Published on July 17, 2024 by Nishant Chawla and Tahlil Patel

Most G7 economies have been going through a cycle of high inflation to disinflation since the pandemic, achieved through a series of rate hikes over the past two years. Their central banks have faced the daunting task of managing growth and inflation at the same time and are finally seeing light at the end of the tunnel. We believe that with most economies’ inflation prints pointing towards slowing inflation, the central banks will likely start their rate-cutting cycles to boost consumption and growth.

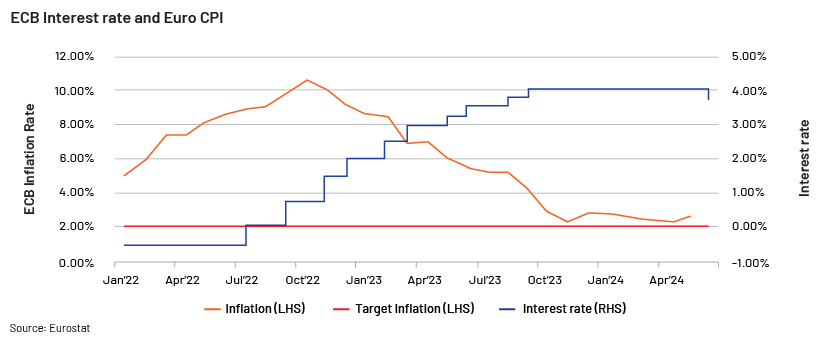

The European Central Bank (ECB)

The ECB cut its key policy rate to 3.75% in June 2024, after holding it steady at 4% for nine consecutive months. This was supported by the steady decline in inflation to 2.5% in June 2024 since peaking in October 2022 at 10.6% along with wage growth easing to 4.7% y/y in 1Q24 from 5.1% y/y in 3Q23. Wage inflation is expected to have moderated further, based on ECB meeting minutes.

We believe the ECB will skip the rate cut at its July meeting, as the May inflation print was higher than expected. The ECB’s inflation gauge, the Harmonized Index of Consumer Prices (HICP), increased by 2.6% y/y, and core inflation excluding food and energy rose by 2.9% y/y. However, we expect the central bank to make two more rate cuts later this year if inflation eases further.

Key risks:

While goods-related inflation is declining, services-related inflation in some sectors remains sticky. This, coupled with increase in wage growth, could be a downside risk to rate cuts. Another downside risk that could follow the ECB rate cut is depreciation of the euro.

Consensus:

While the 6th June rate cut was widely expected, there is some debate over how many more rate cuts the ECB can implement. Over two-thirds of those polled in a recent Reuters survey expect two more rate cuts this year.

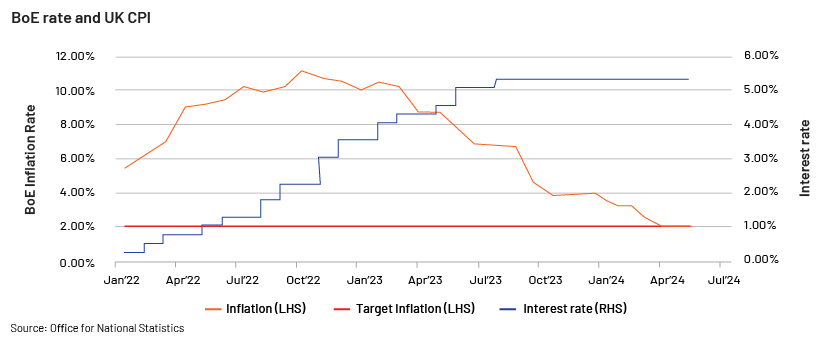

UK

The Bank of England (BoE) kept the rate unchanged at 5.25% at its policy meeting on 20th June despite inflation reducing to its target level of 2% y/y. This decision was driven mainly by higher-than-expected services-related inflation, which grew 5.7% y/y compared to consensus of 5.5% y/y. This was offset by energy cost deflation, which constitutes around 30% of the CPI basket weight and declined sharply by around 16% y/y.

The pace of inflation slowed considerably, to 2% in May 2024 from its peak of 11.1% in October 2022, driven mainly by energy regulator Ofgem’s 12.3% reduction of the household bill cap in April 2024 and lower food inflation in May 2024.

We expect the BoE to start cutting rates once services-related inflation also starts to ease.

Key risks:

Rising wage growth and sticky services inflation, both of which are hovering around 6%, three times the inflation rate of 2%, could derail plans of a rate cut.

Consensus:

The BoE is expected to start cutting interest rates in August, according to the Reuters poll, and financial markets expect only one rate cut this year.

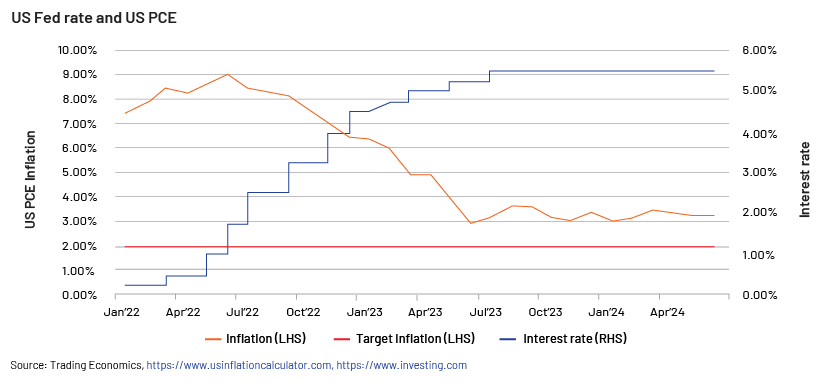

US

The US Federal Reserve (Fed) has been following a stance of “higher for longer” and has maintained its policy rate at a multi-year high of 5.25-5.5%, as it is still not comfortable with the inflation trajectory.

Recent macro data shows that although inflation growth has moderated to 3.3% y/y, it is still running above the target level of 2%, driven by the persistent housing shortage and the US job market remaining tight due to strong wage growth, adding further risk to the possibility of a delayed rate cut.

At the recent Fed meeting, FOMC members lowered their forecasts of number of rate cuts and reduced projections for the median interest rate at end-2024 to the mid-point between 5% and 5.25%. The FOMC also hinted that the central bank is looking at just one rate cut for 2024, versus the three cuts estimated in March 2024.

Key risks:

The US unemployment rate ticked higher, to 4% in May 2024 from 3.9% in April 2024; this may force the Fed to take a cautious approach to rate cuts.

Consensus:

Most of the economists polled by Reuters expected the Fed to start cutting interest rates in September and make one more rate cut before year-end. However, the recent Fed meeting indicated only one rate cut in 2024.

Canada

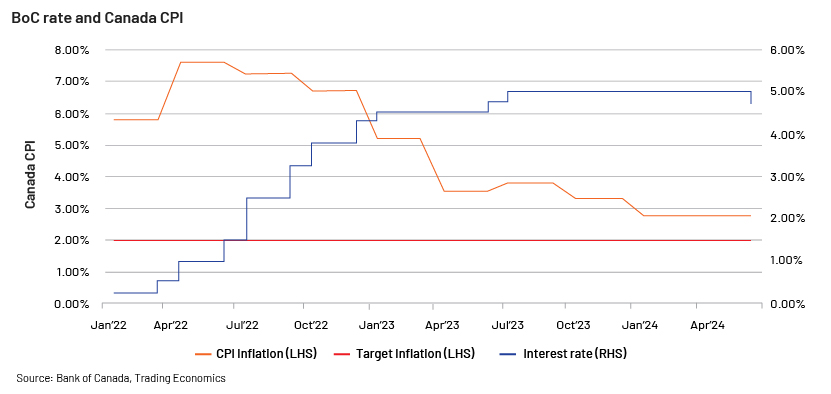

The Bank of Canada (BoC) was the first central bank among G7 central banks to announce a policy rate cut at its policy meeting on 5th June.

It cut its policy rate by 0.25% to 4.75% in response to a slowing CPI inflation print. The most recent inflation reading was 2.7% in April, the lowest in the past three years but higher than the BoC’s target rate of 2%.

This first rate cut in over four years came as somewhat of a relief to highly indebted Canadians who faced a steep hiking cycle by the BoC in its efforts to reduce inflation. Canada’s economy is more sensitive to interest rates; the country has 5-year fixed-rate mortgages versus the US’s 30-year fixed-rate mortgages. This means that a number of Canadians would have had to renew their mortgages during the period of high interest rates.

The BoC’s governor pointed out that rates would fall more slowly than at the pace in which they increased and settle at a higher level than before the pandemic. Based on easing inflationary pressure, we expect the BoC to cut rates two more times before year-end.

Key risks:

The BoC noted in its press release that the economy is still experiencing wage pressure, which is moderating only gradually. High shelter price inflation is still a concern, and a higher-than-expected pace of inflation could make it cautious about the timing of rate cuts.

Consensus:

The market expects two more policy rate cuts of 25bps each this year.

Japan

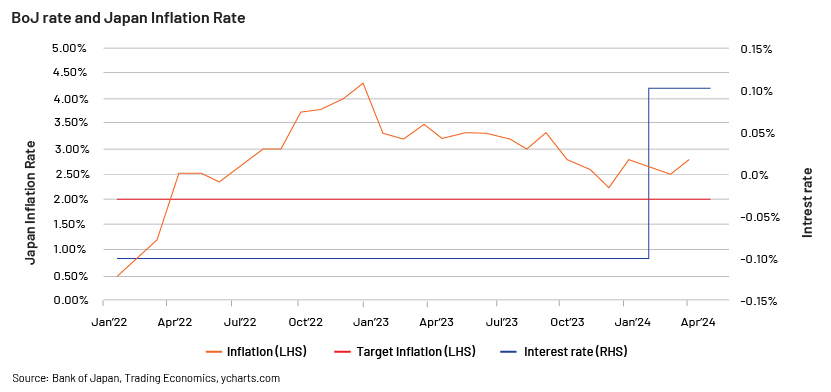

The Bank of Japan (BoJ) kept its policy rate unchanged at 0-0.1% at its policy meeting on 14th June. It raised its interest rate for the first time in 17 years in March 2024.

It said in a statement that it could reduce purchases of Japanese government bonds after the July meeting, hinting at more restrictive monetary policy to fight inflation. It also hinted at raising the policy rate, as inflation remains higher than its target of 2%.

Japan’s core inflation reading was 2.5% in May, an acceleration from 2.2% in April. Core CPI in Tokyo also rose to 1.9% in May from 1.6% in April.

We expect the BoJ to increase its policy rate in order to bring CPI within the target inflation range.

Key risks:

The BoJ is also concerned about the weak yen. The BoJ governor said in his comments in May that the central bank will scrutinise the yen’s recent declines when guiding monetary policy.

Consensus:

The market expects one more rate hike of 25bps this year.

Most G7 economies need to find a comfortable balance between inflation and rate cuts to support growth. A rate cut too soon could disrupt the difficult progress made towards controlling inflation, but a delayed rate cut could hamper growth and impact the economy, as corporations would shy away from incurring capex. Overall, we expect central banks will adapt balanced approach in the rate cuts to counter any recession pressure amid global economic uncertainties.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific/macroeconomic experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients gain a unique, sustainable edge.

Sources:

-

Fed policymakers see just one rate cut this year, 4 cuts in 2025

-

June ECB rate cut a done deal, majority expects cuts in Sept, Dec too: Reuters poll

-

Bank of England set to bury Sunak's pre-election rate cut hopes

-

ECB and Canada cut rates as easing among big economies gets going

-

BOJ to keep ultra-low rates, debate fate of huge bond buying

-

Inflation in Japan's capital accelerates, keeps BOJ rate hike prospects alive

Tags:

What's your view?

About the Authors

Nishant has around 6 years of experience in equity research, working with buy-side clients, covering Banking sector and other Financials. He has been associated with Acuity Knowledge Partners (Acuity) since July 2022 and currently manages deliverables for a US based hedge fund with an AUM of $12bn. Prior to joining Acuity, he has worked with a Singapore based Asset Manager covering Indian equities. Nishant holds an MBA (Finance) from University of Mumbai.

Tahlil has around 10 years of experience in equity research. He has been with Acuity Knowledge Partners (Acuity) since November-2020. He currently manages delivery for a buy-side client in the Europe, supporting them with their research needs, and covering multiple sectors. Prior to joining Acuity, he worked with Sutherland global service covering healthcare companies. Tahlil holds an MBA (Finance) from University of Mumbai

Like the way we think?

Next time we post something new, we'll send it to your inbox