Published on April 21, 2025 by Disha Tolani

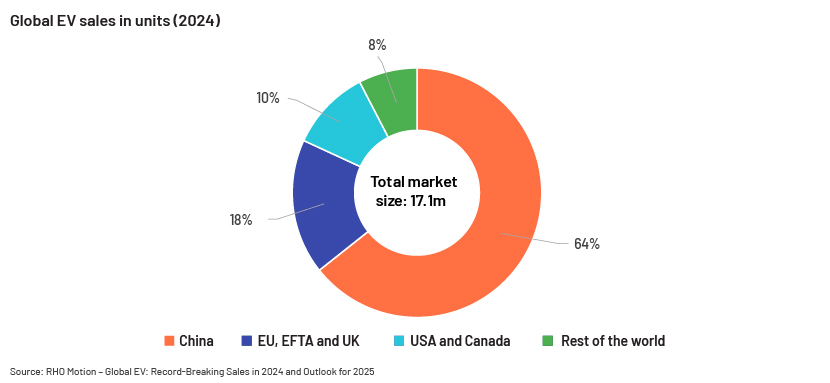

The electric vehicle trends in 2024 have shown remarkable growth, with a 25% year-over-year increase in global EV sales, driven by both technological advancements and environmental concerns. There were 17.1m EVs sold in 2024 globally, a 25%1 y/y increase. China led the market with sales of 11m EVs (64% of the total), achieving 40%1 growth y/y. The US and the EU accounted for 28% of global EV sales in 2024.

EVs – the impact on real estate

As EV trends continue to evolve, it’s clear that a robust charging and battery production infrastructure will be critical in supporting the growth of electric vehicles and their integration into the real estate sector. Sales of battery EVs (BEVs) are expected to increase by 30%2 y/y in 2025, according to S&P Global Mobility. Robust charging and battery production infrastructure are becoming essential to sustain this growth. The EV revolution has impacted the following CRE sectors:

EVs – opportunities for real estate

Residential

-

Multifamily developments. An EV owner can save up to 50%10 or more of the electricity cost by using an electric charger in their residential development, according to the University of California, due to the difference in per unit electricity cost for residential versus commercial use. As the cost of charging equipment continues to decline, it would become more practical to distribute the equipment widely throughout a residential garage.

-

Community housing. Real estate companies in China are partnering with charging service providers to establish extensive charging networks within residential areas. For example, a prominent developer – GLP China – along with YKC Clean Energy Technologies, plans to invest approximately USD138m in their portfolio of 40m11 sqm of land. This initiative aims to build one of the country’s largest EV-charging networks, directly benefiting residential communities.

Retail and office

-

Office and mixed-use developments. Demand for EV charging points in business hubs and science parks in decentralised locations and suburbs is increasing. New office developments in Australia are required to provide charging points in 10%4 of car parking spaces according to CBRE. Singapore and India have adopted similar regulations, and Tokyo is set to introduce measures in April 20254.

-

Big-box retail outlets. Around 89%3 of EV drivers make purchases while charging their vehicles, according to Blink Charging (a US-based manufacturer). In the US and the UK, real estate and auto firms are integrating EV charging, with partnerships such as Starbucks and Volvo installing chargers along routes from Colorado to Seattle. 78%4 of major shopping centres in Australia are equipped with charging points, according to CBRE, and around 35%4 of EV users in China prefer to charge their vehicles close to retail and entertainment establishments. In mainland China and Korea, EV manufacturers are strengthening their presence in shopping centres by setting up showrooms, giving priority to leasing space in malls with chargers.

-

Convenience retail. The rise of EV real estate is making it increasingly important for commercial developments to integrate charging infrastructure, with more shopping malls and office parks investing in EV chargers to cater to the growing demand. Gridserve, a renewable energy company, has opened the UK’s first-ever electric forecourt, with 36 high-power5,6 EV chargers and a service centre with retailers such as WHSmith and Costa Coffee.

-

Experiential retail outlets. Tesla recently opened its first Tesla Experience Center at Uptown Parade in Taguig in the Philippines.7 The experience centre is a one-stop hub and provides services ranging from sales and delivery to support. Even traditional automobile manufacturers are moving to an experiential retail strategy. In May 2024, Hyundai’s luxury brand, Genesis, expanded its EV sales to 37 states and established 268 new standalone retail facilities across the US.

-

Specialised retail In China, Xiaomi has moved to a last-mile retail shops strategy through which it plans to open 10,0009 new “Mi Home” stores internationally over the next five years. This expansion aims to bolster its retail footprint closer to the end consumer and support its growing EV business by using specialised retail real estate.

Infrastructure

-

In Norway, more than 22,00012 public chargers have been installed for servicing over 0.5m EVs on the country’s roadways. The government has approved installation of more EV chargers at malls, gyms and universities and on highways. At several urban gas stations, where space is a constraint, compact EV chargers are installed.

-

The largest number of alternative fuelling stations (AFSCs) in the US were in California (15,000), New York (3,500) and Texas (2,700)13 as of August 2023, with the highest concentration of EVs. Siemens, a major components maker, opened a manufacturing hub in Dallas-Fort Worth in 2023. It plans to produce 1m EV chargers to support growing demand for EVs.

-

Major automobile/components makers such as BMW, GM, Hyundai, Kia, Mercedez-Benz and Stellantis have announced a joint investment of at least USD1bn13 to build nearly 30,000 fast EV chargers on major highways and other areas across the US and Canada over the next few years.

Industrial and logistics

-

Tesla opened a 10m sqft gigafactory in Austin, Texas, in April 2022.14,15 The company operates eight gigafactories and plans a further USD3.6bn15 investment in Nevada. The market in Austin witnessed the 42nd consecutive quarter of positive net industrial demand in 4Q2416. In addition, major investments from Tesla and Samsung attracted global automotive and semiconductor OEM suppliers to the area in 202417.

-

In China, BYD has constructed an EV factory in Zhengzhou, spanning 50sqm and employing 60,000 workers, with plans to hire an additional 200,000 workers. This facility is designed to produce over 1m vehicles annually18, boosting local employment and activity. The factory has spurred the development of production buildings, recreational facilities, housing and warehouses, driving economic and real estate growth in the region.

Upcoming major investments in EV manufacturing globally. Major EV manufacturers and original equipment manufacturers (OEMs) are undertaking the following large projects13, 19-

-

22 EV facilities for battery and vehicle manufacturing worth USD37.3bn are under construction in the US

-

A 3.5m sqft gigafactory facility and a USD328m-worth production plant are scheduled to be built in Mexico

-

In Canada, EV facilities worth USD6.5bn are under construction

-

An investment of JPY107.4bn has been made for EV plants in China

Conclusion

As EV adoption continues increase, the real estate sector would need to adapt to new demands and opportunities. Properties with EV-charging infrastructure, green features and alignment with smart-city initiatives are likely to see increased demand and higher values. Additionally, industrial and warehousing assets would need to adapt to the substantial requirements of gigafactories. Conversely, the challenge of integrating EV technology and infrastructure into existing and new developments would need to be addressed to ensure equitable access and sustainability. The synergy between EVs and real estate is shaping the future of both sectors.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading provider of specialised research and analytics services relating to the real estate investment sector. Our team of experts have deep domain knowledge, enabling us to deliver high-quality insights and support to our clients. This expertise helps clients enhance their operational capabilities and focus on strategic, value-added activities and critical decision-making processes. Our comprehensive and customised suite of services span the entire investment lifecycle and all asset types such as office, retail, multifamily, industrial and warehousing developments.

References:

-

S&P Global Mobility forecasts 89.6M auto sales worldwide in 2025 – 20 December 2024

-

Host an EV Charging Station at Your Retail Location in India

-

CBRE APAC Report_How will electric vehicles impact real estate in Asia Pacific_Final

-

Electric vehicles: driving change in real estate | Savills Impacts

-

Tesla officially lands in PH, opens flagship showroom in BGC

-

Xiaomi to expand globally with 10,000 Mi Stores: Lu Weibing outlines ecosystem growth vision

-

How Electric Cars Might Affect Multifamily And Other Real Estate

-

What Norway’s evolution reveals about the EV charging market | McKinsey

-

Electric Vehicle Trends and Challenges for Industrial Real Estate | CBRE

-

How Many Gigafactories Does Tesla Have? Tesla Factory Locations

What's your view?

About the Author

Disha possesses 12 years of experience in the commercial real estate industry, specializing in investment research and asset management. Currently, at Acuity, she is supporting a prominent investment manager with various RE credit tasks, preliminary loan sizing, rent roll analysis, comparable property assessments, market research and preparation of investment committee memorandums. Prior to her role at Acuity, she held positions at Cushman & Wakefield and Newmark, where she led teams in the appraisal review process and was actively involved in valuation and advisory services. Disha holds an MBA in Finance & Marketing and a bachelor’s degree in commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox