Published on November 10, 2020 by Jayraj Gohil

“World under lockdown”, “Stay at home”, “All sporting events cancelled”, “Employees to work from home” – how many times have we heard these headlines recently? The novel corona virus has spread indiscriminately, infecting millions, and has changed the world as we knew it.

In this article, we focus on the damage this pandemic has wreaked on the European economy, and what measures the European Central Bank (ECB) has taken to control it.

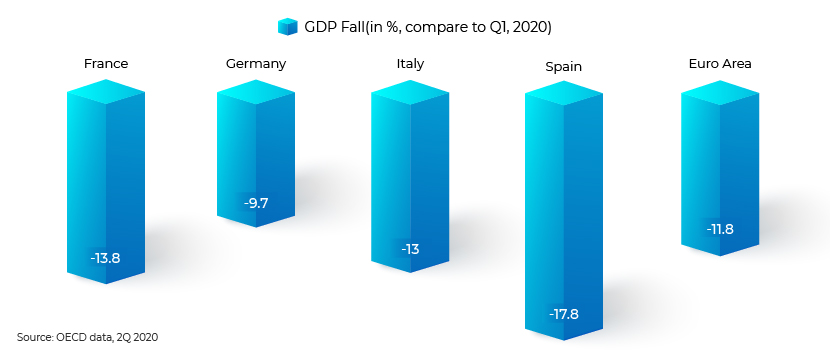

Arguably, Europe’s economy is one of the largest in the world in terms of industrial production; any dent in this economy would, therefore, impact the global market. The novel corona virus outbreak has definitely disturbed the chain of supply and demand of industry products, raising unemployment and driving down GDP and activity in the services sector.

Unemployment forecasts for 2021 remain a concern, and the rate is likely to rise if the necessary measures are not taken.

Europe’s economic response to the pandemic

The Frankfurt-headquartered ECB has been very active since the initial phase of the outbreak and has implemented the following measures:

-

Targeted Longer-term Refinancing Operations (Improved terms)

-

Pandemic Emergency Longer-term Refinancing Operations

Pandemic Emergency Purchase Programme (PEPP)

Market liquidity is one of the crucial aspects of a healthy economic environment, and when “market liquidity risk” rises, it becomes more difficult to exit market positions. There was fear of liquidity risk amid the pandemic, but the ECB was alert at the early stages and proposed a USD750bn PEPP to help overcome the likely economic consequences.

The programme will see a temporary purchase of securities from private and public sectors. Purchases will be conducted until at least the end of June 2021.

Potential challenges:

Even as PEPP is considered highly beneficial for the economy, there are challenges the ECB may face in placing the purchases.

-

Too many purchases would be a problem: the ECB has announced purchasing a significant EUR600bn under this programme. It would be critical to determine how much would be sufficient to achieve its main objective, i.e. ,the price stability of securities

-

Non-standardised safeguards: there are no standardised safeguards in place, but the Court of Justice of the European Union (CJEU) insists that the following be adhered to:

-

Not selective: The ECB will not be selective in the PEPP allocation process, and will purchase securities issued by all euro-area countries

-

Eligibility criteria: ECB to follow a stringent and precise process to determine eligibility criteria for security purchases

-

Nature of transaction: ECB needs to make sure that purchases will be temporary in nature

-

Trade limitations: ECB will need to limit the trades by size and risk per issue and issuers

-

Targeted Longer-term Refinancing Operations (TLTRO III)

In simple terms, this measure intends to “finance the banks”. In particular, credit institutions (banks and financing firms) will be provided longer-term funding at attractive terms. The main objective is to preserve stable and favourable borrowing conditions for banks lending to non-financial corporations and households.

The first series was launched on 5 June 2014, TLTRO II on 10 March 2016 and TLTRO III on 7 March 2019.

Highlights of TLTRO III

-

A series of seven targeted longer-term refinancing operations

-

Maturity of the operations: three years

-

The borrowing rates of the operation can be as low as 50bps

Some of the steps taken by the ECB to ease conditions of TLTRO III

-

Reduced borrowing rates by 25bps; these can be as low as 25bps, versus 50bps at the launch of TLTRO III

-

An early repayment option will be offered from September 2021

Pandemic Emergency Longer-term Refinancing Operations (PELTRO)

Similar to TLTRO, PELTRO’s main objective is to maintain liquidity and smoother money-market conditions amid the pandemic. However, PELTRO targets European markets facing challenges.

The ECB decided to conduct the PELTRO series in April 2020, In line with TLTRO borrowing rates, PELTRO rates could be 25bps or lower, even as low as 0%.

Role of compliance/legal factors in the ECB’s operations

Certain compliance aspects would need be considered before and while implementing the operations launched by the ECB. The following are some factors that need to be taken care of from a compliance perspective based on the CJEU’s recommendations.

-

Allotment of funds: The ECB’s operations bring in billions of dollars of funds to provide market stability in difficult times. These funds need to be allocated in the most fair and balanced manner among all member countries.

-

Country/bank eligibility: Eligibility to receive funds from ECB operations is mostly determined by the economic requirement and the damage a country has faced amid the pandemic.

How Acuity Knowledge Partners can help:

Acuity Knowledge Partners is an influential player in the global market, offering compliance expertise and a wide array of other services. We enable our compliance clients to manage increasing demands on their teams by providing customized managed services solutions, based on specialized skills and technology, and by delivering operational efficiency, resilience, and significant cost savings. We believe our offering is even more relevant in the post-COVID-19 economic and operating environment, where compliance teams have seen a significant increase in workload in tasks such as trade surveillance, communications surveillance, distribution compliance and virtual client on-boarding and transaction monitoring. Please refer to Acuity’s compliance offerings in details here.

Tags:

What's your view?

About the Author

Jayraj Gohil has over 14+ years of experience in compliance, having worked for various firms including State Street Global Advisors and Goldman Sachs. His expertise spans across the risk and compliance sector, focusing on compliance reviews of marketing/advertising materials. At Acuity Knowledge Partners he is part of the central compliance team and specializing in marketing material review. Jayraj is an MBA from Global Academy of Technology, Bengaluru (VTU).

Like the way we think?

Next time we post something new, we'll send it to your inbox