Published on June 25, 2020 by Ankit Agrawal and Sharmi Basu

-

Market analysts expect USD200-250bn worth of “fallen angels” in the US in 2020, representing 3.5-3.7% of investment-grade debt, more than the record USD100bn downgraded in 2005

-

Over USD300bn worth of global debt was relegated to the fallen angel category by end-May 2020, with 30 issuers downgraded in the first five months of the year (six in May 2020)

-

Fallen angels have outperformed the broader HY bond market by approximately 4.0 percentage points annually over the past two decades

The coronavirus pandemic, coupled with a sharp fall in oil prices, has triggered a supply-demand shock and affected global financial markets. However, this scenario presents a number of opportunities for asset managers (refer to our previous blog for details here), including purchasing “fallen angels” (i.e., companies whose bonds were investment-grade when they were issued but have been downgraded). Risk aversion owing to uncertainty resulted in a sharp sell-off in credit assets in March and April 2020. This also put the credit ratings of companies under pressure, and we saw a spate of downgrades from all credit rating agencies in April and May, with some of the largest players, such as Ford Motors and Occidental Petroleum, being downgraded to high yield (HY).

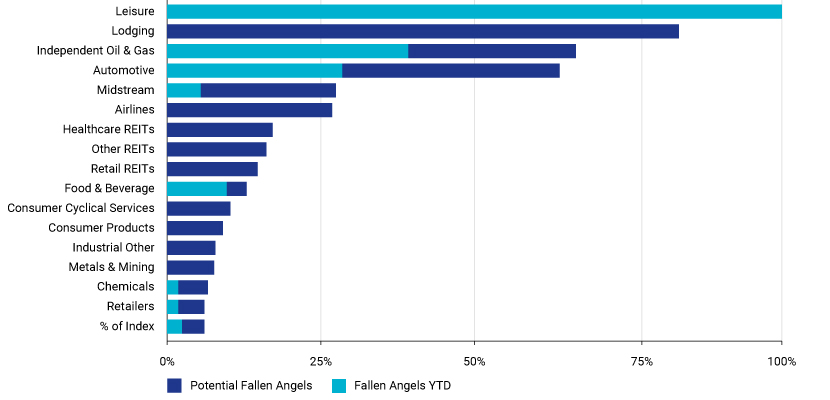

Companies rated Baa face the highest risk of entering the fallen angel category, presenting the most lucrative opportunities for investors. The highest risk of fallen angels are in sectors such as leisure, lodging, retail energy (including the oil and gas sector) and transportation – the sectors worst hit by the pandemic and oil price crash. The larger, more diverse universe suggests that the supply of fallen angels would be much higher this time around. Estimates from rating agencies and sell-side research suggest that supply could increase to 25-35% of the HY universe in the next 12 months.

Fallen angel risk is spread across sectors - % of Bloomberg US Corporate Index sectors at risk of downgrade to HY

Source: GSAM estimates based on company data (as of 5 April 2020)

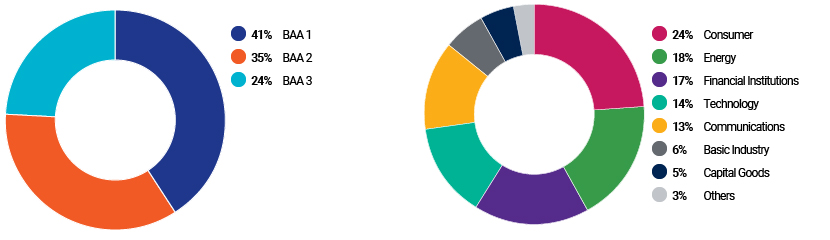

The crossover category – Supply and opportunity

The market value of Baa rated debt of the US corporate index is marginally shy of USD2.5tn, of which USD603.7bn was rated Baa3 by Moody’s in March 2020. The market value of Baa3 rated bonds declined from about USD725.0bn in February 2020 on price erosion and downgrades. Of the USD603.7bn, the market value of corporate bonds at risk of becoming fallen angels surged to about USD350.0bn in March 2020.

The US Baa universe and the composition of Baa3 rated debt by sector

Source: Bloomberg.com

At end-May 2020, 121 issuers were at risk of being downgraded to junk; these accounted for USD375.8bn in bonds in the ICE BofAML Corporate Bond Index, representing ca 28% of the ICE BofAML US High Yield Bond Index. This excluded 21 issuers (amounting to USD143.7bn) that had already been reconstituted in the ICE BofAML US High Yield Bond Index from the ICE BofAML Corporate Bond Index.

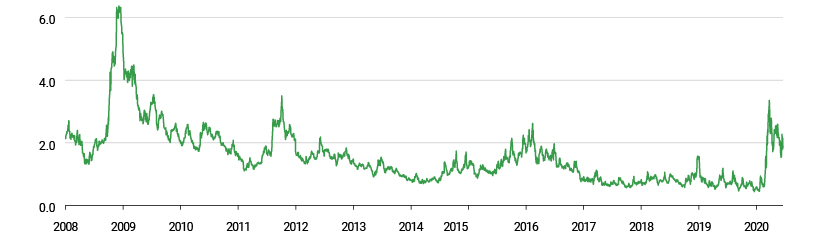

As companies are downgraded, their spreads widen to accommodate the increased risk. While the difference in spreads between BBB and BB rated bonds ranged from 60-90bps from 2018 through to 24 February 2020, it spiked to 335bps in March 2020 (190bps on 17 June 2020), after the global spread of the disease (vs its highest level of about 650bps during the global financial crisis in 2008-09).

The yield gap between ICE BoFA US BBB and BB Indices (effective yield, in percentages)

Source: FRED

Fallen angels have outperformed their peers

Fallen angels have historically outperformed their peers, mainly due to the upside on pricing, after the sell-offs following the rating downgrades. For instance, the VanEck Vectors Fallen Angel HY Bond ETF generated an annualised return of 6.8% since its inception in April 2012 to April 2020, higher than the 2.9% annualised return generated by the iShares iBoxx USD High Yield Corporate Bond ETF. The Bloomberg Barclay’s US HY Fallen Angel 3% Cap Total Return Index rose 84% during the 2008-09 financial crisis (November 2008 to December 2009), after falling 29% from July to November 2008. The Index increased a steep 165% from end-2009 to 17 June 2020, after factoring in an 18% fall in March 2020 alone. Overall, fallen angels returned 400bps more than HY indices on an annualised basis from January 2000 to April 2020, especially outperforming them during a financial crisis or liquidity crunch.

Historical comparative returns – US fallen angels vs US HY

Source: VanEck

Finding diamonds in the rough

As evidenced by the trajectory of fallen-angel funds, the current economic shock has created a lucrative basket of opportunity for investors expecting steep gains after the dust settles. Although we at Acuity Knowledge Partners believe the market has yet to hit rock bottom, as the pandemic has yet to plateau, we think the time is ripe to track the market and cherry pick investments at the opportune moment. We support the largest asset managers globally in identifying such opportunities through rigorous investment research and analysis.

Summary-

“The current pandemic to offer fixed income investors with opportunities to earn lucrative returns through exposure in bonds of fallen angel”

Sources:

Bloomberg.com

VanEck.com

FactSet

Standard & Poors

Financial Times

Moody’s

Tags:

What's your view?

About the Authors

Ankit has close to 12 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Sharmi Basu has 11+ years of experience in fixed income research with a focus on Utilities, Telecom, Automobile and Retail sectors. Over the course of this time, she has worked for asset managers and hedge fund managers across the US and Europe and UK, helping them make investment decision by preparing detailed credit reviews – including detailed forecast based models with opinionated investment notes on corporates. Currently, she is supporting a large global asset management firm and covers US and European issuers across sectors for investment purposes and monitoring the portfolio on a day-to-day basis. Sharmi holds a Master of Business Administration (Finance) and a Master of Science..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox