Published on April 28, 2023 by Abhisek Sasmal

Old habits die hard

In every financial crisis, when market crashes, it brings down everything along with it. During the 2008 global financial crisis (GFC), better-capitalised investment banks underwent corrections, similar to the distressed ones. Even during 2012 sovereign bond crisis, banks with lesser distressed sovereign debt profile were materially impacted. However, in both cases, institutions with stronger fundamentals bounced back early and outperformed the broader market.

In this blog, we take a look at the European banking sector in the light of the recent events, such as the failure of Silicon Valley Bank (SVB) and the acquisition of the troubled Credit Suisse (CS) by UBS. We believe the recent panic sell-off has created a highly unique investment opportunity for some sector heavyweights, as most European banks are currently in a much better regulatory health versus their US peers.

The trigger

The panic sell-off was set in motion by high deposit outflows at SVB amid a downturn in the start-up industry. Also, there was a major drawdown on its USD80bn Mortgage Backed Securities (MBS) portfolio amid rising interest rates. But SVB was a company specific case and had suffered due to 1) higher deposit concentration, 2) low liquidity and 3) larger maturity mismatches. Even with CS, the problems were mostly legacy issues and the rapid loss of confidence. It was impacted by 1) the collapse of Greensill Capital & Archegos Capital Management, 2) failure of due diligence regarding money laundering and client data privacy breach and 3) failure to design effective risk assessment systems and under-reporting of risk.

Despite all the rounds of panic selling across the markets and rumours about the financial health of some systematically important banks (SIBs), two questions have yet to be answered:

a) Will the negative effect trickle down to other EU banks?

b) Are EU banks fundamentally sound than before?

To answer the first question, we believe despite the absurd treatment of the CHF16bn AT1 debt by Swiss authorities, this event should not be allowed to create a widespread credit crunch and recession in the Eurozone. Eurozone authorities have already reassured credit investors through a press release (click) that 1) additional Tier1 (AT1) will remain a fundamental part of European banks’ capital position and 2) the bail-in rule book will be followed in EU banks’ resolutions. ‘In particular, common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier 1 be required to be written down. This approach has been consistently applied in past cases and will continue to guide the actions of the Single Resolution Board (SRB) and European Central Bank (ECB) banking supervision in crisis interventions’, it said.

ECB President, Christine Lagarde, told European lawmakers in March that the exposure of Eurozone banks to Credit Suisse was in millions rather than billions. So, the issue is with one particular long-suffering bank, which investors and other financial institutions are well aware of. The shock element inherent in a bank’s failure is absent here, and the only concern is the behaviour of credit funding markets following Swiss authorities’ peculiar treatment of AT1 bonds. However, this issue has already been addressed by the ECB and other central bank authorities. Moreover, European banks have hardly any exposure to SVB’s assets and the contagion connection is missing.

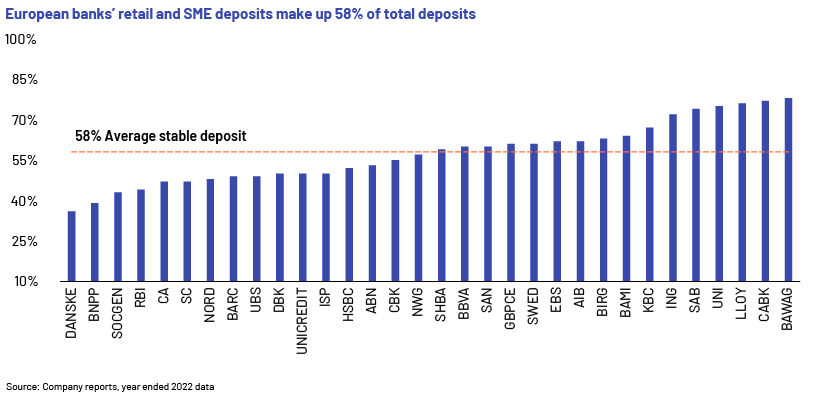

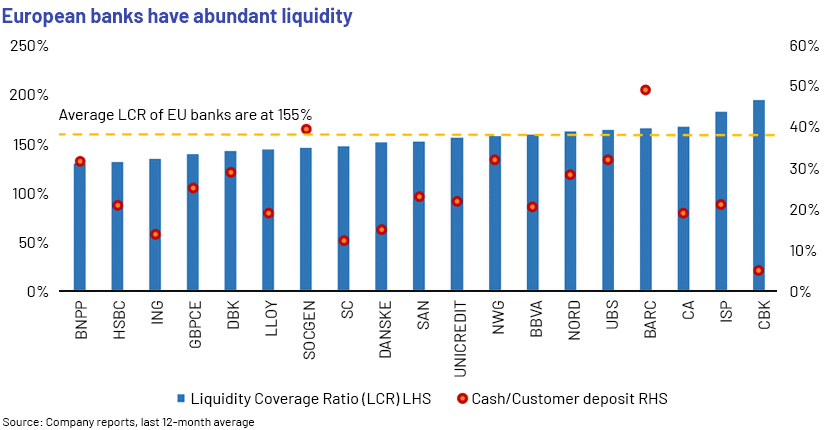

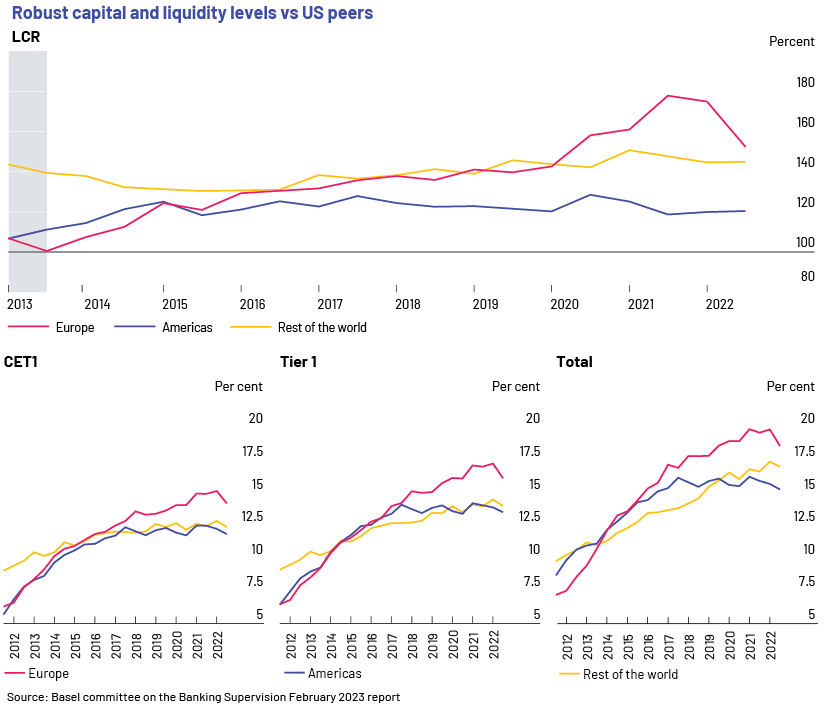

To answer the second question, we must say that European banks are in a much stronger capital and liquidity position, compared to the 2008 and 2012 crises. They have a stable deposit base (chart 1), abundant liquidity (chart 2) and robust capital levels (see chart 3).

To conclude, in our view, EU banks have suffered owing to issues at other banks. Over the last decade, EU regulators have tightened quite a few loose ends in financial markets, making EU banks more immune to sudden shocks. That said, AT1 market and intermarket credit movements need to be closely monitored but that does not warrant a sector-wide sell-off (SX7P lost all of its YTD gains). If we are right about Europeans banks’ liquidity and capital health, these corrections should be considered as intermittent roadblocks in a long journey towards the Eurozone’s economic and financial recoveries.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our experience and expertise to rapidly increase internal analyst bandwidth and expand coverage of equities and credit. We set up dedicated teams of analysts (CAs, MBAs and CFAs) to support our clients on a wide range of activities, including idea generation, financial modelling, financial analysis, thematic research, database creation and sector coverage. Each output is customised based on a client’s requirement and made available for the client’s exclusive use. This ensures our clients enjoy a unique, sustainable edge.

Sources

https://www.bankingsupervision.europa.eu/press/pr/date/2023/html/ssm.pr230320~9f0ae34dc5.en.html

https://www.bis.org/bcbs/publ/d546.pdf

Tags:

What's your view?

About the Author

Abhisek Sasmal has over 15 years of work experience in equity and macro research, financial and credit risk modelling. Currently he is supporting a European buy side client mainly on the diversified financial sector. He has been with Acuity for last 14 years supporting Global Fund Managers and sell side analysts in their research on Global BFSI. He is an MBA in finance and CFA charter holder. Before joining Acuity Knowledge Partners, he used to work with some leading domestic sell side firms in India on diversified sectors.

Like the way we think?

Next time we post something new, we'll send it to your inbox