Published on August 16, 2024 by Natasha Agarwal

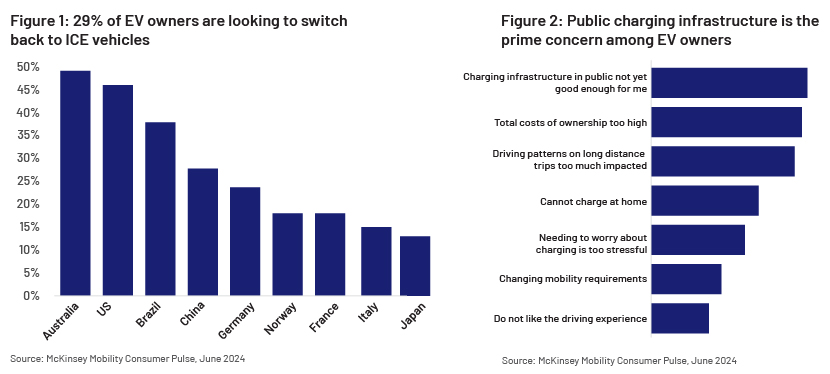

A recent survey by McKinsey revealed that 29% of EV owners globally are looking to switch back to internal combustion engine (ICE) vehicles (Figure 1). Of the several reasons cited, inadequate public charging infrastructure was the top concern among EV owners (Figure 2).

Widespread adoption of EVs hinges on wider availability and accessibility of public charging facilities. Private charging is currently the most common way of charging electric cars where EV owners have access to private parking spaces; the use of private charging is almost 10x more than public chargers. However, highly densely populated areas, where private parking spaces are less frequently available, pose a significant hurdle for private charging installation; most EV owners, therefore, rely on public charging stations.

Public charging infrastructure market for electric light duty vehicles (LDV)

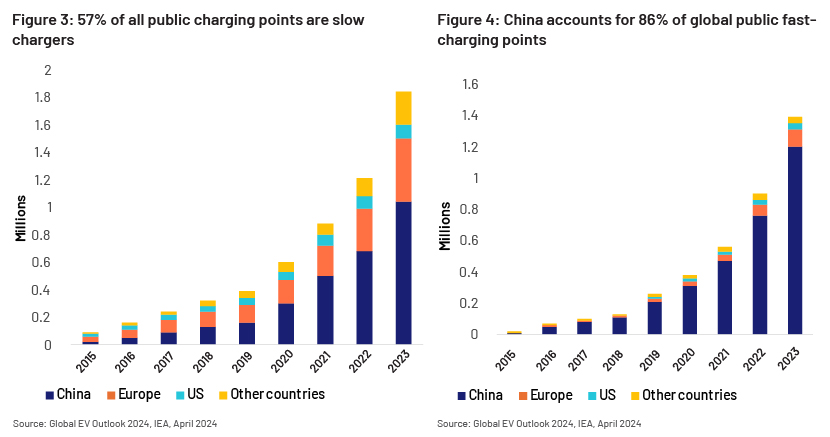

There were about 3.23m public charging points globally by end-2023, having grown at a CAGR of 48% from 2019. Fast-charging points accounted for c.43% of public charging points by end-2023.

China has the largest number of public chargers – more than 85% of the world’s fast-charging points (Figure 4) and c.57% of the world’s slow-charging points. Unlike in other nations, the central government’s long-term planning has driven the buildout of EV-charging infrastructure.

The government issued Guidelines for the Development of Electric Vehicle Charging Infrastructure in 2015, to construct 500,000 public charging stations and 4.3m private charging stations by 2020 to cater to 5m EVs. The plan also required that 10% of parking space in new public buildings be equipped with EV charging facilities. Furthermore, it developed a single national standard for direct-current (DC) fast charging for better user experience. Following the efforts by the central government, local and provincial governments also promoted development of EV-charging infrastructure by providing financial incentives and formulating new-building construction policies. For instance, in 2017, the Beijing municipal government mandated that all parking spots in new residential developments have EV charging points. The government has been implementing supportive policies to further develop EV charging facilities. As part of its rural-vitalisation efforts, it is now rolling out targeted measures to accelerate the development of charging infrastructure in rural areas.

While China leads in EV-charging infrastructure, other regions are lagging behind significantly., There were about 0.57m EV public charging points across Europe by end-2023, and only 19% of the charging points offered fast-charging capability, according to the International Energy Agency (IEA). 61% of the EU charging points are concentrated in the Netherlands, France and Germany. According to the European Commission, 3.5m charging points should be installed by 2030 to drive mass-scale EV adoption, implying that c.2.9m charging points will be installed in the next seven years. Stricter CO2 emission standards by 2035 have made EV adoption inevitable, indicating that governments across Europe should implement robust strategies to ramp up EV infrastructure investment. The EU’s Alternative Fuels Infrastructure Regulation (AFIR), which came into effect on 13 April 2024, has established mandatory national deployment targets for EV-charging infrastructure. This regulation provides that by 2025, fast-charging points of 150kW for cars/vans should be installed every 60km along the EU’s main transport corridors. It also regulates payment options and requires charge-point operators to provide consumers with complete information on the availability, waiting time and price at different stations.

EV-charging infrastructure in the US is extremely poor, with just over 0.14m public charging points by end-2023. To fast forward EV infrastructure development, President Biden has set a target to build a network of at least 500,000 public chargers by 2030, with this government making significant investment to this end. As part of its Bipartisan Infrastructure Law signed in November 2021, it has set aside USD7.5bn to build a nationwide EV charging network. As of July 2024, c.40 EV charger factories were announced/opened in the US. To tackle the issue of multiple chargers and plugs, the government has also laid down minimum standards for all EV chargers funded through federal programs.

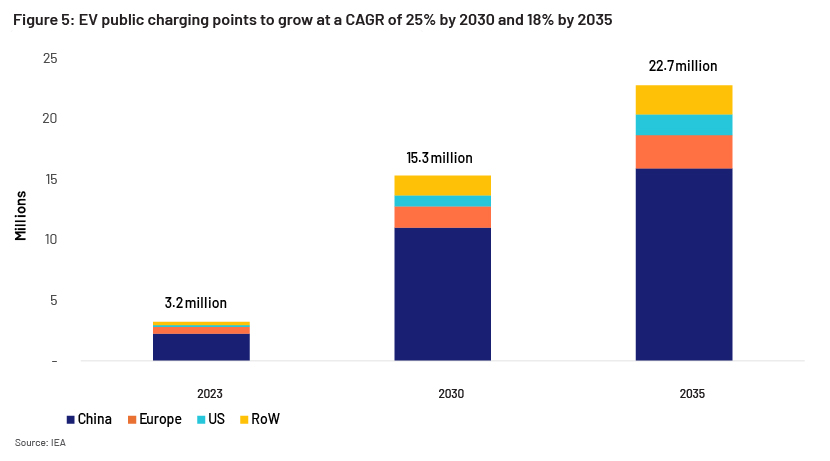

The roll-out of public charging facilities needs to keep pace with EV sales. In 2023, nearly 14m electric cars were sold globally, representing 18% of all cars sold that year. IEA estimates based on current stated policies indicate that electric LDV sales are expected to triple to over 43m by 2030 and account for 40% of all LDV sales, while the global number of public charging points is projected to exceed 15m by 2030 and reach 23m by 2035.

Tesla, Schneider Electric, ABB, Siemens eMobility and ChargePoint are the top five players providing fast EV charging solutions for public charging. Furthermore, to cater to growing demand for EV-charging infrastructure, EV OEMs are collaborating with EV charging players to also provide end-to-end EV charging ecosystem.

Examples:

-

In February 2024, China’s leading EV OEM, BYD, joined hands with Raizen to build an EV charging network of 600 stations in eight Brazilian cities (link)

-

Mercedez Benz plans to create 2,000 fast-charging points globally by 2024 and over 10,000 charging points by 2030 (link)

-

In July 2023, seven auto OEMs – General Motors, BMW Group, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis – formed a joint venture to build an EV fast-charging network in North America by installing at least 30,000 chargers in the US and Canada (link)

-

In July 2022, General Motors partnered with Pilot Co. and charging network EVgo to build 2,000 DC fast-charging stations across the US (link)

How Acuity Knowledge Partners can help

With the rapid increase in the number of EVs, driven by strict environmental regulations and government incentives, EV-charging infrastructure is expected to expand. We provide bespoke research and analytics services to financial institutions and consulting companies, including asset managers, to identify and track key industry-specific themes. We provide actionable insights, helping our clients identify profitable investment opportunities across the industry value chain.

Sources:

-

Trends in electric vehicle charging – Global EV Outlook 2024 – Analysis - IEA

-

Outlook for electric vehicle charging infrastructure – Global EV Outlook 2024 – Analysis - IEA

-

McKinsey survey claims 46% of US EV owners likely to switch back to ICE (teslarati.com)

-

EV chargers market growth Part I: Policy Stimulus in China, India and the US - PTR Inc.

-

China's EV Charger Industry: Prospects for Foreign Investors (china-briefing.com)

-

Electric vehicle charging: What can the US and China learn from each other? | Dialogue Earth

-

The European Alternative Fuels Infrastructure Regulation (AFIR) comes into force - electrive.com

-

[1] Top 10: Rapid Charging Companies, EV Magazine, July 2024

Tags:

What's your view?

About the Author

Natasha has over 13 years of experience in various research areas – equity research, business research and market research. She is currently supporting a buy-side client with thematic research. Prior to joining Acuity, Natasha worked with CRISIL, PwC and KPMG.

Like the way we think?

Next time we post something new, we'll send it to your inbox