Published on January 11, 2023 by Sandani Saparamadu

Introduction – the nexus between sustainability and bank loans

Bank loans, the source of funding that powers the debt world, are rapidly being restructured to include sustainability clauses. Lenders that have found a nexus between environmental, social and governance (ESG)-based lending and sustainability are incentivising borrowers to transition the world to sustainability. ESG-based lending refers to general-purpose loans linked to the ESG performance of borrowers. However, the most scepticism is around the “operation” of ESG-based lending.

How do ESG-based loans work?

In essence, these loans work through tweaking margins. The margin of the loan is tied to the ESG performance of the borrower, where the lender issuing ESG loans includes clauses or covenants the borrower should achieve. If the borrower achieves the KPI targets set by the lender, the pricing of the loan is discounted, whereas if these targets are not achieved, a premium is added to the pricing of the loan. However, many mistake green loans for ESG-based loans, as corporates use both terms to showcase “sustainability”.

ESG loans and green loans – is there a difference?

ESG loans and green loans have one ultimate goal – sustainability. Even though these two terms are trending among bankers, ESG loans are issued with the objective of improving performance of borrowers in terms of ESG aspects, whereas green loans are issued solely to finance “green projects”, focusing only on one factor – the environment.

Why is ESG-based lending trending?

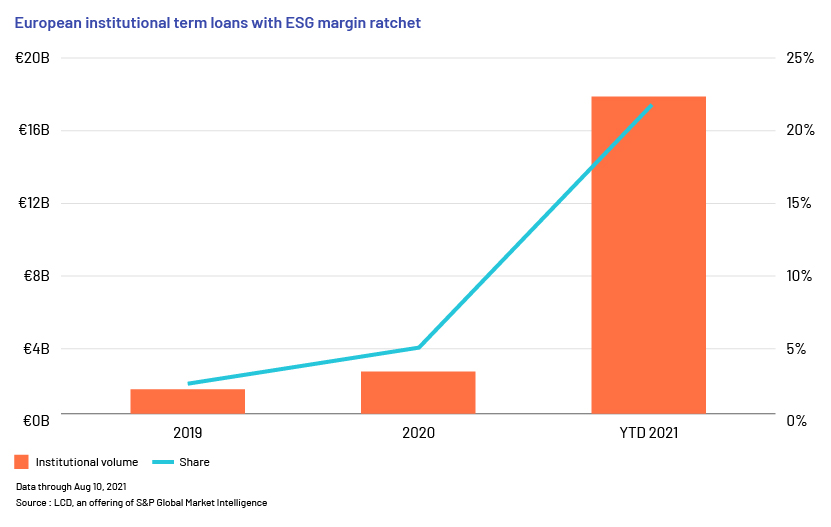

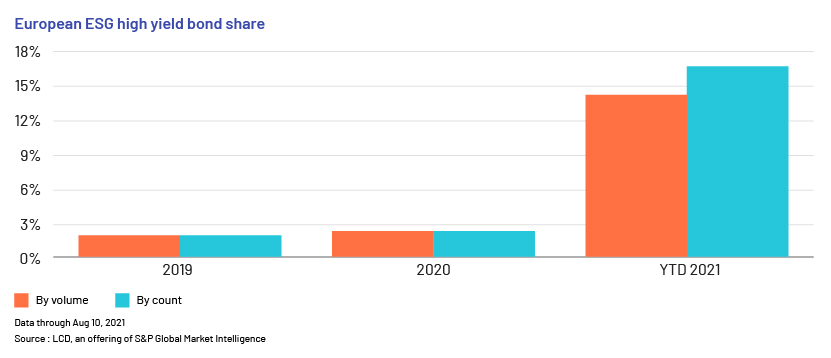

ESG-based lending has grown exponentially globally, from USD6bn in 2016 to USD322bn in 2021, whereas ESG-linked loans accounted for more than 12% of global bank lending in 2021. European institutional term loans with an ESG margin ratchet rose sharply to EUR18.52bn in 2021 from c.EUR2bn in 2020.

What are the benefits of ESG-based lending for lenders and borrowers?

-

Good Samaritans – Lenders and borrowers who hold ESG loans in their portfolios signal that they are accountable for a sustainable future. Consequently, borrowers able to maintain high ESG standards willingly borrow from lenders that have the expertise to effectively coordinate ESG performance pricing contracts and monitor the borrowers’ ESG practices.

-

Good soldiers – Increased regulations have asserted pressure on organisations to adhere to ESG principles. However, firms and banks may also engage in ESG-linked lending for “greenwashing” purposes; this refers to ESG-contingent contract terms making unsubstantiated claims to stakeholders about their sustainability practices. More transparent reporting by both lenders and borrowers can ease such concerns.

-

Win-win – The borrower adhering to clauses and covenants included in ESG-based loans provides the lender a safety cushion on the principal loan, and the borrower reaps the benefit of discounted margins.

-

Net zero – Increased focus on the environment could reduce the carbon footprint, leading to net-zero economies. A study of adoption of ESG-based lending by country found that countries with strict environmental regulations have seen an increase in ESG-based lending in recent years.

ESG-based lending for real estate – EU

Why ESG-based lending is important for the real estate market

ESG-based, green and sustainable lending has picked up significantly in the EU’s real estate sector, indicating that the EU is the main driver of global warming. Buildings account for 40% of the energy consumption in the EU, prompting policymakers to reduce carbon emissions. In the UK, energy performance certificates rate buildings on a scale from A to G, where A indicates the most efficient and G the least efficient; it will be considered “illegal” to let out a building rated F or G by 2023. The Netherlands expects to draw the line at buildings rated C or below.

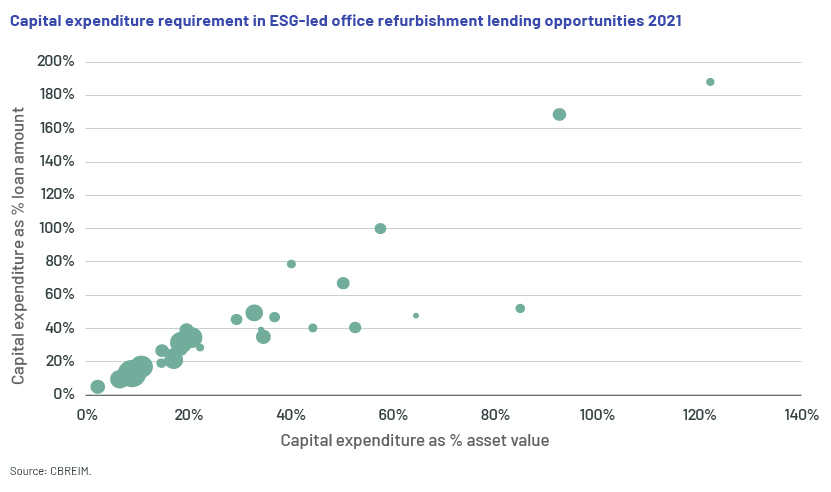

To achieve these goals, Europe’s real estate market is undergoing a wave of transformation, requiring investors and property owners to make properties occupiable from an ESG compliance perspective; 60-75% of the buildings would need to undergo substantial renovation, requiring total capital outlay of EUR160-200bn. This is where ESG-based lending and green loans would come into play, as banks have always been dominant participants in the EU credit market.

New EU disclosures and rules related to ESG

One reason for the increase in ESG-based loans in the EU is the effort of regulators, policymakers and environmentalists to streamline ESG activity. Numerous policies have been crafted to regulate ESG-based lending over the years, but only a few stand out.

-

Sustainable Finance Disclosure Regulation (SFDR) – walk the talk

Many companies tend to greenwash their activities. Under the new EU regulations, as of March 2021, all asset managers and owners are required to report on (1) the impact of sustainability risks on their investments and (2) the adverse impact of their investments on sustainability factors. Such disclosures have three main objectives:

-

To counter greenwashing

-

To improve disclosures so that institutional asset owners and retail clients can understand, compare and monitor firms’ sustainability characteristics

-

To ensure a level playing field within the EU so that European firms will not be exposed to unfair competition from firms outside the EU

The SFDR goes hand in hand with the EU’s Sustainable Finance Action Plan that aims to promote sustainable investment across the EU. The SFDR is implemented in two levels; the first was implemented in March 2021, and the second is proposed to be implemented in January 2023 with stricter regulations and disclosures. These regulations require borrowers to be transparent in reporting their green activities, protecting lenders from borrowers’ greenwashing activities.

-

Taxonomy regulations – the path to ESG labels

With buildings accounting for 36% of CO2 emissions in the EU, taxonomy regulations were crafted to clear ambiguities relating to economic activities termed "green". Activities are screened under three criteria to be eligible to be referred to as "green activities".

-

Activities that substantially contribute to environmental objectives

-

Activities that do not significantly harm other environmental objectives

-

Activities that respect minimum social safeguards

These taxonomy rules are particularly important for the commercial real estate market, enabling a building to be classified as a “green building”. However, the main aim is to optimise the contribution of the real estate sector to Europe’s climate goals by transforming existing buildings and constructing new buildings in line with net-zero-carbon standards. In line with these taxonomy regulations, lenders and borrowers need to be transparent in reporting green activities, and lenders are advised to take extra care when deciding on KPIs to measure the ESG performance of borrowers.

-

EU renovation wave – from old to gold

More than 220m building units (85% of the EU’s building stock) were built before 2001, according to the EU Commission. However, as these buildings are not so energy-efficient, the Commission stipulates that 35m buildings would need to be transformed in the coming decade under the new ESG directives declared by the EU to achieve its de-carbonisation goals. In essence, this renovation wave has three priorities.

Source: https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/renovation-wave_en

While the EU has allocated budget to fund these renovations, bank loans would no doubt be useful in accelerating these renovations, as extracting funds through budget approval has historically proven to be time-consuming.

-

Fit for 55 – build for the future

With Fit for 55, the EU regulator intends to make buildings in the EU fit for a greener future by reducing their greenhouse gas emissions by 55% (versus 1990 levels) by 2030 and reaching carbon-neutrality by 2050. Under this directive, real estate managers or owners need to consider the following:

-

Energy performance of buildings

-

Use of renewable energy

-

Use of clean energy while avoiding polluting fuels

This amplifies demand for ESG-based loans as corporates rush to comply with the EU’s carbon-neutrality directives.

KPIs to measure ESG performance

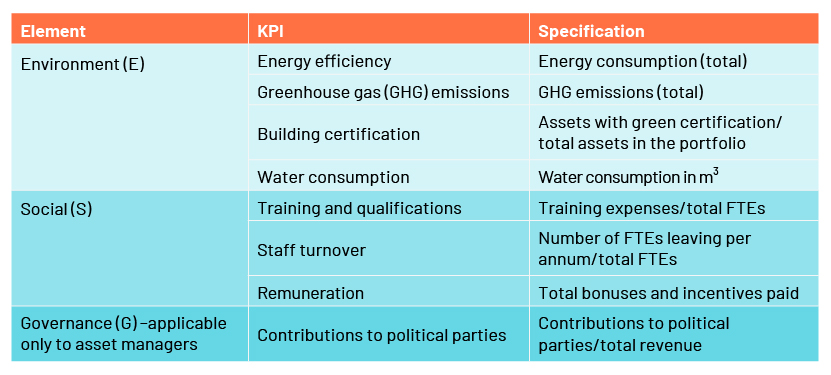

Lenders need to measure borrowers’ ESG performance using KPIs periodically, as this performance is linked to the margin ratchet.

More than 100 organisations now collect and analyse data, and rate or rank companies’ ESG performance, according to the Global Initiative for Sustainability Ratings. The European Federation of Financial Analysts Societies have compiled a list of KPIs used in the real estate sector; these are summarised below.

How Acuity Knowledge Partners can help

We help commercial real estate lenders manage and monitor loan portfolios. Our knowledge of the real estate sector, coupled with cutting-edge monitoring technologies, help portfolio managers mitigate risks and maximise returns of asset portfolios. Our covenant monitoring, customised credit reviews and risk ratings provide early warning signals to loan officers. Our team of experts have years of experience in sustainable finance and can help measure and monitor sustainability and ESG performance of borrowers so loan officers and deal teams can adjust their margin ratchets.

References:

-

Dursun-de Neef, Ö., Ongena, S. and Tsonkova, G., 2022. Green versus sustainable loans: The impact on firms’ ESG performance. Swiss Finance Institute Research Paper, (22-42)

-

https://energy.ec.europa.eu/topics/energy-efficiency/energy-efficient-buildings/renovation-wave_en

-

https://www2.deloitte.com/pl/pl/pages/real-estate0/articles/taxonomy.html

-

Kim, S., Kumar, N., Lee, J. and Oh, J., 2022, March. ESG lending. In Proceedings of Paris December 2021 Finance Meeting EUROFIDAI-ESSEC

What's your view?

About the Author

Sandani is an associate attached to the commercial lending division. She is currently part of the Real Estate Finance team undertaking covenant monitoring and covenant validations for a leading European bank.

She is a CIMA passed finalist, holding a bachelor’s degree in finance from University of Colombo. She is currently pursuing a MBA (Finance) from University of Bedfordshire.

Like the way we think?

Next time we post something new, we'll send it to your inbox