Published on February 13, 2023 by Shubha Kamath

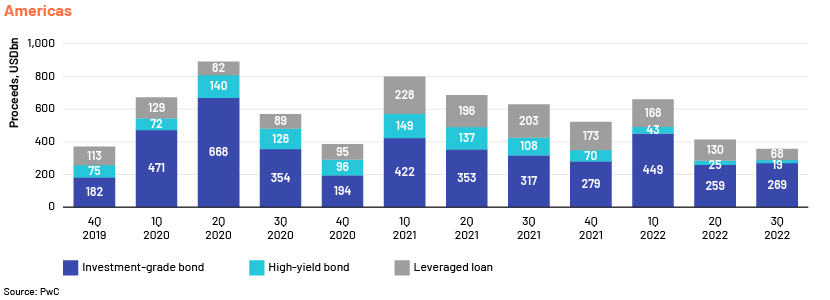

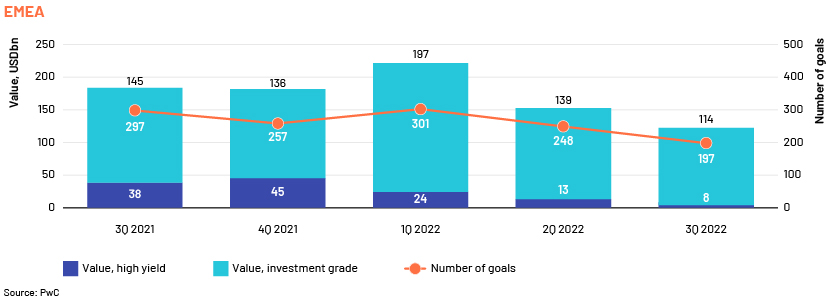

Debt capital market activity picked up pace in November 2022, after a tough year against the backdrop of high inflation, extreme interest rate hikes, supply-chain disruptions and the war in Ukraine. Concerns had led to a pullback in corporate debt issuance that broadly reached pre-pandemic levels, mainly in the Americas and Europe, the Middle East and Africa (EMEA). Revenue from fixed income products in the Americas in the first three quarters of 2022 was 46% lower than in 2021, and in EMEA, 33% lower.

The two years of financial lightening until 2021 helped companies stock up cash through debt issuance, refinancing and extending maturities. By late 2022, this liquidity had started to dry up, and companies resorted to cash-preservation strategies. The Federal Reserve (Fed) chairman’s news of slower interest rate hikes in the future and the evident improvement in inflation rates are resulting in a gradual recovery.

Value of the Americas’ non-financial investment-grade (IG) debt issuance fell by 28% in the first 10 months of 2022 compared to the 32% fall in 2021. The 10-month value of these IG bonds of USD439bn was significantly higher than the USD79bn of speculative-grade (SG) bonds. Two key trends in debt capital markets include the rising cost of borrowing and shifting corporate credit ratings. Companies such as car retailer Carvana and glass manufacturer Oldcastle have faced both these challenges. They issued high-yield bonds at c.10%, significantly above their norms of c.5%; this was followed by a downgrading of their ratings. The ratio of downgrades of bonds to upgrades was 2:1 in the first 10 months of 2022. The technology sector saw the most downgrades, mainly due to post-pandemic market corrections. The upgrades were led by hotels and restaurants, followed by the entertainment and industrial sectors, as a result of markets reopening.

As part of emerging trends in debt capital markets, issuers are expected to leverage favorable Fed signals to pursue new debt issuances in 2023. IG bonds in the technology; banking, financial services and insurance (BFSI); consumer and utilities sectors will likely gain traction in 2023. Companies would have exhausted cash accumulated in 2021 by 1H 2023 and move to cash preservation or new issuances at higher costs. Signs of cash preservation were already evident in 4Q 2022, when companies started firing employees en masse. Technology disruptions would pave the way for further investments in the sector. The BFSI sector will likely perform relatively well in 2023 with rising interest rates. Consumer subsectors such as restaurants, c-stores and retail businesses are expected to have increase footfall but not to pre-pandemic levels, as purchasing power would remain relatively low. The utilities sector is promising, with demand flowing from Europe. This would require investments in grid modernisation, infrastructure, transportation and technology in 2023.

The Fed is expected to make smaller interest rate hikes in 1H 2023 and stabilise rates thereafter. This should translate into lower inflation rates and growth starting in 3Q 2023. Demand for IG bonds over SG bonds would continue, considering the spread is not as deep as in previous recessions, which means IG bonds are offering higher yields. Banks would, therefore, continue to expect new issuance and very few refinancing opportunities, with hardly any debt maturing in 2023. Due to the fewer opportunities, direct lending may gain traction over syndicated loans, maintaining an aggressive pricing strategy.

The impact was lower in EMEA, as government spending on pandemic-related relief was lower than in the Americas. Additionally, European central banks resorted to interest hikes after September 2022, as opposed to the Fed that started rate hikes in March 2022. Debt market activity was low in 2022, with IG bonds performing only slightly better than SG bonds. IG bond issuance declined 21% in 3Q 2022 compared to 3Q 2021, and SG bond issuance declined 69%; this is because IG bonds are less resilient and have strong credit profiles. The major IG bond deals were in the financial and utilities sectors. While the financial sector also dominated SG bond issuance, the consumer discretionary sector added to deal volumes. ESG bonds took the region by surprise, with deal value in 3Q 2022 increasing by 6% compared to 3Q 2021.

2023 started with the EUR strengthening as inflation showed signs of recovering. This was due to energy prices increasing and the winter being milder than expected. The region’s energy requirement was met by imported liquefied natural gas (LNG), which was also sufficient to meet winter demand. However, a rebound in China’s demand, the ban on seaborne imports from Russia effective from February and reducing reserves would widen the demand-supply gap. Companies already invested in

renewable energy would be at an advantage, considering the setup takes time to reap benefits. Furthermore, the shortage in supply would require investment banks to advise on investments in the sector, which would also benefit from government grants. Banks could underwrite green bonds and sustainability-linked bonds in this area. IG bonds would continue to provide opportunities for new issuance. SG bonds could be advised on capital restructuring, paving the way for private equities sitting on large amounts of dry powder.

Most economies in Asia Pacific were well positioned in terms of inflation, but uncertainty in developed countries had a significant impact on developing countries. Investors pulled out from emerging markets when developed countries hiked interest rates. This led to currency depreciation and higher costs of borrowing. These challenges, combined with the defaults in China’s real estate sector and the country’s Zero-COVID policy, added to market volatility.

Among the regional trends in debt capital markets, Asia Pacific (excluding China) stands out for its stable debt dynamics and controlled inflation levels. However, the indirect effect of the Fed’s interest rate hikes and global recession will likely last until mid-2023. Investment in China would face increased regulatory constraints. Funding in local currency may seem to be a cheaper option than cross-border transactions. The debt market should continue at the same pace and may slightly recover in the second half with Fed rates stabilising.

SG bonds maturing during this volatile phase face more refinancing risk than other debt classes. SG bonds maturing in 2023 account for 15% of total debt maturing in 2023. Low demand for riskier assets has increased borrowing costs. On the demand side, companies with hoarded cash and fewer maturities may provide less opportunities for new issuance. On the debt supply side, banks are being vigilant, building up leveraged finance on their balance sheets. At the prevailing prices, direct investment in companies with strong credit performance offers better opportunities. Banks could anticipate high demand for credit advisory services

Major banks and rating agencies expect policy rates to continue increasing but believe the percentage increase will stabilise by mid-2023. The high cost of borrowing, low valuations and low consumer purchasing power in the first half would result in a number of financially distressed companies. Investment banks could advise such companies and provide restructuring support. Additionally, decreasing purchasing power may disrupt sectors that rely on disposable income (such as the consumer, manufacturing and transport sectors), as supply will be higher than demand. These disruptions would create opportunities for investment banks, private equity firms and financial sponsors to provide liquidity assistance, financial advice and fund new rounds of debt.

How Acuity Knowledge Partners can help

We help investment banks meet the sudden rise in demand for restructuring and debt advisory services. We enable our clients to win more mandates and expand their outreach by providing insolvency and reorganisation, liquidity management, creditor advisory and turnaround support.

Sources:

-

https://www.spglobal.com/ratings/en/research/articles/220801-credit-trends-global-refinancing-

-

https://pitchbook.com/news/articles/leveraged-loan-downgrades-outpace-upgrades-by-fastest-

-

https://viewpoint.pwc.com/dt/uk/en/pwc/nonaudit/cmas/assets/debt-watch-europe-q3-2022.pdf

-

https://finance.yahoo.com/news/high-yield-bond-issuance-slumps-060000089.html

-

https://pitchbook.com/news/articles/struggling-us-high-yield-bond-market-sees-first-triple-c-

-

https://www.financialexpress.com/investing-abroad/featured-stories/17-out-of-24-apac-cities-

-

https://www.whitecase.com/insight-our-thinking/us-levfin-2022-inflation-increasing-interest-

-

Private Credit 2023 Outlook: More market share, higher yield. But more defaults, too |

What's your view?

About the Author

Shubha Kamath has over 6+ years of experience working across different value chain in the Investment Banking domain. Currently, supports Consumer and retail team for a U.S. based mid-market Investment Bank, in Bangalore. She has good exposure working through the deal life cycle, including deal origination to deal execution. She has experience working on different pitchbooks, evaluating business dynamics and CIMs. She has extensive knowledge in financial modelling and capital structure analysis. Prior to joining Acuity, she was part of sell side research team of Crisil Ltd. She holds a Master’s degree in Business Administration in Finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox