Published on August 7, 2024 by Saravanan Subramanian

Introduction

In the dynamic realm of finance, where every choice holds important outcomes, collateral management plays a crucial role in guaranteeing the security and effectiveness of financial transactions. Managing collateral has become more complicated and difficult for financial institutions and organisations.

There is demand for financial-market participants to integrate environmental, social and governance (ESG) metrics in all areas of their business operations. ESG is a top concern globally, reflected in events such as the 26th United Nations Climate Change Conference (COP26) and the United Nations’ Sustainable Development Goals (SDGs), with ESG programmes also influencing local national, banking and corporate policies. Where companies are concerned, clients, shareholders, investors and employees all look for a structured strategy for handling ESG considerations.

Understanding collateral management and ESG

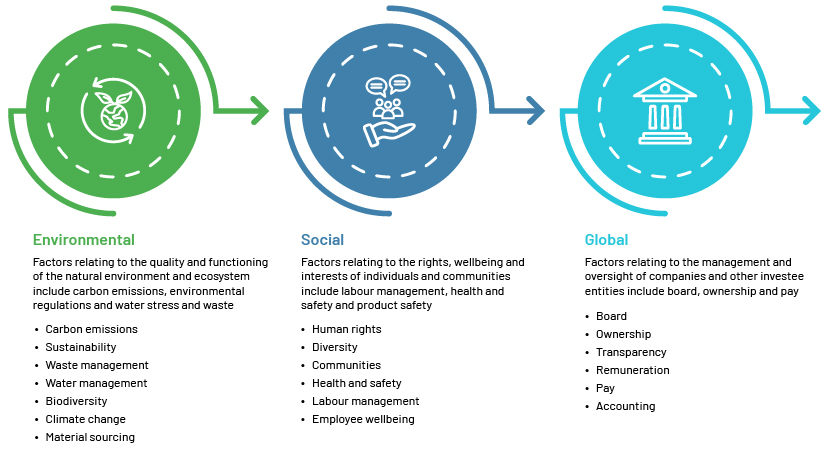

Collateral management involves the administration of collateral to mitigate credit risk in financial transactions. Traditionally, this has focused on maximising liquidity, minimising counterparty risk and ensuring regulatory compliance. However, the increase in ESG-related criteria has added a new dimension to these practices, demanding that collateral be not only financially sound but also aligned with broader sustainability goals. ESG provides a structure for evaluating companies and truly understanding how they measure up to industry counterparts in terms of performance on these criteria.

-

Environmental considerations include assessing water usage, waste production and overall environmental practices to evaluate how efficiently companies manage their resources and care for the environment

-

Social considerations refer to how companies interact with their customers, how they treat their employees and include diversity in management and workforce

-

Governance metrics focus on the share-class structure and the company’s governance structure and overall performance

ESG impact on collateral management

The integration of ESG factors in collateral management is becoming increasingly significant as investors and regulators emphasise sustainable practices. ESG considerations impact the valuation, selection and acceptance of collateral, promoting assets that meet sustainability criteria. This shift enhances management by prioritising environmentally friendly and socially responsible investments, thus potentially reducing exposure to long-term systemic risks. Additionally, incorporating ESG factors can improve transparency and foster trust among stakeholders. As demand for sustainable finance grows, ESG-focused collateral management practices are becoming essential for aligning financial activities with broader sustainability goals.

We explore below how ESG factors influence collateral-management procedures.

1. ESG and the financial services value chain:

-

ESG criteria impact a number of subsectors of the financial services sector – from deciding which assets investors hold in their portfolios to how those portfolios are funded

-

Downstream collateral-management processes are essential for assisting in securities lending, collateral pledging and asset servicing

2. Securities lending and ESG factors:

-

Investors seeking to match their portfolios with ESG objectives trigger adjustments in collateral-management procedures

-

Recall procedures for returning borrowed securities have been strengthened to align with investors' ESG preferences

-

Proxy voting, short covering and collateral utilisation now take ESG criteria into account

3. Emerging market for ESG financing:

-

ESG investing has gained momentum, resulting in a market for ESG financing

-

In this market, green bond baskets can be financed on favourable terms through a practice known as "green repo"

-

An example of this is when Deutsche Bank arranged a USD300m transaction with Akbank of Turkey, where the repo interest rate was determined by factors such as gender diversity, electricity procurement and avoidance of financing for new coal power plant projects

4. Implications for policy:

-

ESG considerations now impact treasury and collateral-management policies

-

These guidelines dictate the lending of securities to counterparties for short covering, proxy voting and collateral usage to meet margin requirements across products and business sectors

Note: The examples of E, S and G factors listed below are illustrative and limited.

Challenges in integrating ESG into the collateral-management process

Central banks must make sure that their ESG strategy aligns with their management framework and the traditional purposes of investment, which include safety, liquidity and returns. Institutionalising the practice of incorporating ESG considerations in investment policy is the most effectively achieved goal, but several challenges remain, as listed below.

1. Data availability and quality:

-

Reliable ESG information is crucial for making well-informed decisions. Yet, acquiring precise and thorough ESG information can present difficulties.

-

The quality of data differs between companies, sectors and regions. Inadequate reporting standards and a lack of transparency can impede the evaluation of ESG-related risks and opportunities.

2. Complexity and materiality:

-

ESG factors are complex and interrelated. Collateral managers need to consider different aspects such as carbon emissions, labour practices, diversity and board governance.

-

Deciding on the importance of certain ESG concerns for a particular collateral pool can be challenging. The importance could vary, depending on the type of asset, sector and investor preferences.

3. Risk assessment and pricing:

-

Incorporating ESG into risk assessment models involves adjusting current frameworks. Collateral managers must evaluate the effect of ESG risks on the value of collateral.

-

It can be difficult to accurately price ESG-related risks. Conventional models might not completely consider these factors, resulting in possible misevaluation.

4. Liquidity and collateral eligibility:

-

ESG assets may exhibit varying liquidity characteristics. Collateral managers would need to balance liquidity requirements with ESG factors.

-

Certain ESG assets, such as green bonds, may not meet the necessary criteria for use as collateral. Rules relating to eligibility would need to be adjusted to include ESG instruments.

5. Legal and regulatory frameworks:

-

Collateral-management procedures function within the constraints of laws and regulations. Incorporating ESG considerations would require conforming to changing regulations.

-

Legal hurdles involve meeting ESG disclosure rules and fiduciary responsibilities relating to ESG.

6. Behavioural and cultural shifts:

-

Collateral managers, counterparties and investors must incorporate ESG into their decision-making culture.

-

Behavioural biases such as a focus on short-term outcomes could clash with long-term ESG objectives. Education and awareness are needed to overcome these biases.

7. Reporting and transparency:

-

There is growing demand for ESG reporting. Collateral managers need to present clear details on ESG-related risks and measures implemented.

-

Transparency fosters investor trust but requires strong reporting systems and procedures.

8. Collateral optimisation and ESG constraints:

-

Collateral optimisation seeks to reduce funding expenses while adhering to regulatory standards. ESG limitations bring added complexity.

-

It could be difficult to balance ESG preferences with optimisation goals, such as minimising haircuts.

As ESG considerations become increasingly central to financial decision-making, the future of collateral management will likely see a continued shift towards sustainability. Institutions that proactively adapt to these changes would not only mitigate risks but also position themselves as leaders in the emerging sustainable finance landscape.

Moreover, investor demand for transparency and responsible investment is expected to grow, further driving the integration of ESG principles. Financial institutions must remain agile, continuing to evolve their practices to align with the latest ESG standards and stakeholder expectations.

Incorporating ESG into collateral-management procedures requires addressing data obstacles, adjusting risk models, handling legal issues and promoting cultural changes. Creating a sustainable and responsible collateral-management framework requires cooperation between all parties involved.

Conclusion

Integrating ESG considerations into collateral management is essential for addressing financial and sustainability challenges. As the financial landscape evolves, such integration ensures that asset selection not only meets financial standards but also contributes to broader societal goals. This alignment mitigates long-term risks associated with climate change and social inequalities, fostering a more resilient financial system. By prioritising ESG-compliant assets, institutions can enhance transparency, build stakeholder trust and support sustainable economic growth. Although the transition poses challenges, such as the need for robust ESG data and regulatory frameworks, it ultimately positions the financial sector to lead in promoting sustainability and addressing global ESG challenges effectively.

How Acuity Knowledge Partners can help

We lead the financial services outsourcing sector and offer a variety of services to clients, including analytics and detailed research on ESG indicators, policies and structured frameworks.

With a steadfast commitment to sustainability and responsible investing, we offer tailored solutions to help clients navigate the complexities of sustainable finance.

We provide comprehensive ESG support services, including research, data analysis and reporting, to help clients integrate ESG considerations into their investment decision-making processes and enhance transparency and disclosure on ESG-related issues. Through collaborative partnerships and innovative solutions, we empower financial institutions and corporate clients to drive positive environmental and social impact while achieving their sustainability objectives and creating long-term value for stakeholders.

References:

-

Global-PSSL-draft-standard-on-collateral-published-on-29-July-1.pdf (gpssl.org)

-

Clients Embed ESG Principles into Collateral Management Leveraging BNY Mellon ESG Data Analytics

Tags:

What's your view?

About the Author

Saravanan Subramanian is a part of commercial lending with more than 8 years of experience in the US Residential Mortgage & Commercial Lending domains. His expertise spans preunderwriting and servicing activities of mortgage loans and has been part of various migration projects. His attention to detail and thorough understanding of mortgage domain ensures smooth transactions and successful outcomes in process transition and functioning. Currently supporting to a leading US bank in its loan operations and onboarding processes. Prior to this, Saravanan had supported on loan processing and data transition between different platforms. Saravanan holds bachelor’s degree in electronics engineering from Kamaraj College of Engineering & Technology.

Like the way we think?

Next time we post something new, we'll send it to your inbox