Published on October 10, 2024 by Aditya Bakliwal

Crypto ETFs to create opportunities with regulatory support

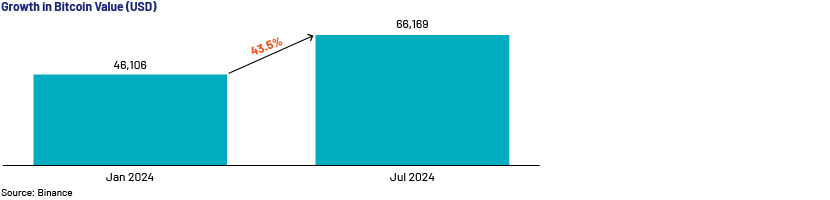

The global financial landscape is continuously transforming as new digital financial products such as cryptocurrency exchange-traded funds (crypto ETFs) compete with traditional ones. These financial instruments have become a focal point for investors seeking to capitalise on the growth of digital assets without directly holding them. The surge in interest in crypto ETFs signifies a broader acceptance and integration of cryptocurrencies into mainstream finance. For instance, after the launch of the first Bitcoin exchange-traded fund (ETF), Bitcoin's price surged 43% within six months – from c.USD46k in January 2024 to USD66k in July 2024.

Understanding crypto ETFs

Crypto ETFs are investment funds that track the value of single or multiple digital currencies. ETFs are also traded on traditional stock exchanges to provide regulated access for investors to gain exposure to the crypto ETF market. Direct cryptocurrency investments need secure storage and the expertise of digital wallets, while ETFs provide a familiar and simplified investment vehicle. This ease of access is a significant factor contributing to their rising popularity, as investors can now purchase crypto ETFs through traditional brokerage accounts.

Fintech innovations to propel crypto ETFs to new heights – robust platforms for trading a variety of crypto ETFs

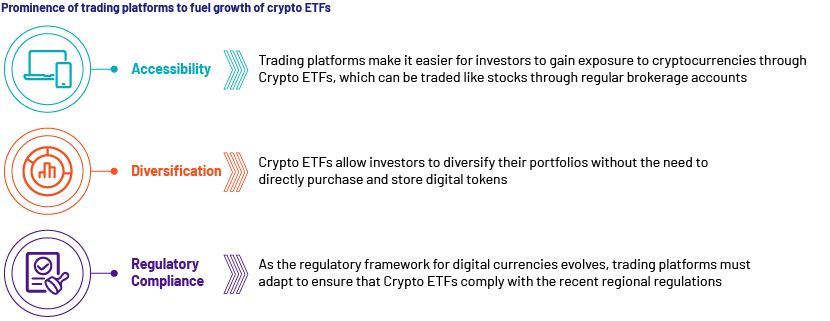

Trading platforms are essential for the growth of crypto ETFs, as they bridge the gap between the complex world of cryptocurrencies and traditional financial markets, offering a regulated, accessible and diversified investment option.

Prominence of trading platforms to fuel growth of crypto ETFs

Key developments in the fintech domain expected to boost the adoption of crypto ETFs among institutions and retail investors:

-

ETFSwap, a decentralised finance (DeFi) project, is working to launch its crypto ETF trading platform by the end of 2024 to provide investors with an advanced infrastructure to seamlessly trade cryptocurrencies, spot Bitcoin ETFs, spot Ethereum ETFs and Solana ETFs

-

FalconX, an institutional digital asset prime broker, launched Prime Connect, an exchange settlement solution, in April 2024. This enables institutional investors to trade on exchanges and serves the critical needs of institutional investors trading in digital assets

-

Hong Kong’s Mox Bank (a subsidiary of Standard Chartered) introduced a crypto ETF service on its Mox Invest platform in August 2024 and plans to offer advanced trading solutions to retail investors by the end of 2024

Factors driving demand for crypto ETFs

-

Regulatory clarity and approval: Regulatory approval is a critical factor in the adoption of crypto ETFs. Governing bodies such as the US Securities and Exchange Commission (SEC) initially hesitated to grant approval, as they were concerned about market manipulation and investor protection. However, the approval of the first Bitcoin ETF in Canada in early 2021 paved the way for regulators to trust that crypto ETFs have a good future. This led to greater regulatory acceptance, encouraging other countries to follow suit.

| Date | Governing body | Initiative to drive crypto ETFs |

| July 2024 | Australian Securities Exchange (ASX) | Approved listing of a second Bitcoin ETF on its platform |

| May 2024 | US SEC | Approved eight Ethereum ETFs for listing and trading on SEC-regulated exchanges |

| April 2024 | Hong Kong’s Securities and Future Commission (SFC) | Enabled three spot Bitcoin and Ethereum ETFs |

| January 2024 | US SEC | Approved US-listed Bitcoin ETFs |

-

Institutional Interest: Institutional investors have a significant role in increasing demand for ETFs. Financial institutions, alternative and traditional asset managers, and hedge funds have begun to accept the potential in investing in digital assets. Crypto ETFs offer a secured and regulated means for both retail and institutional investors to capitalise on cryptocurrencies, diversify into high-growth risky digital assets and avoid the complexities of direct investments.

-

Market diversification and volatility: Cryptocurrencies are known for their volatility, which can be both beneficial and risky. While volatility may provide noteworthy profit opportunities, it also involves extensive risk. To mitigate such risks, crypto ETFs offer a diversified portfolio. Investors can gain exposure to multiple cryptocurrencies, reducing the impact of price fluctuations by holding a single digital asset.

-

Investor education and awareness: With growing awareness and understanding of cryptocurrencies, more investors are getting interested in this space. Hence, crypto ETFs act as an entry point for investors, providing a lower-risk path to participate in the market without the need for in-depth technical knowledge and a regulated environment.

Navigating challenges: the resilient path forward for crypto ETFs

Regulatory uncertainty in key markets such as the US and China limit increasing adoption of crypto ETFs. Moreover, concerns relating to market liquidity, manipulation, security and usability of underlying crypto assets need to be addressed.

However, crypto ETFs are expected to gain significant traction in the coming years. As the market grows, new regulatory frameworks would be introduced, enabling the emergence of more innovative products and platforms. The market is expected to witness enhancements in crypto ETFs, including a wider range of cryptocurrencies, DeFi tokens and mechanisms for generating passive income through staking. It is, therefore, likely to see a significant shift from mainstream ETFs to digital assets as crypto ETF trading platforms gain traction.

Increasing investment in crypto ETFs globally represents a significant shift towards the adoption of digital assets. In addition, with the introduction of new and more secure regulation, the market will continue to develop, and crypto ETFs are expected to play a significant role in the financial ecosystem, increasing the adoption and integration of digital assets.

How Acuity Knowledge Partners can help

We are the leading provider of research and analytics to emerging sectors, including fintech, paytech and digital asset platform providers. We offer a wide range of customised solutions and capabilities and have a pool of subject-matter experts able to conduct research across asset classes, including cryptocurrencies. We offer in-depth insights on cryptocurrency market dynamics, regulatory changes and emerging tech investment opportunities with data analysis, market trend identification and corporate strategy research. We also support fintech providers to identify and analyse startups and trading platforms operating in these emerging domains, and track technology developments and best practices relating to crypto ETF solutions and technologies. Our customised reports in the fintech space help identify potential risks, capitalise on profitable trends and support go-to-market strategies for growth and innovation in the emerging crypto ETF trading space.

Sources:

-

https://www.nasdaq.com/articles/australias-largest-stock-exchange-approves-its-second-bitcoin-etf

-

https://www.globalxetfs.com.au/bitcoin-etfs-riding-the-wave-of-success/

-

https://fintechmagazine.com/articles/us-sec-approves-spot-ethereum-etfs-cryptos-rise-continues

-

https://www.oysterllc.com/what-we-think/the-rise-of-bitcoin-etfs/

-

https://www.withum.com/resources/cryptos-rise-bitcoin-etfs-in-a-new-era-of-legitimacy/

-

Hong Kong's Mox Virtual Bank Launches Crypto ETF Service | Coinspeaker

-

The spot Ethereum ETFs' first week by the numbers | The Block

Tags:

What's your view?

About the Author

Aditya has over 7 years of experience in the corporate strategy and consulting domain. Currently, he works with senior strategy executives of the technology and capital market firms and helps them meet their strategic goals such as market entry strategy, competitive intelligence & benchmarking, product benchmarking, and many more. Aditya previously worked at Evalueserve, where he assisted clients across industrial automation domain in strategic projects.

Like the way we think?

Next time we post something new, we'll send it to your inbox