Published on April 28, 2017 by

The Asian G3 bond market has witnessed a spectacular growth in the first quarter of 2017. Issuances in 1QFY17 were at a record high with total volumes doubling to c. USD90bn (120 transactions) in 2017 from c. USD45bn (72 transactions) in 1QFY16. The performance is commendable considering the lingering macroeconomic uncertainties in Europe and interest rate related policies initiated by the US Fed. A growth in these adverse scenarios illustrates the Asian market’s ability to move forward, based on its own underlying strength.

High-yield bonds driving growth

High yields (HY), or lower credit rated bonds, have particularly put wind in the sails of the Asian bond markets. As per market data, 26 HY deals totaling USD10bn were launched during 1QFY17 to record the highest level of issuance since USD12.3bn in 1QFY13. This was a jump of more than 2x from the USD4.5bn issuance recorded in 4QFY16, mainly driven by investor tolerance for lower credit quality and refinancing by issuers. Refinancing needs are expected to further drive issuance in the coming months. The surge in issuance has also been instrumental in building stronger liquidity for key sector players. In the larger scheme of things, the number of B3 and below rated companies has been on the rise since 2012, with such issuers accounting for USD7.2bn of rated debt as at March 2017, of which USD2bn will mature by March 31, 2018.

Dragon leading the pack

China-based corporates have dominated the market with the mainland’s property companies accounting for USD5.6bn of issuances. Property developer Evergrande Group, which has been through a series of credit downgrades, closed a billion-dollar deal. While the company has outstanding notes rated as low as CCC+, investors showed appetite for its bonds, resulting in an order book worth USD5.4bn and a deal size of USD1.5bn. Fosun International was also a major issuer, raising USD800m. The robustness of this market is also manifested by a strong demand for longer tenor bonds. Overall, the Chinese market for bond issuance has been largely driven by refinancing needs of corporates in the wake of a large proportion of its debt maturing in 2017

Lucrative market for Investment Banks

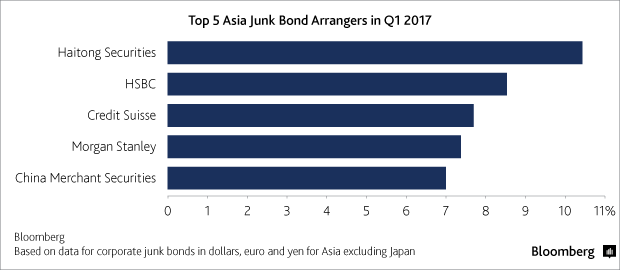

HY or junk bond issuance is gaining traction among Investment Banks as it offers lucrative fees than high-grade bonds, giving an extra boost to banks’ income. Chinese brokerage firms, with a deeper understanding of the mainland market, have now started giving their international peers a run for their money. Haitong Securities topped the league table for HY issuances in Asia (excluding Japan) in 1QFY17, while China Merchants Securities Co. moved up four places to reach the fifth position.

Cautiously optimistic outlook

In terms of outlook, the Asian bond market looks delicately balanced in terms of supply and demand. The outlook for 2017 looks positive as issuers seek to lock in long-term funding while selling riskier products. The investor appetite remains high while the rates are low. Asian HY corporates currently show adequate liquidity, and it is expected that the Asian non-financial HY corporate default rate will remain low at 3.1% in 2017; although the risk for companies rated B3 and below is high.

However, protectionist policies in the developed markets, faster-than-expected Fed rate rise, and the current geopolitical crisis in the Middle East and North Korea may throw a spanner in the works of an otherwise soaring market.

Acuity Knowledge Partners can enable investment banks to ride this growth in DCM markets by providing specialized research and analysis solutions tailored towards bond issuance. We have over five years of DCM and Loan Syndications experience, working with leading global investment banks, especially with a focus on Asian markets. Source: Bloomberg, IFR Asia for market data

Tags:

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox