Published on April 20, 2023 by Archie Garg

Data science has been adopted increasingly in financial services offered by commercial banks, investment banks, asset management firms, hedge funds and consulting firms over the past decade. Data science groups help decision makers improve business performance and generate insight on an unprecedented scale. However, data science in private equity (PE) is still at an early stage. Only 4% of the sector’s leaders use machine learning (ML) or artificial intelligence (AI) in their business processes. More than 80% of these few leaders’ initiatives are in the review phase.

In this blog, we take a look at the different areas PE firms can leverage data science in a pragmatic manner across private investment workflow. The use cases are mapped across three phases:

-

Target screening

-

Due diligence

-

Value creation

The target screening phase involves identifying target assets for investment purposes and then conducting a preliminary valuation of these assets. While most firms leverage proprietary networks, financial data analysis, investment banking channels, niche consultants, etc., data analytics private equity is hardly leveraged in-house to identify emerging themes and associated companies in a scalable manner.

The preliminary due diligence stage takes a deeper dive into the target’s financial and operational performance. There are two ways in which data science in private equity solution can help at this stage.

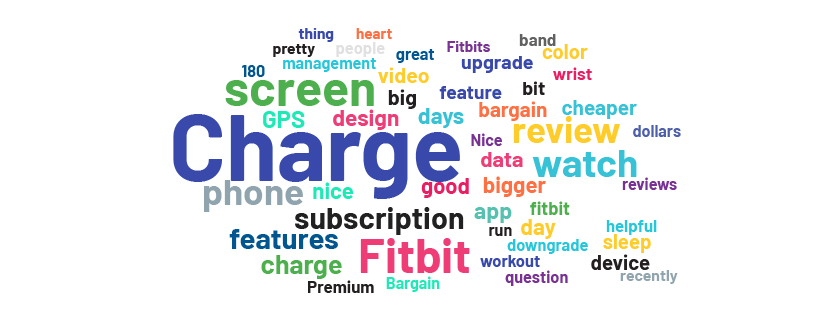

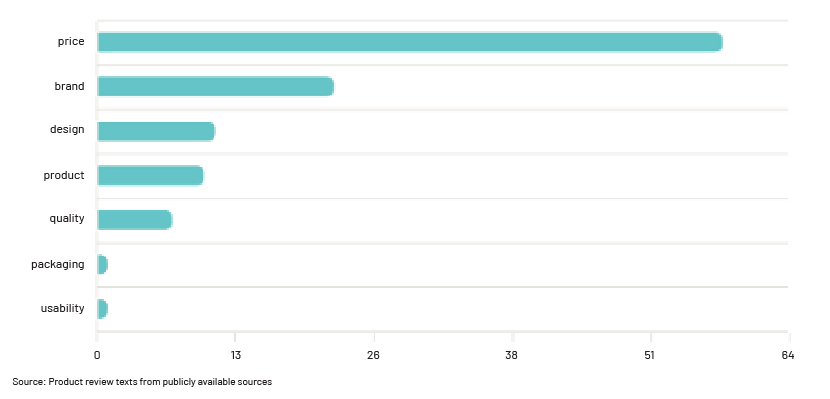

1. Apply statistical methods to analyse structured datasets from the deal data room faster, eliminating human error.

2. Leverage AI-based techniques to analyse unstructured data on the target, i.e., product reviews, news articles, press releases, internal publications, etc.

Of these three use cases, we have seen significant focus on the post-acquisition side (improving company performance/value creation), where data scientists help companies improve their performance in key areas such as marketing, HR, financial analysis and business intelligence. This is mainly due to company data being more accessible after acquisition.

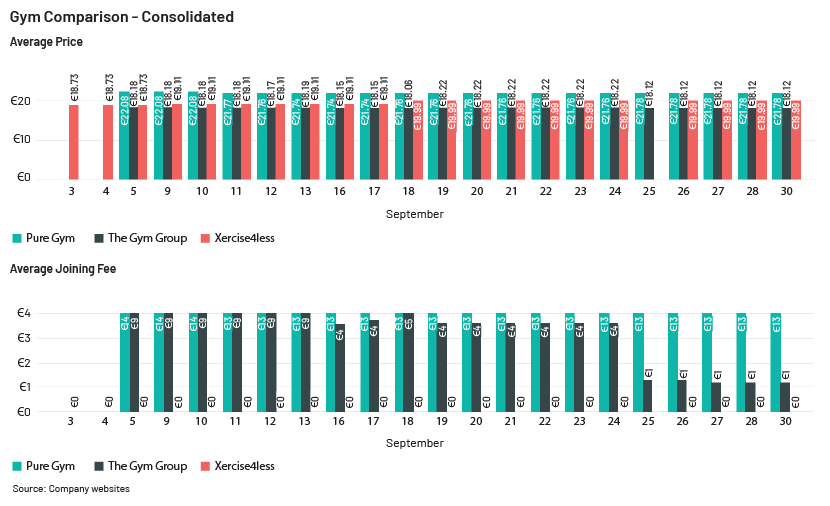

PE research has traditionally included detailed research on a company – background, industry vertical, financial position, location, size, filings, press releases and projections. It also consists of analysing peer and competitor data, and the company’s investors and market research.

A PE deal may take months since the initial screening, with the due diligence process comprising a number of steps, including substantial research and information gathering, analytics, discussions and assessments.

Data science in PE can help create in-depth company reports for the following purposes:

1. Market research

Identifying the latest top and emerging market trends over a period of time. This could be product-specific and relate to an industry segment, or general trends. These trends can then be used to rank the company’s popularity compared to competitors’. Market analysis can also involve creating strategy to improve brand competitiveness in its niche market by analysing consumer requirements and the need to improve brand products.

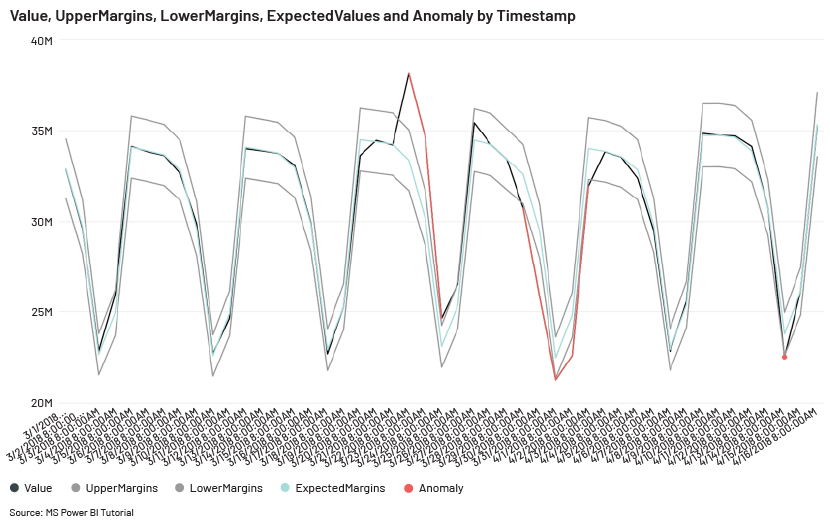

2. Sentiment

This is a well-known and popular use case. For PE, news and press releases related to the company can be tracked. Public sentiment towards the company and its products can then be analysed, also in terms of how it has changed over a period of time.

3. Consumer portfolio – With transactional and historical data available from across the globe, customer details – such as volume, demographics and competitor reach – can be understood and comparisons made. It could also be used to identify low-performing markets and assess customer growth or product segments that could be explored. Models could be created to target specific consumers, based on data.

4. Brand awareness

This includes analysing the popularity and market share of a brand and its products in a company’s niche market. It also consists of identifying brand presence and influence on social media platforms. Data can be used to improve existing marketing channels or strategies.

There is a large untapped domain in PE ready to be explored by data scientists. The above are only some examples of the application of data science in private equity. Use cases also include improving business intelligence and HR processes to increase a company’s value. All these applications do not mean there will be no requirement for an analyst. We require both human intelligence and machine intelligence to reap the benefits of emerging technologies.

How Acuity Knowledge Partners can help

In the competitive landscape of PE, leveraging data-driven insights is essential for maintaining a strategic advantage. We are a leading provider of bespoke research, analytics and technology solutions, empowering firms to harness the power of data science. Our dedicated team of data scientists, engineers and domain experts deliver innovative, high-impact solutions tailored to the business needs of PE firms. The following are key ways in which we enhance data science capabilities:

Customised solutions:

We collaborate with PE firms to understand their unique business objectives, challenges and requirements. We design and implement tailor-made solutions, ensuring alignment with each firm's specific needs and goals.

Comprehensive data analysis:

We use cutting-edge data analytics techniques and tools to uncover hidden patterns, trends and relationships in complex datasets. By transforming raw data into actionable insights, we enable PE firms to make informed investment decisions and identify new growth opportunities.

Domain expertise:

We have deep knowledge of the PE space, helping us ensure that data-driven insights are relevant, accurate and meaningful. Our expertise spans a number of sectors, allowing for a comprehensive understanding of market dynamics and trends.

Scalable solutions:

Our data science solutions are designed to grow alongside PE firms, providing scalable and flexible support as needs, data sizes and user bases increase and evolve. This adaptability ensures that firms can maintain their competitive edge in a constantly changing market landscape.Financial Data Extraction tool

Seamless integration:

We work closely with PE firms to integrate data science solutions into existing workflows and processes, ensuring a seamless transition and minimal disruption to business operations.Private equity outsourcing

References:

-

Ekimetrics-Report-Driving-Value-Creation-Using-data-science-in-Private-Equity-December-2020.pdf

-

Private Equity and Data Science: Due Diligence Stage – DataScienceCentral.com

Tags:

What's your view?

About the Author

Archie is a data scientist and engineer with 6+ experience in building analytics tools for various financial clients helping them to extract insights and make predictions from structure and unstructured data. She has built end-to-end AI and NLP analytics models and frameworks for investment managers to support their investment decision making on potential new targets. She is skilled in building real world solutions to data problems utilizing the experience in Python, AI and NLP.

Like the way we think?

Next time we post something new, we'll send it to your inbox