Published on April 4, 2019 by

Globally, business models are being disrupted across industries, services, and professions. Investment Banking, long characterized by advisory fees and healthy margins, too is facing its own set of headwinds that have hitherto been unknown. These challenges have provided a unique sense of opportunity for Investment Banks to reinvent the wheel and stay ahead of competition. In this increasingly VUCA (volatile, uncertain, complex, and ambiguous) business environment, digital technology is acting as a key enabler for bankers to explore new and unique business models – thereby adding a critical edge to their business.

Challenge to the ‘model of disintermediation’

Traditionally, Investment Banks have been able to build robust businesses and capture high margins on the basis of disintermediation between the buy-side and sell-side parties.

- Mergers & Acquisitions (M&A): Investment Banks have played the role of an ‘advisor’ on a typical M&A transaction, between a buyer and a seller

- Capital Raising: Companies have also trusted Investment Banks’ proprietary relationships with other institutional investors to raise capital

This traditional ‘model of disintermediation’ has enabled banks to build pedigree and develop institutional knowledge to execute successful transactions.

However, in recent years, this ‘model of disintermediation’ is being increasingly challenged. The trend of deals having no involvement of an investment banker is on the rise. This disruption has been symbolized by recent transactions in the US.

- As per the Wall Street Journal (WSJ), Comcast acquired DreamWorks Animation along with its characters Shrek and Kung Fu Panda for US$3.8 billion and handled the talks in-house

- In another transaction, AbbVie acquired privately-held Stemcentrx for US$5.8 billion, without announcing hiring any advisory firm

- Spotify, an audio streaming platform, used a direct listing approach by allowing the opening public price to be determined by orders collected – thereby bypassing bankers

So, where is the disruption to the legacy business model coming from?

Corporates are building internal deal strategy and advisory teams as a self-service model to execute transactions directly. This enables them to be flexible and act quickly when required. Importantly, it also saves them from paying high fees, wherever they can. Corporates are hiring senior ex-bankers from leading Investment Banks as deal strategists to move quickly and close transactions fast.

Impact of increased ‘regulatory costs’

Industry developments related to increased regulatory and compliance costs are adding further complexity to an already dynamic scenario. On the Equity Capital Markets (ECM) front, Investment Banks have relied on IPOs to generate fees. However, with high regulatory and reporting costs, companies increasingly prefer to stay private. Statistics reveal that, from 1980 to 2000, on an average 300 companies went public each year. However, as per latest data, this has decreased to c.100. Unicorns such as Uber have found ways to raise money outside of the traditional investment banking model.

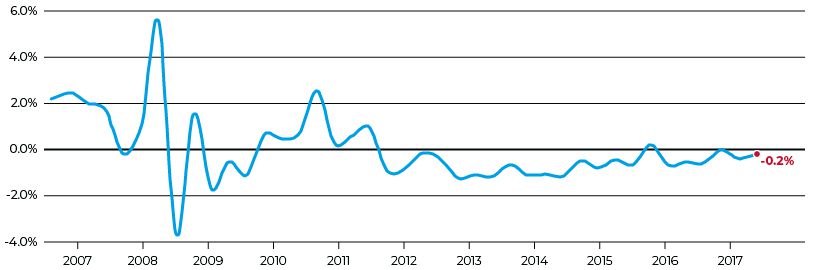

These disruptions and industry developments have impacted Investment Banking revenues, profitability and employee headcount growth.

Top 9 Global Investment Banks – Total Headcount

Unadjusted Quarter-on-Quarter Growth

Source: Alphacution Research Conservatory, Company Data

Digitization – a bulwark against disruption

While the challenge is enormous and these developments surely signify tectonic shifts, it doesn’t imply that the Investment Banking industry faces an existential threat. This has brought into focus the importance of being nimble footed, closing more transactions in lesser time and leveraging institutional knowledge built over decades of experience. Margin-driven products are also gradually making way for volume-driven operations. The Investment Banking business model is now being reinvented on the back of Digital Technology. ‘Digitization’ has enabled the convergence of legacy knowledge and new age technology.

Technologies, such as Artificial Intelligence, Machine Learning, and Natural Language Processing are being leveraged to develop Digital Platforms. These platforms are having a multi-dimensional impact on bankers’ workflow, client coverage, and data analyses. Digital platforms can:

- Leverage knowledge of historical transactions

- Provide interactive scenarios that are used in client discussions

- Offer data visualization

- Develop new analyses

Overall, this is building efficiency, providing deeper insights and analysis, automating standard tasks, and enabling bankers to focus their bandwidth on winning more deals.

Acuity Knowledge Partners is also transforming the IB KPO model and has over 200 tech specialists and Data Scientists developing a suite of bespoke digital technology enablement tools for our clients. BEAT offers a set of tools that automate a range of IB tasks and analyses. We have increasingly deployed the BEAT platform for our clients to deliver high efficiency on engagements.

Acuity Knowledge Partners is conducting a survey on digitization and technology trends impacting the Investment Banking industry. Your inputs and insights would be extremely valuable to assist us with this survey. It will take three minutes to complete, and we will share the report with you on publication.

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox