Published on November 6, 2023 by Ankita Upreti

The private equity sector is large (10,000+ firms with c.USD7.6tn in assets under management), and it is vital that all the firms and portfolio companies that are part of it collaborate to mitigate the effects of climate change and social challenges and ensure human wellbeing. Private markets are increasingly adopting ESG investing private equity strategies, also referred to as socially responsible investing, impact investing and sustainable investing.

Private equity’s increasing interest in ESG investing

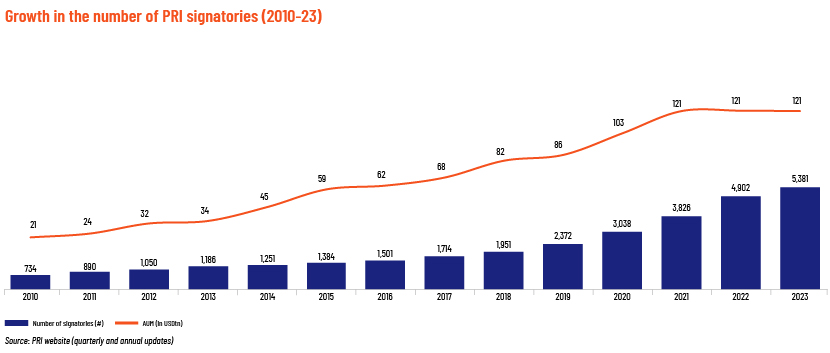

ESG investing private equity strategies have gained significant traction in private markets, as reflected in the increasing number of signatories to the United Nations Principles for Responsible Investment (PRI) – to 5,381 in 1Q 2023 from 734 in 2010, representing c.USD121.3tn of assets under management. The most growth (26-28%) in the number of signatories was reported during 2020-22, driven by the effects of the pandemic.

PRI signatories are committed to ESG investing, as evident in a survey. More than 75% of 633 private equity investors surveyed in 2021 said they assess ESG materiality for individual companies rather than looking only at industry-level factors. Sixty-six percent stated that they view ESG as a tool not just for mitigating risk, but also for value creation.

ESG factors have become key drivers in private equity and venture capital deals, with a target’s good ESG performance increasing its long-term value and sending positive signals to shareholders, while a poor ESG performance could lead to reputational and financial risk for the buyer.

Growth in the number of PRI signatories has been driven by the following key factors:

(1) Increased interest in ESG considerations amid the pandemic: The concept of stakeholder capitalism – that an organisation’s responsibility extends beyond its shareholders to efforts towards helping people and the planet – was growing before the pandemic. The pandemic accelerated its growth, with investors rewarding companies that focused on long-term goals rather than prioritising near-term profit amid the crisis.

While environmental issues have always been the key focus of ESG considerations, the pandemic heightened interest in social and governance issues as well.

ESG-focused funds performed better than the overall market during the pandemic. Investment funds with ESG criteria outperformed (27.3-55% growth) the broader S&P market, which grew at 27.1%, from March 2020 to March 2021. ESG inflow in the US reached USD51.1bn in 2020, double the level in 2019.

“We expect increased investor focus on ESG considerations after COVID-19, with particular demand for greater corporate transparency and stakeholder accountability” – UBS

(2) More investors are keen to incorporate ESG factors in their investment decisions to mitigate risks and contribute to a sustainable society. According to a survey by Bain & Co.,

-

93% of limited partners (LPs) may disregard an investment opportunity if it posed an ESG concern

-

50% of LPs believe better investment performance is a key reason to incorporate ESG considerations in their investment decisions

This shift to ESG investing may be attributable to factors such as the better performance of ESG funds and the changing perception of ESG, from “the right thing to do” to an opportunity for value creation. The shift indicates that esg investing private equity approaches are now being acknowledged by firms as a lever of transformation.

(3) Favourable government regulations in key private equity markets driving growth in ESG investing: Regulatory changes have been a major catalyst in shifting ESG considerations from being voluntary to mandatory in many instances, primarily for private equity firms with investments in Europe. The finalisation of the climate disclosure rules proposed by the SEC in March 2022 may have a significant impact.

-

Europe: Regulations such as the EU’s 2021 Sustainable Finance Disclosure Regulation (SFDR) relating to the categorisation of sustainable funds have specific requirements for firms marketing investment products as sustainable, resulting in increased demand for diligence and data on ESG. In 2022, the European Securities and Markets Authority proposed that funds with impact-related words must provide data on how they generate a measurable social/environmental impact. In addition, to be categorised as an impact-related fund, c.80% of investments must meet impact investment objectives in line with the fund’s investment strategy.

-

US: The biggest development in the US affecting the private equity market is the passage of the 2021 Inflation Reduction Act. According to the act, incentives will be offered for renewable energy (e.g., wind, solar, carbon capture and hydrogen) projects; this has led to increased investor interest in the renewables space. In 2022, the SEC mandated that any fund with an impact-related word in its name allocate c.80% of its investments to meet impact investment objectives in line with its investment strategy. The need for detailed ESG disclosure in fund prospectuses, annual reports and brochures may impact the compliance policies, procedures and marketing strategies of private equity players.

Conclusion

ESG investing has seen increased interest in recent years as more investors prioritise the impact of their investments. ESG has become a differentiator and resulted in value creation for private equity funds. ESG-focused funds have reported positive financial returns from their investments, including higher sales, lower costs, more employee engagement and higher valuations. The increased interest in ESG investing has also been driven by growing focus on social factors amid the pandemic, more interest from limited partners and favourable regulation. The private equity sector is large and, therefore, can play a crucial role in mitigating the effects of climate change and social challenges.

How Acuity Knowledge Partners can help

We provide customised ESG research solutions for private equity clients, covering sector- and country-specific ESG risks and opportunities. We support client teams in ESG research and advisory through a top-down, bottom-up or combined approach. Our ESG research solutions include building databases at the company and country level, developing frameworks, modelling, analysis, writing reports and preparing presentations. We support asset managers, investment banks, commercial and regional banks, venture capital firms, think thanks and specialist advisory firms.Private equity outsourcing

Sources:

-

https://www.bain.com/industry-expertise/private-equity/esg-in-private-equity/

-

https://www.unpri.org/signatories/signatory-resources/quarterly-signatory-update

-

https://www.ivp.in/resources/blogs/the-changing-role-of-esg-in-private-equity/

Tags:

What's your view?

About the Author

Ankita Upreti is part of the Private Equity & Consulting team at Acuity Knowledge Partners. She has 9+ years of experience in research, and currently supports private equity clients with research assignments including industry research, company analysis, thematic reports, economic updates and data research. She holds a bachelor’s degree in technology

Like the way we think?

Next time we post something new, we'll send it to your inbox