Published on May 10, 2024 by Shekhar Jha

In recent years, the concept of sustainability has transcended its status as a mere buzzword, becoming a critical driver of business practices across various industries. In the realm of real estate, the integration of Environmental, Social, and Governance (ESG) principles has gained significant momentum, transforming the landscape of the US Commercial Real Estate (CRE) sector.

In this blog, we delve into the exploration of ESG principles within the realm of US Commercial Real Estate, examining the significance and benefits of integrating ESG principles into the real estate sphere.

Understanding ESG in US CRE

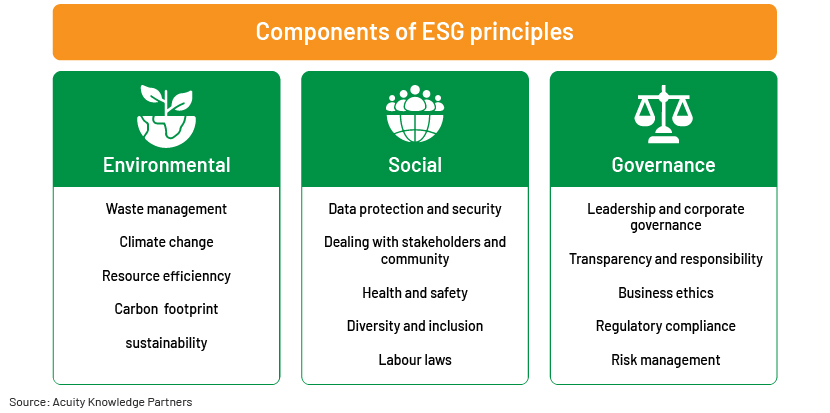

Environmental, Social, and Governance (ESG) criteria serve as a framework for evaluating the sustainability and ethical impact of an investment or business. In the context of US CRE, ESG principles encompass a wide range of considerations:

Environmental

:The environmental aspect addresses the impact of real estate operations and developments on the natural world. Green building certifications such as LEED (Leadership in Energy and Environmental Design) and ENERGY STAR have gained prominence, encouraging developers to prioritize energy efficiency, renewable energy, and environmentally responsible construction materials.

Social

:The social dimension of ESG focuses on the well-being of communities and occupants. Developers are increasingly incorporating features that promote the health and well-being of occupants, such as indoor air quality improvements, green spaces, and accessibility enhancements.

Governance

:Governance pertains to the ethical and transparent management practices of real estate companies. Companies that prioritize strong governance structures are better positioned to navigate challenges and deliver sustained value to stakeholders.

Benefits of ESG Integration

Integrating ESG principles into CRE practices not only aligns with sustainable and responsible investment goals but also offers numerous benefits for investors, tenants and communities alike:

Risk Mitigation

:ESG considerations can help identify and mitigate potential risks associated with regulatory changes, climate-related events, and social unrest. Companies that proactively address these risks are better positioned to protect their assets and maintain long-term value.

Here's how ESG considerations are contributing to risk mitigation in US CRE:

-

Climate Risk and Resilience: CRE properties are susceptible to climate-related risks such as flooding, extreme weather events, and sea-level rise. By incorporating ESG principles, investors and developers assess the vulnerability of properties to these risks and implement strategies to enhance their resilience. This might involve selecting locations less prone to climate hazards, designing properties to withstand extreme weather, and using sustainable building materials.

-

Regulatory and Legal Compliance: Adhering to ESG standards helps CRE firms stay ahead of evolving regulations and compliance requirements. Many districts are implementing stricter environmental and energy efficiency regulations. By proactively addressing these standards, companies can avoid fines, penalties, and potential legal issues.

In March 2022, the US Securities and Exchange Commission (SEC) released a draft climate-related disclosure proposal. Among other things, the proposal would require domestic and foreign SEC registrants to disclose qualitative information about climate-related risks and various quantitative metrics, including GHG emissions.

In March 2024, SEC enacted the first ever mandatory reporting on financial factors related to climate risk. This exercise of the agency's authority to protect investors is an important first step in ensuring that investors have clear, comparable and reliable data for use in their investment decisions.

-

Risk Management and Due Diligence: Integrating ESG considerations into due diligence processes can uncover potential risks associated with a property. This could include environmental contamination, social conflicts, or governance issues. Identifying these risks early allows investors to make informed decisions and respond appropriately to mitigate them.

Operational Efficiency

:Improving energy and resource efficiency in CRE properties not only reduces environmental impact but also lowers operational costs. Energy-efficient buildings consume less energy and water, leading to cost savings for property owners and tenants. This financial benefit contributes to risk mitigation by providing a buffer against fluctuating utility costs.

Insurance and Financing

:Some insurance companies offer favourable terms and rates for properties with robust risk management strategies, including those related to ESG considerations. Financial institutions are also becoming more inclined to offer financing to CRE projects that align with sustainable practices, recognizing their reduced exposure to long-term risks.

Companies with strong ESG performance can achieve lower cost of capital. They can gain access to cheaper debt and equity financing as financial institutions view them as lower risk.

A study published on ResearchGate shows that loan default risk for Green Buildings was 27% lesser compared to the non-green buildings.

Community Relations:

Social responsibility is a critical aspect of ESG. By engaging positively with local communities, CRE firms can reduce the risk of opposition to their projects, regulatory hurdles, and reputational damage. Involving communities in the planning and development process can lead to smoother project execution.

Enhanced Financial Performance

:Sustainable and well-governed real estate assets often outperform their non-ESG counterparts in terms of returns, rental rates, and occupancy rates.

According to the 2020 SG report by NAREIT, the US real estate investment trust trade body green building certifications can lead to up to 8% higher rental income and up to 31% higher sale premiums than realized for traditional buildings.

The Inflation Reduction Act (IRA) includes significant benefits to green buildings by offering increased deductions for installing solar panels, heat pumps and charging stations for electric vehicles.

Tenant Attraction and Retention

:Increasingly, tenants are prioritizing sustainability and wellness features when selecting office spaces. ESG-aligned properties offer an attractive proposition to tenants seeking spaces that align with their values and contribute to employee well-being and satisfaction.

According to the 2020 SG report by NAREIT, the US real estate investment trust trade body green building certifications can lead to up to 23% higher occupancy rates.

In the Subsequent version of this blog, we will discuss about the challenges and recent innovations associated with the integration of ESG principles in US Commercial Real Estate. We will also try to explore ideas as to how we can prepare ourselves for the future where ESG considerations hold immense importance for Commercial Real Estate.

Acuity and its prowess with the ESG for Commercial Real Estate:

Acuity Knowledge Partners is a leading ESG solutions’ provider in the realms of private markets and commercial real estate. We excel in the collection, integration, analysis, and communication of ESG information. Our experts have aided commercial real estate clients in gathering environmental metrics and have provided thorough evaluations of diverse green building certification systems worldwide. We ensure that emissions and energy usage data are accurately verified and audit ready. Additionally, we assist our clients in developing systems that adhere to regulatory standards, including the SFDR and EU Taxonomy. Our comprehensive ESG offerings span the entire maturity spectrum, facilitating the creation of solid ESG reporting infrastructures.

Sources:

Tags:

What's your view?

About the Author

Shekhar has four years of experience in financial and investment research, with a focus on commercial real estate assets. He has worked with Private Equity, Consulting and Valuation firms on a variety of research and analysis assignments. He has gained exposure to supporting a wide spectrum of Private Market client engagements (with RE focus) at Acuity.Shekhar is a CMA Level 3 candidate and holds a bachelor’s degree in commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox