Published on November 6, 2017 by Nuwan Jayawardana CFA

Regulations thus far have acted as a barrier for foreigners seeking to invest in China’s domestic bonds

China’s yuan-denominated local bond market (of about USD9 billion) has been largely out of bounds for foreign investors due to government restrictions. The existing alternative of investing via the Qualified Foreign Institutional Investor program has not been attractive to most investors due to investment quotas and licensing requirements. Consequently, foreign investors’ participation in China’s lucrative local bond market has been limited to <2%, significantly less than the global norm of about 10%.

‘Bond Connect’ provides foreign investors better access to China’s local bond market

In this backdrop, the launch of the China-Hong Kong Bond Connect scheme (Bond Connect) by China on July 3, 2017—allowing overseas investors to invest in China’s local bond market via Hong Kong Exchanges and Clearing (HKEx)—marks a significant step in liberalising and elevating the county’s capital market to the levels of more developed international financial centers.

High likelihood of large global indexes entering China

Given the removal of access restrictions and the large size of the market, it should only be a matter of time before large global bond indexes—who cumulatively hold over USD4 trillion in AUM—start adding China’s local bonds to their asset allocations to achieve better diversification and enhanced returns.

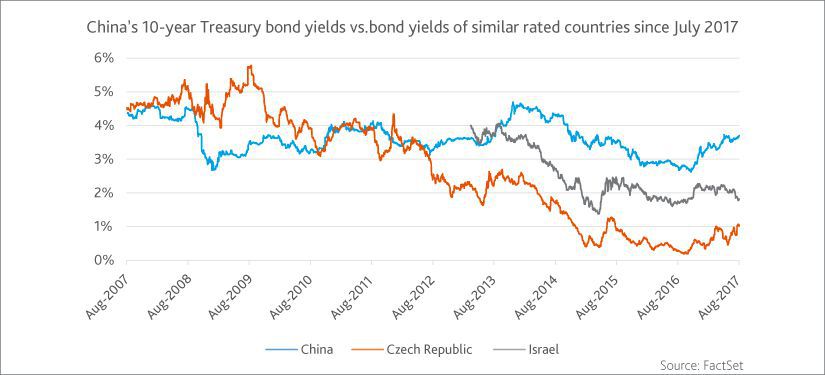

Another compelling reason to invest in China’s local bond market is the existing superior yields in China’s Treasury securities compared with that of countries with a similar credit rating. China’s bond yields have also been relatively stable compared with its peers. Contributing further to investor appetite would be China’s efforts to keep its currency stable.

MA Knowledge Services’ China operations are a compelling avenue for ground support

Despite all the encouraging prospects, one key factor that will continue to be a challenge for foreign investors is the difficulty to assess the credit quality of the corporate issuers in China. Restrictions on global credit rating agencies providing independent ratings and the lack of disclosures by most corporate issuers in China have contributed to investor concerns. Moreover, most companies in China report their results only in Mandarin. A recent decision by China to allow foreign rating agencies to provide credit ratings for issuances in the country will gradually address these issues; however, having a local market presence will continue to play a key role in achieving superior returns for foreign investors.

MA Knowledge Services—with its established research operations in Beijing and its strong track record in supporting global sell- and buy-side clients on emerging market issuers, including China—could help investors who are keen to benefit from the opportunities in China’s local bond markets, by establishing ground support in a fast, practical, and cost efficient way.

What's your view?

About the Author

Nuwan provides global leadership to the traditional asset management segment within the Investment Research Buy-side business unit. As a senior leader in Acuity Knowledge Partners’ (Acuity’s) Sri Lanka delivery centre, he provides oversight to the Buy-side research teams, including resource management.

Nuwan also spearheads the Colombo University Outreach programme, bringing Acuity’s global expertise to Sri Lanka’s brightest minds.

His journey started over 20 years ago as Sell-side Equity Analyst covering the mortgage-backed securities sector. After seven years in the domain, he moved to fixed income research to expand Acuity’s credit research franchise in the Sri Lanka delivery centre. Subsequently, he was appointed Head of fixed income, focused on..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox