Published on February 17, 2025 by Smita Airani

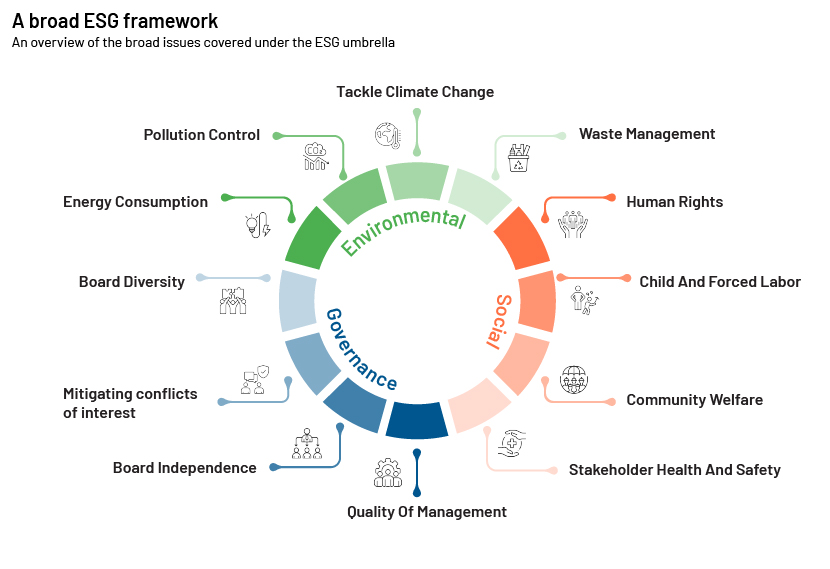

Investment compliance generally relates to financial metrics and risk assessment. Increasing awareness of environmental, social and governance (ESG) considerations has recently shifted the treatment of investment compliance recently. ESG factors have been integrated into investment compliance, considering the importance of their impact on risk assessment, long-term sustainability and ethical issues. Organisations now need to align with a broader array of societal issues, not just focus on financial profit. ESG regulations have evolved significantly, with action moving from recommendations to mandatory compliance.

The Global Reporting Initiative (GRI) and the United Nations Global Compact issued directives to motivate businesses to evaluate their environmental and social impact internally and externally in the ’90s and 2000s. The European Union Emissions Trading System (EU ETS) and other countries' carbon pricing mechanisms had the most significant impact on economic development. In the 2010s, a notable change was introduced in terms of ESG considerations in France, and the UK pioneered regulatory initiatives by rolling out mandatory ESG disclosures for large corporates. The Task Force on Climate-related Financial Disclosures (TCFD) was subsequently set up, focusing on the climate-related risks businesses face.

A number of countries are making ESG reporting – such as on transparency of supply chains and board actions on ESG issues – mandatory. Institutions such as the International Organization of Securities Commissions and the Sustainability Accounting Standards Board have taken further steps to unify ESG reporting frameworks to ensure greater consistency in reporting. With growing awareness of the threat of climate change and inequalities in society, the need to reform the regulatory process has become urgent. Accordingly, sustainability factors are now included in financial regulations, early tax incentives have been granted for green investments and rules governing sensitive businesses have been restructured.

The recent G20 summit also agreed on the importance of joint effort in the areas of environment and climate change and the need to switch to adaptable, accountable and eco-friendly energy systems. The Organisation for Economic Co-operation and Development (OECD), with its expertise in finance and regulation, supports the G20’s environmental agenda.

How ESG rules are regulated

Corporate social responsibility and associated policies are regulated by multiple institutions, such as government authorities, regulators and international bodies. There is no single ESG regulation; rather, all jurisdictions are involved in drafting and enforcing such changes.

Institutions such as the UN and related bodies, including the UN Principles for Responsible Investment (UNPRI) and the UN Global Compact, have contributed to global sustainability and the sustainability of business.

A number of regional and local authorities also influence how ESG policies are implemented. In the EU, for example, the European Commission and the European Securities and Markets Authority (ESMA) have been key players in developing ESG policies. In the US, the Securities and Exchange Commission (SEC) and the Environmental Protection Agency (EPA) have attempted to put ESG issues in the context of corporate reporting and compliance, respectively.

How do compliance platforms help integrate ESG factors?

As organisations seek to incorporate ESG considerations into their operations and decision-making processes, a number of compliance engines and platforms have emerged. These platforms include services designed to cater to the needs of users in terms of ESG compliance and reporting:

-

Sustainability Accounting Standards Board (SASB): The SASB aims to provide a set of standards through which companies can communicate financially-relevant ESG information to investors.

-

Global Reporting Initiative (GRI): The GRI provides a set of standards and guidelines for reporting on an organisation, including its economic, environmental and social performance.

-

CDP (formerly the Carbon Disclosure Project): This is a global system providing climate change-related information that manages and measures the impact of companies, cities, states and regions on the climate.

-

MSCI ESG Research: MSCI provides information to investors on companies and investment portfolios through ESG research and ratings.

-

Sustainalytics: Enhances understanding and addresses risks and opportunities relating to ESG for investors and companies by offering relevant research and ratings.

-

Institutional Shareholder Services (ISS) ESG: This provides a range of services, including ESG research, data and analytics, to help investors and companies integrate ESG factors into their decision-making processes.

The rise of ESG investing has had a profound impact on investment compliance. It has expanded the scope of compliance considerations beyond traditional financial metrics, emphasising environmental, social and governance factors. Investment compliance now requires a comprehensive understanding of ESG issues to ensure that investment decisions are not only financially sound but also aligned with sustainable and responsible principles.

How Acuity Knowledge Partners can help

We help clients integrate ESG frameworks into company procedures and policies. We advise on implementing ESG strategies and prepare ESG reports for regulators through the lens of a fictitious buy-side asset management firm to meet client demand and implement ESG strategies into their investment process. We monitor ESG-related activities and performance for effective reporting by identifying and managing ESG risks to safeguard the organisation's reputation. We also provide guidance and training to foster a culture of ESG awareness.

Sources:

-

https://www.schellman.com/blog/key-benefits-integrating-esg-into-compliance

-

https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf

-

https://www.valueresearchonline.com/stories/49015/the-rise-of-esg-investing/

-

https://sdg.iisd.org/news/g20-recommit-to-sdgs-to-shape-the-world-we-want-for-future-generations/

What's your view?

About the Author

Smita Airani has overall 9+ years of experience in investment compliance. She has previously worked with Northern Trust. Her expertise span across compliance, focusing on compliance review of investment guideline. At Acuity Parents she is part of investment compliance team and specializes guideline coding, Pre-day, and end of day monitoring across the globe. Smita Airani is an MBA postgraduate from Mysore University

Like the way we think?

Next time we post something new, we'll send it to your inbox