Published on February 4, 2025 by Jatin Saini and Praveen Kompella

What is venture capital (VC) due diligence?

VCenture capital due diligence is a structured approach to evaluating the risk and return potential of a company under consideration for investment. It is carried out by venture capitalVC investors to assess a business from different viewpoints such as operational, marketing and financial.

Why is VC due diligence important?

With the rise in startup ecosystems and conducive business policies fromby governments across the world, millions of startups are being launched every year. Most of these startups seek capital in various forms of equity and debt depending on their stage in the lifecycle. VC investors, when approached by these companies, should be able to pick out the companies with optimal return potential within their investment thesis and risk profile. Efficient due diligence helps VCs gauge true business potential of the target company and derive the key metrics with which ideal investment opportunities are shortlisted and finalised.

Additionally, it helps investors do the following:

How to perform VC due diligence

The process involves a comprehensive assessment to check aspects of the business from operational and financial standpoints. It also includes an in-depth study of the associated markets.

It is prudent for the assessor to maintain a list of criteria to examine all directions of business viability. The following is the checklist: .

VC due diligence checklist:

The company and its market

-

-

Business Model: This describes the company’s operations and lays out details in terms of supply and consumption of the core business offering, including revenue generators and cost drivers. It also discusses the key activities of the company’s value chain such as key resources, partnerships, value proposition, distribution channels, customer segments, cost structures, and revenue streams.

-

Unique Value Proposition: This is the most differentiating factor of the products or services offered by the company to its customers. Startups are typically expected to deliver innovative and distinctive products or services, differentiating themselves from conventional businesses in the market.

-

-

-

Revenue Model: This defines how a company generates revenue, with pricing details of its entire product portfolio offered via the various distribution channels.

A deeper understanding of the revenue structure of the target company helps VC investors gauge whether the company can maintain an optimal revenue mix to achieve and/or maximize profitability. Businesses typically tend to build more than one revenue stream for diversification and cushioning the business from economic fluctuations. Concentration of revenue streams, longevity, and scalability are some of the most important aspects that should be investigated while assessing revenue sources.

-

-

-

-

-

Major Cost Drivers and Suppliers/Partnerships: Identify the company’s key partnerships, supplier concentration, resources, and cost centers and how these costs relate to its revenue streams. VC investors assess whether the target company has scalable infrastructure and distribution and will be able to achieve economies of scale.

-

-

-

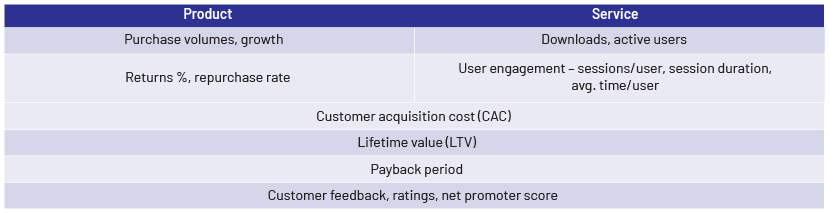

Investors should also assess some of the key performance indicators (KPIs) associated with the target company, such as the following:

-

-

-

-

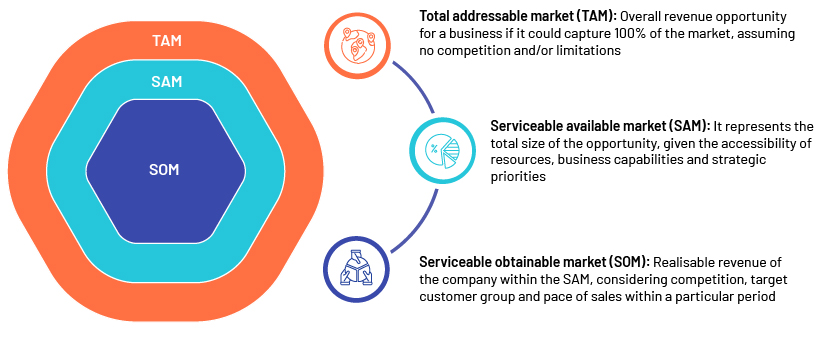

Market and customer segment It is important for VC investors to access the market potential of the target company’s products or services. Objective measures for assessment are calculations of market size metrics such as TAM, SAM and SOM:

Growth estimates of these market size metrics help investors gauge the return potential associated with the sectors. They also help investors assess the competitive nature of the sector and how well the target company is positioned to compete effectively in the market.

VC investors must also evaluate the geographical locations of business operations and the targeted demographic dividend of the customers. This is so as to gauge the following:

-

Whether customers accept and will stick to the product in the long run

-

If the target group is expandable within and across geographies

-

The competitive landscape in operating locations

-

-

Legal information and regulatory assessment

Businesses operate in competitive and regulatory environments and face a number of challenges. It is important that investors understand how the target company navigates these hurdles.

-

Legal standpoint Does the target company have a history of involvement in litigation? This could be in the form of contractual disputes, infringements on intellectual property, discrepancies in partnership agreements, etc.

-

Regulatory standpoint

-

Does the target company operate in a heavily regulated market or sector?

-

Is the company compliant with current regulation?

-

Has the company obtained the necessary licences and permits to run its business?

-

The law of the land – is there a law that hinders the launch of a product or service?

-

Financial information

Evaluating financial projections helps VC investors gain insights oninto a startup’s ability to grow its scale and customer base to achieve profitability. Some key financial metrics are highlighted below:

-

Historical revenue/annualised recurring revenue (ARR) and growth projections over the next 5-10 years

-

Gross margin, contribution margin, EBITDA and net profit

-

Cashflow, cash burn, cash reserves and cash runway

Investors should also ask the following questions when assessing a company’s financial details:

-

What is the company’s rationale and assumptions for the estimates?

-

What is its margin profile and path to profitability? What are its projected breakeven periods?

Financial projections also enable investors to assess a target company’s valuation and return potential. There is no single pre-defined valuation parameter for valuing a company, although there are a number of assessment methods. The following are some of the most commonly used valuation approaches most commonly used by VC investors:

-

Precedent Transaction Analysis: This involves finding M&A transactions of comparable companies in the sector. Revenue/EBITDA/EBIT multiples of the transactions are used for the target company to arrive at the valuation for the target company.

Comparable companies are screened based on the following factors:

Businesses operating in the same sector

Geography

Company size

Business model

Any dissimilarities between the target company and the comparable company should be factored in, in the form of discounts and premiums to the comparable valuation multiple before calculating the target company’s valuation.

-

Venture Capital Method: This assumes a future exit scenario. The target company’s valuation is reverse-calculated based on the exit valuation and expected rate of return for the VC investors.

Valuation of target company = Exit valuation / Expected rate of return

The exit valuation is calculated using revenue or EBITDA (if positive) multiples currently in use in the sector.

-

Discounted Cashflow (DCF) Method: This is based on calculating today’s value of future earnings and is more suited for valuing companies with stable cashflow. It estimates future free cashflow and discounts it to present value using the expected rate of return on investment. Riskier opportunities attract a higher return on investment.

-

Scorecard Valuation Method: Typically used for pre-revenue businesses, it involves scoring the target company on certain parameters with an assigned weightage range for each. Each parameter is then compared with similar-funded companies. The target company is assigned scores higher or lower, based on efficiency compared with that of the comparable company. The sum product of weightages and scores results in a factor, which when multiplied with the comparable company’s valuation, provides the value for the target company.

Given the subjective nature of the valuation process, VC investors use one or a combination of these methods as an approximate reference. In most cases, the final valuation of a company is a value negotiated by the VC investors and company management.

Company assets

The nature of assets varies according to the type of business. Growth of assets at each stage of fund raising is an important criterion for assessing the strategic advancements of the company. Investors should examine the capital allocation plans executed by the management team and the scope of long-term value creation by examining the company’s asset growth.

VC investors must also conduct due diligence on intellectual property (IP) rights such as patents, trademarks and copyrights to avoid conflicting claims on the company’s IP in the future. IP is critical for technology-backed startups, and any infringement or challenge by a competitor could adversely impact the target company’s revenue, even its entire business.

Company personnel

A company is run based on the decisions of the founding team or executive team. The founding team typically brings its expertise for making decisions. Hence, its background and subject-matter expertise are some of the deciding factors before investing in a company.

The capitalisation (or cap) table provides very valuable insights on the company’s previous fundraising, equity spread and the concentration of the founding team among the shareholders. As voting rights allow shareholders to participate in company decisions, insights on the cap table help investors gauge possible conflicts in decision-making that could arise due to the structure of the cap table.

The board of directors guides the executive team towards long-term goals, including high-level strategies, capital allocation and new product launches. The board is required to act in the best interests of the company while approving steps towards strategic and structural shifts by the company. Information on board composition helps VC investors evaluate management capability to navigate difficulties.

Conclusion

With millions of startups being established every year looking to raise funds, it is essential for VC investors to compile guidelines to help them identify those companies with the highest return potential. It is also important that they compile a checklist to help them conduct thorough due diligence of the target company’s ability to achieve this potential based on operational and financial parameters. Such a checklist gives the assessor a broader idea of the measures to be used. The measures and benchmarks vary according to sector and business model, and these nuances should also be taken into consideration during the assessment.

How Acuity Knowledge Partners can help

We are Acuity Knowledge Partners is a leading provider of research, analytics and technology solutions to over 650 financial institutions across the world, including asset managers, corporate and investment banks, and private equity (PE) and VCventure capital firms, across the world. Our services and solutions are supported by a global network of more than 6,000 analysts and industry experts. We assist PE and VC clients across their investment value chain, from industry research, deal screening and due diligence to deal acquisition and portfolio monitoring, enabling and allow them to fast-tracking their investment decisions.

Sources:

What's your view?

About the Authors

Jatin works in the capacity of Delivery Manager at Acuity Knowledge Partners and has 8+ years of experience in PE and VC domain – working with investors from across the world from target screening and deal sourcing to company due diligence and portfolio monitoring. He holds a Bachelor’s degree in Economics from Hansraj College, Delhi University, and has completed all 3 levels of the CFA Program from the CFA Institute.

Praveen is a Delivery Lead within the Private Markets team at Acuity Knowledge Partners. He has over six years of experience in wealth management and private equity space and has gained expertise in analysis, startup research and portfolio management. He is a postgraduate in Financial Services from K J Somaiya Institute of Management, Mumbai. He likes listening to music and reading in his leisure time.

Like the way we think?

Next time we post something new, we'll send it to your inbox