Published on October 16, 2024 by Priya Chakkingal , Uttank Kaushik and Garima Ahuja

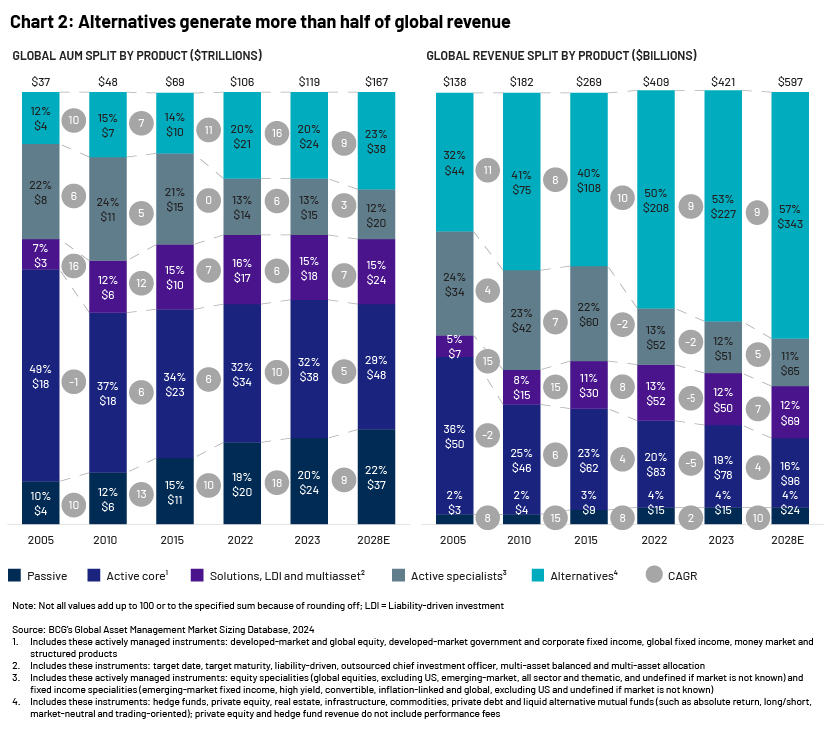

Asset management has been evolving, but this evolution has accelerated in recent years, with the industry growing to USD120tn in 2023. This growth was across markets. Although revenue increased, costs grew too, leading to an 8.1% decline in profits, according to Boston Consulting Group’s 22nd edition of the Global Asset Management Report. There is pressure not only due to growing costs but also due to fee compression, driven primarily by regulations and growing competition, making it important for asset managers to reinvent themselves. There is emphasis on expanding into new investment products and strategies, and on tailoring products and diversifying. This has resulted in alternatives and ESG-related products entering portfolios.

Technology would also play an important role in innovation, driving product strategy and helping to drive efficiencies from a regulatory and cost perspective. In this blog, we try to understand the drivers of this evolving landscape, focusing on how asset managers are navigating the landscape and building their product strategies.

Factors behind shrinking margins

The asset management industry is under pressure as margins continue to shrink, threatening profitability and sustainability. Key factors driving this contraction are explained below.

Fee compression and interest rates

Investment management firms are navigating a perfect storm of fee compression and low interest rates, forcing a fundamental transformation in their investment product strategies. On average, asset management fees have dipped by 20% since 2015, and many investors expect a further decline. Asset management firms have responded by constructing low-cost index funds and ETFs, launching fee-based advisory services and focusing on high-touch, high-value services. Meanwhile, interest rates across the globe have fallen by 50% since 2015, with most investors now expecting low rates to remain for longer. In response, firms are shifting to alternative income-generating assets, drafting interest rate-hedging strategies and turning their attention to preserving capital and income generation.

Regulatory changes

The product landscape has evolved on the back of a number of regulatory changes. Parameters such as disclosures, data transparency, integrating ESG considerations and digitalisation are being revised due to regulations such as Markets in Financial Instruments Directive (MiFID) II, General Data Protection Regulation (GDPR), Sustainable Finance Disclosures Regulation (SFDR), Undertakings for Collective Investment in Transferable Securities Directive (UCITS), Alternative Investment Fund Managers Directive (AIFMD), the US Department of Labor’s fiduciary rule and the emergence of regulations governing digital assets. Asset management firms are reshaping their approach in response to the regulatory changes by prioritising client needs and developing products that are sustainable and cost-effective. For example, MiFID II's requirements on transparency have shifted focus to low-cost index funds, while the SFDR's compulsory ESG disclosures have led to a surge in the growth of sustainable investment assets. Investment firms should keep abreast of regulatory changes and remain responsive in order to revamp their product strategies and cater to evolving client needs.

Increased competition

Heightened competition in the asset management space is pushing firms to revisit their product strategies as they try to differentiate themselves and attract investments in a competitive marketplace. Fierce competition is narrowing margins, driving asset managers to revamp their act and invest in areas to help them manage the competition.

Tackling pressure on margins

To tackle narrowing margins and ensure stability, the asset management industry should look at adopting a proactive approach to boost operational efficiency, optimise costs and drive innovative transformation. The following are steps asset managers could take to increase their profitability amid the growing competition.

Ramp up product research and development

The asset management space has been experiencing a transformation, propelled by swift technological advancements and evolving investor requirements. To avoid falling behind the curve, firms are focusing on research and development (R&D) in five main areas. Alternative data and analytics, for example, are being used to gather unique insights and enhance investment results, with 70% of asset managers making use of alternative data in their decision-making. Another main area is sustainable investing, with around 75% of investors evaluating ESG factors during investment decision-making, driving growth of ESG-integrated investment strategies and products.

Vital areas of R&D include digital investment platforms, which are strengthening investor engagement; artificial intelligence (AI) and machine learning, which are boosting efficiency and precision in investment models and decision-making; and risk management and portfolio optimisation, which are eliminating potential losses and improving investment results. By focusing on these areas, investment management firms could increase business growth, satisfy investors and stay competitive in a dynamic industry.

Adapting to behavioural finance

The impact of behavioural finance on financial institutions has increased in terms of customising products and offerings to meet specific customer needs. By studying psychological catalysts and cognitive prejudices, financial institutions could present a suite of customised investment strategies, instead of the standard ones, enhancing customer satisfaction and financial results and enabling a competitive edge.

Multiple investment funds are tapping into behavioural finance by informing investors on psychological prejudices, precise measuring of risk tolerance and amalgamating behavioural acumen into investment strategies. They concentrate on long-term viewpoints, ensure unambiguous communications and constantly refine their methods through continuing to explore the facets of behavioural finance. They also offer a variety of products, customised to an investor’s psychological profile and financial needs.

Shift towards passive management

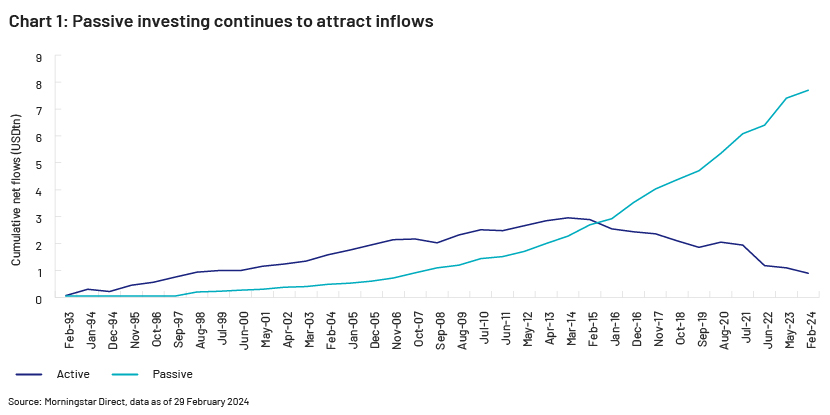

There has also been a noticeable shift towards passive investing strategy including index mutual funds and ETFs in recent years, as it offers investors low-cost, transparent and diversified investment options. Passive management involves creating a portfolio that tracks a specific index, while active management relies on fund managers to make strategic investment decisions to outperform the broad market index.

While the shift towards passive management does not imply the end of active management, it highlights a significant change in investor preferences. Active ETFs, which represent a hybrid approach (merging the benefits of active management with the structural advantages of ETFs), are also gaining traction. That said, market volatility could drive renewed interest in active management, but it remains a mixed bag. According to a BNY Mellon report, 44% of asset managers expect to increase offerings of active/smart beta ETFs, while 60% of owners forecast increased allocations to passive strategies.

Emerging trends

As the investment landscape continues to evolve, several key trends are shaping the asset management industry, including growing interest in ETF structures and alternatives.

Alternative investments

As traditional asset classes – stocks, bonds and cash – face market volatility and economic uncertainty, the appeal of alternative investments has increased. These assets, which exhibit low correlation with traditional markets, offer diversification benefits and inflation hedging, making them particularly attractive in times of economic volatility. At the highest level, alternative investments can be categorised into the following strategy types: hedge funds, private credit, private equity, real estate and infrastructure. Energy, commodities, cryptocurrency and other exotic investments such as art are some of the other alternative assets in play.

Increasing demand for alternatives was triggered largely by the global economic downturn of 2008, which sharply devalued traditional assets. With the “democratisation” of alternatives – the introduction and evolution of client-friendly vehicles – many individual investors now have access to these strategies. These strategies have the potential to address many of the challenges that investors face today – the need for enhanced income, inflation protection, diversification and stability amid volatile markets.

Examples of asset managers adapting to a changing investment environment include Vanguard’s low-cost index fund offerings, BlackRock's fee-based advisory services and PIMCO's alternative income-generating strategies. By innovating and prioritising value creation, investment management firms could thrive in this challenging landscape, redefining their product strategies to meet the evolving needs of investors in a low-fee, low-rate world.

Sustainable funds

Once-booming demand for sustainable or ESG funds appears to have tapered off in the first half of 2024. ESG equity funds suffered net outflows amounting to USD40bn from January to April this year, according to Barclays. Declining investment flows, fears of greenwashing and political attacks in the US underpin investor uncertainty.

This, combined with market sentiment favouring higher-yielding traditional equities, is resulting in many investors reverting to these more conventional funds.

While ESG investing currently faces significant challenges, experts believe the long-term viability of ESG funds remains positive. The fundamental drivers of ESG investing – consumer demand for sustainability, transition towards green technologies and the development of unified global standards – remain robust. As the market evolves in line with these new realities and regulatory frameworks become more established, ESG investing is likely to resume its strong growth trajectory.

Tailored investments

Customisation for the masses is emerging as an important investment strategy. As generating alpha becomes more difficult, investors are seeking personalised products as an alternative to low-cost beta investing. Meanwhile, technological advancements, especially analytics and AI, are empowering asset managers to build highly personalised portfolios that resonate with their clients' values and financial objectives. Data analytics can help asset managers create tailored investment solutions that align with client-specific financial goals and psychological profiles. The nuances of data, reporting, regulatory frameworks and regional requirements make customised solutions increasingly attractive over traditional commingled funds.

How Acuity Knowledge Partners can help

The challenges facing the industry would only continue to grow. To remain competitive and contain costs, asset managers would need to look for solutions that increase efficiency. Finding the right product strategy becomes crucial. From a cost perspective, asset managers could also look to partner with the right providers of support in terms of research, marketing, operations and technology.

We are a leading provider of bespoke research, analytics and technology solutions to the financial services sector, including asset managers, corporates and investment banks, private equity and venture capital firms, hedge funds and consulting firms.

We provide asset managers with integrated solutions across asset classes and functions to improve investment performance, enhance client servicing and efficiently manage investment operations. We provide critical functions such as research, fund marketing, compliance, investment operations and risk solutions. Additionally, with our financial services technology consulting, we collaborate with tech decision-makers to transform business models, enabling them to reduce tech-related debt, execute highly bespoke automations, generate unique insights and deliver enterprise-level applications.

References:

-

Asset & Wealth Management Revolution: Embracing Exponential Change – PwC Channel IslandsAsset Managers Need to Set a Strategy to Leverage the AI Opportunity and Drive Future Growth (bcg.com)

-

Revolutionizing Technology in Asset Management | Infosys BPM

-

New EU ESG disclosure rules to recast sustainable investment landscape | S&P Global (spglobal.com)

-

Asset Management: Key Trends and Strategies for the Future | HEC Paris

-

Asset Management Trends: 7 Key Insights to Know | Morningstar

-

Future of Asset Management: A Trends Report | BNY (bnymellon.com)

-

Sustainability in crisis: Billions are flowing out of ESG funds. What lies ahead? – I by IMD

What's your view?

About the Authors

'Priya has over 20 years of work experience in supporting index and ETF players in managing both benchmark and strategy indices across asset classes. At Acuity Knowledge Partners, she has been instrumental in setting up and managing teams supporting large index providers for over 12 years. Prior to this, she was with Infosys, where she was involved in supporting an Index Quants team for a large investment bank, primarily in construction and maintenance of fixed income indices. She holds a Master of Economics from the University of Southern California and a Bachelor of Economics from the University of Mumbai.

Uttank Kaushik has 14 years of experience in investment operations and portfolio analytics domain. At Acuity Knowledge Partners, he leads client engagements focused on middle and back-office support.

Uttank is a GARP certified FRM and has completed his Master of Business Administration from NMIMS.

Garima Ahuja has 7 years of experience in macroeconomics. At Acuity Knowledge Partners, she works with a global financial client focusing on macro research and analysis.Garima holds a master’s in economics from Gokhale Institute of Politics and Economics, Pune.

Like the way we think?

Next time we post something new, we'll send it to your inbox