Published on December 9, 2024 by Akash Porwal

Debt exchange offer: an introduction

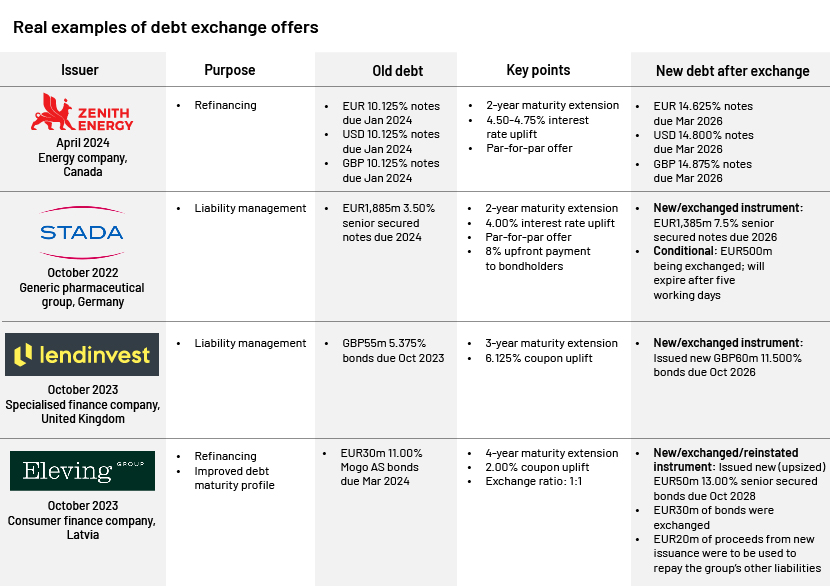

An organisation experiencing financial distress or looking to refinance or optimise its capital structure may use different options to restructure its capital structure. This liability-management exercise involves options such as amend and extend, debt-to-equity swaps and debt exchange or tender offers.

An exchange offer is an offer, primarily by an issuer (or company in distress), to exchange its existing bonds or loans for new equity or debt. If an issuer lacks capital to repurchase existing debt instruments, a debt exchange offer may be a viable option. A debt exchange offer may also be a useful restructuring option for enterprises struggling with potential bankruptcy. It can help the business reduce its interest expenses and improve its credit profile and cashflow position.

However, companies considering a tender offer or exchange offer for restructuring purposes need to keep in mind a range of legal, strategic and logistical considerations directly relevant to conducting and execution of these transactions.

Rules and regulations governing debt exchange offers

A debt exchange offer can typically be structured in three different ways:

-

Registered with the SEC

-

In a registered exchange, an issuer must file a registration statement on Form S-4. It must disclose the terms of the debt exchange offer, the risks associated with tendering existing debt securities and a description of the issue.

-

Rule 14e-1 under the Securities Exchange Act of 1934: Any tender offer, including debt tenders and exchange offers, must stay open for at least 20 business days.

-

-

Exempt from SEC registration pursuant to Section 3(a)(9) of the Securities Act

-

A Section 3(a)(9) exchange offer does not require registration with the SEC.

-

It facilitates the exchange of a company’s securities to its existing security holders.

-

Certain conditions must be met in order to undertake an exchange offer under Section 3(a)(9). These conditions include (1) no money is paid for the exchange solicitation, such as payment of success-based fees to a solicitation agent, (2) the same issuer must offer both the new and old bonds and (3) the bondholders are not required to pay additional cash or other consideration to exchange their old bonds for new bonds.

-

-

Exempt from SEC registration pursuant to Section 4(a)(2) of the Securities Act (by reason of being a private offering)

-

Private exchanges are often limited to qualified institutional buyers (QIBs), which are sophisticated institutional investors that meet certain criteria. The securities issued through a private exchange offer will be restricted securities. Such private exchange offerings under Section 4(a)(2) or Regulation D may include registration rights, which require the company to register the securities after a set period of time.

-

Key documents in a debt exchange offer

-

Offer to Exchange and Consent Solicitation Statement: Basic disclosure document provided to registered holders of the company’s debt securities

-

Letter of Transmittal: Includes the instructions to participate in the exchange offer

-

Notice of Guaranteed Delivery and Consent: It addresses when the securities must be delivered once the exchange offer has ended

-

Indenture: The main agreement governing the terms of the debt securities

-

Supplemental Indenture: It addresses any amendments to the indenture

Pros and cons of debt exchange offers

-

Pros

-

By opting to participate in the exchange offer, investors can choose to reduce their credit risk and/or improve their liquidity

-

An exchange offer helps the issuer increase profitability by reducing interest payments and improving the credit rating owing to the improvement in debt ratios

-

-

Cons

-

Bondholders who do not opt to participate in the exchange offer lose their liquidity, leading to a coercive environment. Fear of illiquidity may force investors to participate, even if it is not in their best interest

-

The issuer refinances the debt to benefit from the lower-interest environment; however, the issuer may not garner enough participation to enable cashflow reduction, and non-participants may launch legal challenges citing impairment/violation of interest or rights

-

How Acuity Knowledge Partners can help

Liability management is an important part of any business for sustainable growth. Bond exchange offer, amend and extend and other liability-management practices require a financial and legal advisor to help the company complete such deals.

We enable advisors to conduct all the research required by providing support across the restructuring and debt advisory spectrum. We enable our clients win more mandates and expand their outreach by providing support with insolvency and reorganisation activity, liquidity management, creditor advisory and turnaround activity.

We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients in a wide range of activities including idea generation, macroeconomic research, financial analysis, capital structure analysis, financial modelling and valuation.

Sources:

-

https://corporatefinanceinstitute.com/resources/fixed-income/bond-tender-offer/

-

https://www.eleving.com/news/eleving-issues-50-million-in-bonds

-

https://www.londonstockexchange.com/news-article/market-news/interim-financial-results

What's your view?

About the Author

7+ years of experience in Financial Advisory Experienced in financial modelling, business valuation, financial analysis, credit analysis, cash flow models, investment reporting, and debt restructuring pitch books. He is a qualified CFA charter holder from CFA Institute, USA and holds management degree in Finance from Faculty of Management Studies (FMS), Delhi University.

Like the way we think?

Next time we post something new, we'll send it to your inbox