Published on June 4, 2024 by Sudhir Shetty

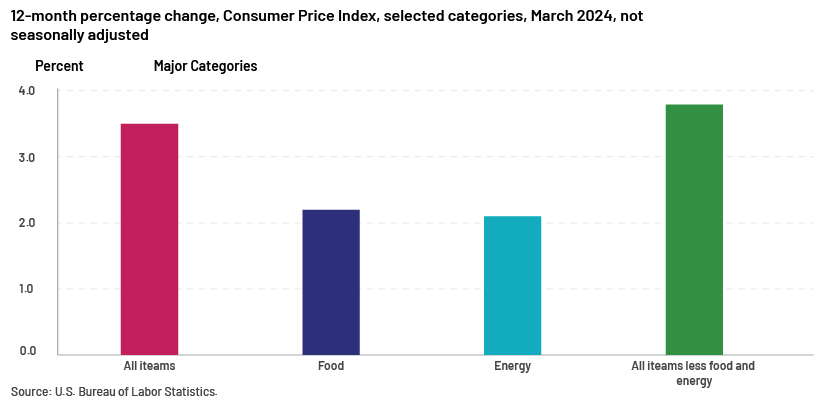

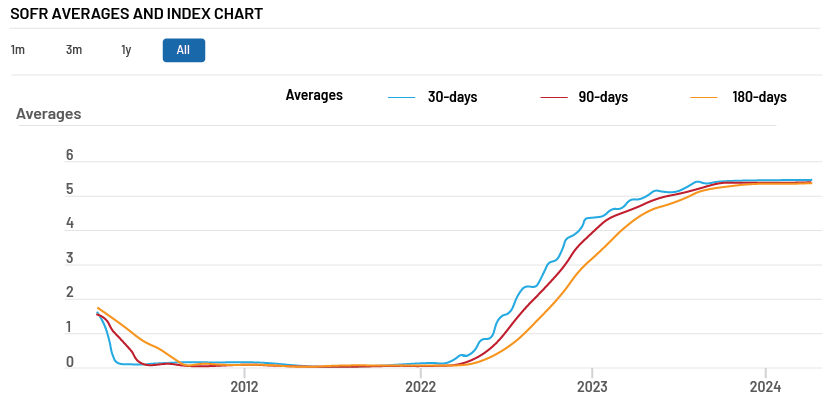

The higher-for-longer interest rate regime that peaked in July 2023 was expected to ease in early 2024. In the US, however, sticky inflation data, high consumer spending and other macroeconomic indicators have meant that the Federal Reserve (Fed) would wait for more clarity before reversing interest rates. The previous estimate of three rate cuts in 2024 is unlikely to materialise; a solitary rate cut is likely when the Fed meets in September (before the US presidential elections in November). At its meeting in May, it kept interest rates unchanged, stating that it wants inflation to trend down sustainably to its 2% target.

Source: SOFR Averages and Index Data – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

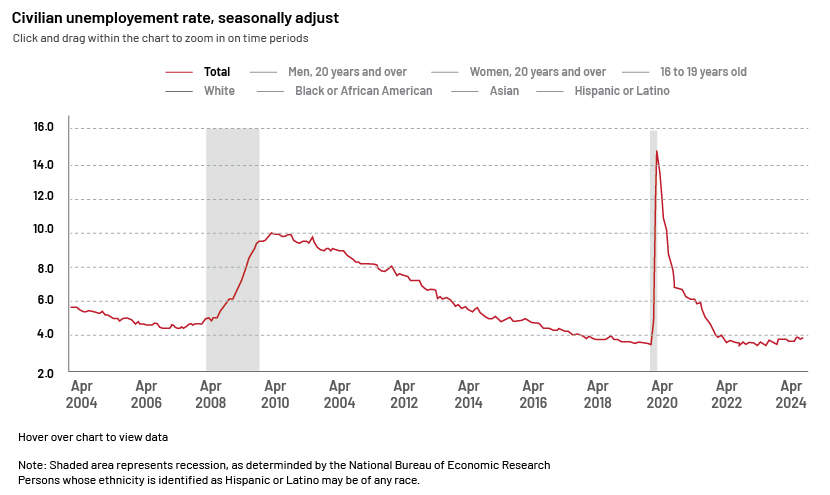

Unemployment rates and non-farm payroll data

The April 2024 non-farm payroll (NFP) and unemployment data should boost hope of a Fed rate cut at its September FOMC meeting. NFP data showed that only 175k jobs were added in April (315k jobs added in March) versus expectations of an addition of 238k jobs. The unemployment rate inched higher to 3.9% in April (from 3.8% in March). However, a September rate cut could also be counter-productive for the Fed, as it may be seen as influencing the electorate before the elections in November.

Geopolitical tensions, starting with the Russia-Ukraine conflict in early 2022, do not show signs of easing – in terms of a permanent ceasefire (with Vladimir Putin being re-elected as president). The Israel-Gaza flare-up could lead to a larger, West Asia crisis, already evident in the impact on the movement of cargo ships near the Strait of Hormuz. High oil prices will most likely result in higher inflation, trickling down to central banks taking policy decisions on reversing interest rates in the coming months.

Lenders are trying to balance riskier borrowings and focusing on higher credit quality.

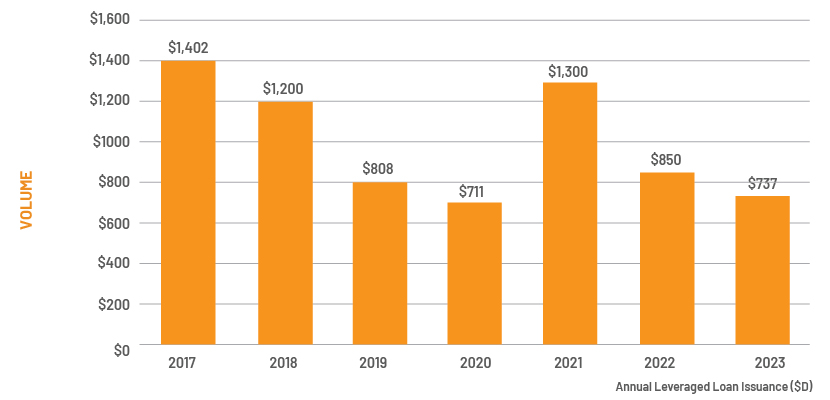

Leveraged lending issuance trends in the US in 2023

-

Leveraged loan new issuance was USD737bn (down 13% y/y)

-

Total syndicated lending was USD2.4tn (down 19% y/y)

-

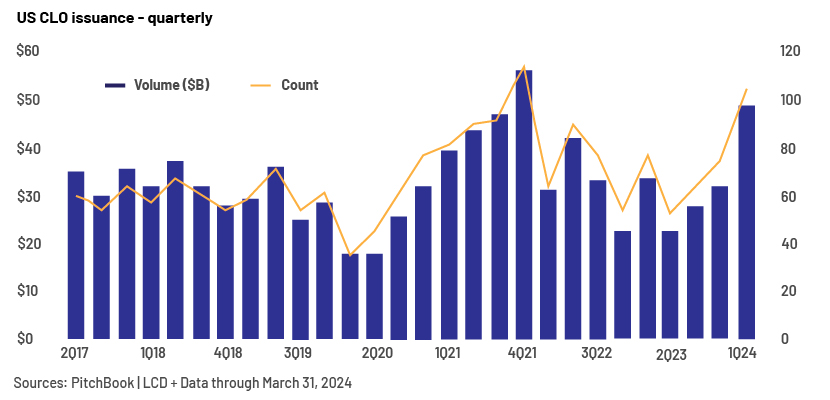

CLO new issuance was USD115.6bn (down 10% y/y)

-

Broadly syndicated lending (BSL) CLO new issuance was USD88.9bn (down 23% y/y)

-

The only silver lining was in middle-market/private-credit CLO issuance, which more than doubled to USD26.7bn

Higher interest rates, a weak M&A pipeline and banks’ conservative credit outlook resulted in refinancings, repricing, amend and extend (A&E) transactions and dividend recapitalisations dominating the loan markets in 2023.

In a tightened credit environment, A&E transactions performed strongly, reaching an all-time high of USD175.9bn in 2023 (c.USD110.1bn in 2021). With c.USD329bn of leveraged loans maturing in the next two years and a further c.USD532bn maturing in 2028, A&E and refinancing transactions would be the space to watch.

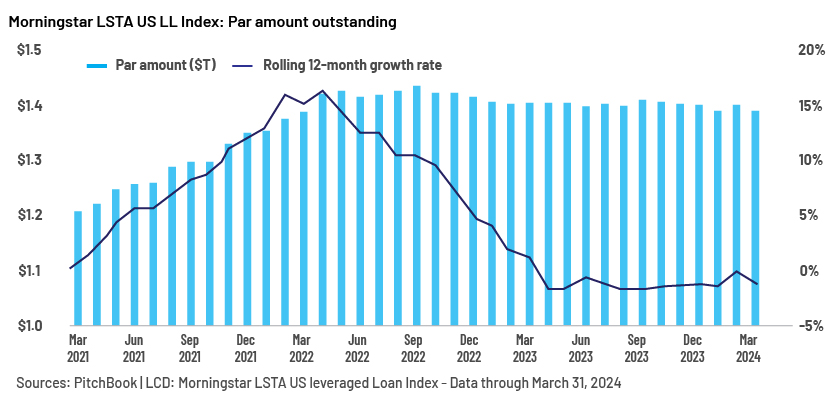

Around 90% of US leveraged loans were covenant-lite in 2023 (as in 2022), according to Pitchbook/LCD. Direct lenders are also accepting lighter financial covenants and pricing in their facilities with a view to increasing market share. The direct-lending market was worth USD1.4tn in 2023 (similar to the leveraged loan market).

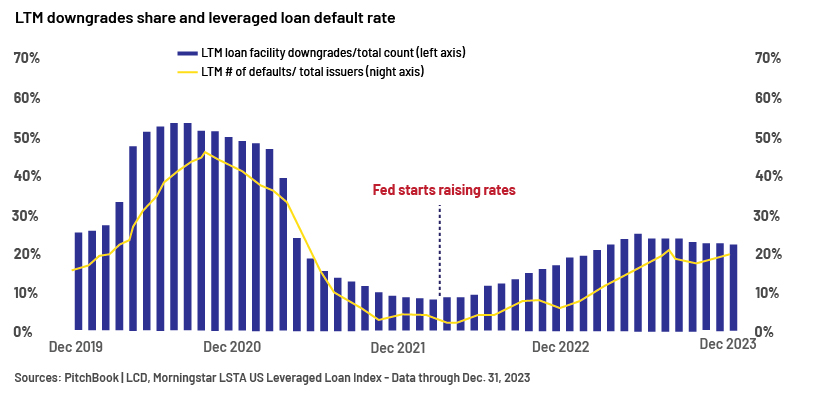

Higher interest rates resulted in the default rate among distressed borrowers increasing to 3.04% in 2023 (1.6% in 2022), with loan default volumes of USD50.5bn, according to Fitch Ratings. Fitch expects the leveraged loan default rate to increase to 3.5-4.0% in 2024, mainly impacting sectors such as healthcare, telecom and technology.

Corporate bankruptcies peaked in 2023, with 642 bankruptcy filings (an increase of 72.5% from 2022), according to S&P Global Market Intelligence.

Leveraged lending loan agreement terms in 2023

-

Leverage ratios to be set appropriately, in line with commercial realities

-

Borrowers should have limited access under the loan agreement to free up assets to support additional borrowings

-

Higher interest rates have resulted in the inclusion of multiple financial ratios. Middle-market transactions would include financial ratios such as the maximum senior secured net leverage ratio, the minimum consolidated interest cover ratio and the minimum liquidity test

-

Higher interest payments for borrowers with weak liquidity profiles have resulted in payment-in-kind (PIK) interest provisions.

-

EBITDA addbacks

-

Lenders are paying attention to speculative addbacks, including extraordinary and unusual items of expenditure

-

Run-rate cost saving was capped at 15% for large-cap BSL markets

-

Run-rate cost saving was capped at 10% of consolidated EBITDA for middle markets, while the overall cap was as low as 5%

-

1Q 2024 volumes and other trends

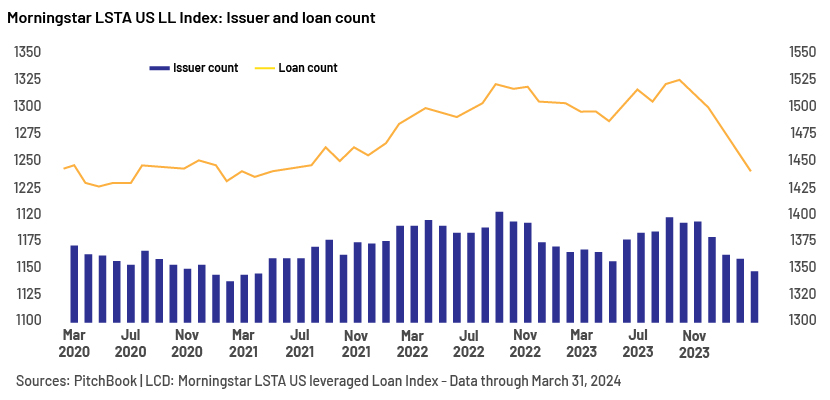

Lower M&A activity reflects the reduction in outstanding loans and borrower count in the index in March 2024, according to Pitchbook/LCD.

Senior secured lending in the US was c.USD167bn while high-yield bond issuance was c.USD85bn in 1Q 2024.

During the first quarter of 2024, managers issued c.USD48.8bn in broadly syndicated and middle-market CLOs across 106 transactions.

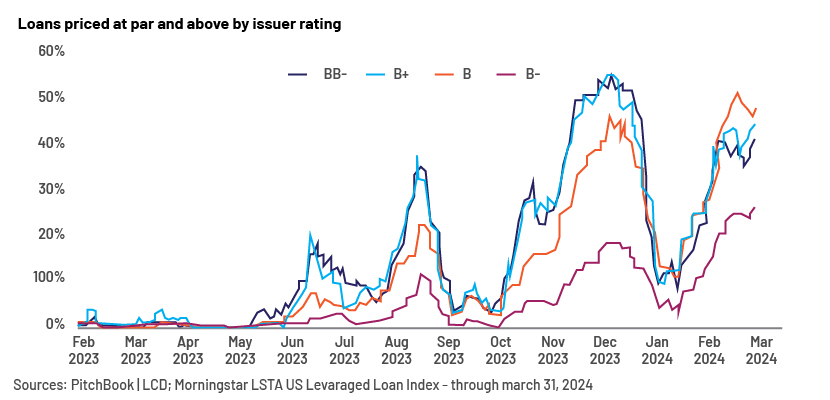

The above graph shows that lenders seem to have developed higher risk tolerance towards companies rated B- for the period ended March 2024 (demonstrated by better or at par pricing for B- companies). These riskier loans accounted for c.26% of the overall loan market by par amount outstanding (the most for any rating category).

Outlook

Although the current geopolitical scenario, higher-for-longer interest rates, US presidential elections and other macro indicators paint a bleak picture, investors remain optimistic given the clear direction provided by the Fed.

M&A activity is expected to boom given pent-up demand and capital availability at lower interest levels (once interest rates are reversed). Private credit had >USD400bn in investible funds as of September 2023, according to S&P Global.

Barclays forecasts US CLO issuance of USD135-145bn in 2024, driven primarily by BSL CLO activity (USD110-115bn).

However, focus will likely be on keeping track of borrowers with weak credit indicators, as default rates are expected to increase in 2024 given the current economic conditions. Elevated interest rates and costs of labour, healthcare and oil and gas would have a bearing on the liquidity profiles of leveraged borrowers in 2024.

How Acuity Knowledge Partners can help

We continue to empower our stakeholders through constant monitoring of leveraged debt, delivering innovative solutions to new challenges, timely alerts on the latest news and detailed projections with quality credit reports so they could take action-oriented decisions.

Sources:

-

https://finance.yahoo.com/news/bofa-forecasts-110b-2024-clo-060000136.html

-

US leveraged loan Weakest Links count rises in 2023 as debt costs soar – PitchBook

-

What’s Market: 2023 Year-End Trends in Large Cap and Middle Market Loans (americanbar.org)

-

Leveraged Finance Insights: First Quarter 2024 | PineBridge Investments

-

Leveraged Loan Insight & Analysis – 4/22/2024 – The Lead Left

-

Barclays raises 2024 US CLO issuance forecast to USD135-145B – PitchBook

-

12-month percentage change, Consumer Price Index, selected categories (bls.gov)

-

SOFR Averages and Index Data – FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org)

Tags:

What's your view?

About the Author

Sudhir has over 15 years of experience working with leading global organizations in the credit-rating and commercial-lending domains. Currently, he is part of a commercial-lending team that works with a large Canadian Bank supporting their alternate finance team. Prior to this, he supported the commercial-lending teams of a large European banks and was responsible for communicating with the origination teams, writing annual and interim credit reviews, responding to risk queries and performing post-credit-sanction formalities. Prior to joining Acuity, Sudhir worked for a leading rating company and supported the US public-finance domain, both in his individual capacity and in the capacity of a team lead. Sudhir holds a Master in..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox