Published on June 12, 2018 by Gayathri Bodhidasa

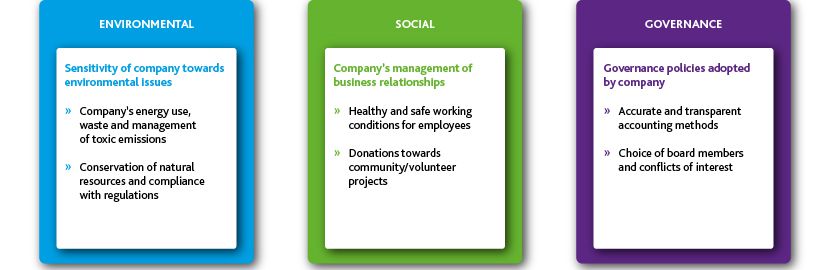

Investors increasingly seek to better understand the impact their investments are having on the environment and society. They use Environmental, Social and Governance (ESG) factors to evaluate corporate behavior and make a call on the future financial performance of their prospective investment opportunities. A focus on ESG factors allows responsible investing to take place, creating sustainability in the long term.

ESG related investments is today’s largest generational trend in money management. A McKinsey & Co. study found that more than 25% of global assets under management in 2017, totaling US$ 88 trillion, were investments guided by environmental, social and governance principles. But does prominence given to ESG factors make an actual impact?

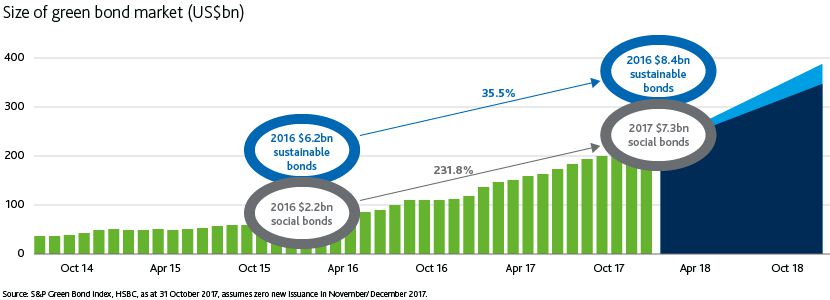

Data from HSBC’s S&P Green Bond Index, shows that the social bonds market rose by 231.8% over the 2016 and 2017 calendar years, while sustainable bonds jumped 35.5%,

According to Paul Ellis from Gitterman Wealth Management, “In 1985, 80% of a company’s stock performance was based on financial metrics; in the modern era, 80% of a company’s stock performance is based on mostly brand identity and customer loyalty” (2017). The only tools that allow to screen for predictability around those issues are Environmental, Social and Governance factors.

In 2017, the CFA institute conducted a survey of more than 1,500 PMs and research analysts in the industry. When asked to rate ESG issues from most impactful to least impactful, board accountability, human capital, and environmental degradation were ranked as top three issues that could have a significant impact on financial markets.

Managing risk and client demand were cited as the reasons respondents take ESG integration into consideration in investment analysis.

While more general ESG funds might aim for merely avoiding companies that they see as bad for society, such as ¬fossil-fuel companies or weapons makers, social impact funds, take it one step further, aiming to invest in companies that actively try to make the world a better place.

According to research from Morgan Stanley’s Institute for Sustainable Investing survey of 1,000 active individual investors, more investors are interested in sustainable investing (75% in 2017 cf. 71% in 2015) with Millennials leading the change ( 86% in 2017).

A significant majority of millennials believe that their own investment decisions can influence climate change (75%) and alleviate poverty (84%). Almost all millennial investors expressed interest in sustainable investments as part of their 401 (k) portfolios.

Further, retail investors still account for a very small share of the ESG investing market, largely due to organizations being sluggish in incorporating this trend in their 401(k)s. Few retirement ¬accounts have a sustainable fund options. This is a significant opportunity for organizations who are looking to attract and retain the best talent available in the market, as an organization with such socially conscious offerings are viewed as responsible employers.

ESG investing as a trend does not stop at the portfolio, company or industry level. For a socially conscious investor, it is more of a lifestyle – with every action and transaction executed in a socially conscious manner. It provides an opportunity for investors to align their personal values and beliefs, with their financial goals.

“Sustainable investing isn’t about changing the world, it’s about understanding how the world is changing” (French, 2017). With this mantra in mind, organizations will need to rethink and re-assess elements of their businesses, procedures and fund offerings that are yet to embrace ESG factors. Large-scale crises on a global scale are more prominent and more frequent in this day and age. With more organizations embracing ESG factors, investors are able to determine which companies are best equipped to face the global challenges of tomorrow.

What's your view?

About the Author

A Certified Public Accountant (CPA) and an Associate Member of CIMA with nearly 11 years of experience in capital markets, asset management and finance. Currently supporting a US-based asset manager in the preparation of RFPs/RFIs for institutional and retail businesses and performing quality reviews for team members. Prior to joining Acuity Knowledge Partners, was a Management Consultant at a chemical manufacturing firm, where she was responsible for assessing product profitability and improving business processes.

Comments

10-Mar-2020 11:16:57 am

Like the way we think?

Next time we post something new, we'll send it to your inbox