Published on March 26, 2024 by Saswata Mohanty and Akshata N. Upadhyaya

Debt capital markets: a resilient outlook amid uncertainty

Market volatility, combined with geopolitical tensions and central banks hiking interest rates to offset increasing inflation, led to turmoil in DCMs in 2023. However, as consumer price increases slowed and market sentiment turned positive towards the end of the year, market activity picked up. The major central banks are gearing up for a potential shift in their interest rate hikes and economic policies in 2024. This paradigm shift would pave the way to reducing financial pressure, benefiting companies and governments.

Debt capital markets: a resilient outlook amid uncertainty

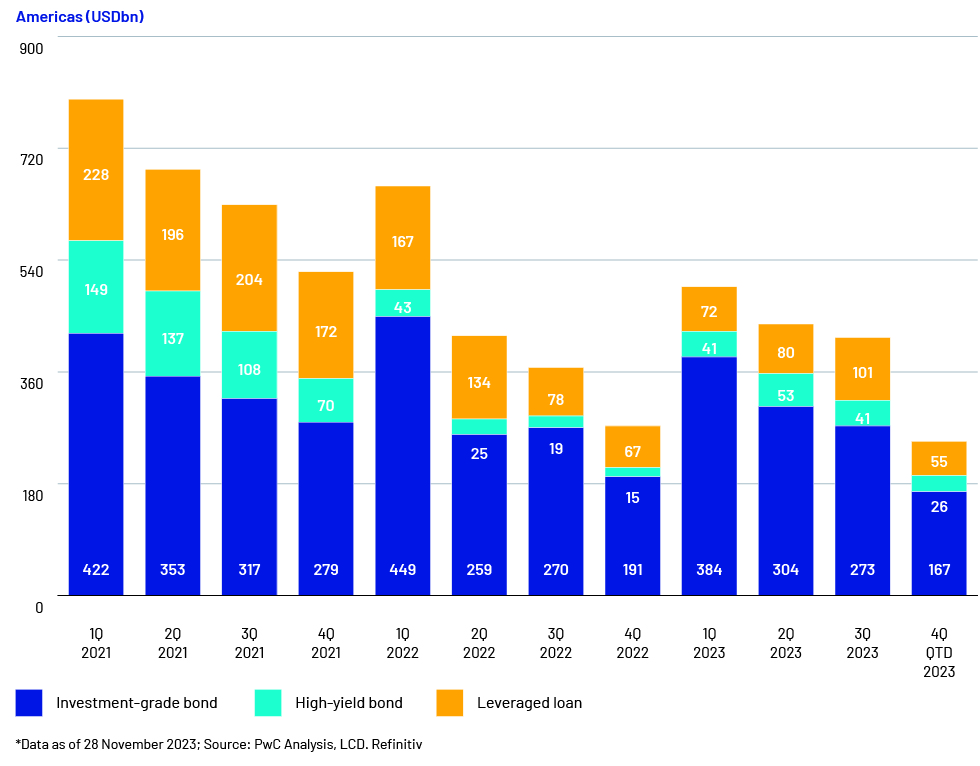

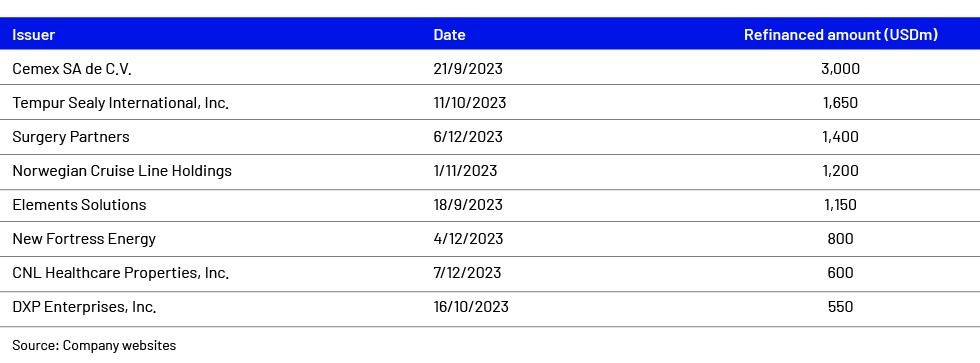

Rising inflation, Fed rate hikes and geopolitical tensions caused turmoil in capital markets in 2023. However, inflation steadying and a pause in interest rate hikes paved the way for optimism during the last quarter of the year, and the market seemed to stabilise. Refinancing volumes in the leveraged financing space increased to 74% of total volumes in the first half of 2023, significantly reducing the number of maturities in 2024 and 2025. USD101bn worth of US leveraged loans mature in 2025 and USD185bn in 2026. Issuers expect a recovery in M&A activity to increase leveraged financing in the market.

The higher interest rates that make borrowing expensive have impacted small businesses and are risky for borrowing companies but have minimal impact on large corporates. Large corporates, therefore, started investing their surplus cash in investments that generate returns higher than interest expenses.

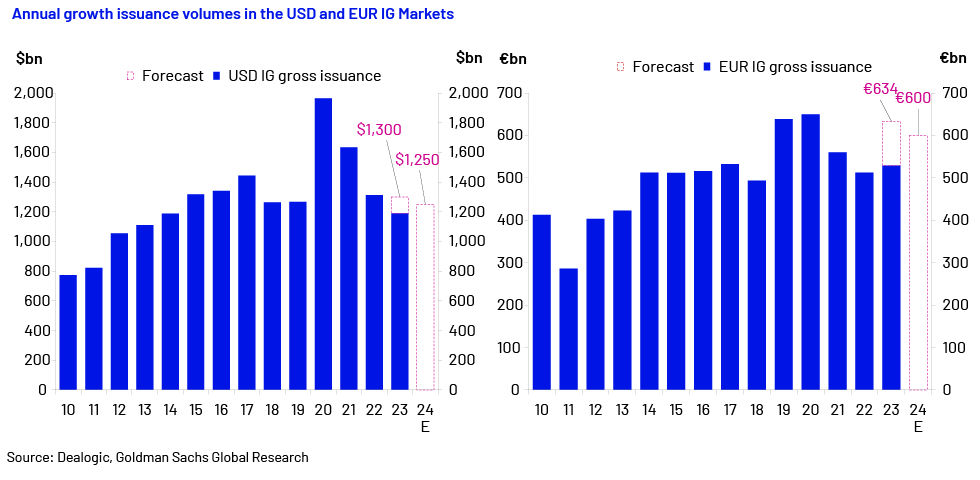

The benefit of higher net interest income would end if the Fed’s interest rates are not reduced, as many debt instruments fall due in the coming two years and corporates would need to refinance them at higher interest rates. The US, Europe and UK economies are set to see slower growth; the US and Europe are also expected to cut rates by mid-2024. High-quality fixed income bonds and government bonds are likely to be placed better in 2024. In 2023, US corporate and government bond yields reached their highest since 2009 and are expected at 3.95% by end-2024, followed by German bond yields at 1.8%.

Bond market turning the tables:

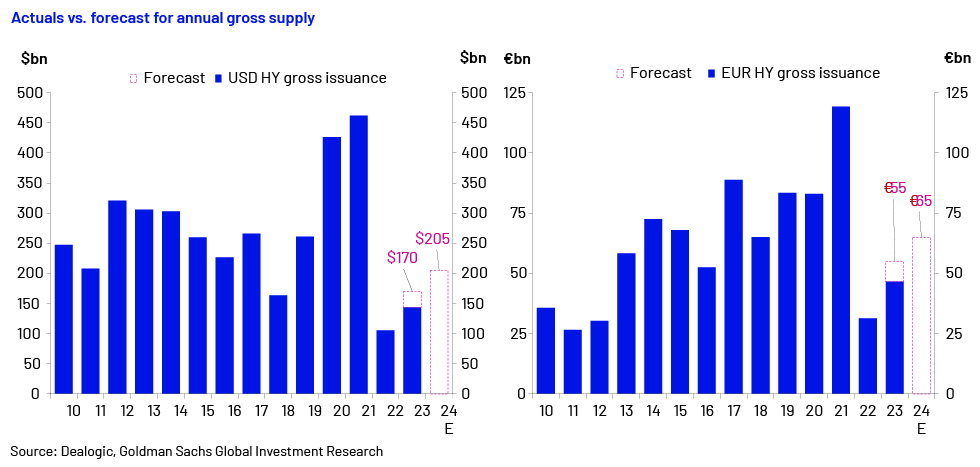

Demand for fixed income securities such as government bonds, agency mortgage-backed securities and investment-grade debt increased in 2023 due to the high yields they offered. These high-income debt securities are expected to offer higher yields with lower risk in 2024. High-yield bond issuance improved by 60% y/y in the US and by more than 100% in Europe through November 2023.

The energy sector saw an improvement, with strong cash flow helping the companies deleverage and providing opportunities for refinancing and M&A activity. Volumes of secured financing are also improving as collateral securities protect investor interest in this volatile environment.

Refinancing to the rescue:

A number of companies expect the central banks to cut rates in the first half of 2024, but such cuts would not necessarily mean that funding costs would also reduce at the same pace. Such uncertainty is prompting companies to refinance their debt maturing in the next couple of years.

US interest rates have stopped increasing due to the stability needed; this improved investor sentiment and issuer confidence, enhancing refinancing activity, especially during the latter part of 4Q 2023. Average spreads on investment-grade debt fell to 111bps, the lowest in 2023.

More than USD150bn worth of investment-grade (IG) bonds was issued by QTD 4Q 2023. IG spreads were at their tightest in 2023, and some borrowers were looking at de-risking portions of their funding needs for 2024, increasing refinancing activity.

Growth in the private credit market:

Many issuers moved to private credit in 2023 due to the difficulty in entering the syndicated market, leading to significant growth in the private credit market, with a number of take-private and sponsor-to-sponsor transactions.

The market is expected to grow to USD2.8tn in the next five years. Current market sentiment has resulted in the need for traditional asset managers to improve their private credit capabilities, with a number of players, including BlackRock and Fidelity Investments, opening private credit units to cater to this growing need. Companies, such as technology companies, with strong recurring revenue but limited EBITDA will likely find funding options in private credit more feasible than those via banks. The decline in bank lending, high levels of dry powder with investors and the need for more funds would continue to drive the private credit market for the next five years.

Reviving commercial mortgage-backed securities (CMBS):

Rising interest rates have increased the cost of financing, and with fewer lenders in the market, commercial real estate is likely to find accessing capital in 2024 more difficult. Global property sales volumes decreased 57% globally and 55% in the US as of September 2023. Around USD900bn worth of loans are set to mature in the US in 2024; there could be some difficulty in refinancing these in the current situation.

US CMBS loans are facing significant delinquency – this had increased by close to 14bps to 4.4% in September 2023. In the current challenging scenario, we expect lenders and borrowers to take a more conservative approach and adopt measures such as opting for mezzanine or preferred debt, and diversification strategies by using capital for property types other than the traditional ones.

With significant loan volumes maturing in 2024, commercial real estate (CRE) leaders are looking at alternative ways in which to cope with the challenges and increase sales volumes. They are moving towards sustainability initiatives for their buildings, with more focus on procuring renewable energy capabilities, and finding ways to boost operational efficiency through technology and vendor management. Borrowers are also considering alternative sources of capital such as mezzanine debt.

We expect just a small number of CMBS loans in the office space in 2024 due to the hybrid working format; however, the industrial and multifamily segments are likely to be positive. Other segments expected to grow in 2024 are retail and lodging. The future of CRE depends on how leaders adapt to the trends shaping the sector.

DCMs show a mixed outlook for 2024. With inflation currently stable and the Fed’s interest rate hikes paused, investors gained confidence in December 2023 as did corporates. Corporates are seeking shorter‑tenor issuance to mitigate the increasing cost of funding. Refinancing will likely continue as they look to reduce at least some of the borrowing cost. Corporates and investors alike expect central banks to cut rates in 2024.

What's your view?

About the Authors

Saswata Mohanty has over 13 years of experience working across different value chain in the Investment Banking domain. Currently, supports Public Finance / Project Finance team, with a focus on Municipal Finance and Infrastructure - Public Private Partnership(P3). He is also responsible for quality check and overall functions of Investment Banking team, for a U.S. based mid-market Investment Bank, in Bangalore. Prior to joining Acuity, he was with Verity Knowledge Solution (affiliate of UBS) for close to 6 years. He holds a Master’s degree in Business Administration in Finance.

Akshata is a Delivery Lead at Acuity Knowledge Partners, completing a decade of experience since joining the company as a fresh graduate. Akshata is an integral member of a mid-market U.S. Investment Bank’s team based in Bangalore. Throughout her tenure, she has adeptly navigated through various roles, supporting a diverse range of sectors and product teams. She actively engages with onshore bankers and supports across the value chain, from deal origination to execution, for various live pitches. Alongside the service delivery, Akshata takes an active role in delivering training to enhance team competencies and mentoring

Like the way we think?

Next time we post something new, we'll send it to your inbox