Published on October 11, 2024 by Indradeep Biswas

A mortgage rate, or mortgage interest rate, refers to the amount of interest a lender charges on a mortgage loan extended to a borrower. The US 30-year mortgage rate is generally considered to be the benchmark in the US, as most homebuyers opt for it. Due to its long tenure, resulting in lower monthly instalments, the 30-year mortgage rate is more popular than other shorter-tenure interest rates.

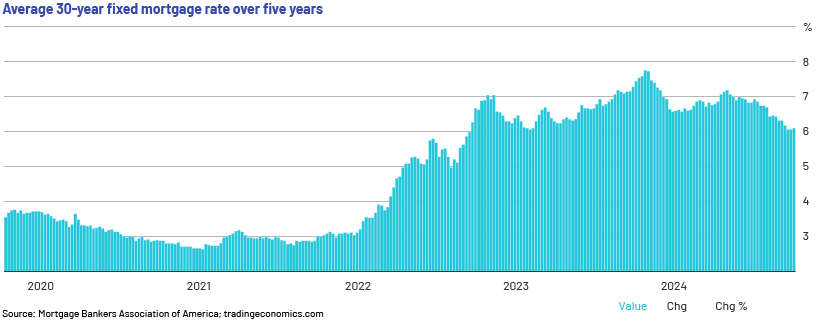

The US 30-year mortgage rate has been on a roller-coaster since the pandemic. After reaching its highest level of 7.22% at the beginning of May 2024, it dropped below 7% in early June 2024 and fell consistently until the third week of September 2024. A complex set of factors impact its volatility.

1. Inflation and interest rates and their relationship with the mortgage rate

Inflation and mortgage rates move in tandem, as interest rates are the basic tools used by central banks to control inflation. The Federal Reserve (Fed) targets average annual inflation of 2%, to promote maximum job creation and maintain price uniformity. In contrast, in times of lower inflation followed by a suspension of economic growth, central banks tend to lower interest rates to boost the economy. Usually, inflation causes upward pressure on the economy and fades the currency over time; hence, lenders also revise their mortgage rates to recover loss of value. Mortgage rates are directly correlated to bond yields. A rise in interest rates causes an increase in bond yields and vice versa. Hence, ongoing inflation, combined with bond yields, determines the mortgage rate.

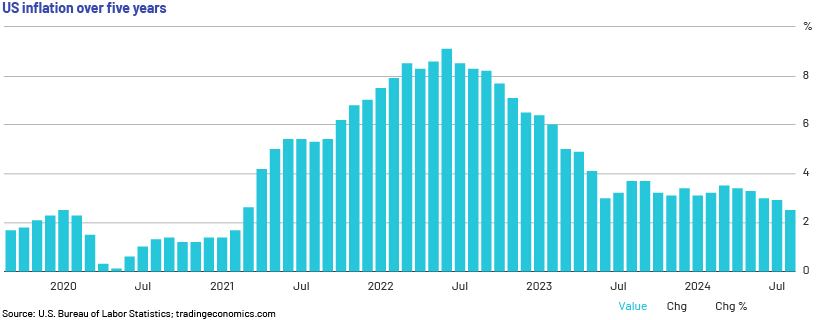

As the two charts above show, the direction of 30-year mortgage rates and US inflation is more or less the same. However, in some scenarios, we observe a discrepancy. Inflation skyrocketed from 2.6% in March 2021 to 6.8% in November 2021, while the mortgage rate continued below the 4% mark. Another inconsistency was during the second half of 2023, when the 30-year mortgage rate continued to increase from 6.67% to 7.79% while inflation remained at 3-3.4%.

Inflation declined by 2.5% in August 2024, the lowest since April 2021. With the decline in inflation, the mortgage rate also dipped in July 2024 and August 2024. The mortgage rate remained on a downtrend from the first week of July 2024 to the last week of August 2024 and currently hovers around the 6.15% mark. This is in line with market expectations of a Fed rate cut in September 2024 due to inflation easing.

2. Relationship between Treasury yields and mortgage rates

Mortgage lenders have historically linked their interest rates to Treasury yield, resulting in a positive correlation between the two and rates moving in tandem. Meanwhile, when the Treasury yield drops, mortgage interest rates tend to fall, resulting in a positive correlation with each other. On the other hand, it is known that Treasury yields and bond prices have an inverse correlation with each other. Hence, when bond prices are on the rise, Treasury yields become less attractive in the secondary market, as they offer a lower return at the current price. As bond yields become less attractive, a corresponding effect is observed in the mortgage rate as well.

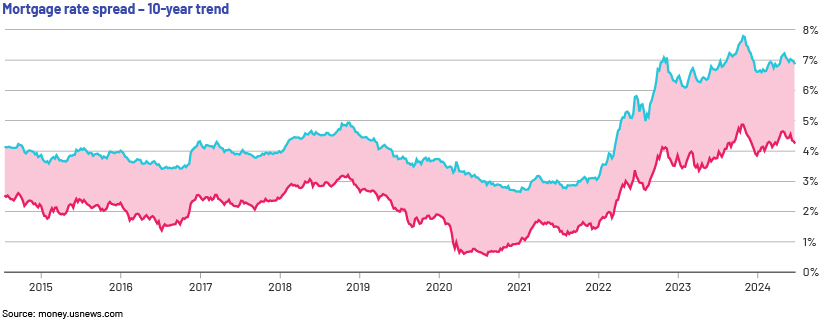

Although the 30-year mortgage rate and the 10-year Treasury yield move in the same direction, there is always a spread between the two. The spread has historically been between 160bps and 180bps, but it increased for most of 2023 and was closer to 300bps, which was surprisingly high. During the first half of 2024, the spread narrowed and is currently hovering around 250bps. Considering the historical trend, there is a large c.80bps spread correction expected soon.

3. Unemployment rate and US housing starts and their relationship with the mortgage rate

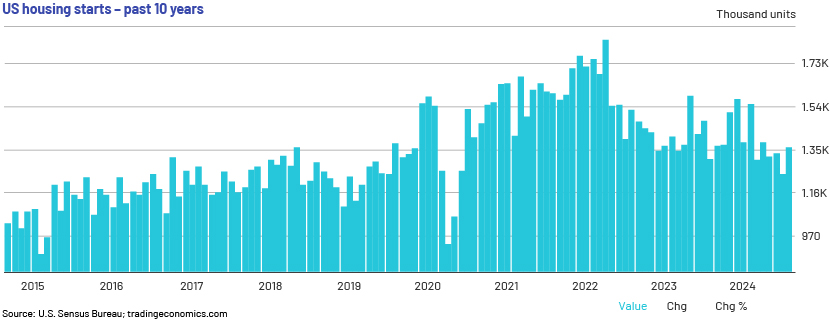

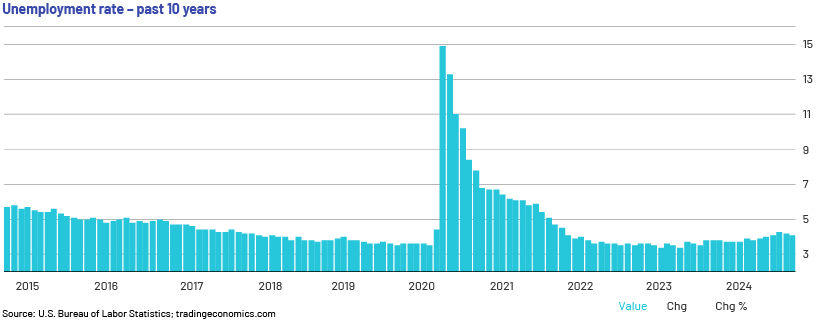

The unemployment rate is a major indicator that determines the economic health of the labour market and, subsequently, consumer purchasing capacity. Overall consumer purchasing power increases as the unemployment rate falls, supporting new-home construction activity, and vice versa. Hence, growth in new-home construction drives the mortgage rate higher, indicating that consumers are ready to pay more for new-home construction.

US housing starts have an inverse correlation to the unemployment rate. A higher unemployment rate suggests a weakening economy, producing fewer jobs and resulting in lower purchasing power. Hence, theoretically, consumers would refrain from new-home construction, resulting in sluggish housing starts. In the US, the unemployment rate indicates the number of individuals actively looking for a job as a percentage of the total labour force.

The past-10-year trend in housing starts indicates a gradual increase from 2015 to mid-2018, followed by a slowdown until August 2019. Simultaneously, the unemployment rate continued to decline (5.7% in January 2015 to 3.8% in July 2018), while it remained at 3.7-4% for the next one year. On the other hand, construction activity did not surpass the peak in May 2018 of 1.36k housing units as the jobless rate hovered at c.4% during the period and failed to show a marked improvement. Nonetheless, the unemployment rate was on a gradual downtrend until February 2020, before economic growth was arrested by the pandemic.

Before the historic dip in February 2020, new construction activity reacted the same way. It was at 1.55k and 1.58k units, respectively, in December 2019 and February 2020 – the highest since 2004. Due to the pandemic-related lockdown restrictions, new construction activity was at its lowest and was supported by a spike in the unemployment rate (which peaked at 14.9% in April 2020). The unemployment rate cooled over the next two to three years and hovered at 4.2% in August 2024.

4. Mortgage refinancing and its impact on mortgage rates

In terms of refinancing mortgage loans, mortgage borrowers refinanced their mortgages in 2020 and 2021, when rates were at record lows. They spiked at the start of 2022 owing to the Russia-Ukraine war, which resulted in elevated interest rates due to heightened inflation. However, from October 2023 to the first half of 2024, the mortgage rate declined from its all-time high of 7.9%; it is currently hovering at c.7%. The mortgage refinancing rate also stands at 6.96%. As soon as both rates return to 2021-22 levels, i.e. 3-6%, we are unlikely to see major demand for refinancing.

Americans traditionally tend to refinance their mortgages when the rate drops. The average 30-year mortgage rate was c.6.9% in mid-July 2024, but the average mortgage rate on all outstanding mortgages was only 3.8%. This is much higher than the 3.3% in January 2024, when the Fed started to hike interest rates. Many homeowners locked in their borrowing amid low interest rates, as this would not take a toll on their spending. Millions, therefore, are not feeling the bite of the higher mortgage rate.

Current market sentiment

The recent trend suggests that Americans, on average, are spending just 9.8% (as of 4Q 2023) of their post-tax income on monthly repayments of their overall borrowings. However, this is only 30bps higher than the Fed’s rate hike in 2022. According to the study, a major part of household debt was made up of refinancing mortgages at a very low rate during the past one and half decades, as the Fed kept the interest rate at nearly zero in an effort to boost the economy. As a result, these mortgages, which accounted for a large part of overall borrowings, have remained largely unaffected despite the Fed’s rate hikes in recent years.

Young Americans have been increasingly concerned about the heightened mortgage rate in the past two years and are sceptical about new-mortgage financing. As a result, refinancing demand is still 70% lower than in early 2020, when the mortgage rate was roughly 3.5%.

However, we have seen a reversal in 2024; the 30-year fixed rate mortgage fell to 6.15% in September 2024, the lowest since March 2024. This spurred existing home loan borrowers to refinance, which they had not been able to do since August 2022. Refinancing of home loans surged 15% in the second week of July 2024 versus a year ago. This suggests a recovery in the refinancing market as borrowers expect a drop in the mortgage rate in the coming months.

How Acuity Knowledge Partners can help

We have more than 20 years of experience in supporting global banks across the loan lifecycle. Our retail lending services offer origination, processing, underwriting, closing and post-closing support across consumer mortgage and other retail products, covering the range of basic to complex tasks. Leveraging a mix of people, process and technology, we provide tailor-made solutions to our 90+ banking clients in the retail, business, middle-market, real estate and leveraged finance segments.

Sources:

-

Mortgage Forecast: Will Rates Go Down in 2024? | U.S. News (usnews.com)

-

Inflation and Interest Rates Relationship Explained (investopedia.com)

-

Mortgage Forecast: Will Rates Go Down in 2024? | U.S. News (usnews.com)

-

Powell opens key week of Fedspeak as rate cut case develops | Reuters

-

World Economic Outlook (April 2024) – Unemployment rate (imf.org)

-

Mortgage refinance demand jumps to a 2-year high, as interest rates drop (cnbc.com)

-

The Relationship Between Inflation & Mortgage Rates | The CE Shop

-

United States MBA 30-Yr Mortgage Rate (tradingeconomics.com)

What's your view?

About the Author

Indradeep Biswas has been associated with Acuity Knowledge Partners for more than 2 years in lending services. He has worked in asset-based lending, credit review reports and other lending operations projects for international banking and financial companies.

Prior joining to Acuity he worked in Equity Research wherein he covered both international and domestic markets.

Indradeep holds a PGDM in Finance from the All India Management Association (AIMA), and a B Com in Accountancy from Calcutta University.

Like the way we think?

Next time we post something new, we'll send it to your inbox