Published on September 27, 2024 by Anshul Sehgal

Key takeaways

-

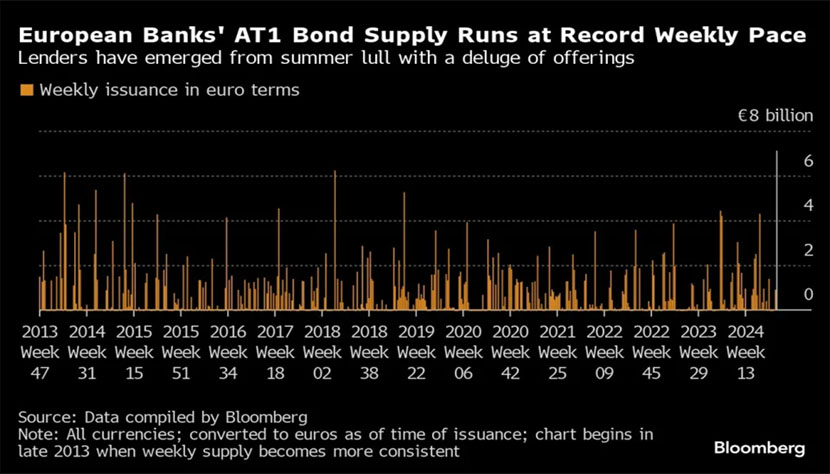

Soaring investor demand for yield and duration drove unprecedented supply of Additional Tier 1 bonds (AT1s) in the first few days of September

-

Markets remain open to lower-rung issuers with negligible new-issue premiums on offer

-

We expect a slowdown in issuance for the rest of the year. The key driver of medium-term AT1 issuance would be the upcoming regulatory changes

We consider the Australian Prudential Regulation Authority’s (PRA’s) proposal to scrap AT1s as a non-event for European banks

It’s raining AT1s!

The recent wave of banks’ issuance, following the usual summer lull in August, is sure to have caught market participants by surprise. The first few days of September have historically been modest in terms of issuance as investors and syndicates ease into their desks following the summer break. However, this year has been a stark exception, as we have witnessed an unprecedented supply onslaught.

Soaring investor demand for yield and duration following near-certain Fed rate cut guidance sparked a flurry of bank debt issuance. While there has been issuance across the bank debt stack, investors’ hunger for yield is most evident in the AT1 space.

The issuance uptick could also have been influenced by the issuers aiming to avoid the uncertainty around the US elections in November. Heightened market volatility in August (following Japan’s interest rate hike) also led to unfulfilled funding needs following 2Q results.

ABN Amro opened the floodgates, and we witnessed record cumulative AT1 deals of c.USD12bn by European banks in the first 10 days of September. YTD issuance stands at about USD40bn. The market has welcomed not only the national champions such as BNP and ING, but also higher-beta issuers such as Alpha Bank. Additionally, UniCredit, which had been notably absent from the AT1 space since 2021, also made its presence felt.

Nearly all issuances have boasted strong oversubscription levels (5-10x), leading to substantial tightening from initial price thoughts and pricing at close to fair value with negligible new-issue premiums. This demand has driven AT1 yields to their lowest point in the past two years.

Banks have been quick to tap into the conducive market sentiment. Banks such as ABN Amro, HSBC, BNP and ING have locked in capital by opting for Perpetual Non-call 10-year bonds over the typical Perpetual Non-call 5-year ones, taking advantage of investor demand for duration.

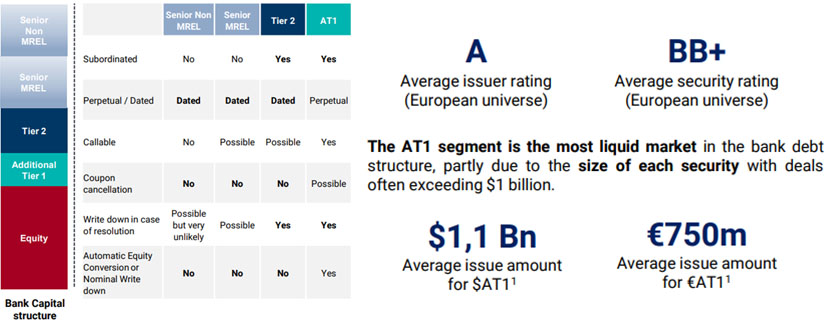

AT1s – the most subordinated bank debt instrument

Introduced after the global financial crisis, Additional Tier 1s, or CoCos, are the riskiest and most subordinated layer of banking debt stack, ranking just above equity. AT1s were designed to be bailed in during insolvency to avoid taxpayer bailouts. AT1s are perpetual in nature and can be converted into equity or written down contingent on a breach of capital-level threshold. The AT1 market now stands close to USD250bn.

Source: Lazard Asset Management

AT1s are here to stay. Are they really?

This AT1 supply bonanza comes merely 18 months after the Credit Suisse AT1 wipeout when concerns were raised about the future of AT1s. Ironically, the doubts were laid to rest by UBS (which acquired Credit Suisse), attracting strong demand for its AT1 issuances in November 2023.

Given the strong levels of issuance YTD, we expect a slowdown in supply for the rest of the year. The blackout period before 3Q results and the US election in November would lead to a supply lull. Most banks have already issued to refinance upcoming AT1 calls, and further issuances are likely to be opportunistic.

The key driver of medium-term AT1 issuance would be the upcoming regulatory changes. AT1s have not really been effective in crisis situations (and thus, unfit for the purpose of their introduction). They do not serve as going-concern capital but more like gone-concern capital. This has led to calls for changes to the instruments’ structure.

European banks have significantly strengthened their capitalisation, with CET1 ratios in the mid-teens on average. As such, the point of non-viability would be much higher than the AT1 triggers. It is highly unlikely that a bank would be allowed to operate under duress until its CET1 ratio falls to the 5.125%/7% trigger levels embedded for AT1 conversion. Furthermore, most bank failures are driven by liquidity woes and not by capital concerns.

Australia to phase out AT1s

-

The Australian PRA has taken the lead and announced a proposal to scrap AT1s from 2027

-

The complexity and potential for legal challenges were highlighted

-

The high share of AT1 holdings by retail investors and tax considerations surrounding international issuance were also material

-

The PRA stated that replacing AT1s with more reliable securities will simplify and improve the effectiveness of bank capital in a crisis

-

AT1s are to be phased out by 2032, with a grandfathering of existing AT1s until first call dates

While the Australian proposal was influenced by the large number of domestic retail investors holding AT1s, European bank AT1s are held only by institutional investors. Nevertheless, challenges remain for AT1s to function as efficient loss-absorbing instruments, as highlighted above.

We expect structural changes to European bank AT1s over the medium term, with a primary focus on conversion trigger levels and coupon cancellations. However, we foresee a limited probability of an AT1 phase-out by EU regulators. The discontinuation of AT1s would require increased equity levels and would face extensive backlash from the sector.

Nevertheless, any changes to the structure of AT1s would be gradual and include grandfathering provisions for the existing AT1s. This would imply a near-certain likelihood of next-call-date redemptions. Thus, we expect limited risk to current European bank AT1 investors and expect AT1s to remain highly liquid and rewarding assets.

How Acuity Knowledge Partners can help

We have been supporting asset managers invested in the global financial space. Our expertise ranges from buy-side investing support to sell-side research publishing. We combine qualitative and quantitative fundamental credit research with technological solutions that not only improve our speed to market, but also provide actionable insights. We are supported by access to highly experienced in-house subject-matter experts

Sources:

-

Bloomberg, GlobalCapital, Yahoo!Finance, TwentyFourAM

What's your view?

About the Author

Anshul Sehgal has around nine years of experience in credit research, with a primary focus on the European banking sector. Currently, he works as the financial sector credit analyst for a UK-based credit hedge fund, providing trade recommendations across the capital stack for global banks through a mix of bottoms-up fundamental research and relative valuation. Prior to this, he was the desk analyst of a global investment bank’s top-ranked European banks team covering regulations, issuance, ratings and bank debt trade opportunities. Anshul holds an MBA from IIM Raipur and a Bachelor of Technology (Computer Science and Engineering) from Maharaja Surajmal Institute of Technology, New Delhi.

Like the way we think?

Next time we post something new, we'll send it to your inbox