Published on July 19, 2022 by Prakhar Agarwal

Thousands of organisations around the world are looking to measure the environmental, social and governance (ESG) impact of their business but have been unable to do so for a number of reasons. Some find it difficult to find a starting point while others are delaying the process because integrating ESG considerations could require overhauling the entire business operation that may have been functioning successfully for a considerable period of time. Many consider it a costly affair, while some find it difficult to identify the key performance indicators (KPIs) they need to track. Even if they are successful in tracking the indicators the first time, continuing to do so is often considered to be a strenuous exercise that requires dedicated resources and co-ordination with multiple teams to track real-time data and meet reporting requirements.

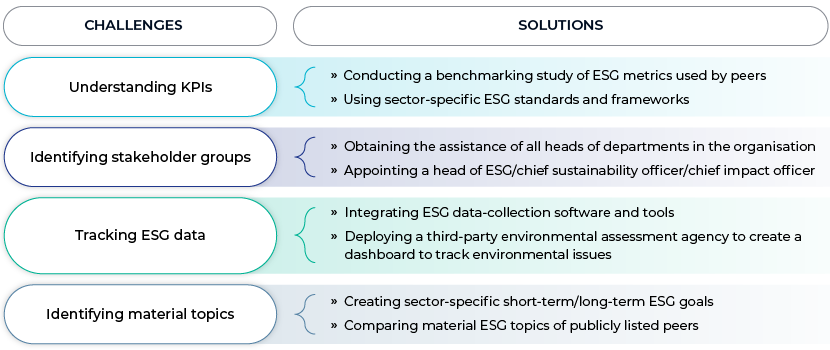

ESG challenges and solutions – a snapshot

The following are some of the most common challenges organisations face in ESG reporting, and possible solutions:

Understanding and identifying KPIs are two of the most difficult tasks for organisations considering ESG integration and reporting

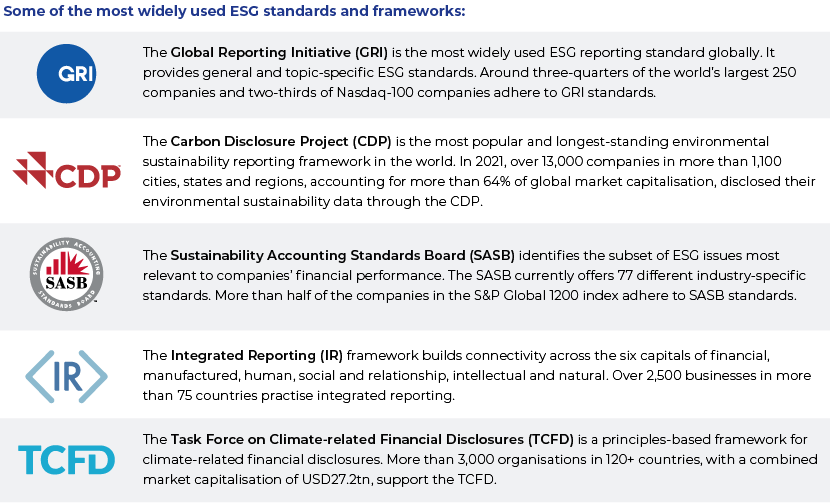

It is common for organisations to juggle multiple standards and frameworks when looking for an ideal materiality matrix to help them finalise their list of KPIs. Unfortunately, this is not the right way to go about it.

The first step in understanding and identifying ESG KPIs is to conduct a benchmarking study of publicly listed companies in the sector. Most KPIs can be easily extracted from this study. It is also advisable to not delve too deeply into complicated matrices of standards and frameworks in an effort to meet all KPI requirements in the first year itself. A materiality map in line with the Sustainability Accounting Standards Board’s specifications could be developed or the most relevant material topics according to the Global Reporting Initiative could be chosen to begin the ESG reporting journey.

To make things even simpler, the United Nations Sustainable Development Goals (SDGs) could be allocated to an organisation’s ESG issues to create an easy-to-use KPI list. The following is an example of how SDGs can be assigned to ESG parameters:

Identifying relevant stakeholders is important for ESG integration and reporting

The heads of departments are responsible for implementing ESG considerations in their departments; they should dedicate resources for collecting data pertaining to KPIs relevant to their departments.

ESG reporting is not a futile exercise: it can significantly improve an organisation’s performance and productivity. It is also a very strong marketing tool that helps build positive branding for an organisation. Hence, stakeholders involved in implementing ESG practices should be authoritative decision makers. The most compliant ESG organisations have appointed heads of ESG/chief sustainability officers/chief impact officers who report to the CEO/board to streamline the implementation of ESG practices in every department. Many organisations aspiring to be ESG-compliant are creating vacancies for such positions.

Tracking and collecting ESG data are challenging

The large list of KPIs requiring data collection could prove to be a challenge. While most data, especially data pertaining to social and governance issues, can be sourced internally, collecting data on environmental issues seems to be difficult, particularly for large organisations. Moreover, the authenticity of data needs to be checked and updated in real time to build a strong database of ESG KPIs.

Data collection is a complicated exercise but using third-party software tools that align all business units with the common objective of collecting important data on an organised technology platform could be helpful. A specialised environmental assessment organisation could be deployed to measure and manage a company’s environmental issues relating to water, waste, energy and emissions. It also entails creating dashboards to track environmental issues in real time and taking remedial action without delay.

Organisations often find it difficult to identify key material topics among the ESG KPIs tracked

While quantitative KPIs can be tracked easily, qualitative KPIs are often neglected. Hence, the focus largely remains on business-specific regulatory requirements when it comes to material topics. However, an ideal ESG-compliant organisation must not restrict itself to just addressing regulatory requirements, especially those relating to environmental and governance issues, but should also look to address broader ESG concerns.

Besides meeting regulatory requirements, an organisation must find sector-specific material topics and set short-term and long-term targets to address those. These include environmental concerns such as emissions, waste, energy consumption and water usage; social concerns such as gender equality, diversity and inclusion, uplifting the local community, educational and training needs of underserved population; and governance concerns such as creating value for all stakeholder groups. An ideal way to set targets is by comparing the organisation’s material topics against those of public companies in the same sector.

Conclusion

Although the process may appear to be lengthy and costly , it is recommended that organisations incorporate procedures aligned with ESG from inception.

-

Starting an organisation’s ESG journey is like starting an individual investment journey. The earlier you start integrating ESG into your business operations, the better the chances of building a more sustainable organization.

-

The biggest advantage of starting early and making ESG a fundamental policy across departments is that the organisation would not have to overhaul its processes or endeavour to get all stakeholders on board.

-

In such a scenario, the abovementioned challenges are addressed at a very early stage and the relevant team managers are aware of their respective department’s ESG KPIs and data-collection requirements.

-

Hence, it is advisable for early-stage companies and startups to consider integrating ESG at the policy development stage, so as to avoid having to implement them only to meet investor and regulatory requirements. Mature organisations may need to hire professional consulting firms to help align their business objectives with ESG parameters.

How Acuity Knowledge Partners can help

The ESG Research team of our Private Equity and Consulting vertical offers the most comprehensive ESG report-building support to organisations looking to publish ESG/sustainability reports. Our researchers and subject-matter experts are well versed in globally accepted standards and frameworks that form the backbone of any ESG report. We provide customised ESG research and reporting solutions to organisations looking to begin their sustainability journey.

References:

https://corpgov.law.harvard.edu/2020/09/21/esg-disclosures-frameworks-and-standards

Tags:

What's your view?

About the Author

He is a key member of Acuity's Corporate and Consulting vertical and is responsible for client and project oversight for ESG research and consulting.

He holds experience in executing and managing projects around ESG and social impact across sectors involving business research, corporate strategy, market & competitive intelligence, target screening, operating & financial benchmarking, ESG KPIs identification, goal setting, etc.

Prior to Acuity, he worked with a social enterprise working on impact leadership and content development around ESG, Sustainability and Impact. He has been part of multiple on social impact projects with a leading startup in healthcare sector. He also has over half a decade of experience working..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox