Published on April 8, 2025 by Shuchi Gupta and Manjunath Deshpande

Summary

Sell side firms operate in a very challenging and competitive environment, requiring them to provide detailed analysis and recommendations to their clients. Financial modelling support is a crucial part of this process, enabling analysts to evaluate companies, sectors and markets. However, building and maintaining these models can be time-consuming and resource-intensive, potentially diverting analysts' attention away from revenue-generating activities such as client meetings, trade ideas and selling investment reports. To address this, non-core activities such as financial modelling can be outsourced to third parties so in-house analysts could focus on the company’s main activities and strengthen its footprint.

Challenges faced by sell-side firms

Sell-side analysts face several challenges in today's fast-paced financial landscape:

Time constraints: Building and maintaining financial models is a time-consuming task and takes up a substantial portion of an analyst's time. Analysts have to collect and analyse vast amounts of data, making assumptions and updating the models to reflect the latest market conditions and company performance.

Resource allocation: Maintaining a team of skilled financial analysts can be expensive. Sell-side firms must balance the need for exhaustive modelling capabilities with cost-effectiveness.

Accuracy and consistency: Financial models must be accurate, consistent and aligned with established industry practices. Errors or inconsistencies can lead to inconsistent analysis and poor investment recommendations.

Coverage expansion: Sell-side firms should expand their coverage universe to stay competitive. This requires building new financial models and keeping them updated, which can stretch resources.

Regulatory compliance: Compliance with regulatory requirements and standards can be difficult and time-consuming.

Benefits of offshoring financial modelling work

Financial modelling support tasks can be delegated to third-party providers, as this approach offers a number of benefits for sell-side research firms. Customised financial modelling services strengthen research capabilities, improve efficiency and deliver value-added services to clients. These enable faster time-to-market services, especially when multiple companies release results simultaneously. Sell side firms can free up analysts’ time significantly by partnering with a third-party research firm to update financial models, enabling them to concentrate on higher-value activities. Additionally, automation and simplified processes reduce the time required for model development.

Time savings: Third-party providers have dedicated teams working on these tasks. This can lead to faster turnaround and more timely insights.

Access to expertise: External service providers specialise in financial modelling and employ professionals with extensive experience and knowledge. This ensures high-quality models, which may be challenging to achieve with an in-house team.

Improved accuracy and reliability: External vendors often use advanced tools and practices to ensure the accuracy and reliability of financial models in addition to thorough peer quality check. Rigorous quality checks reduce errors. Independent validation ensures consistency and reduces biases, critical for maintaining client trust.

Scalability: Third-party providers help accommodate resources dynamically to match coverage needs without the need for long-term commitments. This enables quickly expanding coverage of new companies or sectors during peak demand.

Cost savings: Collaborating with a third-party research firm can significantly reduce costs associated with hiring, training and maintaining an in-house team. Third-party providers often operate in regions with lower labour costs, passing on the savings to their clients.

Enhanced data security: Reputable third-party providers implement strong data-security measures to protect sensitive financial information. These include role-based permissions and audit trails to ensure data integrity and compliance.

Time-zone/flexibility advantage: Major third-party firms operate in time zones different from the US, Europe and other major trading hubs in APAC, enabling them to start work in the early hours and have tasks ready for onshore analysts’ morning meetings.

Access to advanced tools: Subcontracting firms typically use the latest tools and technologies, providing access to cutting-edge modelling capabilities.

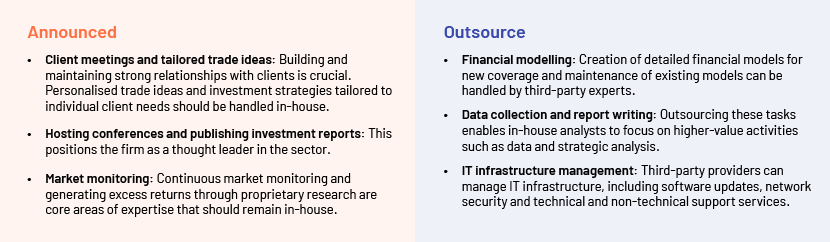

Revenue-generating vs non-core activities

Sell-side firms should retain activities that are strategic and client-facing, and that contribute directly to revenue generation (e.g., client meetings, providing tailored trade ideas, hosting conferences and publishing investment reports) while offshoring non-core, time-intensive and repetitive tasks such as financial modelling support , tracking the coverage universe and maintaining databases to third-party research partners. They can, thus, focus on their strengths, enhance client relationships and improve overall efficiency. This approach aligns with industry trends where firms prioritise cost efficiency and focus on high-value activities.

How Acuity Knowledge Partners can help

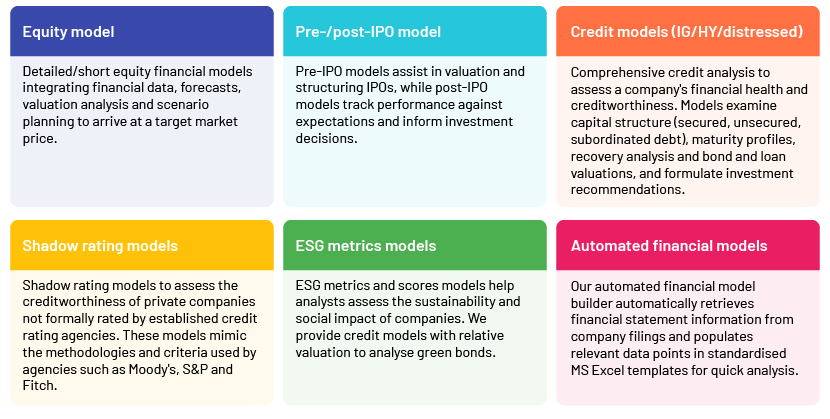

We offer customised financial modelling consulting services so sell side firms can enhance their research capabilities, improve efficiency and deliver superior value to their clients.

Our experienced team develops customised financial models to cater to the specific needs of equity, credit and ESG analysts. By analysing historical data, we identify trends and key performing indicators to forecast a company’s growth, enabling a closer look at its financial health and making informed investment decisions. Each model undergoes a rigorous two-level quality check to ensure accuracy and consistency. This thorough approach helps sell-side firms promptly expand their coverage of new companies or sectors by developing robust initiation models.

Our spectrum of financial modelling services across sectors

Automated financial models

Our automated financial model builder automatically retrieves financial statement information from company filings and populates relevant data points in standardised MS Excel templates for quick analysis.

Sources:

-

https://mergersandinquisitions.com/buy-side-vs-sell-side/#:~

-

Strategic Offshoring in Finance: Models, Risks, and Workforce Dynamics – Accounting Insights

What's your view?

About the Authors

Shuchi has over 17 years of experience in investment research on both the buy side and sell side. She specializes in high-yield credit research and distressed debt analysis. Since October 2019, Shuchi has been a part of Acuity Knowledge Partners, where she supports sell side analysts at a major investment bank, covering high-yield issuers. Shuchi holds an MBA in Finance and CFA.

Manjunath has over 15 years of experience in fixed income credit research, with a focus on HY and IG issuers. At Acuity Knowledge Partners, he supports a leading European investment bank’s HY desk, preparing financial models, tracking the portfolio and updating charts and earnings summaries. Earlier, he supported a sell-side research team of Europe’s leading investment bank through a wide range of research on EM issuers. Manjunath holds an MBA (Finance) from Shivaji University, Kolhapur and a Bachelor of Commerce from Karnataka University, Dharwad.

Like the way we think?

Next time we post something new, we'll send it to your inbox