Published on April 14, 2025 by Heli Amarakoon

Introduction

In the aftermath of the 2008 financial crisis, the role of collateral management has become increasingly critical for ensuring operational efficiency, regulatory compliance and mitigating counterparty risk. Dynamic global regulations have driven the development of advanced solutions that facilitate the efficient flow and transformation of collateral, benefiting the participating entities by reducing risk, increasing liquidity, improving regulatory capital and cost management and maximising returns on investments.

Eurosystem – ensuring liquidity in the Eurozone

Eurosystem credit operations involve providing credit to eligible counterparties, such as credit institutions and market participants, against adequate collateral. The process of transferring collateral to national central banks (NCBs) and the subsequent handling of collateral until it is returned to the counterparty is known as collateral management in the Eurosystem. Collateral includes marketable or non-marketable assets that meet the Eurosystem's eligibility criteria as assessed by the NCBs that are accessible to counterparties regardless of their location. All NCBs follow the same rules but maintain individual collateral management systems and implement changes to the legal framework separately.

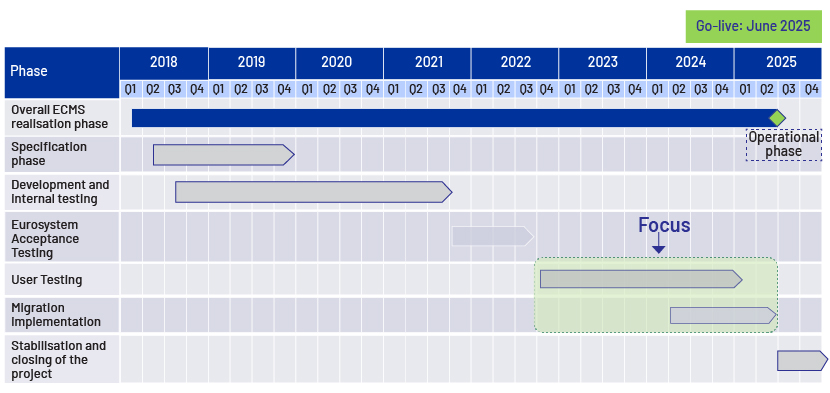

To replace these fragmented and decentralised systems, the European Central Bank (ECB) approved the Eurosystem Collateral Management System (ECMS) and subsequently published harmonised rules, to come into effect with the launch of the ECMS in June 2025. Preliminary work on the ECMS began in December 2017 as part of the ECB’s Vision 2020 aimed at enhancing financial market infrastructure to improve its readiness to face new challenges and opportunities in the financial landscape.

The ECMS in banking is a unified system for managing assets used as collateral in Eurosystem credit operations, supporting the handling of monetary policy operations and enhancing financial market infrastructure. The harmonised rules aim to streamline and standardise collateral management across the Eurosystem, offering significant benefits such as the following:

-

Harmonisation:

-

For NCBs: Unified and simultaneous implementation of the collateral framework and updates

-

For counterparties: Enhanced efficiency by eliminating the need to interact with various local collateral management systems, using a single system and interface

-

For the market: Promotion of integration through a unified system for managing collateral pools in Eurosystem credit operations

-

-

Achieving operational and cost efficiency by implementing changes within a single system

-

Establishing financial integration of the Eurosystem’s market infrastructure while supporting the development of the EU’s Capital Markets Union

-

Interoperability resulting from standardised messaging across financial market infrastructures, leading to increased functionalities

-

Reduced risk in managing securities and collateral due to the standardisation of processes

-

Ensuring equal opportunities (a level playing field) for all market participants across Europe

ECMS operating mechanism

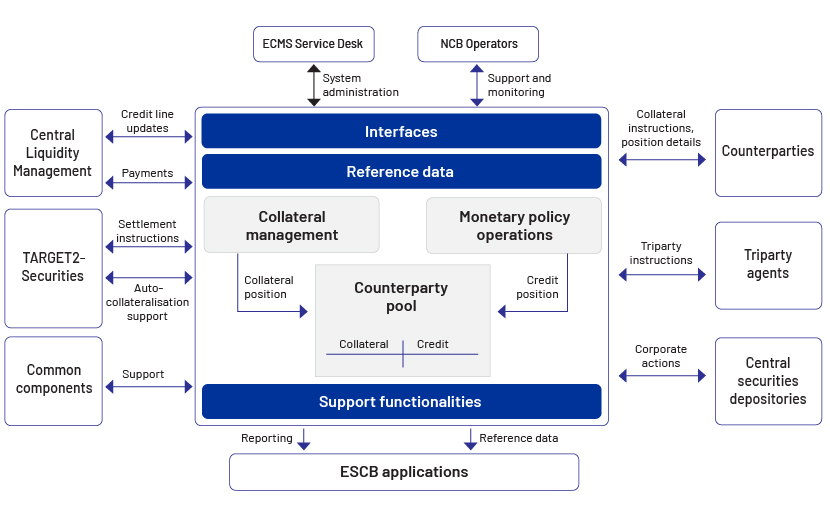

The ECMS operates by tracking the collateral and credit positions of NCBs’ counterparties. It calculates the available credit line for each counterparty and sends this information to the central liquidity management tool. Mobilisation instructions from counterparties are converted into settlement instructions, which are then settled in TARGET2-Securities (T2S). It manages corporate actions, triparty instructions and the use of credit claims as collateral in a standardised way. The ECMS interface manages all communications, ensuring appropriate communication methods are used, and conducts technical entry checks. Connections to the ECMS are made via the Eurosystem Single Market Infrastructure Gateway (ESMIG).

Interactions of the ECMS

Migration and testing strategy

Eligible counterparties need to adapt their systems to ensure they are ready to use the ECMS. This involves reviewing the compatibility of internal systems and processes, familiarising oneself with new processes and the legal framework and continuing effective communication with the relevant stakeholders to gain insights on best practices. Therefore, it is vital for counterparties to engage in testing activities with NCBs to identify and rectify potential issues in integration.

Testing principle: The testing framework provides details on the user testing (UT) plan for the ECMS community and other stakeholders. It includes central bank testing, community testing, operational testing, business day testing and migration testing while establishing incident and defect management. Pre-migration and migration dress rehearsals are conducted to reduce migration risks.

Migration principle: Migration follows a big-bang approach, where all NCBs and their communities participating in the ECMS are migrated simultaneously. A robust readiness strategy along with contingency measures are in place to monitor the preparedness of relevant stakeholders. The migration work is split into four parts:

-

Preparing for migration: Covers planning, elaborating on migration deliverables, migration risks and mitigation measures.

-

Migration testing phase: Covers migration testing and completion reporting by stakeholders. The go/no-go decision by the Market Infrastructure Board (MIB) should be taken four weeks before the planned migration date (by 16 May 2025).

-

Conducting migration: This is organised in two phases: (1) pre-migration: includes all activities that must be performed before migration (e.g., network connection, reference data input) and (2) migration: includes all activities to be performed during the preparation weeks (2-13 June: receiving data from external sources to initialise the ECMS database, migrating reference data considered too volatile for pre-migration) and the migration weekend (13-15 June: migration of transactional data) to ensure a fully functional system from the go-live date.

-

Post-migration: Covers activities carried out after the migration weekend, such as reporting on migration results.

Reporting: This includes pre-migration and post-migration reports. The ECB project team and NCBs established the reporting framework and input template during the “preparing for migration” phase. The results are consolidated and delivered to project governance bodies.

High-level project timeline

Current status (Timeline and key milestones): Pre-migration activities are expected to be finished by end-March 2025 and the operational, contractual and legal adaptations by 04 April 2025. Completion of user testing has been scheduled for 22 April 2025 and reaching a go/no-go decision by 16 May 2025.

Shaping middle-office operations

The ECMS in banking transforms middle-office functions of counterparties, improving risk management, compliance, collateral optimisation, and regulatory reporting. They would need to adapt to new ECMS workflows and regulatory requirements for faster and more reliable settlement of transactions.

Collateral management and optimisation: Middle-office teams must ensure the eligibility of collateral under ECMS rules, reassessing collateral pools in line with the harmonised rules and undertaking real-time collateral tracking across multiple jurisdictions.

Risk management: The ECMS enforces uniform risk parameters across the Eurozone, affecting haircuts, valuations and margin calls, leading to real-time monitoring of collateral sufficiency. Automated margin adjustments would require faster decision-making.

Settlement operations: The ECMS leads to standardising collateral settlement cycles via TARGET services, reducing reliance on manual reconciliation for repo and securities lending and increased use of centralised tri-party collateral management services.

Compliance and regulatory reporting: The ECMS follow the ECB’s standardised reporting requirements for collateral holdings, increasing the need for real-time transparency in collateral use and automated reconciliation with regulatory databases for compliance checks.

Accordingly, the ECMS demands operational changes in middle-office processes, resulting in enhanced automation, risk analytics, compliance frameworks and data standardisation to ensure a smooth transition.

Conclusion

The new system is not expected to alter existing business and legal relationships between counterparties and NCBs. Overall, the new harmonised rules and the introduction of the ECMS represent an essential shift towards a more integrated and efficient European financial market. Market participants are advised to align their practices with these new rules to fully benefit from the enhanced and improved operational framework.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners provide end-to-end expertise for all loan operations, covering collateral management. We have nearly 20 years of experience in supporting global banks across the loan lifecycle, providing tailormade solutions to 90+ banking clients in the retail, business, middle-market, real estate and leveraged finance segments.

With the ECMS, counterparties that previously operated with individual NCBs now have the opportunity to centralise their collateral management tasks, enhancing consistency and efficiency. Our domain expertise and extensive experience in operating with credit institutions in the Eurozone enable us to ensure consistent extraction, transformation and loading of data into the ECMS, maintaining data integrity and compliance with ECMS formats and standards.

References:

-

Focusing on collateral in 2025, it’s not just about the back office – Securities Finance Times

-

ECB publishes legal framework for the Eurosystem Collateral Management System (ECMS) – PwC Legal

What's your view?

About the Author

11+ years of experience in Banking and Financial Services industry. At Acuity Knowledge Partners, she has been operating as a Team Lead in the TMT&H sector of a large European Bank conducting covenant monitoring, financial spreading, internal risk rating and analytical credit review writing. She is currently supporting to setup Loan Operations in Colombo. Prior to joining Acuity, she worked in a leading Commercial Bank in Sri Lanka conducting credit risk analysis, financial analysis, client relationship and portfolio management. She holds a Master of Business Administration from the University of Colombo and Bachelor of Business Management (First Class) from Bangalore University.

Like the way we think?

Next time we post something new, we'll send it to your inbox