Published on October 3, 2024 by Rabin Thakur

The Sustainable Finance Disclosures Regulation (SFDR) aims to introduce greater transparency and standardise disclosures in financial markets. According to the classification system provided under the SFDR, a fund is to be classified as Article 6, 8 or 9 – depending on the fund’s sustainability characteristics.

Article 6: Funds without a mandate or scope of sustainability

Article 8: Funds that promote environmental or social characteristics, also called “light green” funds

Article 9: Funds that have sustainability as their objective, also called “dark green” funds

Shedding light on Articles 6, 8 and 9

In practical terms, if classified under Article 6, an asset manager has to, as a bare minimum, disclose how they have integrated sustainability risks into their funds, regardless of whether the fund is promoted as having or not having any sustainability characteristics. In the event a fund is promoted as having sustainability characteristics, it must be classified under Article 8 or 9, based on how many classification criteria it meets. The following paragraphs elaborate on the criteria for classifying funds under Article 6, 8 or 9.

| Article 6 | Article 8 | Article 9 |

| Disclose sustainability risks | Disclose sustainability risks Ensure good governance in investee companies Disclose environmental or social characteristics | Disclose sustainability risks Ensure good governance in investee companies Have sustainable investment as an objective |

| Sustainability indicators for measuring or evaluating sustainability characteristics | ||

| To be classified as an Article 6 fund, sustainability risks need to be identified, and how these risks impact the returns of the financial products needs to be assessed. Funds classified as Article 6 funds need not be classified as ESG, sustainability or green funds. In the event a fund manager believes sustainability risks are not relevant, a clear and concise explanation needs to be provided. | To be classified as an Article 8 fund, the fund must exhibit some environmental or social characteristics or a combination thereof. | Similarly, for a fund to be classified as an Article 9 fund, it must have sustainability as one of its objectives. |

| To be classified as an Article 8 or 9 fund, fund managers are to choose sustainability indicators through which some sort of measurement or evaluation of the sustainability characteristics may be made. | ||

For Article 8 and 9 funds, a key requirement is reporting on sustainability indicators. These indicators should be such that the sustainability characteristics of the funds could be measured or evaluated.

Sustainability indicators

While the regulation leaves the choice of which sustainability indicators are be reported to fund managers, the choice depends on common criteria such as credibility among limited partners, the fund’s objective or the ability to benchmark and compare target companies. To classify the fund as an Article 8 or 9 fund, an important aspect is disclosure on sustainability indicators.

The following are certain ways in which fund managers disclose sustainability indicators:

| Sustainability indicator | Typical features | Suitability | |

| Pros | Cons | ||

| Alignment with UN SDGs | Globally accepted framework Easy to map and absorb | No consideration of specificity to an industry or sector | Funds investing in companies globally and whose investment strategies target those companies covered by the SDG framework |

| Alignment with EU Taxonomy | Broadly accepted measure of revenue attribution of businesses to sustainable activities | Investment universe and applicability are very low at present | Funds investing in companies covered by the EU Taxonomy |

| Disclosure on Principal Adverse Impacts (PAIs) | Accepted as the most relevant KPIs relating to ensuring sustainability | Limited KPIs, which do not translate into a holistic understanding of the environmental or social impact | Funds looking to remain invested in low-carbon-emitting industries and in companies with carbon-reduction targets |

| Exclusion criteria | Simplest to understand and apply | Very narrow view of including sustainability in investment decisions | Funds whose investments are industry-agnostic |

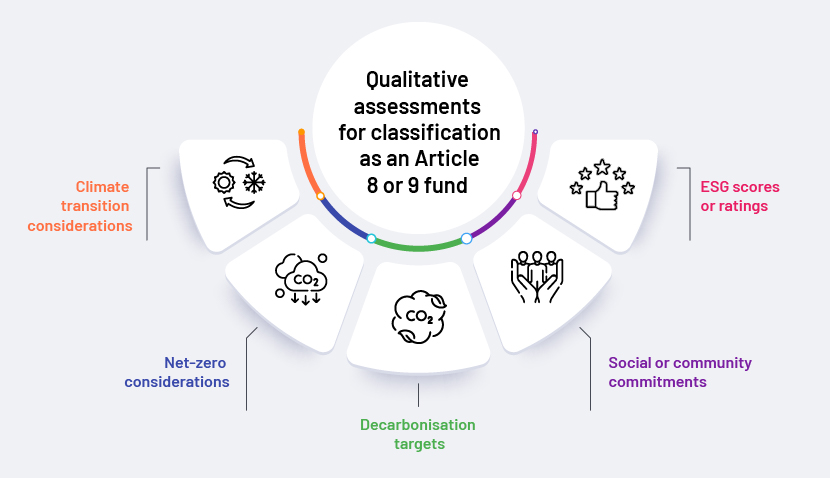

In addition to these indicators of sustainability, fund managers opt for qualitative assessments to highlight the sustainability characteristics of their funds.

Methods fund managers use to classify their funds as Article 8 or 9 funds include assessing climate transition or net-zero considerations, setting decarbonisation targets, engaging with communities or relying on externally provided ESG scores or ratings for underlying companies in the fund.

How Acuity Knowledge Partners can help

Under SFDR reporting, we are well trained to conduct deep-dive research on mandatory PAIs and ESG policies and processes. We help clients with preparing templates, collecting data from portfolio investments, collating and aggregating ESG data on bespoke templates or tools and running visualisations for use in internal and external reporting.

Sources:

-

Platform Briefing on EC targeted consultation regarding SFDR Implementation

-

ESMA Final Report: Guide on funds’ names using ESG or sustainability-related terms

Tags:

What's your view?

About the Author

At Acuity, Rabin is overseeing multiple ESG engagements which includes research, analysis and reporting assignments for clients in the US and Europe. Overall, Rabin holds an experience of ~11 years which is spread across various areas of client management and interface within the domain of ESG and Sustainability. Rabin holds a post-graduate diploma in Sustainable Management from Indian Institute of Management, Lucknow

Like the way we think?

Next time we post something new, we'll send it to your inbox