Published on September 17, 2024 by Vishakha Sinjani

Since its inception, the US housing market has continued to evolve, influencing the national and global economies materially. Despite being central to the major crises in the sector, such as the 2008 subprime mortgage crisis, it remains integral to the American dream. Real estate brokerage Redfin reported that the US housing market was valued at a record USD47tn in February 2024, as low inventory drove up prices.

Housing investments, which are capital-intensive and typically loan-financed, are affected by mortgage rates, which are closely tied to the Federal Open Market Committee’s (FOMC’s) interest rates. Higher rates make borrowing costlier, reduce inflation and slow the economy. The FOMC raised rates 11 times between 2022 and mid-2023, maintaining the status quo since then. Notwithstanding the aggressive rate hikes to combat inflation, the country has avoided recession, due mainly to robust consumption expenditure and a stronger-than-expected labour market. However, such hikes and other economic factors have significantly impacted the US real estate sector.

Supply-demand dynamics

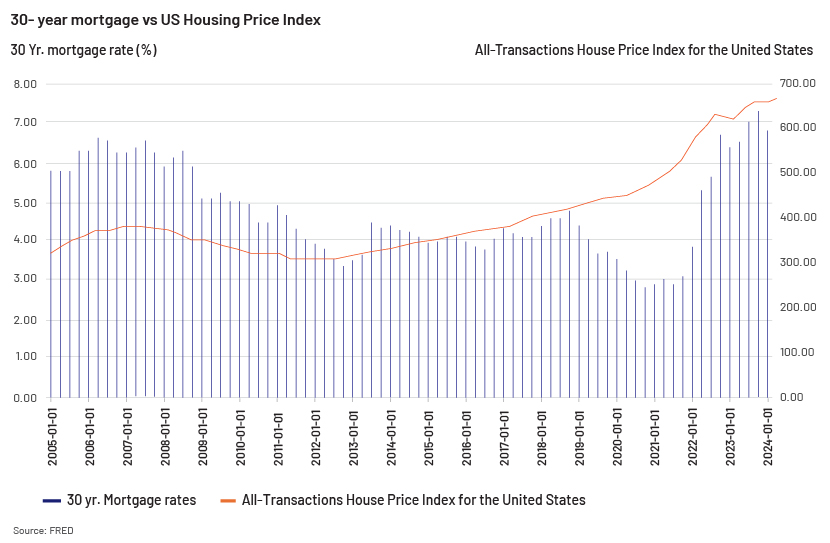

House prices in the US have peaked, making houses less affordable relative to income and mortgage rates. The mortgage rate has stood at c.7%, on average, since October 2022. According to , the median sales price of houses sold in the US increased c.13 times to USD420,800 in 1Q24 from USD32,500 in 1Q05.

Since 2020, domestic house prices have scaled up at unparalleled rates as the US economy re-emerged from the pandemic-induced slump that year. Rock-bottom mortgage rates (refer to left graph) and the shortage of houses on sale were the main driving forces. Interest rates have been on an upswing since then; this, together with the existing house shortage and growth in the number of millennials looking for larger houses to raise families, has compounded the problem.

In the graph above, the 30-year mortgage rate – the mortgage rate on a house loan with an amortisation term of 30 years – is plotted along the primary Y axis. The US All-Transactions House Price Index (USSTHPI) is plotted along the secondary Y axis, representing the average change in single-family house prices, with 1980 as the base year.

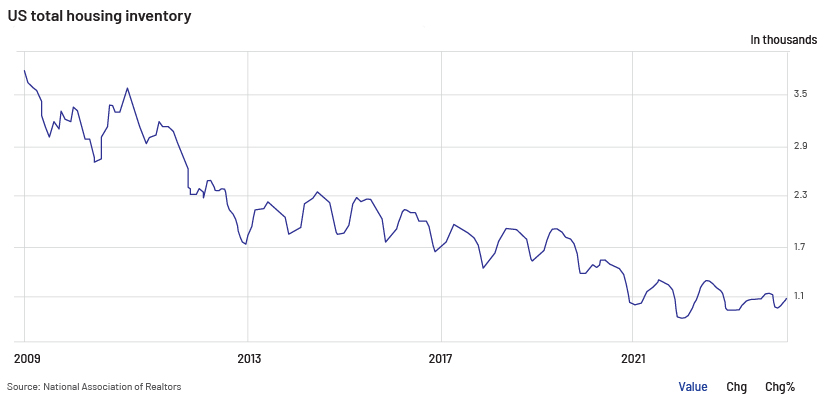

Existing house sales fell 1.9% annually to a seasonally adjusted annual rate of 4.14m units in April 2024, according to the National Association of Realtors. The data suggests that housing inventory peaked in this month in the last two and a half years but did not have enough share of entry-level houses, due to high interest rates and diminished purchasing power owing to high .

This makes it imperative to study the affordability factor in detail. The US has a total deficit of 1.2m single-family housing units and 800,000 other units, according to Moody’s.

Financial services company Morningstar reported in September 2023 that most market participants were of the opinion that the FOMC would likely begin cutting rates starting 2024, assuming that the FOMC would be able to curb inflation to the desired level amid expected slowing economic growth. In 3Q23, however, the US economy grew at a significant 4.9% (annually), followed by 3.4% (annually) in 4Q23 (vs consensus estimate of 1.9%), prompting anticipation of a rate cut from mid-2024, as per Forbes.

Real GDP grew 1.3% annually in 1Q24, according to the ‘second estimate of the US Bureau of Economic Analysis’. This prompted market participants to revisit their stance on rate changes. Banks, including Morgan Stanley, now expect the Fed to cut rates in September 2024 as inflation slows. Consumer price index inflation cooled slightly in May 2024 to 3.27% (vs 3.36% in April 2024), while personal consumption expenditure growth in May 2024 came in at 2.56% (vs 2.68% in April 2024).

Scenario 1: Unchanged rates – ‘higher for longer’ and impact on prices and demand & supply

In its June meeting, the FOMC held the rates unchanged for a seventh consecutive time, expressing satisfaction with inflation’s trajectory. Nonetheless, it admitted the slowdown was not quick enough to cut rates. Later, JP Morgan reported that the FOMC was likely to opt for only one rate cut later this year.

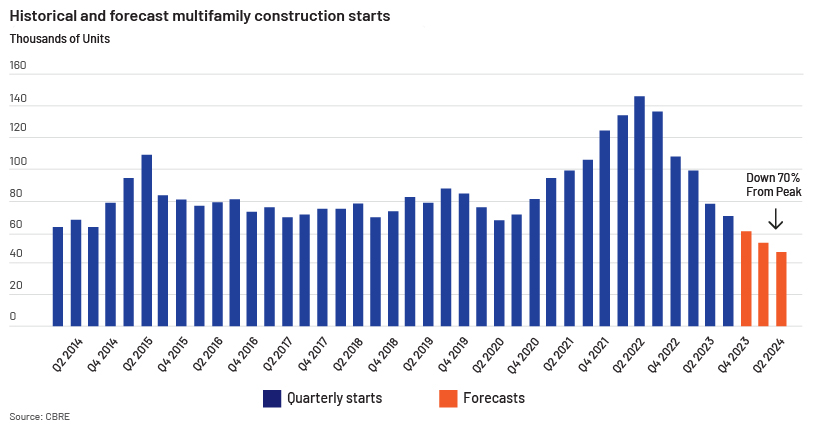

This indicates that the persisting soaring costs could stall further construction (on the supply side) and demand may remain sluggish owing to the skyrocketing mortgage rates. That said, the influx of new supplies under construction may come as a temporary relief in 2024-25. CBRE estimates a delivery of 440,000 new units this year and c.900,000 units under construction. However, new supplies are expected to decline 45% in 2024 from their the pre-pandemic average and 70% from the peak achieved in 2022 (refer to above graph). The decline in construction starts suggests that new deliveries will likely be less than half the current level by 2026. This means the housing market is likely to see sustained shortages over the long term, which may prevent the prices from falling. In fact, the most reasonable antidote for weathering the housing affordability crisis is income growth given that higher rates are here to stay, at least until the end of this year. The median price-to-income ratio increased to 4.7x in May 2024 from 4.0x in May 2020, according to the Federal Reserve Bank of Atlanta. Big banks, including JPMorgan, expect the housing crisis to ease in three and a half years. This has solidified the anticipation that the affordability crisis will likely prevail for some time.

Scenario 2:Change in rates and market response to revised prices

If the market responds to the FOMC’s operations and inflation cools to the desired 2.0% Personal Consumption Expenditure, the FOMC may trim interest rates. This would bring more money to the economy, reduce borrowing costs and address the affordability crisis. On the other hand, if rates are raised, inflation may soften, but housing affordability would likely worsen, keeping house ownership out of reach of most people. However, as explained above, the FOMC is not expected to cut rates anytime soon, as inflation has yet to be contained. Therefore, this scenario is likely ruled out.

How Acuity Knowledge Partners can help

We offer deep domain expertise in real estate investment research and analytics, enabling clients to expand their capabilities and concentrate on value-added tasks and critical decision-making. Our comprehensive and customised suite of services span the investment life cycle and all property types.

Sources

-

https://www.bea.gov/news/2024/gross-domestic-product-first-quarter-2024-advance-estimate

-

United States Total Housing Inventory (tradingeconomics.com)

-

https://www.cbre.com/insights/books/us-real-estate-market-outlook-2024/multifamily

-

https://www.richmondfed.org/publications/research/econ_focus/2024/q1_q2_federal_reserve

-

https://www.cbre.com/insights/books/us-real-estate-market-outlook-2024/multifamily

Tags:

What's your view?

About the Author

Vishakha has six years of experience in financial services Industry, with two years especially dedicated to investment and market research. She has worked with investment banks and financial advisory companies. She has gained exposure to supporting a wide spectrum of Private Market client engagements (with RE focus) at Acuity. Vishakha holds a PGDM in finance and a bachelor’s degree in commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox