Published on April 12, 2022 by Kriti Dawer

The journey so far

The global sustainability movement was gaining momentum even before the pandemic, which further enhanced the value of environmental, social and governance (ESG) factors in sustainable investing. Sustainable investing assets in five major global markets grew at a CAGR of 7.3% to USD35.3tn at the start of 2020, surpassing the CAGR of 3.5% for professionally managed assets over the past two years, according to a Global Sustainable Investment Alliance (GSIA) report of 2020.

As the financial world took initiatives to implement these concepts in investing, ESG ratings emerged. The 2020 trends report of the Forum for Sustainable and Responsible Investment estimates that 33% of all US assets under professional management are tied to sustainable investing or are related to ESG practices.

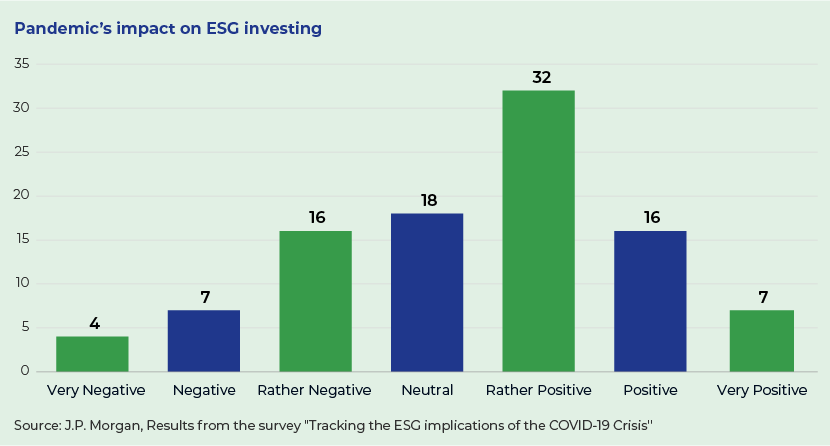

ESG investing has evolved in recent years to meet the demands of institutional and retail investors, as well as those of certain public-sector authorities that wish to better incorporate long-term financial risks and opportunities in their investment decision-making processes to generate long-term value. J.P. Morgan polled investors from 50 global institutions, representing a total of USD12.9tn in assets under management (AuM) to assess how they expect the pandemic to impact the future of ESG investing.

Let’s dig deeper into the major challenges facing ESG investing, steps taken to overcome them and what the future likely holds.

Challenges involved

News relating to ESG metrics has been encouraging in recent years, but the reality is different, as current ESG practices are exposed to material information that is accessible and utilised by investors in an effective manner. For all its potential prospects, ESG considerations pose challenges on integration into existing risk management frameworks:

-

Strategy and framework: Firms have ESG-related aspects in their current risk frameworks, but gaps and opportunities would need to be identified if management is to be improved. ESG factors would need to be integrated into risk management frameworks across risk types, and risk appetite would need to be defined. Additionally, management would need to understand how ESG considerations could impact existing products and services or necessitate the launch of new offerings

-

ESG data accessibility: ESG data is easily available and cost-effective to obtain. Not all companies disclose data and measurement methodologies differ, making comparison even of the same metrics difficult. While setting standards would help, firms should actively develop and implement ESG data and reporting strategies while keeping abreast of changes

-

Disclosures: Regulators, supervisors and exchanges are moving towards making ESG disclosures, such as those required by the Task Force for Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB) and World Economic Forum, mandatory. For international firms, this poses a particular challenge, as different countries may have different requirements. Firms should consider adopting tools or processes to monitor and scan through emerging regulations on a real-time basis and assess against current frameworks

-

Greenwashing: Greenwashing is the process of making unsupported claims meant to deceive consumers into believing a company's products are environmentally friendly. For example, companies involved in greenwashing behaviour may claim their products are made from recycled materials or have energy-saving benefits.

Steps taken to overcome challenges

Much needs to be fixed and many processes accelerated, to which end the following ESG regulations have been adopted in recent years:

-

TCFD: The Financial Stability Board launched the TCFD in 2015; this refers to a set of company disclosures presented to all stakeholders relating to climate-related risk exposures. The framework was supported by the G7 group of countries in June 2021. The status report issued on 14 October 2021 showed the TCFD framework was followed by 89 countries, covering almost all sectors and accounting for a market cap of over USD25tn, a 99% increase y/y. The number of corporations supporting the TCFD surged to 1,505 in 2020 from 282 in 2017, according to the State of Green Business 2021 report published jointly by S&P Global, Trucost and GreenBiz Group

-

UN Agenda 2030: Includes 17 Sustainable Development Goals (SDGs) to spur responsible, sustainable growth within the private and public sectors

-

Principles for Responsible Investment: A roadmap of how corporations should approach an ESG-centric investment strategy to leverage capital to achieve the SDGs

-

Paris Climate Agreement: A legally binding multinational treaty designed to promote sustainability on a national and international scale, catalysing domestic regulations on the financial services sector to meet the assigned goals

-

EU Taxonomy implementation: On 3 August 2021, the EU provided recommendations on sustainable finance, defining which activities could be assessed as being sustainable under the remaining four environmental objectives of the EU Taxonomy Regulation. The recommendations will inform a delegated act, expected to be published in 2022, defining whether a given economic activity is aligned and does not conflict with the Taxonomy’s objectives related to water/marine resources, the circular economy, pollution prevention/control and biodiversity

-

UK publishes green claims code for avoiding “greenwashing” marketing claims:In September 2021, the UK’s Competition and Markets Authority (CMA) published guidance on how businesses making environmental claims can comply with their obligations under UK consumer protection law and avoid greenwashing

-

New voluntary standard released for corporate net-zero targets:In October 2021, the UN-backed Science Based Targets initiative (SBTi) released a net-zero standard for companies, aimed at establishing a credible and independent assessment of corporate net-zero target setting and allowing companies to align their near- and long-term climate action with limiting global warming to 1.5°C.

Looking ahead

All these regulations may ensure strict scrutiny of unsustainable sectors, and companies will need to respond if they hope to survive in the long run. It is forecast that by 2025, approximately 33% of all global AuM (not just domestic) will have ESG mandates. The sector is expected to grow 433% from 2018 to 2036, resulting in total global assets of USD160tn. As a result of the Paris Agreement adopted in 2015, the International Finance Corporation anticipates nearly USD23tn in investment opportunities in emerging markets between now and 2030. From a broader perspective, ESG regulation will be the next wave to comply with, benefiting stakeholders and boosting investment in the long term. A sector transformation is expected as stakeholders and regulatory priorities continue to evolve, making it essential that all decision makers stay informed.

How Acuity Knowledge Partners can help

We offer comprehensive thought leadership and specialised ESG research solutions. We also enable investment banks and advisory firms to establish and grow their sustainable finance practices by providing a wide range of customised analysis and support.

Sources:

-

Livemint

-

Deloitte

-

JP Morgan

-

TCFD report

-

S&P Global

https://www.sullcrom.com/esg-trends-and-hot-topics-november-2021

https://www2.deloitte.com/xe/en/insights/topics/strategy/esg-disclosure-regulation.html

https://www.jpmorgan.com/insights/research/covid-19-esg-investing

TCFD status report for 2021 – Regulation Tomorrow

https://finance.yahoo.com/news/growth-sustainable-investing-190000841.html

What's your view?

About the Author

Kriti has done graduation in B.Com(H) from University of Delhi and currently, a CFA L-1 candidate. She has over 2 years of experience. She is a member of Private Equity and Consulting in Acuity and prior to that, worked as a credit & research analyst.

Like the way we think?

Next time we post something new, we'll send it to your inbox