Published on July 26, 2024 by Huijuan Luo , Yue Zhang , Ying Liu and Liguo Xin

The EV industry is growing rapidly, as more consumers are turning to environment-friendly transportation methods. Emerging opportunities are creating new paths for growth and innovation. One such opportunity is EV battery charging, which includes both charging infrastructures and battery swapping. Charging infrastructures enable drivers to charge their EV batteries (at home, work place or public charging stations). Battery swapping is an efficient alternative, which allows drivers to exchange their depleted EV batteries for fully charged ones at designated stations. Another emerging opportunity is battery recycling, which includes cascade utilisation and disassembly recycling.

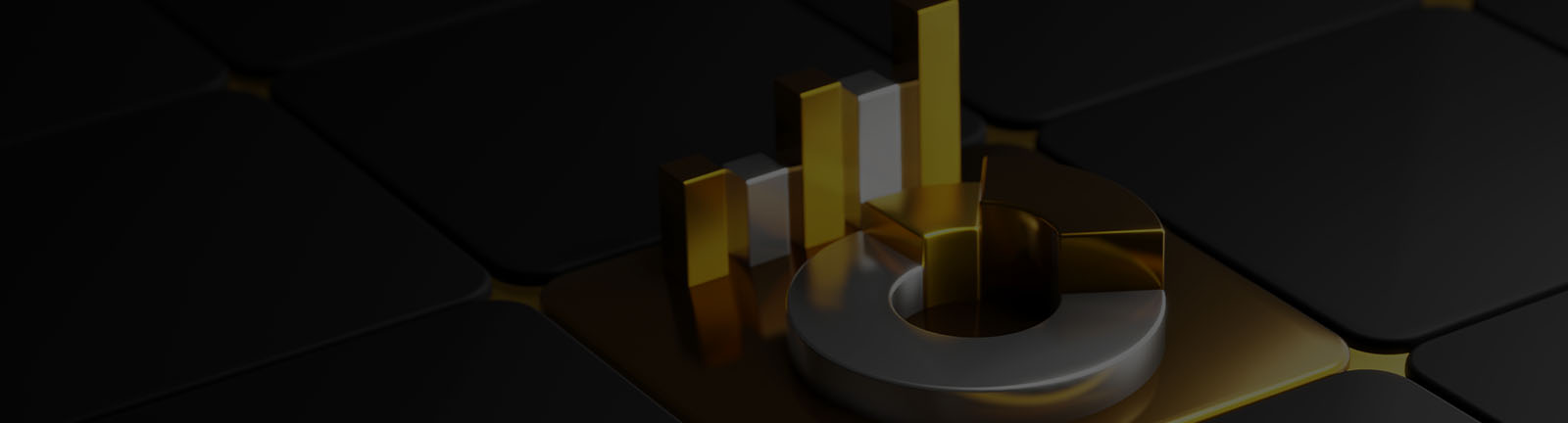

Exhibit: Total charging piles in China

Source: EVCIPA, Acuity Knowledge Partners research

In addition to building denser and more convenient charging piles, many EV makers have launched superchargers, also known as rapid chargers, which offer incredibly fast charging speeds.

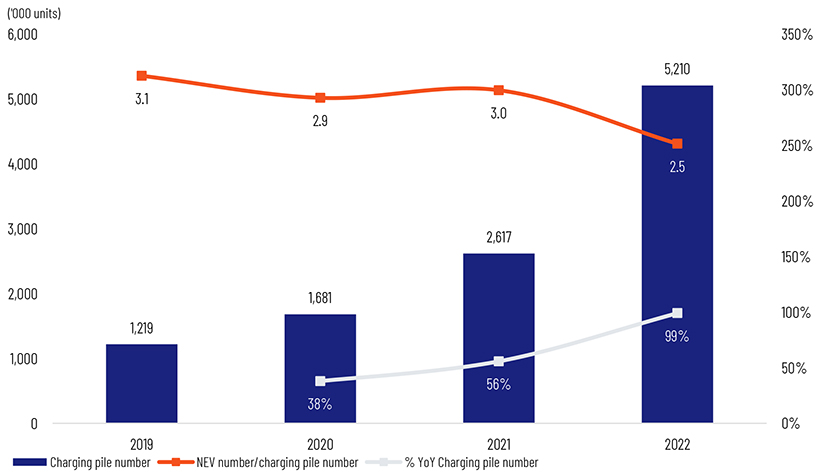

Growing demand for charging infrastructure in China: According to EVCIPA, the number of public charging piles reached c.1.8mn units in 2022, up 56.7% YoY – DC fast charging piles (761,000 units) accounted for a 42.3% share, and AC charging piles (c.1.04mn units) made up a 57.7% share.

Exhibit: Number of public charging piles and growth

Source: EVCIPA, Acuity Knowledge Partners research

Industry Risks

Geopolitical ramifications: Tensions between China and other countries could lead to trade restrictions or tariffs, possibly making it more difficult and expensive for Chinese EV makers to export their products or import components.

Softer-than-expected EV demand: Although retail sales have recovered after the COVID-19 pandemic in China, automotive consumption remains volatile. For example, in 1Q23, China’s retail sales of goods totalled around RMB11.49tn, up 5.8% YoY, while automotive purchase dropped 2.3% YoY to c.RMB1.1tn. EV prices were unstable and customers adopted a wait-and-watch policy, which shrank orders, turnover rates and dealer profitability.

Global shortage of semiconductor chips: Automakers produced 4.5mn fewer EVs in 2022 because of the shortage of vehicle chips, compared to the shortfall of 10.5mn units in 2021, according to AutoForecast Solutions. The shortage of semiconductor chips could also impact the delivery of new EV models and lead to sales loss for EV manufacturers.

Pollution from lithium batteries: The EV industry is touted as a solution to climate change, but the production and disposal of lithium battery could have unintended environmental consequences. Mining can lead to water pollution and soil degradation, and the production of lithium batteries can create hazardous waste. In addition, if lithium batteries are not recycled or disposed of properly, they can release toxic chemicals in the environment.

Safety concerns: EV is a relatively new concept, and safety concerns could impact consumer adoption and confidence in the industry. One major concern relates to the batteries used in EVs, which can be prone to thermal runaway and catch fire or even explode in certain conditions.

Conclusion

The comprehensive analysis of China's EV industry has revealed a dynamic and rapidly evolving sector that is poised to play a pivotal role in the global shift towards sustainable transportation.

The industry's background is rooted in the country's strategic push for innovation and environmental sustainability, which has been supported by a robust value chain. Regulatory frameworks have been instrumental in shaping the industry, with government policies promoting EV adoption through subsidies and infrastructure development. The growth drivers of the industry are multifaceted, encompassing technological advancements, economic incentives, cost reduction due to localization and consumer awareness. These factors have contributed to a notable increase in market share for EVs within China, signaling a broader acceptance and integration of electric mobility solutions.

The competitive landscape is characterized by both domestic and international players, with fierce competition driving advancements in technology and customer experience. Emerging opportunities within the industry are abundant, particularly in the realms of battery technology.

These opportunities are not without their risks, however, as the industry faces challenges such as supply chain disruptions, technological uncertainties, and the potential for policy shifts.

In summary, China's EV industry represents a landscape of immense potential, tempered by a set of unique challenges. As the industry continues to mature, the role of strategic guidance and expert analysis will be crucial in unlocking the full potential of this promising sector.

Tags:

What's your view?

About the Authors

Huijuan is an Associate Director in Acuity Beijing’s Investment Research team. She supervises buy-side teams at Acuity Beijing that serve hedge funds, mutual funds, asset management firms and private equity firms in countries and regions such as Hong Kong, Japan, Singapore, Europe and the US. She has 13 years of investment research experience at Acuity, covering China and Japan markets by leveraging her trilingual capabilities and a total of 17 years of working experience. Huijuan holds a master’s degree in Finance from the University of International Business and Economics, China.

Yue is an Assistant Director in Acuity Beijing’s Investment Research team. She has over 10 years of working experience at Acuity including over 5 years in a management role. She supervises Acuity Beijing’s sell-side equity research teams in Mandarin, Japanese and English. Yue previously supported multiple equity research teams at a Europe-based global investment bank, most notably in China’s internet and Japan’s precision machine sectors. She holds a master’s degree in Finance from the University of Sydney, Australia. Yue is an ACCA Affiliate.

Ying is an Associate in Acuity Beijing’s Investment Research team. She has over five years of working experience in investment research, focusing on China’s TMT and industrial sectors. She currently supports a global sell-side equity research client, covering China’s internet sector. Prior to Acuity, she worked as a research analyst with an asset management firm in Hong Kong. Ying holds a master’s degree in Social Work from the Chinese University of Hong Kong. She has passed CFA Level 2.

Liguo is an Associate in Acuity Beijing’s Investment Research team. He currently supports an international sell-side equity research client, covering China’s financials sector. He previously supported equity research teams of multiple top-tier global investment banks, covering Asia’s commodity and China’s EV sectors. He holds a master’s degree in Finance from the University of Iowa (US). Liguo has passed CFA Level 2.

Like the way we think?

Next time we post something new, we'll send it to your inbox