Published on November 10, 2022 by Sachith Vijayaraghavan and Anitha Revanna

An environmental, social and governance (ESG) framework helps shareholders recognise how an organisation handles risks and opportunities associated with ESG investment. Organisations that incorporate ESG considerations communicate this to the public via different channels. Digital media is a prominent method of communicating company-related news or updates, which could be in the form of, for example, press releases, social media posts or blogs.

Organisations invest in ESG, both for business development and for recognition, and this is advertised with the hope of attracting more investment. Investors are attracted to ESG-related products and believe their values will be aligned with their objectives of achieving financial goals, reducing their carbon footprint and building a green portfolio by investing in organisations that are governed responsibly and are socially conscious. Investors also expect such organisations to highlight the material and financial impact of any ESG-related initiatives undertaken. This information is distributed via email, presentations or social media.

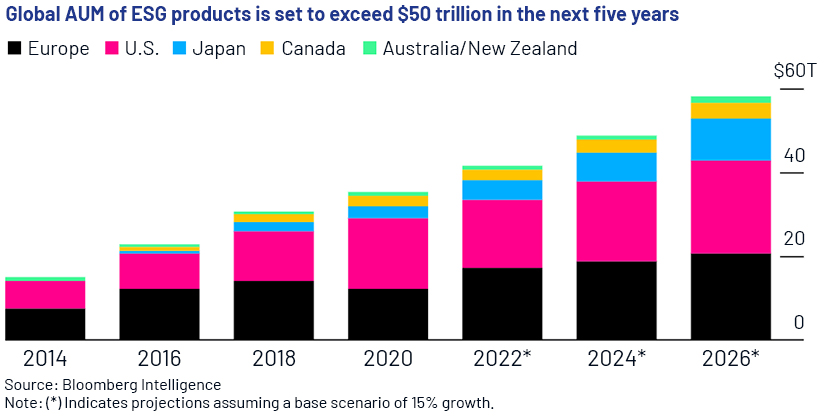

Investments in ESG are expected to surpass USD 50 trillion by 2025 on growing demand. With the growth of ESG, companies are developing sophisticated investment practices. This causes significant confusion and could result in asset managers acting with less integrity. Some organisations advertise vague or false claims relating to sustainability; this is referred to as greenwashing. Greenwashing is a fraudulent practice when an organization markets itself as being environmentally conscious, even though it is not.

Regulators have, therefore, introduced rules to ensure the appropriate adoption of ESG considerations, such as the Sustainable Finance Disclosure Regulation (SFDR). This has encouraged organisations to look internally at their compliance framework of policies and procedures, training, monitoring and auditing processes, etc. and incorporate programmes to meet regulatory requirements.

Organisations will also have to reconsider the approach of using traditional media to reach the right audience. With focused ad campaigns on digital media organisations can could ensure that the advertisements are largely received by the targeted audience.

Things to keep in mind from a compliance perspective before promoting ESG via digital media:

As digital media is easily accessible and has a wider reach, marketing teams publish ESG updates on these platforms. However, before doing so, they need to diligently abide by and apprehensive of marketing and advertising rules.

-

Understanding the regulations:

Asset managers must understand and incorporate all the upcoming ESG-related rules and regulations within the specified deadlines with proper guidance from their legal and compliance teams.

-

Cover ESG-related communication:

A company’s content promotion strategies can help it succeed or fail in communicating via social media. ESG-related content needs to be monitored, and the marketing team needs to be careful they do not publish any deceiving, misleading or false information.

-

Do not make forward-looking statements:

The team should be mindful before making any ESG related forward-looking statements, false promotion or showcase on ESG that could misdirect the investors. No one can predict the future, so making promissory statements could risk an organisation’s credibility and reputation.

-

Be careful when communicating ratings/scores:

Stakeholders use sustainability scores to analyse portfolios and understand how a company is performing. These scores provide clarity and set a standard for measuring performance. Marketing teams should disclose all assumptions used in calculating ratings and scores.

-

Provide accurate sources and timely updates on sustainability performance:

Marketing teams also need to ensure that any information provided is accurately sourced and appropriate footnotes are included, also that it is complete and updated. Investors cannot make informed decisions with false or misleading information.

Conclusion:

How Acuity Knowledge Partners can help

We create tailor-made dynamic functions with a robust, responsive and profi-cient control framework and process delivery. We are experienced in providing unique solutions with the help of our state-of-the-art technology.

We have a pool of subject-matter experts for process delivery, training, pro-jects and automation to mitigate costs. Our established compliance capabilities help clients identify problems and opportunities to navigate through a challenging business environment.

Sources:

-

ESG Compliance: What Does It Mean and How Can You Achieve It? (diligent.com)

-

Fund Managers’ ESG Claims Face Credibility Test as Gaps Found – Bloomberg

Tags:

What's your view?

About the Authors

Sachith Vijayaraghavan has 8 years of experience in compliance and has completed 8 years with Acuity Knowledge Partners. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials and Email Surveillance. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Sachith is an MBA from Bharathiyar University.

Anitha has 10+ years of experience in Marketing Compliance. She has previously worked with State Street Global Advisors. Her expertise spans across compliance and risk sector, focusing on compliance reviews of marketing/advertising materials and social media contents. At Acuity Knowledge Partners she is part of the central compliance team and specializes in marketing material review and social media reviews. Anitha is an MBA graduate from RV Institute of Management, Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox