Published on August 27, 2021 by Manish Mohan Raj

The UK Financial Conduct Authority (FCA) recently published its business plan for 2021/22 and annual report for 2020/21. In this blog, we summarise the key focus points.

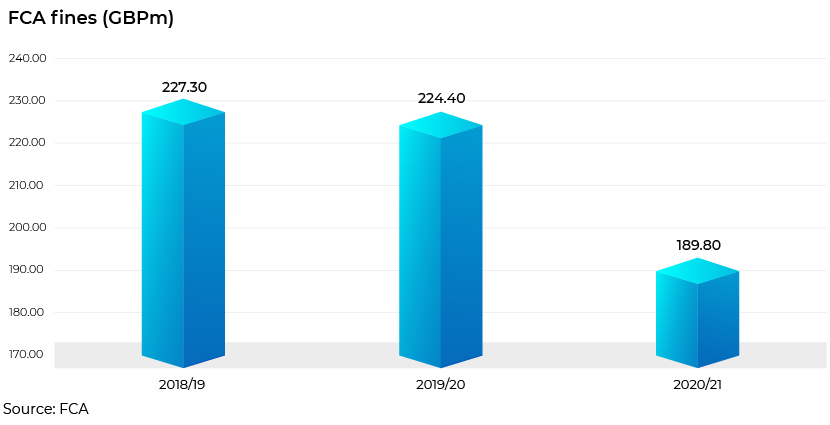

The FCA issued 134 final notices (119 to firms and individuals trading as firms and 15 to individuals), secured 147 outcomes using its enforcement powers (144 regulatory/civil and 3 criminal) and imposed 10 financial penalties totalling GBP189.8m.

Consumer priorities:

The FCA’s priorities are to cater to consumer primacy in the coming year and improve consumer outcomes through the new Consumer Duty. It aims to continue its efforts from last year, highlighting the following priorities:

-

enabling effective consumer investment decisions

-

ensuring consumer credit markets work well

-

making payments safe and accessible and

-

delivering fair value in a digital age

-

Enabling consumers to make effective financial decisions: The FCA aims to increase consumer confidence, help investors understand the risks being taken and make them aware of the regulatory protection available. The FCA seeks to reduce harm to consumers from unsuitable advice and inappropriately risky investments. It sees cryptoassets as a very high-risk investment that is currently not regulated; hence, if investors want to invest in them, it warns that they should be prepared to lose all their money. The Treasury has also published a consultation paper to extend the financial promotion rules for investment in cryptoassets so that appropriate warnings are a requirement. It has also published a consultation paper and call for evidence on the broader regulatory approach to cryptoassets. Making payments safe and accessible: With the growth of payments in the services sector, the FCA requires consumers and smaller businesses to be able to safely access a variety of payment services. The FCA is working with the Treasury to develop policy and recommendations on payments, e-money and cryptoassets, following its call for evidence last year as part of its Payments Landscape Review.

-

Consumer Duty: The FCA is currently consulting on a proposal for Consumer Duty to set clearer and higher standards for firms’ culture and conduct. The consultation concluded on 31 July 2021. The FCA will finalise and introduce any new rules before the end of July 2022.

FCA priorities across markets:

The FCA has outlined key focus areas on important cross-market issues. It also intends to work on its website and the Regulatory Initiatives Grid that provide information on the timing of further initiatives that may have a significant operational impact on firms.

-

Fraud strategy: The FCA highlights that with the increase in the volume and variety of fraudulent activity in the UK, it will continue to work with its partners. It is looking at a collective effort to tackle fraud and will work closely with the Home Office, the National Economic Crime Centre and law enforcement agencies.

-

Financial resilience and resolution: The FCA is looking to minimise the harm and loss to customers and markets when firms fail. It intends to do the following:

-

Introduce the Investment Firms Prudential Regime (IFPR) for investment firms

-

Strengthen data-driven monitoring of the financial resilience of self-regulated firms

-

Automate and combine financial resilience data with other data on firms that the FCA holds

-

Tackle the root causes of harm that create compensation liabilities through the Consumer Investments Strategy and improve firms’ financial strength to reduce the number of disorderly failures

-

-

Operational resilience: With the disruption caused by the pandemic, the importance of firms maintaining their services despite moving to remote working was highlighted, as were challenges to their control environments and the need to ensure staff wellbeing. The FCA has published its final operational resilience policy statement and shared the policy summary with the Bank of England and the Prudential Regulation Authority (PRA). The policy statement shows the FCA requires firms to be better prepared to prevent, adapt to, respond to, recover from and learn from operational disruptions.

-

Environmental, social and governance (ESG): ESG factors play a central role in the transition to a low-carbon economy and a more sustainable future. The FCA aims to support this by adapting a regulatory framework to enable a market-based transition. The FCA plans to achieve this by doing the following:

-

Implementing disclosure rules in line with the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD). The FCA is consulting on new disclosure rules for asset managers, life insurers and FCA-regulated pension schemes linked to the TCFD’s recommendations

-

Bringing the new rules into force from 1 January 2022, which would standardise climate-related disclosures by listed companies and other FCA-regulated market participants

-

Working to address concerns about greenwashing

Wholesale market priorities: The FCA continues to focus on market integrity, which would foster confidence, trust and the level of participation in wholesale markets and will be reflected in the effectiveness of the markets.

-

Review of rules in primary and secondary markets: The FCA has published two consultation papers proposing amendments to the Listing Rules. These papers include a more robust framework for listing by special-purpose acquisition companies (SPACs) and entry requirements for new commercial company listings. Considering retail investors can buy shares in SPACs, the proposal aims to strengthen key investor protections while supporting access to capital markets for issuers seeking to list and improve investment choices.

-

Market abuse and financial crime: The FCA is looking to be effective in preventing market abuse and reducing the risks of financial crime for the firms it regulates. It aims to achieve this by continuing to monitor transactions in financial instruments reported to it, assess Suspicious Transaction and Order Reports (STORs) and follow up on intelligence from whistleblowers of financial crime or fraud.

-

Asset management and non-bank finance: The UK investment management sector manages the savings and pensions of millions of people across the UK, the EU and globally. The FCA aims to ensure that firms offer products to clients that have fair value, meet their investment needs and offer an appropriate level of protection. Marketing campaigns and disclosures related to these products need to be fair, clear and not misleading. The FCA aims to achieve this by increasing supervisory focus on asset managers to present ESG properties of the funds relating to fairness, clarity and non-misleading statements. Based on a publication of “host” authorised fund managers, the FCA has identified weaknesses in governance structures, managing conflicts of interest, operational controls and oversight of third-party investment managers.

-

Regime of appointed representatives: The FCA has noted increased problems from principal firms with poor due diligence and oversight by their appointed representatives (ARs). The focus is for principals and ARs to be competent and financially stable, and ensure fair outcomes for consumers when selling products or giving advice. The FCA plans to implement more targeted supervision to reduce the most significant risks from ARs in wholesale markets.

Acuity Knowledge Partners’ solution

We aim to create an approach that develops controls that are dynamic, robust and proficient in addressing risk at all levels of a company. We are experienced in identifying and reviewing gaps in compliance programmes, meeting regulatory requirements and providing unique solutions with the help of our state-of-the-art technology.

With our focused set of offerings in the areas of forensic analysis, compliance testing, monitoring programmes, risk trend analysis and risk mitigation, we customise and design reviews dedicated to mitigating your company’s risks, keeping the latest regulatory expectations in mind. We offer a well-thought-through approach – from initial analysis to end documentation and recommendation – to provide you with a holistic view of your business’s risks and how to safeguard it.

Sources:

https://www.fca.org.uk/publications/business-plans/2021-22

https://www.fca.org.uk/publications/annual-reports/our-annual-report-accounts-2020-21

Tags:

What's your view?

About the Author

Manish is the delivery manager and subject matter expert for the forensic testing compliance practice. He has over 8 years of experience in the financial services industry. Prior to joining Acuity Knowledge Partners he worked as an associate with Goldman Sachs – GSAM Compliance. He was part of the global forensics team and was part of the marketing and portfolio management compliance team. Manish was also part of the controls management team for the asset & wealth management team at JP Morgan and was part of the HSBC KYC remediation team for multiple lines of business.

Like the way we think?

Next time we post something new, we'll send it to your inbox