Published on January 4, 2024 by Sridhar Shivaram

Rate cuts – a strategy for risk management

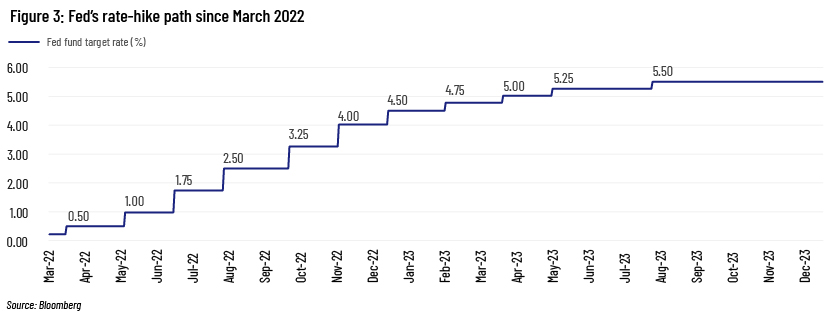

The US Federal Reserve’s (Fed’s) December meeting underscored its strong ability to pave the way for a soft landing of the US economy and begin the rate-cut process. Fed Chair Jerome Powell in his speech in 2018 stated that this process is a strategy meant to manage risk. Lowering the projected path of the federal funds rate (FFTR), committee members indicated that they believe the balance of risk has shifted in favour of achieving lower inflation. Thus, the chances of further hikes have diminished, and decisions now favour creating economic conditions that would warrant rate cuts. However, history suggests that once the Fed begins to cut rates, the pace could be faster than the projected path for the median rate in 2025.

The December meeting

The Fed, in its last meeting for 2023, decided to leave rates steady for the third consecutive time; it kept the terminal rate at 5.25-5.50%, with an extraordinarily dovish tone. Powell supported lower rates next year, saying, “naturally, it begins to be the next question”. The policy decision mainly came in with two edits to the post-meeting statement:

-

First, while it continues to note that inflation is elevated, it now also acknowledges that it “has eased over the past year”.

-

Second, the forward guidance, which had been discussing the conditions that would warrant “additional policy firming”, now adds the qualifier “any” to that phrase.

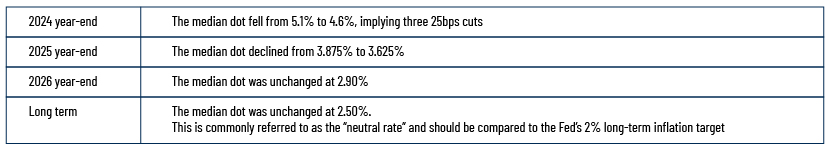

The dots now show three cuts next year, the post-meeting statement now acknowledges inflation has eased and the statement’s forward guidance tempered the possibility of further hikes. At the press conference, Powell said this addition (“any”) was “an acknowledgment that we are likely at or near the peak rate for this cycle”. The median “dot” for 2024 fell to 4.625% from 5.125%, implying 75bps of rate cuts over 2024.

On the economic front, revisions to the economic projections supported these dovish changes: core PCE inflation for this year was revised down 0.5% to 3.2% and for next year, down 0.2% to 2.4%. GDP growth this year was revised up to 2.6%; this is expected to moderate to 1.4% next year. The median unemployment rate projection still peaks at only 4.1%.

During the policy meeting, the word “progress” came up repeatedly: “he’s pleased with the progress he’s seen so far but he’s going to need to see further progress”. The more dovish part of the press conference was Powell’s acknowledgement that the Committee is already talking about “dialing back the amount of policy restraint in place”. That topic has “come into view” and was discussed “at our meeting today”.

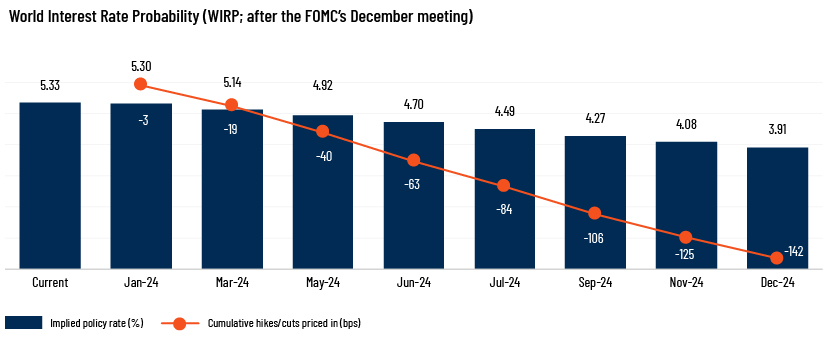

Markets post-FOMC took an even more dovish message after witnessing the economic projections and the key iterations made in the statements last seen in the September meeting. Markets are currently pricing six rate cuts or 1.50% of reduction in the terminal rate, which would translate into 3.75-4.00% by year-end 2024. This would likely mean “sooner-than-expected” progress on shifting back to the Fed’s 2% target or facing more severe economic conditions in 2024 to get that kind of easing in policy.

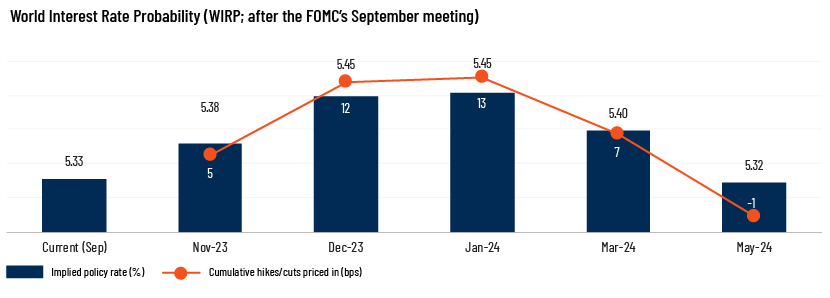

WIRP is a statistical function developed by Bloomberg that uses fed funds futures and options to infer the implied probability of future FOMC decisions. It is widely used to calculate the chances of a rate hike at each of the FOMC meetings using futures trading data.

Source: Bloomberg

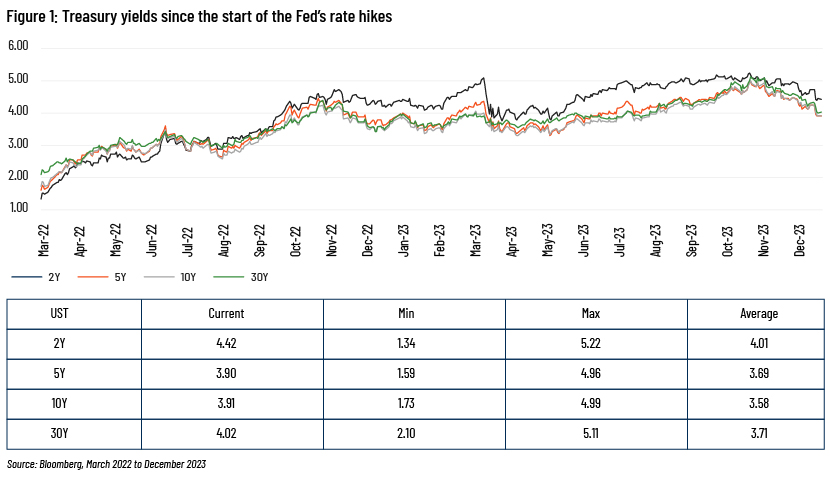

So far in 2023, the FOMC has raised the terminal rate by 100bps, taking it to the highest range since 2008. The cycle of raising rates began in March 2022, with a cumulative 525bps increase so far. The next FOMC meeting concludes on 31 January 2024.

Lessons from past cycles

A study of the more-than-130 policy rate cutting cycles in 14 developed markets over the past six decades shows that central banks tend to cut more aggressively than the market expects. This partly reflects the difficulty markets have in anticipating recessions and the tendency of policymakers not to reduce rates until they are completely confident that the economy is in recession with rising unemployment.

However, in a handful of instances, central banks have initiated rate cuts without an impending recession. In such cases, inflation had peaked and the labour market had eased as unemployment surged from well below trend status, similar to the recent occurrence. Interestingly, even in these non-recessionary instances, central banks have, on average, delivered around 200bps of cuts in the first year.

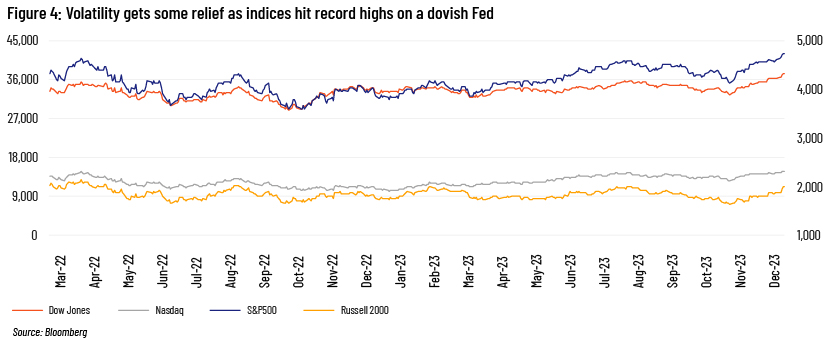

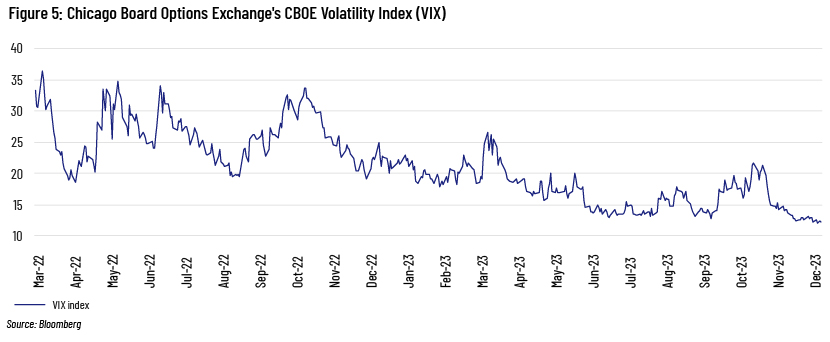

The Fed's unexpected dovish signals spark market euphoria

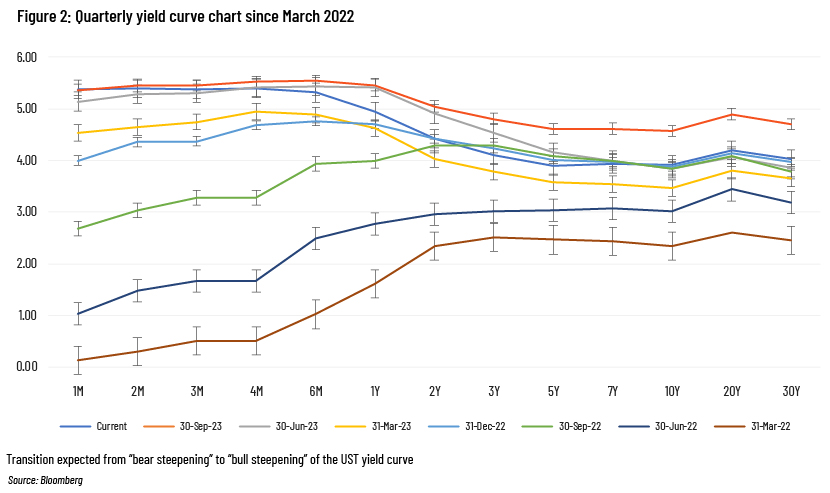

The September meeting statements and the 3Q dots no longer indicate the possibility of another 25bps hike; instead, they indicate the possibility of three 25bps cuts in 2024. The dovish surprise led Treasury yields to plummet from their multi-year highs in October 2023.

Specific to the federal funds rate dot plot:

The December meeting was not expected to be a game changer for the financial markets. The Treasury curve steepened on hope of the Fed’s easing cycle starting in 2024: the 2-year yield declined 22bps, the 10-year 13bps and the 30-year 9bps. The USD depreciated by about 1.0%, and US stock indices rallied by approximately 1.4%, nearing all-time highs.

Conclusion

The markets cheered the Fed’s extraordinarily dovish tone by pushing the policy-sensitive two-year note by about 30bps during the session and continuing to price in six cuts (versus the previous four) by end-2024, in contrast to that implied by Fed officials’ median rate projections. However, pricing of real yields for the long run remains elevated, suggesting that the markets expect a more gradual pace of cuts than historically delivered.

The dovish move by policymakers is a ray of hope for bond-market participants, providing room for issuers to raise funds via foreign-currency issuances at attractive levels while benefiting investors with new structural innovations. We expect issuers (sovereigns and the financial services sector) to capitalise on the early-bird advantage by coming to market in January 2024. We expect credit spreads to tighten further, giving issuers the right opportunity to tap the markets with fresh issuances that may provide better borrowing costs after the nearly-two-year-long high interest rate regime.

Investment-grade and sub-investment-grade issuers had to get used to a higher interest rate environment and raise funds from the markets to meet their business and refinancing needs in 2022. This has changed after the Fed’s dovish tone, providing issuers with hope that 2024 will see scope for a rebound in the currently subdued issuance market.

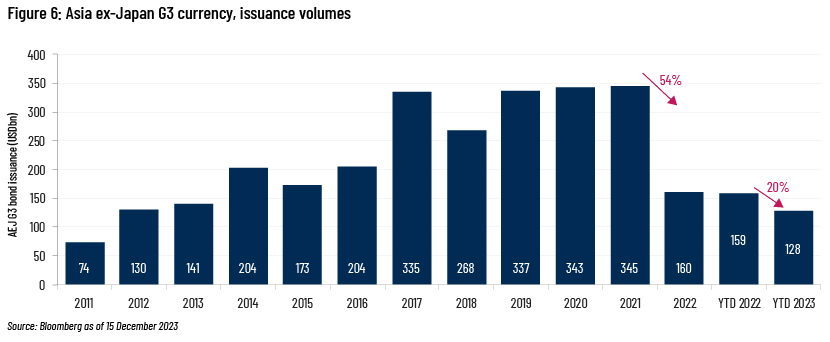

Asia ex-Japan G3 primary-market issuance volume (Figure 6) stood at USD160bn in 2022, 54% lower than in 2021. 2023 issuance volume stands at USD128bn so far, 20% lower than in the same period in 2022. The markets have come to a standstill in terms of primary activity owing to the higher interest rate environment.

The markets are looking forward to high-quality bonds for attractive yields and the likelihood of prices rising further as developed-market (DM) economies weaken into 2024, pushing yields even lower. DM government bonds remain preferred, and the markets expect the US 10-year government bond yield to soften further, to below 3.90% over the next 3 months and to 3.30-3.50% over the next 6-12 months.

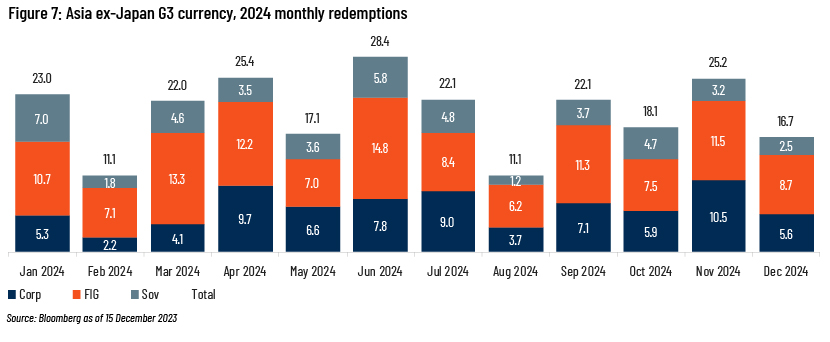

There are significant redemptions from Asia ex-Japan G3 (Figure 7), releasing more liquidity to the markets and supporting primary activity, which would also provide a sufficient cushion and execution certainty for transactions.

How Acuity Knowledge Partners can help

We are a leading provider of high-value research, analytics and business intelligence to the financial services sector. We support over 400 financial institutions and consulting companies through our specialist workforce of more than 5,200 analysts and delivery experts across our global delivery network. We provide bespoke support to capital markets (CM) teams of investment banks and advisory firms across the world through a wide range of solutions for corporate CM, financial institutions group (FIG) CM, sovereign, supranationals and agencies (SSA) CM and sustainable CM teams. Our team of CM experts regularly tracks macroeconomic factors affecting the markets and provides end-to-end support, from deal origination to execution, including the most intricate financial analysis and after-market support. The CM team also provides assistance with request-for-proposal support and covenant analysis of different types of debt products by actively monitoring and capturing the covenants being incorporated by issuers in the offering circular, interpreting the ultimate purpose of the investments and how far they will benefit investors and helping issuers raise funds.

Sources:

Tags:

What's your view?

About the Author

Sridhar has been working with Acuity’s Global Capital Markets (GCM) team for over 4 years. He is currently supporting the GCM team of a major European investment bank and has demonstrated his proficiency in comprehending the Investment Grade and High Yield bond markets across the United States, Asia and EMEA. Prior to joining Acuity, Sridhar was working with an Indian mid-size investment bank where he was responsible for providing assistance to Investment Advisory and DCM Origination and Sales teams in their fund raising initiatives. Sridhar holds a Post Graduate Diploma in Management, specializing in Finance from New Delhi Institute of Management. He is also passionate about the equity markets,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox