Published on February 23, 2021 by Akshay Verma and Sameera Rao

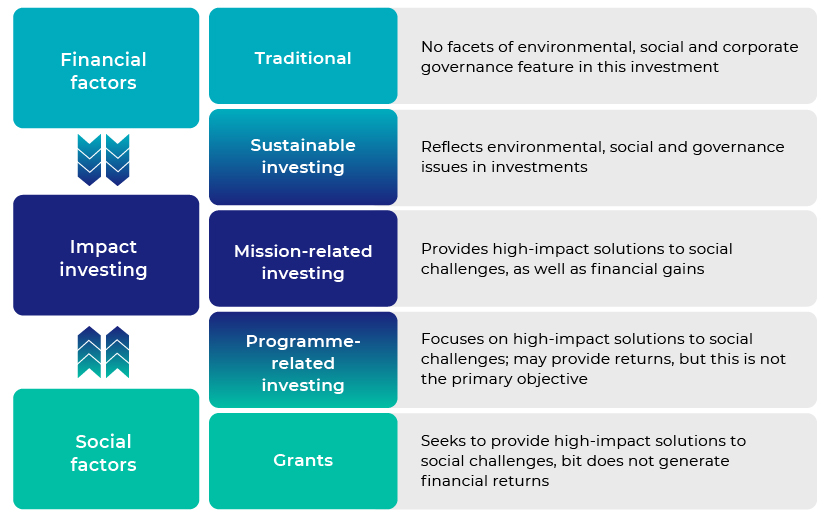

Over the last decade, impact investing has gained prominence in the financial and economic sectors globally. While it boasts positive societal and environmental ramifications, it does eye financial returns (see the illustration below).

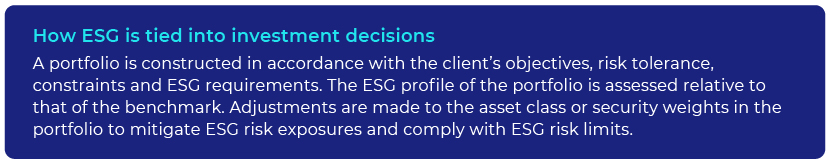

ESG factors and how they are incorporated into investment decision-making

-

Environmental: This encompasses aspects such as the consumption of non-renewable sources of energy (e.g., nuclear energy and fossil fuels), which are detrimental to the environment, as they lead to pollution and climate change and deplete natural resources.

-

Social: This covers human rights – child labour, women’s and children’s safety and development, engagement of multicultural community groups and improvement of relations with employees and stakeholders, among others.

-

Governance: This factors in management’s quality and effectiveness, resolution of conflicts of interest with peer groups and clients, promotion of transparency in key business processes, etc.

Factors driving ESG integration

Catalysts in the integration of ESG into investments in the asset management industry include:

-

Focus on long-term value creation: Companies are currently focusing on long-term wealth creation by incorporating sustainable practices (including ESG factors) into their day-to-day activities.

-

Changing regulations, along with long-term liabilities: Businesses are often exposed to risks such as changing regulatory requirements and societal reforms. Insurance companies and pension funds have long-term liabilities and fiduciary responsibilities and seek to cushion blows from a volatile environment. By tying ESG and sustainable investments to their portfolios, they can meet their long-term commitments to clients and society, in general.

-

Market potential of responsible investments: The potential for responsible investments is growing, fuelled by investors’ increasing focus on such vehicles, including socially responsible index funds.

-

Investors’ access to ESG information: The increasing penetration of responsible investment and sustainable investment across global markets has raised investors’ awareness on mainstream practices, helping them make informed decisions on their investments.

-

Regulation of ESG investments: ESG investments, accorded the highest importance, are promoted and regulated across global markets. The UN, which created Principles for Responsible Investment (PRI), is one of the primary bodies that have been regularly introducing reforms in the ESG space (such as carbon emission norms) and sustainable practices across industries. Their efforts have translated into exponential growth in assets managed by ESG-focused funds.

Is the growing clout of ESG fact or fiction?

Global warming and heightened air pollution have drawn attention to carbon emission, water consumption and paper use. Most regulators have set specific norms on ESG integration into investment processes. Institutional investors are evaluating the ESG policies of asset management firms before investing. Most of them demand that firms be a signatory of the UN’s PRI.

Why has there been an increase in ESG questionnaires in RFPs?

With more firms becoming ESG cognisant, asset managers are increasingly including ESG considerations in their business models. Going beyond the traditional company analysis, they are developing comprehensive ESG integration strategies to analyse underlying companies. The degree of ESG integration and methodologies employed vary by region, asset size and asset class. This variability and the availability of a number of options to managers have resulted in a significant increase in ESG questionnaires in requests for proposals (RFPs)/due diligence questionnaires (DDQs). Consulting databases, too, have devoted exclusive sections to ESG aspects.

How Acuity Knowledge Partners can help

RFP specialists and other experts in the field face myriad challenges on ways to best communicate their ESG practices. With priorities changing every year, leading to continued changes in the ESG investment horizon, proposal teams today need a certain level of expertise in reporting and communication. Tailored on-the-job training, access to ESG doyens and working groups, and active participation in industry forums can broaden investment managers’ ESG skills. Moreover, proposal teams should work with investment teams and ESG specialists to create persuasive language relating to their ESG philosophy and process, which can be part of the proposal library accessed by their global teams.

Acuity Knowledge Partners offers a suite of services in marketing and investment communication. We support prominent investment managers in ESG-specific RFPs/DDQs and marketing collaterals, as well as assist in ESG e-mail campaigns and investment commentaries. To help organisations communicate their ESG themes better, we leverage our fund management specialists’ rich and extensive experience, built over the years through collaboration with leading investment management firms.

Sources

1. https://www.pwccn.com/en/asset-management/esg-an-opportunity-for-asset-managers.pdf

3. impact-investing-chart-new.jpg (700×469) (siliconvalleycf.org)

4. ESG, SRI, and Impact Investing: What's the Difference? (investopedia.com)

5. GUIDANCE AND CASE STUDIES FOR ESG INTEGRATION: EQUITIES AND FIXED INCOME -UNPRI

What's your view?

About the Authors

Akshay has a total experience of 12 years and has been working with OCIO clients for the last 6 years. He has done his post-graduation in Finance and Marketing and completed CFA Level 2. Akshay has keen interest in capital markets and the asset management industry.

Sameera Rao is an Associate in Fund Marketing Services Department. He has over 2+ years of experience working in the Financial Sector and over a year of experience working with the Acuity. Presently, he works as an RFP writer which involves responding to proposals and due diligence questionnaires for Mutual Funds, Separately Managed Accounts across active and passive asset classes. He holds an MBA degree from CMS School of Business Management, Bangalore.

Like the way we think?

Next time we post something new, we'll send it to your inbox