Published on April 15, 2021 by Chiranjita Chintamani

Overview

The past year’s unprecedented circumstances have caused damage, both direct and indirect, across sectors. The global pandemic and the subsequent lockdowns and economic shutdown have not only affected big businesses but also resulted in many small businesses shutting down and employees being laid off. This wave of furloughs and layoffs has impacted the paying capacity of borrowers and contributed to increased mortgage delinquencies in the commercial real estate (CRE) sector.

What exactly is delinquency? In simple terms, it refers to unpaid debt and in the case of mortgage delinquency, refers to borrowers falling behind on their mortgage payments. With more than 20m Americans losing their jobs and income, borrowers have struggled to keep up with the payment cycle. The spike in the delinquency rate was further fuelled by the US federal government’s response to alleviating borrowers’ troubles. The Coronavirus Aid, Relief, and Economic Security (CARES) Act provides a mortgage relief option in terms of forbearance in which the lender allows the borrower to pause payments for a while. Although the loan is not excused, the Act provides for delayed payment, playing a part in driving this spike.

A quick comparison of delinquency rates over the past two years presents a clearer image of the spike: 6.1% of mortgages were in some stage of delinquency (30 days or more past due, including those in foreclosure) in the past year compared to 3.7% in October 2019. Moreover, serious delinquency (90 days or more past due, including loans in foreclosure) had grown three times compared to that in October 2019.

Delinquency rates in the CRE sector, and specifically the commercial mortgage-backed securities (CMBS) portfolio, saw sharp increases in the second quarter of 2020 due to a decrease in rental revenue and increase in vacancies. With the onset of the pandemic, delinquency rates began to increase at an alarming rate and reached an all-time high of 10.32% in June 2020 until forbearance agreements were signed in July 2020.

How did individual sectors perform?

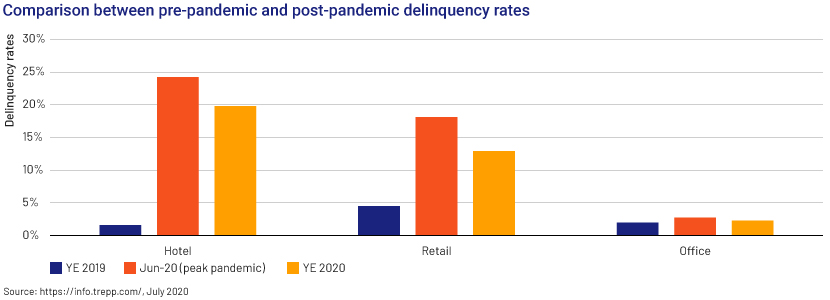

The pandemic affected the CRE sector significantly, but the spike was more pronounced in the hotel and retail sectors.

Hospitality:

No points for guessing the sector hit the hardest. With travel restrictions and COVID-19-related protocols imposed due to country-wide lockdowns, the lodging sector faced the worst delinquencies. This sector’s delinquency rate has soared above 18% since May 2020 from its pre-pandemic rate of 1.5%, and forbearance has scaled new highs. We expect the disruption caused to ease gradually, but it will likely still take a long time to reach pre-pandemic rates.

Retail:

The retail sector was already facing the brunt of the surging online economy when the pandemic started. With shoppers preferring to stay indoors and order their supplies online, store owners struggled to pay rents due to dwindling revenue. The retail sector’s delinquency rate peaked in June 2020 at 18.07% and dropped to 12% by the fourth quarter of the year, according to leading provider of data, analytics and technology solutions Trepp. The COVID-19 vaccination programmes may lead to a further fall in the rate, but the boost the pandemic provided to the e-commerce sector may hinder the recovery of the retail sector.

Office:

Although this sector did not see a major spike in delinquencies (1.98% in 4Q 2019 to 2.66% in June 2020), the future of the modern office may reverse the trend. The boundaries between work and home are diminishing at a much faster rate owing to the remote working model that is soon likely to become a permanent fixture for many companies. Although the delinquency rate for office loans dropped slightly to 2.18% in December 2020, the uncertain future of the corporate work culture may force companies to reconfigure and re-evaluate their need for extending leases, resulting in further spikes.

How is the situation being managed?

Although mortgage delinquencies fell in November due to more economic stability, the numbers are still far higher than before the pandemic. Measures such as forbearance, foreclosure moratoriums, payment deferrals, and improved unemployment benefits have helped borrowers face the crisis. Further loan modification has helped borrowers keep up with mortgage payments as a result of modified loan terms. Although the CARES Act is partly responsible for driving the spike, it has helped borrowers whose loans are backed by the government in meeting their day-to-day expenses. Moreover, stimulus programmes such as the Economic Impact Payments and Paycheck Protection Program initiated by the US federal government have enabled individuals not only to afford their daily necessities but also to meet their debt obligations. However, some challenges that have been plaguing the relief measures are the lack of awareness among the borrowers regarding the options available and, in some cases, lack of proper communication between the lenders and the borrowers. Further, the aforementioned measures though have benefitted homeowners, the hotel and retail sectors have not seen a sharp decline in delinquency rates.

What does the future hold?

With the second wave of the pandemic underway, the US economy is expected to be impacted further. While forbearance is a quick fix, its long-term effect remains to be seen. The Federal Housing Finance Agency (FHFA) has extended bans on certain foreclosures and evictions. However, if the bans are lifted, homeowners delinquent on their mortgages may face serious trouble. For a lender, too, foreclosure is a time-consuming and costly affair; lenders are not in the business of selling homes/properties, but in the business of making money on interest payments. Without a fully recovered economy and healthy job market, these homeowners will still likely be in forbearance and need additional support until the job market recovers significantly. President Biden is expected to come up with plans to provide additional aid that would enable mortgage lenders to work with delinquent borrowers. With the vaccines fostering hope, the economy is expected to recover gradually, leading to a stronger job market and helping borrowers get back on their feet.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners has multi-sector expertise in the areas of financial analytics, valuation and advisory services, with the CRE sector being one of the major focus areas. We are the market leader in helping CRE lending teams navigate challenges, aided by our considerable experience in working across the CRE deal life cycle – loan underwriting and valuation, origination, post-closing and asset management. Additionally, our analysts have expertise in evaluating and underwriting CMBS deals, monitoring portfolios and preparing investment credit memos. They are also involved in monitoring and re-evaluating distressed deals. We help credit teams restructure and modify pandemic-impacted loans.

Sources:

https://info.trepp.com/hubfs/Trepp%20June%202020%20Delinquency%20Report.pdf

https://home.treasury.gov/policy-issues/cares

What's your view?

About the Author

Chiranjita Chintamani joined Acuity Knowledge Partners in December 2019 as a Senior Associate with the Commercial Lending team. She has more than five years of experience in commercial real estate finance. Prior to joining Acuity, she worked with Berkadia Financial Services, Hyderabad. Chiranjita holds a Post Graduate Diploma in Management in Financial Services from the Institute of Public Enterprise, Hyderabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox