Published on November 26, 2024 by Priyanka Tiwari

Overview

A data centre is a facility that houses a large network of computers and other IT infrastructure for data storage, processing and management. These centres serve as the foundation for digital services and cloud computing, enabling anything from corporate applications, e-commerce and social media platforms to government services and data-intensive technologies such as artificial intelligence (AI) and the internet of things (IoT). The data-centre landscape is diverse and caters to various needs.

Types of data centres and their use

Enterprise data centres – Owned and operated by large organisations to manage and store their own IT infrastructure and data, e.g., Equinix, CtrlS

Colocation data centres – Allow businesses to rent space, power and cooling from third-party providers while retaining control over their hardware and software, e.g., Equinix, Yotta

Cloud data centres – Operated by cloud service to support cloud computing services, offer scalable storage, computing power and applications over the internet, e.g., Amazon Web Services, Google Cloud

Managed data centres – Operated by third-party vendors who provide the infrastructure and handle management tasks such as security, monitoring and maintenance. This type is suitable for businesses that need expert management and do not have in-house expertise, e.g., Equinix, IBM

Edge data centres – Small, decentralised data centres located close to end users and devices, e.g., Equinix, CISCO Systems

Hyperscale data centres – Built and operated by large tech companies, such as Amazon, Google and Facebook, to scale up rapidly and handle vast amounts of data and traffic

Data centres in India

India's data-centre sector is on the brink of a significant transformation, poised for remarkable growth. As digitalisation accelerates across sectors, driven by increasing internet penetration, cloud adoption and the rise of emerging technologies such as AI and IoT, demand for robust data infrastructure is unprecedented. Government initiatives and data localisation laws further fuel this momentum, making India an attractive destination for both domestic and international investment. With a unique combination of a large consumer base, favourable policies and a commitment to sustainable practices, the country is positioned to emerge as a global leader and unlock immense potential for innovation and economic growth. India is a desirable global data-centre destination due to factors such as a trained workforce, affordable space and advantageous government subsidies. Hyperscale companies’ plans for long-term facilities investment highlight India's potential to become a dependable international data-centre hub.

Growth of India’s data centres

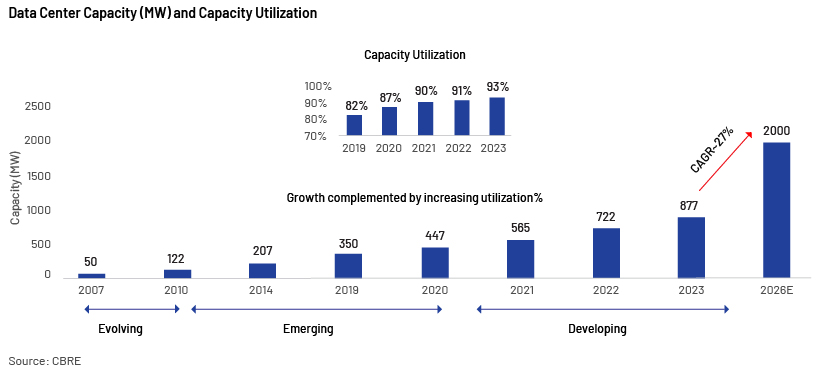

The initial years of data centres in India were extremely slow. The first commercial data centre was established in 2000, and 122MW capacity was reached only by 2010, i.e. an addition of just 12MW per year, on average. After that, growth almost tripled until 2020, i.e. at an average of 32MW annually. Factors that contributed to this boom included broadband policies, the movement from 2G to 3G, the launch of a new telecommunication company (JIO – more network coverage and offering cheap plans to attract consumers) and the country taking bold steps towards digital payments (UPI) by 2016.

Exhibit 1:Data-centre capacity and capacity utilisation

Around 125MW was added from 2020 to 2023, and in just three years, capacity was close to 900MW. The increased capacity was absorbed rapidly, with utilisation increasing to 93% in 2023 from 82% in 2019. Capacity expanded exponentially – at a CAGR of c.29% – to c.877MW in 2023 from c.350MW in 2019. The industry is set to witness remarkable growth, with capacity addition projected at 800-850MW on the supply side from 2024 to 2026, to reach 1.7-2GW, growing at a CAGR of c.27%, according to JLL, CBRE and a CareEdge rating report.

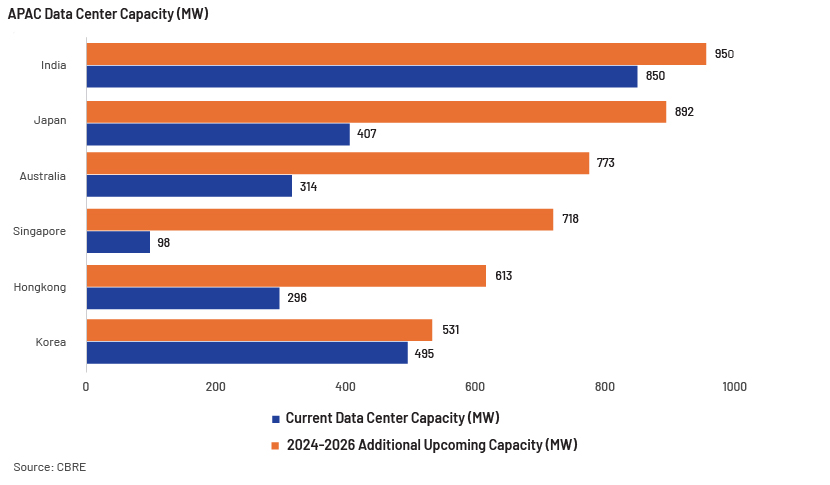

Exhibit 2: India surpasses major APAC countries in data-centre capacity

According to a CBRE report, India surpassed key Asia-Pacific nations including Australia, Hong Kong SAR, Japan, Singapore and Korea in terms of data-centre capacity in the region (excluding China), with c.950MW in 1Q 2024. India is likely to record the highest capacity addition over 2024-26, more than in the major Asia-Pacific countries, highlighting its strategic edge in the data-centre market.

Growth catalysts

Digital transformation. India is moving towards becoming a developed-market economy, and technology is expected to play a pivotal role. Economic growth is being accelerated by digital transformation, leading to substantial data generation. This wave of digitalisation, driven by the expansion of e-commerce, fintech platforms, online streaming and gaming services, is anticipated to increase the number of internet users and boost internet penetration to 87% by FY29 from c.63% in FY23. The adoption of technologies such as 5G, IoT and AI are also expected to significantly augment demand for data and, in turn, data centres. These demand factors are projected to triple data consumption in India.

Lower per-MW cost. India is an attractive location for data centres due to its low per-MW cost. The median cost of constructing a data centre (2H 2023) in India is estimated at c.USD6.8m/MW of capacity, significantly lower than most Asia Pacific nations’ – Australia was at c.USD9.17m/MW, Japan at c.USD12.73m/MW and Singapore at c.USD11m/MW. Data-centre set-up is capital-intensive, with close to 40% cost allocation towards hard costs, i.e. land and building (including fit-out), 40% towards the electrical system and the balance 20% towards heating, ventilation and cooling systems.

Government initiatives. The central government has taken a number of steps, such as releasing a draft data-centre strategy for 2020 and allocating the sector infrastructure status in the Union Budget for 2022-23. The state of the infrastructure makes it easier to obtain institutional credit, obtain long-term financing at favourable rates and present prospects for refinancing. State governments have also started offering incentives, such as single window clearing, power subsidies, stamp duty exemptions and property tax rebates. Regulatory support for data localisation would also lead to an increase in data-centre capacity.

Global connectivity. India’s strategic position, along with its ongoing investments in undersea cables and fibre networks, facilitates global exchange of and access to data. The data-centre sector’s rise would be supported by increasing data traffic, technical advancements, scope for further improvement in technology and a supportive regulatory environment.

Social media. The ever-growing popularity of social media and content streaming services such as Netflix, Hotstar, JioCinema and Primevideo is another catalyst for data-centre growth. Massive volumes of data are generated and managed by these platforms, requiring the use of high-capacity data centres to guarantee lag-free streaming for millions of viewers.

Data sovereignty and security. Concerns about data sovereignty and security have led to increased demand for localised data centres. Regulations and guidelines on data localisation are pushing companies to store and process data within India’s borders, further driving the need for local data-centre infrastructure.

Cloud service providers (CSPs). To meet increasing demand, driven by AI, CSPs have realigned their requirements. CSPs provide vital IT infrastructure systems for data storage and processing capacity, made available through the internet. These suppliers have also announced larger investment to scale up in response to AI-driven growth. The absorption rate dropped in 1H 2023 as CSPs slowed their offtake to align expansion with AI requirements; this subsequently led to a 12% rise in y/y absorption in 2H 2023.

Coexistence of hyperscalers and edge centres

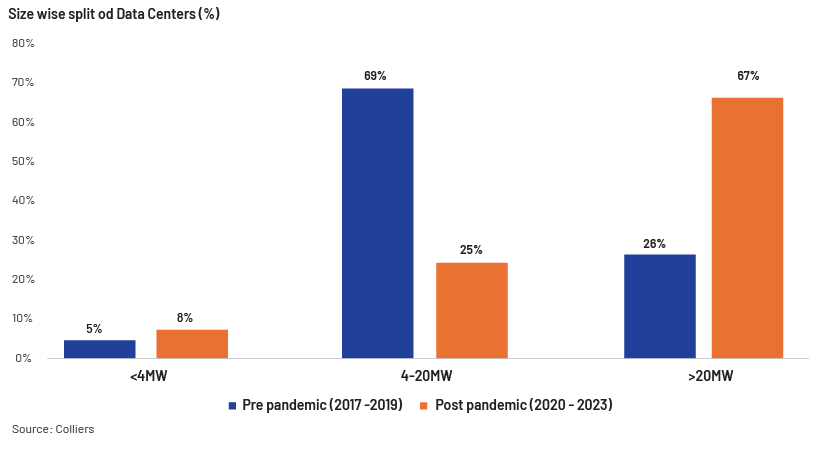

The supply of large data centres, driven by hyperscalers, has increased since the pandemic – the share of large data centres (>20MW) has risen to c.67% from c.26% before the pandemic, due to increased demand. About 70% of data centres have capacities of 4-20MW, serving medium-size retail and wholesale customers. The typical data centre in Mumbai and Chennai is 50-60% larger than that in other cities due to the development of large data-centre parks. Small data centres (<4MW) have low penetration but are expected to expand in the next three to four years due to increased edge deployment.

Exhibit 3: Split of data centres by size (%)

Edge data centres are gaining traction, driven by IoT, AI, cloud, OTT and 5G technologies, as they provide reduced latency, real-time analysis and business agility. Such data centres are being established not only in tier 1 cities but in tier 2 cities as well. Edge data centres would support the sustainable transition to data centres through a smaller footprint and lower energy consumption.

AI to propel growth

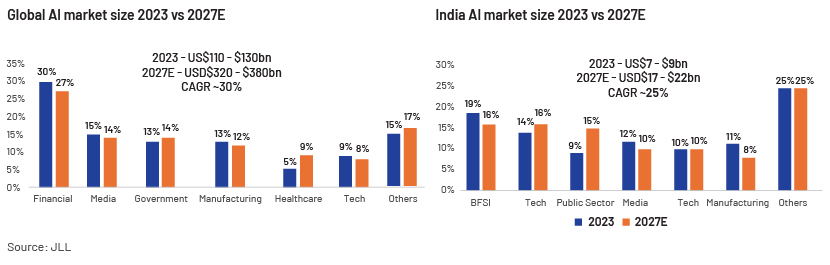

AI requires machines with high computing power, advanced hardware and large amounts of data to understand the patterns and structures present in training data and generate new output. The exponential growth in processing data has led to demand for new data centres that can handle the energy requirements and meet the cooling requirements of high-speed servers. The evolution and growth of other AI disciplines are expected to add to demand for data centres, both in terms of capacity and capability. Increasing need for AI is expected to attract c.USD6bn in investment to India's data-centre market by 2026, of which c.USD1.1bn would be towards civil construction and c.USD4.5bn towards mechanical, electric and plumbing costs, according to analysis by JLL. Mumbai and Chennai are expected to account for most data-centre capacity, i.e. c.46% and c.27%, respectively, because of their infrastructure advantages. The global AI market is expected to grow at a CAGR of c.30% and India’s market at a CAGR of c.35% by 2027.

Exhibit 4:Global and India’s AI market by sector (2023 vs 2027E)

Green initiatives

The cost of power accounts for 65% of total operating costs. The cooling system and IT equipment consume c.75% of the total power input. Power consumption by data centres is predicted to increase, requiring even more processing power. Thus, "green data centres" have emerged to ensure sustainable business. Sustainability is determined by power usage effectiveness (PUE); the score is expected to reduce to c.1.3 from c.1.9 at present due to green data centres. Data-centre operators are expected to increase spending on renewable power sources. Renewable energy currently makes up 20-25% of the requirement, having reduced electricity consumption by 17-20% compared with 2020. The long-term goal is to achieve carbon-neutral data centres and 100% wastewater recycling by 2030.

Key challenges

-

Infrastructure development. Building and maintaining strong infrastructure, including power supply, cooling systems and network connectivity, is critical for data-centre operations. Addressing infrastructure bottlenecks and assuring dependability and scalability are also challenges.

-

Data security and privacy. In an increasingly interconnected world, data security and privacy are top priorities. To protect sensitive information and reduce cyber threats, data-centre operators must follow strict security standards and regulations.

-

Skilled workforce. Demand for skills in data analytics, cybersecurity and cloud computing is increasing. Collaboration between industry, academia and government organisations is necessary to bridge the skills gap and foster talent in emerging technologies.

Conclusion

India’s data-centre sector is experiencing unprecedented growth, fuelled by the country’s rapid digital transformation, increasing demand for data storage and processing, advancements in cloud computing, rollout of 5G technology and supportive government initiatives, and its growth potential is substantial. As businesses and consumers continue to embrace digital solutions, the need for robust, efficient and sustainable data infrastructure will only intensify. The emphasis on green data centres highlights a commitment to sustainability, ensuring that this growth does not come at the expense of the environment. By investing in renewable energy and adopting energy-efficient practices, India is setting a strong precedent for eco-friendly operations.

India will likely play a pivotal role in shaping the future of this digital age and remain a lucrative destination for global investors due to its low per-MW cost and skilled labour. This positioning would be further strengthened by edge centres being established also in tier 2 cities. India is expected to lead Asia Pacific in this regard while rising in global rankings from the current #14. India’s data-centre sector is entering a golden era, offering significant opportunities for growth, innovation and investment.

How Acuity Knowledge Partners can help

We conduct in-depth research tailored to specific sectors and countries that helps clients navigate complex markets and sectors. A number of research firms and global investment banks leverage our expertise to increase internal analyst bandwidth. We have dedicated teams of analysts to support clients on a wide range of activities – idea generation, building financial models, financial analysis, mergers and acquisitions consulting services, thematic research and sector coverage. We explore the latest developments in a number of sectors, analysing the impacts and helping clients stay ahead. Each output is customised based on client requirements and made available for their exclusive use.

Sources:

-

India's data center boom to drive USD 5.7 billion investments by 2026

-

India's Booming Data Centre Market: A Powerhouse for the Digital Age

-

India surpasses major APAC countries in data center capacity

-

CareEdge Ratings Estimates India’s Data Centre Capacity to Hit 2,000 MW By 2026

Tags:

What's your view?

About the Author

Priyanka is a part of Investment Research team at Acuity Knowledge Partners. She has around nine years of experience supporting global sell-side client on Equity Research including report writing, industry research, initiating coverage report, ad-hoc data research, financial analysis & modeling and data base management. In her current role she is covering TMT sector. Priyanka holds an MBA in Finance and bachelor’s degree in finance too.

Like the way we think?

Next time we post something new, we'll send it to your inbox