Published on February 28, 2024 by Monika Singh

The concept of screening, although having been around for decades, has gained momentum in the sustainability-related business market. It was used by faith-based investors in the ’70s and ’80s to exclude sectors or investments that they considered “sinful”. Screening has now shifted gears; it is being used not only by faith-based investors, but also to create a social and environmental impact. The increasing significance of ESG screening in determining the alignment of an organisation’s values with ESG principles has boosted returns and enabled long-term success.

A 2022 study by asset management firm Capital Group showed that 89% of the investors surveyed take ESG issues into account before deciding where to invest[1]. ESG screening offers a standard by which investors can make informed decisions and identify investments that support their social responsibility. There are two broad categories of ESG screening – positive screening and negative screening – that can mitigate ESG-related risks, eliminating potential financial losses and reputational damage.

In the pursuit of sustainable and ethical business practices, positive and negative ESG screening are significant tools for investors, as they support responsible investing. ESG frameworks and regulatory requirements such as the nited Nations’ Principles for Responsible Investment, United Nations Global Compact and International Finance Corporation provide guidelines and standards for ESG screening and reporting. These frameworks and regulations vary by scope, applicability and region, but they collectively contribute to standardising and integrating ESG considerations into investment and reporting practices.

Types of ESG screening

Financial institutions, investors and businesses need to be aware of these standards, frameworks and requirements if they are to navigate the changing landscape of ESG screening and reporting. ESG investing has grown considerably in the past decade. Morningstar data shows that US sustainable funds’ assets under management (AuM) more than tripled from 2012 to 2021[2]. Sustainable funds are defined as funds that use ESG criteria in evaluating investments and their impact on society.

Figure 2: Morningstar data: AuM of sustainable funds

Source: www.morningstar.com/funds/sustainable-funds-landscape-highlights-observations

The introduction of regulations such as the European Union's Sustainable Finance Disclosures Regulations and Non-Financial Reporting Directive, and the US Securities and Exchange Commission's proposed ESG reporting rules underscores the increasing importance of ESG screening in the financial sector. Investor demand for ESG-related products and services is increasing. A number of companies have committed to sustainability and ESG goals, reflecting the importance of positive screening.

The ESG screening process

Investors and fund managers use positive and negative screening strategies to identify and select investments that align with ESG criteria. An ESG scoring system is also used to assess the performance of investments. Alignment with ESG practices gives a company a competitive edge and increases customer loyalty, as it is viewed as a lower-risk investment and, consequently, entails a lower cost of capital. There is also increased awareness of responsible investing and sustainable business practices, making such companies more attractive to investors.

Positive screening statistics could include the average ESG score of selected investments in a portfolio. Investors also consider sector allocation and historical performance in positive screening, selecting investments from sectors considered to be ESG-friendly or tracking the historical performance of ESG-compliant investments versus non-compliant ones.

Negative screening often involves excluding companies involved in activities such as fossil fuel extraction, tobacco production or weapons manufacturing. It also involves considering the proportion of investments that do not meet specific ESG criteria. Negative screening also impacts the composition of a portfolio. Investors may track how negative screening has affected a portfolio’s risk profile. Negative screening also involves considering the number of a company’s ESG-related controversies or scandals and avoiding investment in such a company.

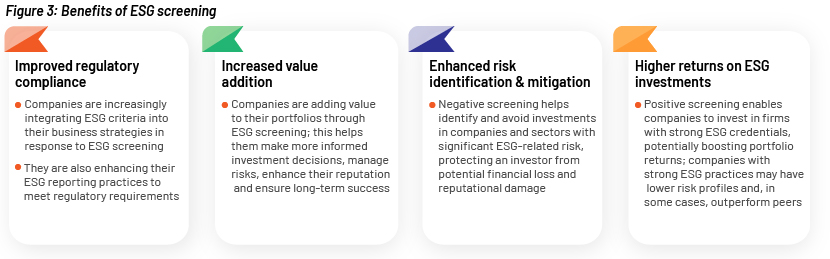

Benefits of ESG screening

Positive and negative ESG screening have had a positive impact on the environment and society and delivered the required financial return. From mitigating risk to maintaining long-term brand value, ESG screening is proving to be a valuable tool for responsible and sustainable investing. The following are some key benefits of ESG screening:

Studies suggest a solid connection between strong ESG performance and financial outperformance. For example, a 2020 study by MSCI found that companies with higher ESG ratings tended to have lower risk and higher returns[3]. Meeting ESG-related regulatory requirements through positive and negative screening ensures that companies remain compliant with evolving ESG disclosure and reporting mandates, reducing legal and regulatory risks.

How Acuity Knowledge Partners can help

We support private-markets clients across asset classes including private equity, private credit/debt, secondaries and buyout firms with investment screening. We conduct positive and negative screening for target screening, LP/GP reporting, regulatory reporting and compliance with the SFDR and EU Taxonomy. We also provide ESG support services across the investment lifecycle, with customised support for pre-deal and post-deal operations.

Sources

Tags:

What's your view?

About the Author

Monika has been working at Acuity Knowledge Partners as an Associate for 2.5 years within PM, and primarily involved in various ESG assignments, comprehensive SFDR reporting with in-depth research and analysis, sustainability report building, data extraction testing, and supports other ad-hoc ESG related tasks.

Like the way we think?

Next time we post something new, we'll send it to your inbox