Published on March 17, 2020 by

The crude oil industry has seen boom and bust cycles over the past decade, affecting supply, and demand due to economic growth. The investment cycle peaked from 2011 to mid-2014, when oil was USD100+ per barrel (/bbl), and bottomed out after the price crash and extended oil downturn from mid-2014 to 2017. The major factors that weighed on the global oil and gas markets during these periods include the following:

-

Weakening economic growth, not only in the US but also in Europe and China

-

Ongoing trade tensions that created uncertainty, dampened growth, and led to modifications in long-established supply chains

-

An uncertain political outlook, including the US election cycle, Brexit, and tensions in the Middle East

-

A global shift towards sustainability that has made the sector look for portfolio rebalancing

The global oil market was roughly balanced in 2019 as global oil supply declined slightly and global oil consumption grew at its slowest pace since 2011. Despite the deeper production cut by the Organization of the Petroleum Exporting Countries (OPEC) in the latter part of 2019, Brent crude oil averaged USD64/bbl during the year, down from USD71/bbl in 2018.

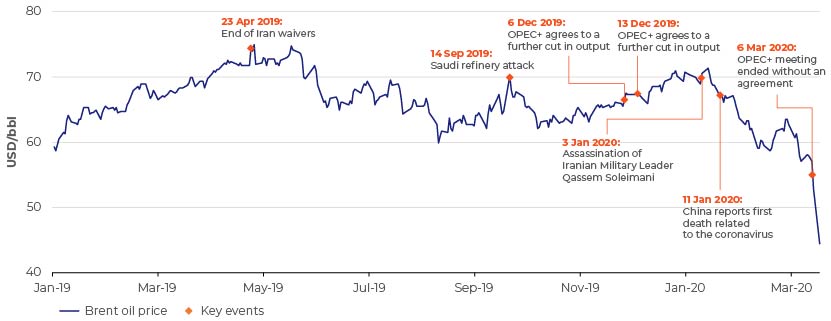

Volatile crude oil price environment

The industry started 2020 on a dramatic note, with prices spiking immediately after the US drone strike that killed Iranian General Qassem Soleimani on 3 January 2020. The killing triggered fear that large-scale unrest could return to the Middle East and threaten the region’s oil supply. Despite the initial shock, the impact of Soleimani’s death on the oil market was short-lived, with Brent crude oil settling at just under USD66.58/bbl by 9 January 2020.

The issues in the Middle East were amid the ongoing trade dispute between the US and China that has resulted in fluctuating oil prices in recent months. The outlook for oil prices was buoyed in late December 2019, when it appeared that the nations were on the verge of reaching an agreement that would boost global economic growth forecasts and oil demand. However, when the “phase one” trade deal was reached in mid-January 2020, oil prices did not show much movement as the US maintained its status quo on most of its tariffs.

The price decline accelerated in late January on concerns around economic growth due to the novel coronavirus (COVID-19) outbreak in China. Furthermore, on 6 March 2020, the OPEC+ group failed to reach an agreement to extend production restraint beyond March 2020. In response, on 8 March 2020, Saudi Arabia announced a steep USD4-8/bbl reduction in official selling prices (OSPs) in April. These cuts are seen as the start of a price war. The Brent crude oil price settled at USD34.36/bbl on 9 March 2020, declining by USD16.93/bbl or 33% from 5 March 2020. The US Energy Information Administration (EIA) forecasts that Brent prices will average USD43/bbl in 2020, down from a forecast USD65/bbl in January.

Black swan events continue to drive crude oil prices

Less demand than supply of liquid fuel mainly due to coronavirus outbreak

The EIA forecast on 11 March 2020 that global demand for liquid fuel would average 101.1m barrels per day (mmbbl/d) in 2020, 0.4mmbbl/d more than the 2019 average. However, the latest estimate is 0.9mmbbl/d less than previously forecast in January 2020. Global supply of petroleum and liquid fuels is forecast to rise by 1.5mmbbl/d to 102.1mmbbl/d in 2020, building inventories by 1.0mmbbl/d for the year. Several recent developments have contributed to significant revisions in the EIA’s outlook for global oil demand and supply:

-

Forecasts of slowing global economic growth, primarily due to COVID-19, have led to significant downward revisions of the EIA’s global oil demand forecast. The increase in the number of new cases outside of China has led to restrictions on international and domestic travel, and reduced activity among global manufacturers

-

As a result of the 6 March OPEC+ meeting, the EIA no longer assumes production management from OPEC members or partner countries that were previously voluntarily reducing production

-

Lower forecast crude oil prices lead to lower US crude oil production, as a result of a price-induced reduction in drilling and completion activity

Most of the reduction in demand is from China. The EIA estimates that COVID-19 will reduce China’s total demand for petroleum and liquid fuels by 0.2mmbbl/d, on average, in 2020, driven by the following factors:

-

-

The reduction in demand for petroleum and liquid fuels caused by the general decline in China’s economic activity

-

The volume of forgone jet fuel consumption in China caused by flight cancellations

-

The additional impact on China’s demand for other transportation fuels

-

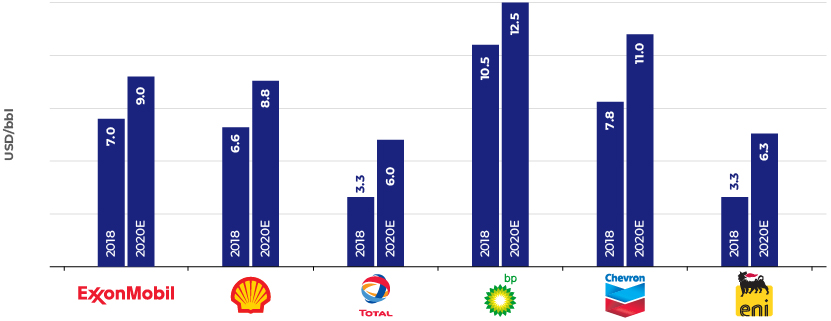

Refiners will get a boost from IMO regulations in 2020

The new International Maritime Organization (IMO) regulations enforced on 1 January will likely see increased demand for higher-quality and higher-value oil products, boosting crack spreads for middle distillates and raising the premium for lighter, sweeter crude. This year will likely be a bumper year for refining earnings. Refiners with scale and complexity, such as Chevron and ExxonMobil, should see the biggest uplift in earnings.

Weighted average refinery net cash margins (USD/bbl)

Portfolio rebalancing and energy transition to continue

This is likely to be another year of incremental evolution of zero-carbon energy for oil and gas companies. The European majors are ahead of their US counterparts, with some of them setting very ambitious targets.

-

-

-

BP aims to become a net zero company by 2050

-

Shell aims to reduce its net carbon footprint by 20% by 2035 and 50% by 2050 from 2016 levels

-

Eni has set a target of reducing the intensity of its upstream greenhouse gas (GHG) emissions by 43% by 2025 from 2014 levels

-

Equinor seeks to cut its CO2 emissions by 3m tons per year from a business-as-usual baseline through 2030

-

Repsol has set a goal of net zero emissions by 2050

-

In 2018, ExxonMobil announced reducing methane emissions by 15% and a 25% reduction in flaring by 2020

-

Chevron intends to lower upstream oil net GHG emission intensity by 5-10% and upstream natural gas net GHG emission intensity by 2-5% from 2016 to 2023

-

-

Over the past decade, oil majors have increased their exposure to renewable energy such as wind and solar as they have looked to transition towards cleaner energy sources. Some notable acquisitions include the following:

-

-

-

2020: Total signed an agreement with Indian conglomerate Adani Group to acquire a 50% stake in its solar business for USD500m

-

2019: Shell acquired 100% of sonnen, a leader in smart energy storage systems and innovative energy services for households

-

2018: Shell bought a 44% stake in US solar power firm Silicon Ranch for USD200m and made a USD20m equity investment in India-based renewable power company Husk Power Systems

-

2018: Total acquired a 74% stake in French electricity retailer Direct Energie for USD1.7bn, propelling the company to become one of the top utility providers in France

-

2017: BP acquired a 43% stake in Lightsource, which has rebranded as Lightsource BP and is Europe’s largest solar power project developer

-

2016: Total purchased French battery manufacturer Saft for USD1.1bn and bought Belgian green power utility Lampiris for USD224m

-

-

Despite growth in renewables, oil majors spent only 1% of their combined budgets on green energy schemes in 2018.

Upstream M&A activities expected to rebound

2019 saw the lowest levels of upstream M&A in almost two decades. However, the deal volumes are likely to rebound this year, driven by stronger capital discipline and overall negative market sentiment amid longer-term demand uncertainty.

-

-

-

The supermajor sell-off will likely trigger supply of upstream assets and packages

-

Low-margin, high-carbon legacy assets and high breakeven growth projects are likely targets

-

Europe is expected to remain a hotspot of deal activity

-

-

Divestment plans of supermajors

|

|

|

|

|

|

|

|

|

|

We believe COVID-19 will have a deep impact on how we do business around the world. Oil industry will need to be more focused to adapt to this new normal of business as they rethink their strategy for 2020.

Acuity Knowledge Partners can help you navigate through these challenging times.

To help our clients navigate both the people and business impact of COVID-19, we have created a dedicated hub containing a variety of topics including our latest thinking, thought leadership content and action oriented guides and best practices.

References:

1) Company information

2) https://www.eia.gov/outlooks/steo/report/global_oil.php

4) https://www.eia.gov/dnav/pet/hist/rbrteD.htm

5) https://iopscience.iop.org/article/10.1088/2516-1083/ab2503

6) https://www.nsenergybusiness.com/features/oil-companies-renewable-energy/

6) https://www.nsenergybusiness.com/features/oil-companies-renewable-energy/

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox