Published on July 31, 2024 by Harini Balasubramanian

Introduction

Following the conclusion of a nine-month anti-subsidy investigation, the European Commission (EC) announced on 12 June 2024 that extra duties up to 38% would be imposed on electric cars imported from China from 5 July 2024 for a maximum of four months. This tariff is in addition to the standard 10% car duty. Within four months, a final decision should be made on definitive duties on the basis of votes from the European member states. Once a decision is adopted, the duties would be final and applicable for five years.

Different rates for different original equipment manufacturers

Additional tariffs range from 17.4% to 37.6% on fully electric cars imported from China. The tariffs are applied erratically on Chinese brands that export electric cars to Europe. Shanghai Automotive Industry Corporation (SAIC) – a joint venture of Volkswagen (VW) and General Motors – will pay the highest tariff of 37.6%, whereas BYD, Geely Automotive and other brands face increased tariffs of no more than 20%.

Chinese carmakers likely to be more impacted by new EU tariffs

While SAIC will pay the highest tariff of 37.6%, Geely and BYD will pay additional duties of 19.9% and 17.4%, respectively.

Some European original equipment manufacturers (OEMs) with operations in China or joint ventures are also expected to pay enhanced taxes to bring their EVs to Europe.

In its investigation, the EC categorised OEMs into two categories: cooperative and non-cooperative. Those considered cooperative will face an additional duty of up to 20.8%, while those considered non-cooperative are expected to pay the higher tariff of 37.6%.

According to Dutch bank ING, BYD has the lowest EU tariff (17.4%).

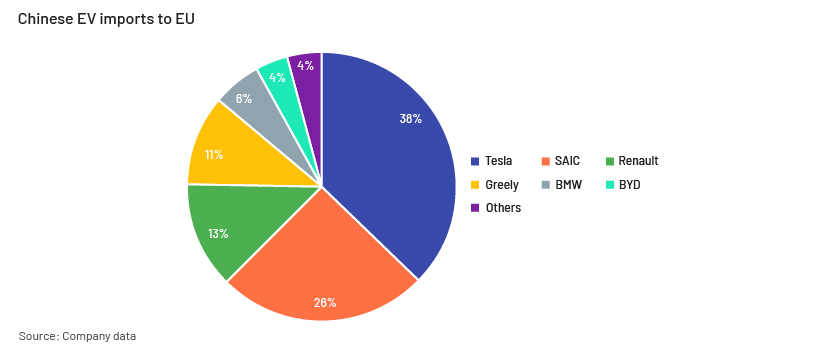

Tesla – a US-based OEM and one of the biggest importers of EVs from China to Europe – has asked EU officials for an individually calculated tariff rate. EU investigators informed that they would decide at the end of the investigation.

Rapid rise of Chinese EVs in Europe and impact on EU carmakers

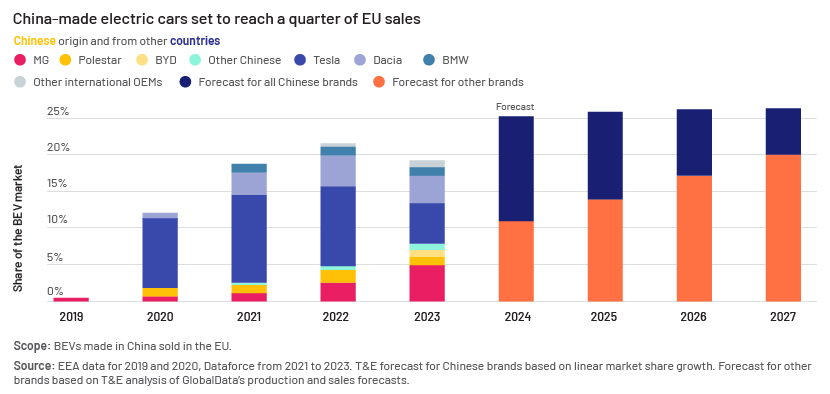

In the recent past, China has become the major player in the global electric vehicle (EV) market. With the drastic increase in local production of EVs, Chinese OEMs started looking for opportunities to export their vehicles, especially in Europe. Initially, European OEMs were not concerned about Chinese competition, as they thought the quality of EU cars may not be matched by Chinese carmakers. However, in less than two years, China’s market share in the EU electric car market has more than doubled, raising concerns among EU carmakers and the governments.

According to Transport & Environment (T&E), ca 19.5% of vehicles sold in Europe in 2023 were made in China; it expects the share to reach 25% in 2024. China’s share in the European car market increased to 2.8% in the first seven months of 2023 from 0.1% in 2019. More specifically, Chinese penetration in the pure battery electric vehicle (BEV) market rose to 3.9% in 2021 from 0.5% in 2019. In 2023, Chinese OEMs claimed that they accounted for ca 8.2% share in the European electric car market following sales of 86,000 battery electric cars.

Reasons for German counterparts’ opposition to new EU tariffs

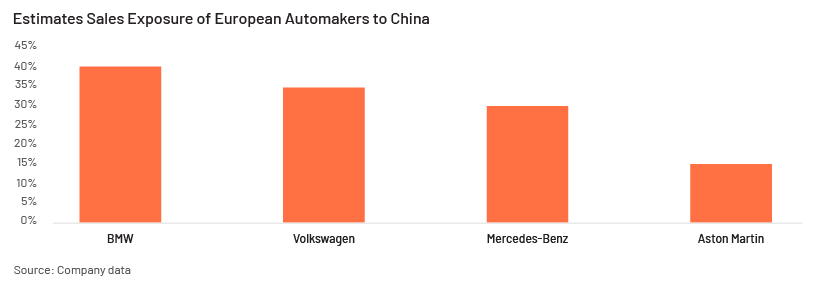

China’s government may start the trade defence mechanism sooner, introducing similar tariffs for imported EVs sold in China. This would hurt German OEMs with a production base in China, creating a risk for all European investments and names exposed to China.

China accounts for 30-40% of sales of German automakers including their joint ventures. Hence, German counterparts are opposing this new EU tariff. Also, increased tariffs may have an impact on Chinese consumers, as they may shift their preference for domestic brands which, in turn, will likely reduce the market share of German OEMs.

German carmakers VW, BMW and Mercedes-Benz, among others, may come under pressure from retaliatory tariffs, as they have bigger production plants in China. Also, they benefit from Chinese subsidies and grants such as relaxed tax regulations and cheaper lands, which may be affected in the future because of these new EU tariffs. German Chancellor Olaf Scholz has remarked that the EU’s tariffs may pose far-reaching threats, especially related to job creation in Germany.

Ways Chinese OEMs can mitigate this tariff risk

To mitigate this tariff risk, Chinese OEMs have been increasing investments in Europe to localise their production. BYD is building a factory in Hungary and planning to ramp up its manufacturing capacity in South America. Some other Chinese OEMs are consolidating their partnerships with EU carmakers. For example, Leap Motor is planning to produce T03 affordable EVs at Stellantis’s production sites. Geely can leverage Volvo’s manufacturing footprints in Europe and shift its production capacity. These initiatives are expected to increase going forward.

Other countries’ strategies surrounding tariffs

Canada is seeking public opinion on imposing tariffs on Chinese EVs. Canada’s Deputy PM Chrystia Freeland has highlighted the challenges faced by the domestic car sector from China’s overcapacity, which is creating an unfair competition. She has also stated that Ottawa will initiate a 30-day public consultation on this issue from 2 July 2024. Based on the outcome, the Canada government will formulate a policy on import tariffs for EVs.

Conclusion

One of the catalysts driving growing Chinese EV sales in Europe is affordability, especially amid the current inflationary environment. We believe these new tariffs will likely ensure a level-playing field for European OEMs. On the other hand, this will likely increase the cost for European EV consumers, which may reduce demand for EVs in Europe in the near term.

How Acuity Knowledge Partners can help

Partnering with Acuity and leveraging on our sector-specific experience allows our clients to rapidly increase internal analyst bandwidth and expand coverage. For brokerage/advisory firms, a partnership with Acuity reduces the cost per research output. By having Acuity take on 30-75% of your coverage initiation and maintenance-related process, your team stays focused on client-servicing and increasing revenue. For asset and wealth managers, Acuity’s experience covers the entire idea generation and idea validation spectrum. Our analysts (with backgrounds in Finance, MBA, CFA) can conduct thematic research, perform sector research, scan broker research, investigate first-cut ideas, construct databases, and provide regular sector coverage support. All outputs produced by Acuity are customized for a client and are available for their exclusive use. This gives our clients a unique edge that is also sustainable.

Sources

Frequently Asked Questions

Q1. What are the new tariffs imposed by the European Union on Chinese electric vehicles?

The new additional tariffs imposed by the European Union on Chinese electric vehicles are ranging from 17.4% to 38% and it varies from one manufacturer to the other.

Q2. What is the potential impact of the tariffs on European electric vehicle consumers?

Due to these additional tariffs on Chinese OEMs, there may be an increase in the price of Chinese electric vehicles in Europe which would be an increasing cost for European electric vehicle consumers which in turn may reduce the demand for Chinese EVs in Europe.

Tags:

What's your view?

About the Author

Harini Balasubramanian has eleven years of experience in equity research, supporting both buy-side and sell-side clients. She has been with Acuity Knowledge Partners for six years and has worked with a buy-side fund manager in the Auto and auto component sectors. In her current role, she supports a buy-side fund manager with coverage of auto and auto component stocks in the US, Europe, and Asia region. She holds a Chartered Accountant Degree from The Institute of Chartered Accountants of India.

Like the way we think?

Next time we post something new, we'll send it to your inbox