI, business intelligence, cloud, 5G, payments, and retail.

Like the way we think?

Next time we post something new, we'll send it to your inbox