Published on September 4, 2024 by Kiran Jagannath

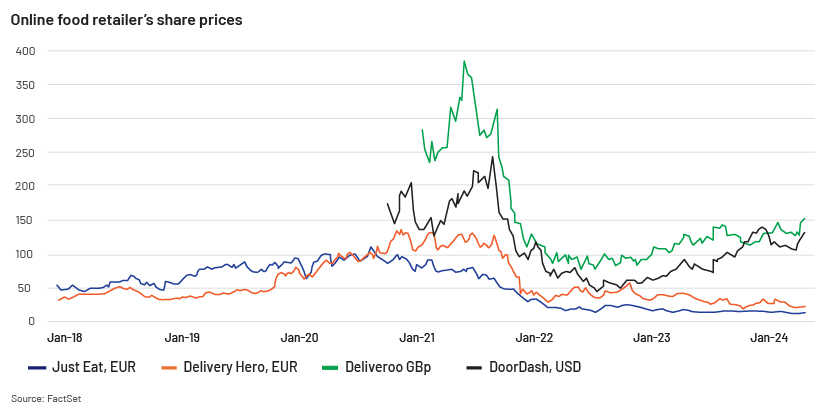

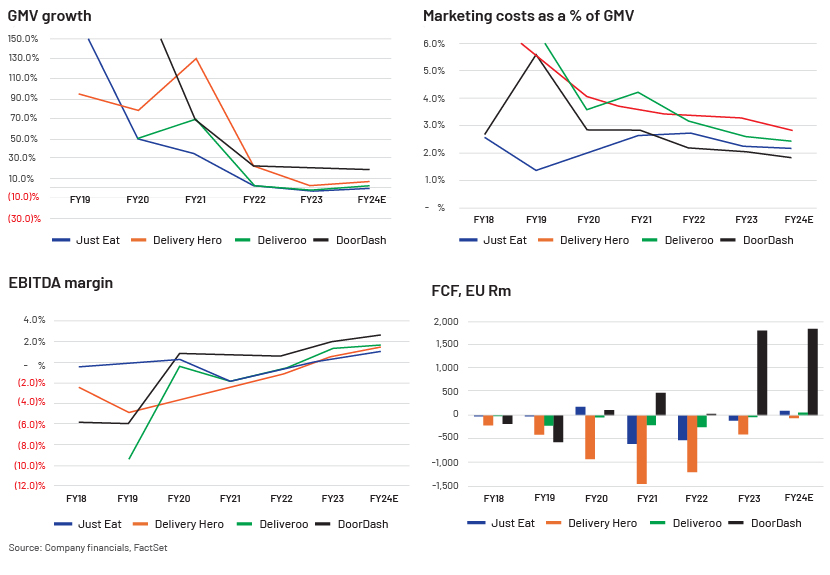

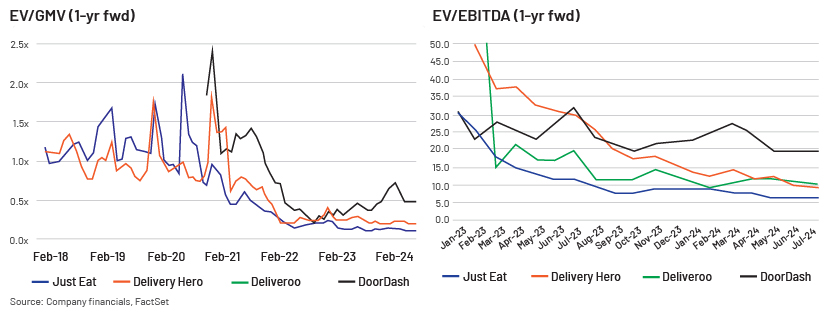

European online food retailers (Delivery Hero, Deliveroo and Just Eat) looked very attractive to investors four years ago (amid the pandemic), with strong topline growth [their gross merchandise value (GMV) was growing at above 20%]. Given high demand for online food, these retailers were consistently gaining market share; they also expanded outside their core markets by acquiring companies or by launching their own platforms. Competition was intense, and there were more than four players operating in every country aiming to become a market leader. While improving online penetration drove their high GMV growth before the pandemic, the crisis accelerated growth as more dined at home. Despite high topline growth, even market leaders were struggling to achieve profitability at the EBITDA level (due to high marketing spend), so investors had to value these companies on EV/GMV or EV/sales. Higher GMV growth expanded their EV/GMV multiples to above 1x, which was considered to be a threshold when comparing companies within the sector. However, the correlation (EV vs EV/GMV) disjointed in late 2021, when investors reassessed these companies, shifting focus from growth to profitability.

As people learned to live with the pandemic, lockdown restrictions were gradually lifted in many counties in late 2021. Investors sensed this as a key headwind to GMV growth as customers started dining out and competition from offline players was imminent. As a result, consensus downgraded GMV growth (2022/23), leading to significant selling pressure. In addition, the war in Ukraine in early 2022 created more panic among investors (growth-focused), as higher oil prices would drive inflation, impacting their margins negatively (with higher delivery costs). The interest rate upcycle was also considered to be a drag on valuation given that most of the fair value came from future cashflow. The average 1x EV/GMV (1-year forward) in the European online food retailer sector collapsed to 0.1x by mid-2022, and a few retailers had lost more than 90% of their valuation by then.

Aggressive investments in grocery added more pain.

Online food retailers typically sell ready-to-eat food to customers who order through mobile apps or web browsers (owned and managed by online food retailers). When GMV growth was slowing, these online retailers added groceries to their delivery options, increasing GMV per order. Adding more goods to each order, their objective was to grow GMV, improve rider efficiency and reduce cost per order. While a few retailers such as Deliveroo partnered with established grocers in Europe or smaller supermarkets so their riders could pick up grocery orders, others such as Delivery Hero built their own distribution centres to offer immediate grocery delivery (carrying inventory risk). These distribution centres required substantial capex and operating costs on the part of retailers that were already burning cash in terms of high marketing spend. Note that grocery is a low-margin business; a packet of milk, for example, costs EUR2-3 versus the typical EUR25 basket size for ready-to-eat food. Despite higher capex, grocery was never considered to be a profitable business, and investors questioned management teams for this irrational capital allocation.

Management teams finally bowed to investor pressure.

One of the unusual features of the food delivery sector is that almost all businesses are run by founders. They usually do not consider how other shareholders perceive this business model. When food retailers were reporting slowing GMV growth, the market rewarded them with lower valuation. Shareholders then pressured management teams to focus on profitability rather than GMV growth. As a result, all companies started disclosing roadmaps for their “path to profitability” and provided positive EBITDA outlooks for 2023. As a result, their valuations moved up slightly but were not sustainable, as the way to achieving positive EBITDA still needed to be proved.

The new strategy led to improved order economics.

In a typical developed and mature market, there exist only two to three online food retailers, competition is less intense, and growth is achieved mainly through increasing online penetration. Developed markets offer better order economics and require less marketing spend (discounts, offers, vouchers, etc.), leading to a 5-6% EBITDA margin. For example, the US market is a well-developed market with high internet penetration and a high propensity to order food online; it has only three players: DoorDash, Uber Eats and Grubhub (generating EBITDA margins of 5-6%). In contrast, many European and Asian countries operated with more than five players (two to three years ago), with intense competition leading to less room for profitability. Therefore, over the past two years, many food retailers in Europe have exited markets where they were not ranked #1 or #2, to focus more on their core markets. This has resulted in many European markets now operating with two to three players, with less competition and offering better order economics for retailers.

Market exits further slowed GMV growth.

Over the past two years, GMV growth in the sector has dropped to mid- to high single digits due to market exits and less cash burn by companies (lower marketing spend). GMV growth was just 2% in 2023 for Delivery Hero and Deliveroo and -2% for Just Eat. As the dust settles, all three retailers have guided GMV growth of above 5% for 2024E, indicating their growth stories are still intact.

Improved order economics have led to positive EBITDA.

Online food retailers have made significant progress (higher pricing, lower marketing spend, improved operational efficiency, etc.) over the past two years. As a result, many have already achieved adjusted EBITDA breakeven and should report positive EBITDA in 2024E. Just Eat generated a 0.1% EBITDA margin in 2022 and now targets a margin of over 2% in 2024E. Delivery Hero generated a -1.1% EBITDA margin in 2022 and now targets a margin of over 1.5% in 2024E. Deliveroo generated a -1.0% EBITDA margin in 2022 and now targets a margin of over 1.7% in 2024E. With companies moving into positive EBITDA territory, we believe the market should be more focused on EV/EBITDA than on EV/GMV. Their current EV/EBITDA (2025E) stands at below 10x, with a massive discount over US peers such as DoorDash trading at 19x.

Food companies are finally turning free cashflow (FCF) positive.

Another key concern for investors was that food delivery companies were largely unproven in generating FCF. FCF for these companies remained negative until 2023. As EBITDA has improved, both Deliveroo and Just Eat are just breaking even at the FCF level, meaning that 2024E should be the first full year when their FCF turns positive (both have guided for positive FCF in 2024E). Delivery Hero expects to generate positive FCF from 2H24E. This should help it reduce debt levels.

Is this a trough cycle for European food delivery names?

At the peak of the cycle (during the pandemic), the market focused on growth rather than on profitability and cash generation. As demand for online orders fell following the pandemic, multiples de-rated (the high interest rate environment accelerated this in 2022). On average, the share prices of Delivery Hero, Deliveroo and Just Eat have lost around three-quarters of valuation in the past three years.

We see this as a “trough” in the cycle, with companies having since focused on FCF generation, which should inflect over the next one to two years. With positive EBITDA, food retailers are showing that they can maintain profitability. As EBITDA margins of European online food retailers approach those of peers in developed markets (c.5% EBITDA margin in the US), their valuation multiples should eventually be rerated (DoorDash typically trades at close to 20x 1-year forward EBITDA). On an EV/EBITDA basis (1-year forward), Delivery Hero, Deliveroo and Just Eat trade below 10x, indicating a significant rerating opportunity. The lower interest rates expected soon should also lower their cost of capital, as these companies are considered to be growth-oriented.

How Acuity Knowledge Partners can help

We support global portfolio managers by leveraging our sector-specific experience. Along sector-specific themes, we help investment firms with idea generation, competitive landscape analysis on emerging trends [such as artificial intelligence (AI), digitalisation, advanced driver assistance system (ADAS) and autonomous vehicles (AVs)] and analysis of investment opportunities through comprehensive research and sector coverage support.

Sources:

Tags:

What's your view?

About the Author

A post graduate in Management (Finance) with nearly 15 years of total work experience in equity research including 8 years in Acuity Knowledge Partners.Well-versed in financial modeling, financial analysis, valuation, writing reports/investment thesis, thematic research (Global M&A and Spinoff Study), special situation analysis (Spinoffs) and portfolio management.

Like the way we think?

Next time we post something new, we'll send it to your inbox