Published on July 5, 2024 by Simran Raheja

M&A dealmaking landscape has high levels of dry powder

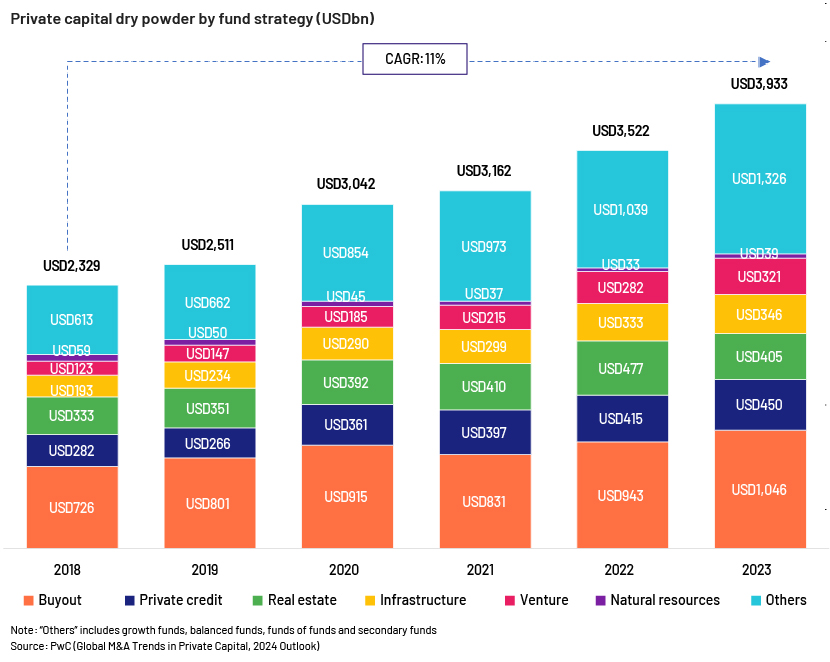

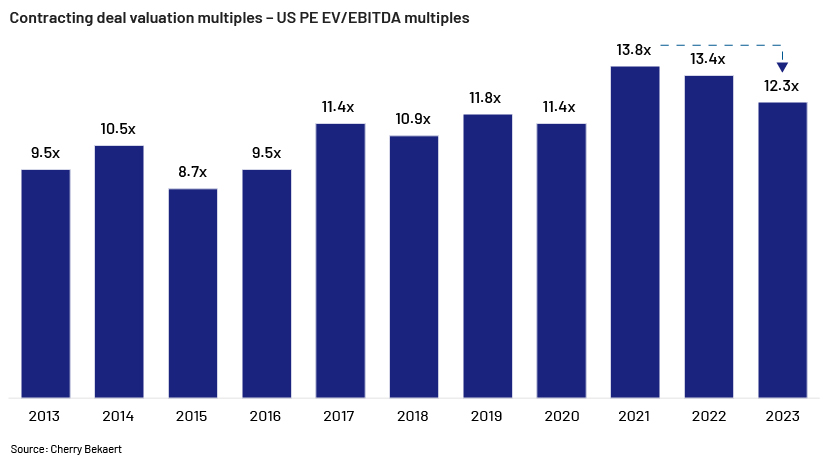

Transaction activity was dampened by the challenging investment environment marked by high inflation and rising interest rates in 2023, making it difficult for private equity support (PE) firms to find attractive deals, i.e., those with higher levels of return and valuation multiples. This made investors extremely cautious in terms of capital deployment and led to them holding on to their assets instead of selling them at undervalued pricing, resulting in an unprecedented concentration of dry powder.

Limited opportunities for PE firms to deploy capital led to smaller deals; transactions involving corporate carve-outs and add-on acquisitions took centre stage, and the valuation gap between buyers’ and sellers’ risk-taking capacity widened, leading to indecision on transaction closing and further increasing dry powder. Effective portfolio monitoring in private equity plays a critical role in identifying these gaps and enabling firms to navigate opportunities amidst such challenging market dynamics.

However, with the prospect of interest rate cuts, sellers are now abandoning valuation targets and buyers are seeking to accelerate their investment platforms and bolt-on acquisitions by committing capital to generate returns. The European Central Bank (ECB) points to a 25bps rate cut to 3.75%, according to a Reuters poll of 82 economists on 29 May 2024. In the US, a large number of economists expect the first cut in September 2024 at the earliest, with the Federal Reserve sending a clear signal of higher-for-longer rates at its most recent policy meeting on 01 May 2024. This visibility on stabilising interest rates and strong conviction of a reduction in rates are expected to aid dealmaking activity.

Deciphering the build-up of dry powder in the corporate environment

In the financial ecosystem, dry powder refers to excess cash reserved by PE firms or individual investors mainly to cover future financial obligations such as new investments or survive amid financial uncertainty.

Due to market turmoil as a result of high inflation, cost of capital and interest rates, investors became more cautious and selective in their investment strategies, resulting in a slowdown in dealmaking activity across the globe and the build-up of dry powder.

Low investment valuations (as shown below) reduced investment substantially, leading to a large number of investors accumulating dry powder; however, PE firms are now likely to be able to capitalise on opportunities in line with their strategies, especially amid recessions, when bargains surface.

Impact of excess unspent capital on financial markets

Impact of excess unspent capital on financial markets

A number of investors becoming selective and prioritising investment in recession-resilient sectors has resulted in increased levels of dry powder, putting investors under pressure to deploy it. General partners (GPs) are expected to actively manage dealmaking, conduct thorough/detailed due diligence and ensure consistent fundraising and monitoring of their portfolios.

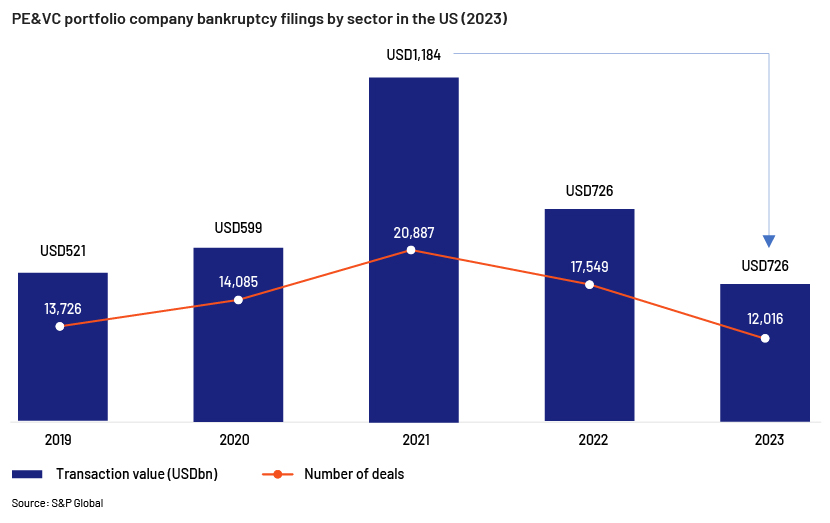

PE firms may use these large cash reserves to generate profit by either acquiring a distressed company’s equity, helping it restructure and become profitable or keep the excess dry powder in reserve to avoid facing a liquidity crunch.

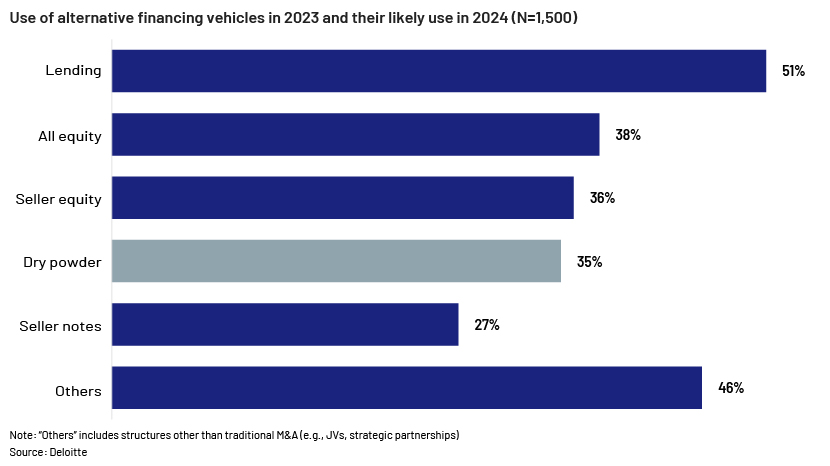

A Deloitte survey of 1,500 executives in the US (including 740 executives from PE firms) conducted by OnResearch showed that 35% of these companies have used or will likely use dry powder as an alternative financing vehicle despite economic, regulatory and operational headwinds, indicating their concern about the need to use their accumulated dry powder.

Investors are preparing for an expected explosion of dry powder-driven investment deals in 2024

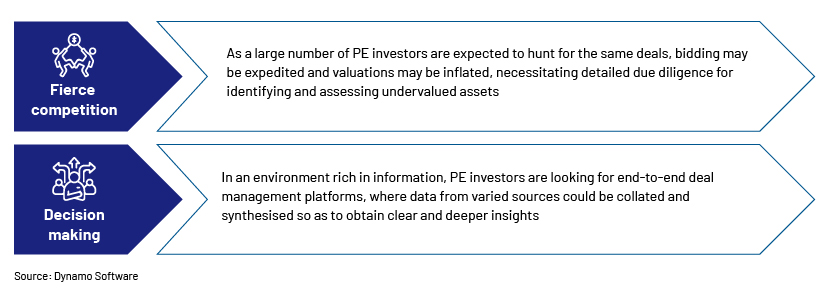

The abundance of unspent dry powder appears promising to investors; however, if this dry powder floods the dealmaking space in 2024, navigating the deal frenzy would be tricky. Investors are, therefore, preparing themselves on several fronts such as the following:

Investors are, therefore, likely to look for external partners to conduct due diligence faster by using AI in their workflow, which efficiently centralises deal-related data, generates automated reminders to accelerate the process and increases transparency for all stakeholders so as help GPs capitalise on investment opportunities.

Attractive investment trends and opportunities

Challenging macroeconomic conditions, including fluctuations in inflation and higher rates of interest, hindered dealmaking, but with markets stabilising, inflation decelerating and high levels of dry powder, appetite for PE investment seems to be recovering.

The following trends and opportunities across sectors in 2024 may shape the M&A space positively:

-

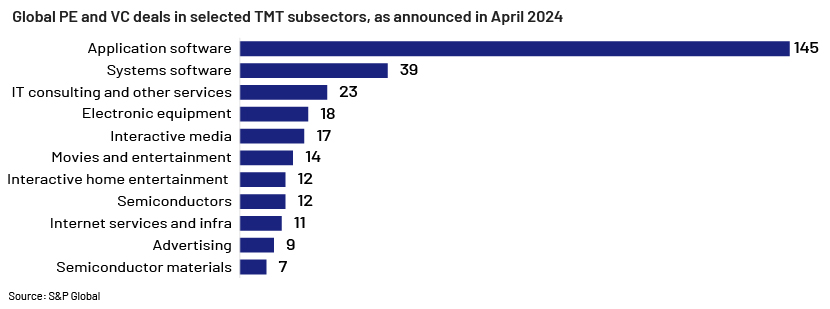

Sector focus: The escalating adoption, penetration and integration of advanced technology in business processes are likely to create lucrative opportunities for PE investors to inject the large reserves of piled-up funds in the resilient technology sector and help businesses to digitalise their operations and upgrade digital infrastructure

-

-

For example, M&A in the TMT sector has rebounded significantly in 2024, again accounting for most of the dealmaking activity, with 328 PE-backed transactions. Within this, the applications subsector accounts for most (145) of the deals, followed by the systems software subsector (39 deals)

-

-

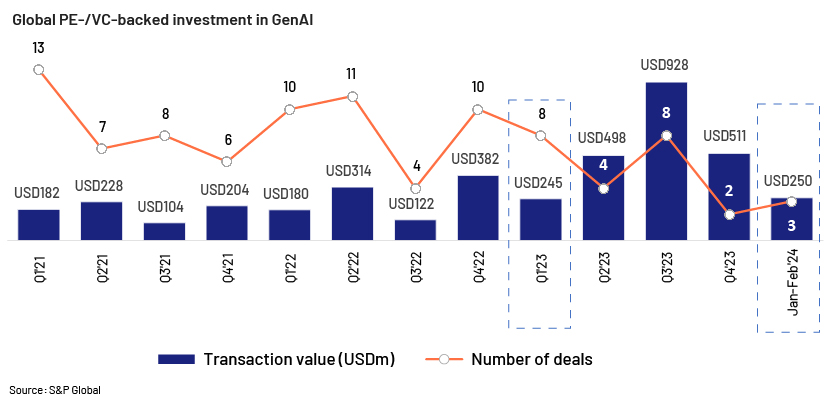

Digital revolution: Investors are increasingly looking for strategically advantageous investment opportunities where the target companies are focusing on digitalisation and enhancing their abilities and competencies to embrace technological innovations such as AI, cloud, cybersecurity and IoT

-

-

PE-backed investment in generative AI (GenAI) companies has surged, driven by fast-growing valuations and aggressive competition from corporate-based strategic buyers of GenAI

-

-

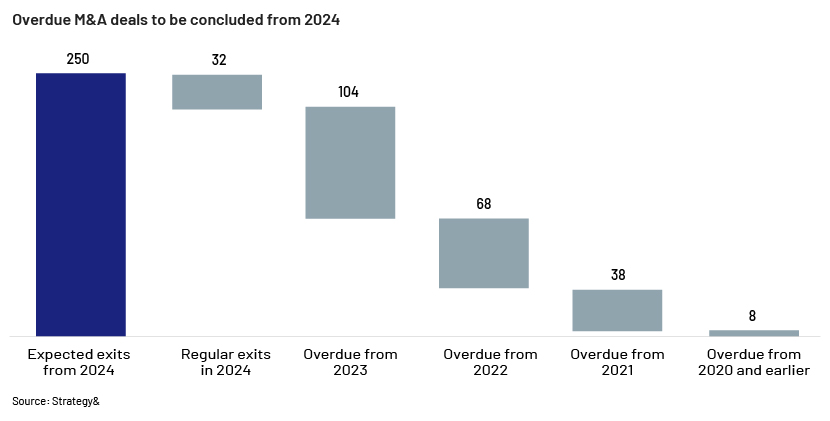

Overdue deals: PE investors held on to their portfolio companies for longer than ever before due to economic uncertainties such as high inflation, rising interest rates and other macroeconomic turmoil, which resulted in a deal backlog, according to Strategy&, powered by PwC

-

-

In the EU, the deal backlog and exits increased significantly due to the number of headwinds since mid-2022; more than 250 deals overdue from 2022 to 2023 are expected to be concluded from 2024

-

These trends are set to redefine the PE investment landscape significantly in 2024 and create lucrative opportunities; therefore, firms embracing this evolution and adapting to this changing landscape are more likely to be well positioned to thrive in the foreseeable future. Based on these developments, there could be ample opportunities in the market to exit investments at the right time. If the timing is not right, due to elevated interest rates, investors would need to look for the most appropriate deal.

How Acuity Knowledge Partners can help

With PE firms perplexed about exits and concerned about valuation and targeting the right investment opportunities, we provide them with the bandwidth necessary to conduct critical due diligence, industry research and opportunity assessment, and provide regulatory support to capitalise on opportunities and enhance operational efficiencies.

Sources:

-

https://huntscanlon.com/2024-ma-dealmaking-outlook-with-an-eye-on-human-capital-markets/

-

https://www.cbh.com/wp-content/uploads/2024/02/TL_Report-PE-Review-2023-1.pdf

-

https://www.nasdaq.com/articles/dry-powder-definition-reasons-sources-and-strategies

-

https://www.pwc.com/gx/en/services/deals/trends/private-capital.html

-

https://www.marshberry.com/resource/private-equitys-record-dry-powder-could-point-to-increased

-

https://www.allvuesystems.com/resources/private-equity-dry-powder-hits-new-highs-and-brings-old

-

https://www.forbes.com/sites/forbestechcouncil/2023/03/17/what-is-dry-powder-and-how-will-

-

https://www.fticonsulting.com/en/canada/insights/articles/ma-market-status-deal-outlook-march-2024

-

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-

-

https://lehotlouis.medium.com/m-a-trends-to-watch-in-2024-navigating-the-shifting-landscape-

-

https://www.investmentmonitor.ai/features/top-five-technology-investment-trends-to-watch-in-

-

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/private-

-

https://www.alpha-sense.com/blog/trends/private-equity-trends/

Tags:

What's your view?

About the Author

Simran is a key member of Acuity's Private Equity vertical, with c.5 years of experience in business consulting & advisory and market research industry, and executed projects across multiple sectors, including financial services, business services, healthcare, FMCG, retail, information technology & telecommunication, and insurance, among others. Holds expertise in delivering support to client’s corporate strategy and marketing teams, along with assisting them in investment opportunity assessment through in-depth secondary research & data analysis.

Like the way we think?

Next time we post something new, we'll send it to your inbox