Published on May 29, 2024 by Prashant Gupta

Introduction: Banks’ foray into private credit

The financial landscape seems to be shifting again, as banks are gradually starting to venture into the lucrative territory of private credit.

In a PitchBook article released January 16, 2024, it stated the following: “In the last six months, banks such as Wells Fargo, Deutsche Bank, Societe Generale, and Rabobank have all launched private credit initiatives—either independently or in partnership with established operators. Media reports have also speculated that Citi, Barclays, and Nomura could soon join the fray, and that JP Morgan plans to expand its existing private credit strategy.”

The private credit industry has grown significantly in the past decade, and many well-established private credit funds (including independent players and a division of PE firms or other larger institutions) have already made this space very crowded. So, why are banks now foraying into this market when they had already parted ways with it after the 2008 global financial crisis (GFC)?

In this article, we will explore what has sparked this move by banks, what are the factors driving banks toward private credit and what are the opportunities and challenges private credit managers may face.

The rise of private credit

The notable growth of the private credit sector is a result of regulatory changes and a bank retrenchment from lending to small and mid-sized corporates, especially in leveraged finance.

Stricter regulatory norms following the 2008 GFC led banks to reduce lending to riskier or less profitable business. This change created a significant funding void, primarily for small and middle-market firms, but that gap has been well taken care of by private credit funds. Over time, private credit has turned out to be a key source of funding for firms that fall outside the traditional lending framework by offering more flexible, customized and timely financing solutions.

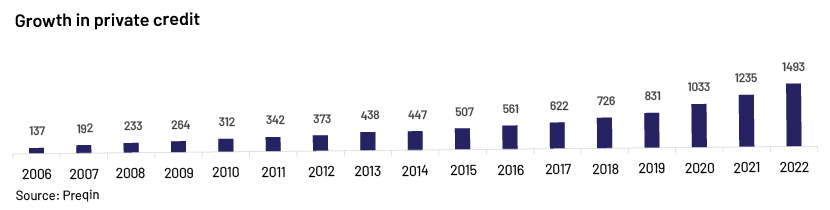

As a result, this segment grew to a substantial USD1.5tn by end-2022 (from just USD200bn in 2008) and is expected to reach USD2.3tn by 2027, according to Preqin.

Are banks recovering lost market share?

Despite banks’ initial pull-back, they have now gradually begun to re-tap the territory of private credit markets. According to PitchBook data, in 1Q24, 28 companies arranged bank loans to refinance USD11.8bn of debt that was previously provided by private credit firms.

Banks clearly intend to recover their lost market share and remain relevant in this financing space. By doing so, they aim to not only capture the higher returns that prevail in the private credit space but also diversify their revenue streams beyond traditional banking operations.

To achieve this goal, banks are paving their way into this space through various strategies. This undertaking includes creating their own dedicated private credit divisions and forming strategic alliances with established private market players in the sector. As banks continue to venture into the private credit space, the industry will experience continuing transformation.

Regulatory outlook

The significant growth of the global private market sector, along with the increasing participation of retail investors, has already raised concerns among regulators globally about the opaque market practices followed by the sector. Moreover, as banks also become more involved in this space, regulators are likely to keep a closer eye to ensure that the systemic risks associated with banking do not spill over to this less-regulated space. Watchdogs might also examine the interplay between banks and private credit funds, particularly if banks start to have significant exposure to these funds, and may consider imposing new guidelines for risk management, transparency and reporting requirements.

Admittedly, as this financial landscape continues to evolve, so too does the regulatory landscape, which may have an impact on the broader private credit environment.

What lies ahead for private credit managers

Banks’ foray into this market presents several challenges for private credit managers. Firstly, banks’ entry will further intensify competition, as more players compete for a limited number of deals, leading to tighter spreads and thus possibly driving down the returns that private credit lenders have been enjoying.

Smaller private credit funds may struggle to compete with the larger resources and customer bases of banks, which can position themselves as one-stop shops for finance, thus risking a loss of market share and a decline in the sector’s diversity and flexibility.

Banks may also leverage technology to gain an edge in the private credit market. Advanced analytics and machine learning can improve credit assessment and monitoring, while blockchain technology could streamline syndication and settlement processes.

Additionally, the arrival of dominant banks could lead to market consolidation, less favorable borrowing terms and increased systemic risks. The flexibility and innovation that define private credit might be compromised if banks standardize lending practices. It is important to consider these potential drawbacks to preserve a competitive and varied private credit market.

However, managers are advised not to succumb to this pressure; instead, they should be vigilant and focus on their strengths. Private credit managers have extraordinary strengths to offer bespoke and tailor-made financing solutions. Their extensive experience in this market and deep connections in the mid- and small-cap space enable them to leverage their position. Additionally, banks could also expand the market by serving borrowers previously beyond the reach of private credit. The impact on collateralized loan obligations (CLOs) and the potential for banks to influence lending practices, due diligence and comprehensive risk assessment should not be underestimated, as evidenced by the increasing prominence of private credit CLOs in structured finance. This also presents opportunities for private credit managers to partner with banks and be prepared to navigate a potentially more complex market, where niche specialization is required.

Conclusion

Banks’ foray into the private credit market marks a new beginning in the financing landscape. While it brings challenges, it also opens doors to innovation and growth. For some investors, banks’ entry may indicate a maturing market with diminished returns, while for others, it may show enhanced liquidity and stability that banks can contribute to the market.

As the market continues to evolve, the collaboration between banks and private credit funds may result in a more dynamic and resilient financial ecosystem.

Above all, private credit funds must continue to make their unique selling proposition clear, showcasing their ability to yield superior returns amid a shifting competitive environment. Lenders will seek out opportunities that not only navigate the challenges of maturing markets but also depict strong performance despite the fierce competition from banks.

How Acuity Knowledge Partners can add value

We have more than two decades of experience in offering support to global clients in the private credit domain. Our Private Credit team’s expertise spans a number of sectors and credit investment strategies. We work as a strategic partner and solution provider, offering end-to-end support across the research cycle – from deep-dive research and complex financial modeling at the deal sourcing/underwriting stage to comprehensive credit research and writing detailed investment committee memos during deal execution.

We continue to provide end-to-end support after investment on portfolio monitoring (including covenant monitoring and performance dashboards) and periodic portfolio valuation (including data management and coordination with stakeholders).

Partnering with Acuity Knowledge Partners gives private market players access to our knowledge and analytical strength, ensuring they maintain a competitive edge.

Sources

-

Private Credit Outlook: Evolution and Opportunity | AB (alliancebernstein.com)

-

Inside the love-hate relationship between banks and private credit (privatedebtinvestor.com)

-

What is Private Credit? How Does It Work and What Are the Risks? - Bloomberg

-

Private Credit Moves In on Traditional Loan Channels, and Regulators Are Watching (garp.org)

-

Banks enter private credit to maintain market share | PitchBook - PitchBook

-

Q3_2023_Global_Private_Market_Fundraising_Report.pdf (pitchbook.com)

Tags:

What's your view?

About the Author

Prashant is a seasoned professional within the Private Market team and has been with the company for over 12 years. His extensive career spans more than 18 years, during which he has garnered a wealth of experience through a diverse range of research and analysis assignments. His clientele is impressive and varied, including top-tier asset managers, private equity firms, and bulge bracket investment banks.

His expertise is broad and deep, with a particular focus on comprehensive end-to-end credit analysis.Prashant’s skill set encompasses capital structure analysis, intricate corporate structure assessments—including guarantees and structural subordination cases—and covenant compliance analysis. Additionally, he is adept at financial modeling and valuation, asset recovery analysis,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox